Why #Tesla needs to double/quadruple down in #China now by increasing EV production, FSD dev; starting RoboTaxi & insurance!

#elonmusk, 4X in China will greatly accelerate transition to sustainable energy and cement Tesla’s leadership.

#elonmusk, 4X in China will greatly accelerate transition to sustainable energy and cement Tesla’s leadership.

1/10 Quick thoughts & winner/loser prediction after watching #NIO day. Impressive event, nice sedan, wish NIO to be successful, but some concerns:

1. FSD HW from #Nvidia. HW spec does not equal good AI results. #Tesla chip is custom & optimized for Tesla only, super efficient...

1. FSD HW from #Nvidia. HW spec does not equal good AI results. #Tesla chip is custom & optimized for Tesla only, super efficient...

1/15

Additional thoughts/info on #NIO after #NIODay, & which #EV#Battery companies I think are best bets 2021.

Again I am rooting for NIO's long term success, while I try my best to focus analysis 100% on facts & share my rationale for your own consideration & benefits.

Additional thoughts/info on #NIO after #NIODay, & which #EV#Battery companies I think are best bets 2021.

Again I am rooting for NIO's long term success, while I try my best to focus analysis 100% on facts & share my rationale for your own consideration & benefits.

2/15

IMO #NIO investors should be aware of the followings, so not get misinformed:

1. NIO announced FSD HW only. Emphasizing 7X #Tesla FSD chip computing power is misleading! As an AI professional, I can assure you any good AI solution needs computing power, algorithms & data.

IMO #NIO investors should be aware of the followings, so not get misinformed:

1. NIO announced FSD HW only. Emphasizing 7X #Tesla FSD chip computing power is misleading! As an AI professional, I can assure you any good AI solution needs computing power, algorithms & data.

3/15

Without proven FSD algorithms & tons of real world data collection, just 7X HW compute power does not mean FSD success.

On the contrary, it means a big power consumption from 4 #Nvidia chips on the car, which will consume more battery.

Without proven FSD algorithms & tons of real world data collection, just 7X HW compute power does not mean FSD success.

On the contrary, it means a big power consumption from 4 #Nvidia chips on the car, which will consume more battery.

4/15

2. Lidar is HW only too & does not mean FSD success.

Here I agree with #Tesla (& many AI experts), that Computer Vision is the best approach for FSD, if achievable.

Using Lidar & HD Maps everywhere have big limitations. Pls do your research & know Lidar's limitations.

2. Lidar is HW only too & does not mean FSD success.

Here I agree with #Tesla (& many AI experts), that Computer Vision is the best approach for FSD, if achievable.

Using Lidar & HD Maps everywhere have big limitations. Pls do your research & know Lidar's limitations.

5/15

3. NIO CEO announced a 150KW solid state battery pack in Q4 2022, then said it is mixed solid & liquid after the NIO day (per Chinese media).

NIO could have done a better job here, it does feel NIO was under pressure to announce solid state for marketing & better #Tesla.

3. NIO CEO announced a 150KW solid state battery pack in Q4 2022, then said it is mixed solid & liquid after the NIO day (per Chinese media).

NIO could have done a better job here, it does feel NIO was under pressure to announce solid state for marketing & better #Tesla.

6/15

4. NIO CEO positions NIO's car as high end to compete w/ BMW Benz Audi, not "low end" #Tesla. NIO guarantees not lower car price to protect owners

I am very skeptical this will work for customer, most are smart to go w/ better car + lower price, not just fancy interiors

4. NIO CEO positions NIO's car as high end to compete w/ BMW Benz Audi, not "low end" #Tesla. NIO guarantees not lower car price to protect owners

I am very skeptical this will work for customer, most are smart to go w/ better car + lower price, not just fancy interiors

7/15

5. Seems NIO loyalty programs will give old owners BIG BIG discount to buy new cars and FSD monthly subscription.

Some complained online this is at the expense of new owners. For #Tesla, new owners get the best price & better functions. We old owners lick lips & applause👍

5. Seems NIO loyalty programs will give old owners BIG BIG discount to buy new cars and FSD monthly subscription.

Some complained online this is at the expense of new owners. For #Tesla, new owners get the best price & better functions. We old owners lick lips & applause👍

8/15

6. Overall it seems #NIO was under tremendous pressure (price, cost, FSD) & had to compare with #Tesla.

A big question is, will NIO be able to maintain high premium price, when #Tesla cut 3/Y price & refresh S/X soon? It seems very hard to me, but I wish NIO the best

6. Overall it seems #NIO was under tremendous pressure (price, cost, FSD) & had to compare with #Tesla.

A big question is, will NIO be able to maintain high premium price, when #Tesla cut 3/Y price & refresh S/X soon? It seems very hard to me, but I wish NIO the best

9/15

Before NIO gets higher volume & lower cost, it will have to convince its customers its premium car status and keep charging high price, which may not work.

Or NIO raises capital to build its own battery & auto factories, and lower price over time to compete. Tough choice.

Before NIO gets higher volume & lower cost, it will have to convince its customers its premium car status and keep charging high price, which may not work.

Or NIO raises capital to build its own battery & auto factories, and lower price over time to compete. Tough choice.

10/15

Again I am hoping everybody reading this got informed by these thoughts, this are purely my opinion & you can make your own decision. I am not bashing any company, I try my best to stay objective & even help #NIO .

Now who do I think the 2021 best bets for EV/Battery!

Again I am hoping everybody reading this got informed by these thoughts, this are purely my opinion & you can make your own decision. I am not bashing any company, I try my best to stay objective & even help #NIO .

Now who do I think the 2021 best bets for EV/Battery!

11/15

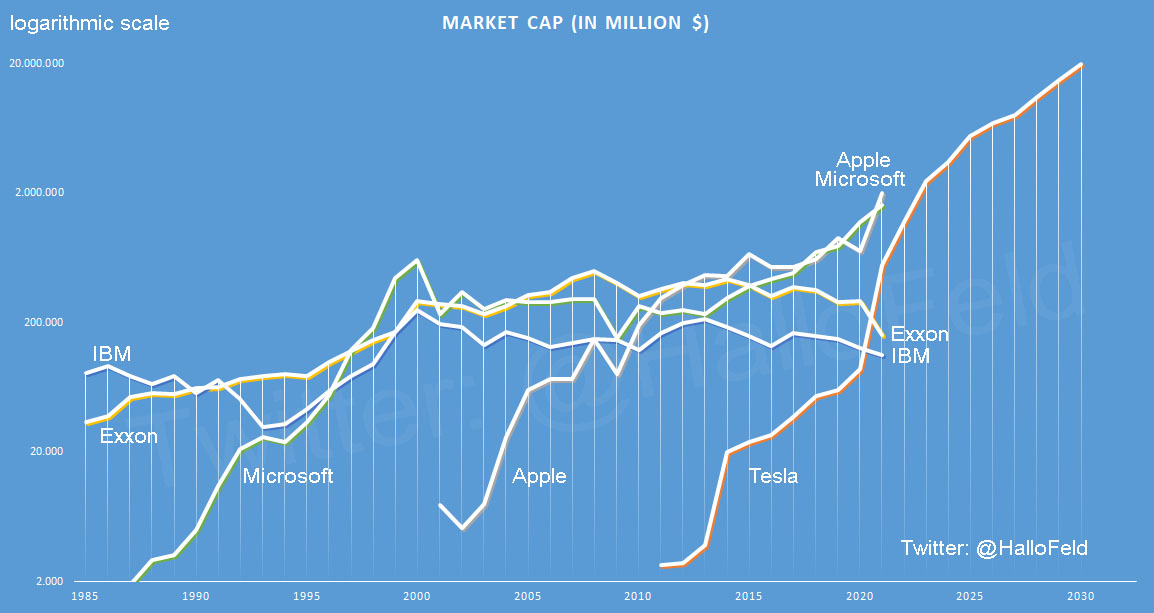

1. #Tesla, no need to say more, still leader in every aspect. I will stay critical though, i.e. Tesla VOICE AI for both English & Chinese do not work well now! @elonmusk

2. CATL. I think its growth is crazy & will last, it is the shovels&jeans for the EV/energy gold rush.

1. #Tesla, no need to say more, still leader in every aspect. I will stay critical though, i.e. Tesla VOICE AI for both English & Chinese do not work well now! @elonmusk

2. CATL. I think its growth is crazy & will last, it is the shovels&jeans for the EV/energy gold rush.

12/15

3. #BYD before #NIO, #XPeng.

. BYD has been working on batteries for decades

. Own its own battery/auto manufacturing & tech stack

. New "blade" battery got a lot of good attention

. Car design is quickly catching up

. Make & export EV buses

. Make iPads for #Apple.

3. #BYD before #NIO, #XPeng.

. BYD has been working on batteries for decades

. Own its own battery/auto manufacturing & tech stack

. New "blade" battery got a lot of good attention

. Car design is quickly catching up

. Make & export EV buses

. Make iPads for #Apple.

13/15

I think $TSLA, $CATL, $BYDDY will do well in 2021, riding the huge EV adoption mega trend. #NIO will thrive in long term, but its valuation is so high & risky, warrant careful consideration.

I also think NIO should focus competing with ICE cars instead of #Tesla.

I think $TSLA, $CATL, $BYDDY will do well in 2021, riding the huge EV adoption mega trend. #NIO will thrive in long term, but its valuation is so high & risky, warrant careful consideration.

I also think NIO should focus competing with ICE cars instead of #Tesla.

14/15

One more thing, I own @Gfilche a reply before holidays. Sorry man I totally forgot🙇

Love Gali's thoughts #apple should acquire #lucid, while I think #BYD is a better choice for Apple to partner, since it has battery & auto manufacturing to scale & already work with Apple

One more thing, I own @Gfilche a reply before holidays. Sorry man I totally forgot🙇

Love Gali's thoughts #apple should acquire #lucid, while I think #BYD is a better choice for Apple to partner, since it has battery & auto manufacturing to scale & already work with Apple

15/15

I don't think Apple+Hyundai is good idea, as Chinese EVs like BYD & China EV supply chain are already established, for both capabilities and low cost. The train left the station:)

#Apple+#BYD is fastest route for #AppleCar, but still not enough to compete with #Tesla IMO

I don't think Apple+Hyundai is good idea, as Chinese EVs like BYD & China EV supply chain are already established, for both capabilities and low cost. The train left the station:)

#Apple+#BYD is fastest route for #AppleCar, but still not enough to compete with #Tesla IMO

• • •

Missing some Tweet in this thread? You can try to

force a refresh