Liquidity providers of $ibETH / $ALPHA will now be able to earn $SFI on top of $ALPHA starting on Dec 15th, 6AM UTC! 💥

Special thanks to @saffronfinance_ on this collaboration

How to earn $SFI and $ALPHA? 👇

blog.alphafinance.io/saffron-will-n…

Special thanks to @saffronfinance_ on this collaboration

How to earn $SFI and $ALPHA? 👇

blog.alphafinance.io/saffron-will-n…

2) $ALPHA is already being distributed to LPs of $ibETH / $ALPHA in a form of high trading fees APY no matter where you are provide the liquidity from.

You will receive these $ALPHA rewards when you remove the underlying liquidity (not airdropped to your wallet).

You will receive these $ALPHA rewards when you remove the underlying liquidity (not airdropped to your wallet).

3) In order to receive $SFI in addition to $ALPHA, you need to either provide the following on Saffron:

--> Provide $ibETH and $ALPHA

--> Or provide UNI-v2 LP token of ibETH/ALPHA pool for those who have already provided liquidity to the pool

--> Provide $ibETH and $ALPHA

--> Or provide UNI-v2 LP token of ibETH/ALPHA pool for those who have already provided liquidity to the pool

4) Note that by supplying your liquidity on Saffron, your liquidity and rewards will be locked until the epoch ends (every other Sunday at 2pm UTC).

Thus, they will be locked until Dec 27th, 2PM UTC.

The second claim period will then be Jan 10th, 2PM UTC, and so on.

Thus, they will be locked until Dec 27th, 2PM UTC.

The second claim period will then be Jan 10th, 2PM UTC, and so on.

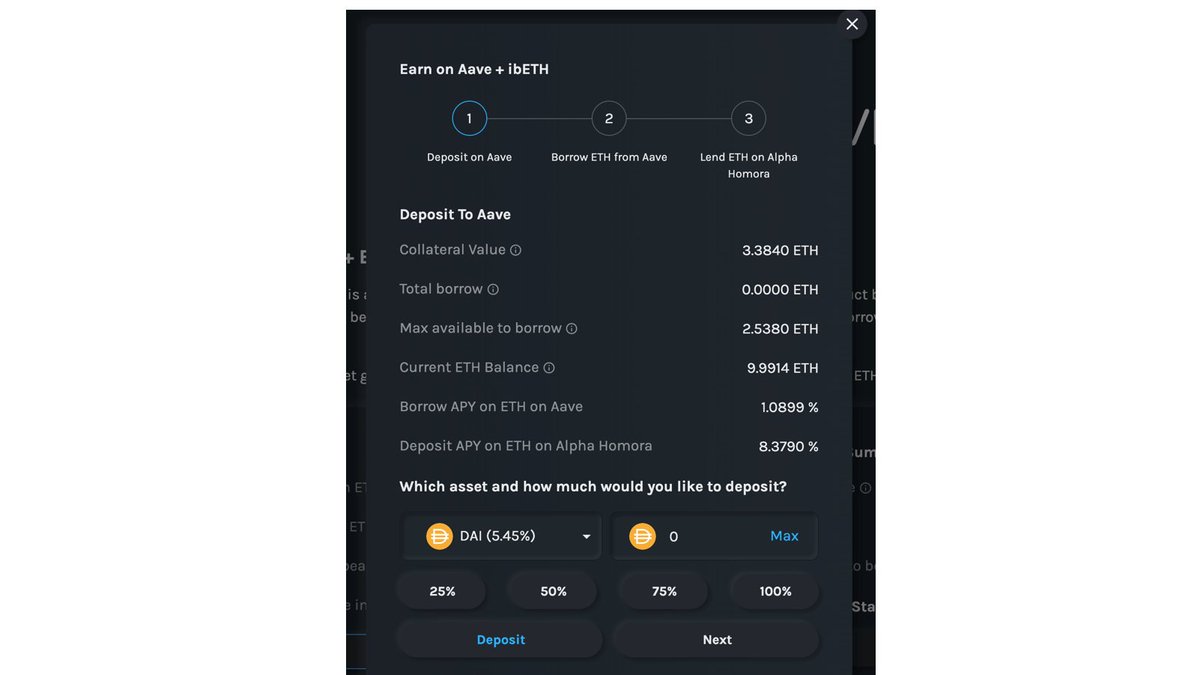

5) Simple step-by-step guide

Step 1: Go to Saffron.finance, select Liquidity Pools, and select ibETH/ALPHA pool

Step 2: Supply both ibETH and ALPHA if you have not already done so. If you have already provided liquidity and have UNI-v2 LP tokens, you can skip to step 3.

Step 1: Go to Saffron.finance, select Liquidity Pools, and select ibETH/ALPHA pool

Step 2: Supply both ibETH and ALPHA if you have not already done so. If you have already provided liquidity and have UNI-v2 LP tokens, you can skip to step 3.

6) Step 3: Deposit UNI-v2 LP token to Saffron in order to be eligible to receive $SFI.

Step 4: After each epoch, liquidity providers can claim $SFI and remove liquidity by selecting the Redeem tab. This means that the first day that you can claim SFI rewards is Dec 27th, 2PM UTC

Step 4: After each epoch, liquidity providers can claim $SFI and remove liquidity by selecting the Redeem tab. This means that the first day that you can claim SFI rewards is Dec 27th, 2PM UTC

7) Note that Saffron.finance contract has not been audited, so please do your research before supplying the liquidity.

• • •

Missing some Tweet in this thread? You can try to

force a refresh