As 2020 is coming to an end, let us share with our community a reflection of 2020 and a preview of what is to come in 2021 for @AlphaFinanceLab!

Let’s dive in 🔥👇

#AlphaHomora #AlphaHomoraV2 #AlphaX #MoreAlphaProducts $ALPHA

blog.alphafinance.io/alpha-finance-…

Let’s dive in 🔥👇

#AlphaHomora #AlphaHomoraV2 #AlphaX #MoreAlphaProducts $ALPHA

blog.alphafinance.io/alpha-finance-…

2/20) Let us divide the 2020 review in multiple sections, starting from

Section 1: @AlphaFinanceLab project 🔥

1⃣ The project was launched in 2020 to build an ecosystem of innovative and user friendly #DeFi products

Section 1: @AlphaFinanceLab project 🔥

1⃣ The project was launched in 2020 to build an ecosystem of innovative and user friendly #DeFi products

3/20) 2⃣ Secured funds from top-tier DeFi investors such as @TheSpartanGroup, @multicoincap, and @DeFianceCapital

3⃣ $ALPHA was listed on @binance in early October 2020 through the Launchpad program

3⃣ $ALPHA was listed on @binance in early October 2020 through the Launchpad program

4/20) 4⃣ Entered into strategic partnership with @SCB10X_OFFICIAL, the venture arm of @scb_thailand - one of the largest commercial banks in Thailand

5⃣ Went on 10 AMA (Ask-Me-Anything) and 10 podcasts/live streamings within a span of 3 months

5⃣ Went on 10 AMA (Ask-Me-Anything) and 10 podcasts/live streamings within a span of 3 months

5/20) Notable podcasts and livestreaming include:

👉@blockcrunch with @mrjasonchoi: open.spotify.com/episode/4rOq3m…

👉@PodcastDelphi with @Shaughnessy119: delphidigital.io/podcasts/alpha…

👉@Yield_TV with @DeFi_Dad: pscp.tv/w/1LyGBdzmNeoxN

👉@blockcrunch with @mrjasonchoi: open.spotify.com/episode/4rOq3m…

👉@PodcastDelphi with @Shaughnessy119: delphidigital.io/podcasts/alpha…

👉@Yield_TV with @DeFi_Dad: pscp.tv/w/1LyGBdzmNeoxN

6/20) Let’s continue to Section 2 in $ALPHA 2020 review: #AlphaHomora 🔥

1⃣ Alpha Homora, the first product by @AlphaFinanceLab & first leveraged #YieldFarming product in #DeFi, was launched

2⃣ Now, it has a TVL of more than $160M and supports 42 leveraged pools in < 3 months

1⃣ Alpha Homora, the first product by @AlphaFinanceLab & first leveraged #YieldFarming product in #DeFi, was launched

2⃣ Now, it has a TVL of more than $160M and supports 42 leveraged pools in < 3 months

7/20) 3⃣ To distribute $ALPHA to our community members, we launched Liquidity Mining for #AlphaHomora and Trading Volume Mining for $ibETH / $ALPHA

Trading Volume Mining program uniquely allows LPs to earn $ALPHA while earning interest on their $ibETH

Trading Volume Mining program uniquely allows LPs to earn $ALPHA while earning interest on their $ibETH

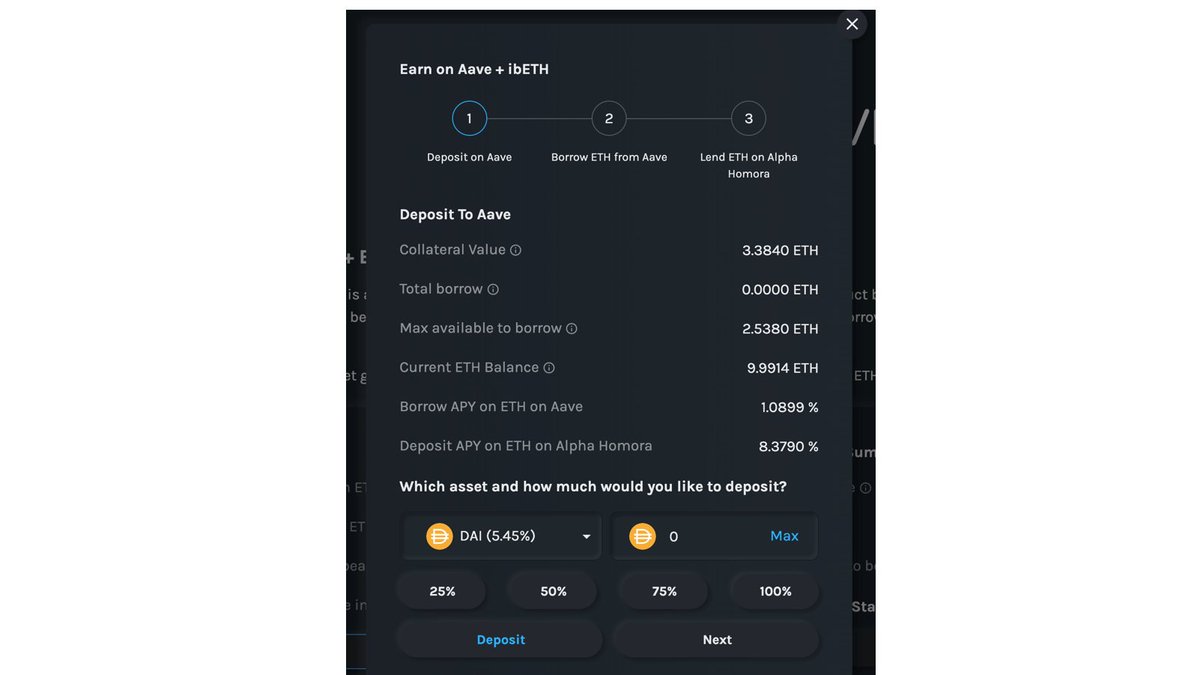

8/20) 4⃣ Alpha Homora partnered and integrated with a number of key #DeFi protocols including partnering with @AaveAave for “Earn on Aave + ETH” feature

9/20) 5⃣ Partnered and integrated with @saffronfinance_, enabling $ibETH / $ALPHA liquidity providers to earn $SFI in addition to $ALPHA and interest rate on $ibETH

6⃣ Partnered and integrated with @NexusMutual, allowing anyone to buy coverage against smart contract risk

6⃣ Partnered and integrated with @NexusMutual, allowing anyone to buy coverage against smart contract risk

10/20) For more details on #AlphaHomora, refer to the documentation here: app.gitbook.com/@alphafinancel….

Let's continue to the last section, section 3, in 2020 review at $ALPHA before we go through a preview of 2021! 👇

Let's continue to the last section, section 3, in 2020 review at $ALPHA before we go through a preview of 2021! 👇

11/20) Section 3 in $ALPHA 2020 review: #AlphaX 🔥

1⃣ AlphaX has been developed shortly after launching #AlphaHomora

2⃣ AlphaX won't only allow #AlphaHomora users to hedge leveraged #YieldFarming/LP positions, but will bring #DeFi a new class of trading product

1⃣ AlphaX has been developed shortly after launching #AlphaHomora

2⃣ AlphaX won't only allow #AlphaHomora users to hedge leveraged #YieldFarming/LP positions, but will bring #DeFi a new class of trading product

12/20) 3⃣ #AlphaX beta private testnet access has been granted to community members who signed up

4⃣ In total, 292 people signed up for #AlphaX beta private testnet and have been actively sharing and discussing feedbacks! 🎉

4⃣ In total, 292 people signed up for #AlphaX beta private testnet and have been actively sharing and discussing feedbacks! 🎉

13/20) The feedbacks have been well received, and we are working on the next iteration of #AlphaX!

For more details on #AlphaX, refer to the blog post below

blog.alphafinance.io/inside-alphax/

For more details on #AlphaX, refer to the blog post below

blog.alphafinance.io/inside-alphax/

14/20) 2020 has indeed been an important year for @AlphaFinanceLab, but we are more than excited for 2021!

In 2021, many new $ALPHA products and $ALPHA token utilities will go live. 🔥

In 2021, many new $ALPHA products and $ALPHA token utilities will go live. 🔥

15/20) #AlphaHomoraV2 will be launched with many unique functionalities to address significant demand from leveraged yield farmers and lenders who're seeking higher yields.

#AlphaHomorav2 will continue to establish itself as the go-to leveraged #yieldFarming protocol in #DeFi.

#AlphaHomorav2 will continue to establish itself as the go-to leveraged #yieldFarming protocol in #DeFi.

16/20) #AlphaX will be launched. With AlphaX, anyone can

👉 buy leveraged tokens on e.g. @UniswapProtocol, @SushiSwap, etc.

👉 hold leveraged token to hedge existing position

👉 #AlphaHomora users can use #AlphaX to hedge risks

👉 Use lev. tokens in other #DeFi products

👉 buy leveraged tokens on e.g. @UniswapProtocol, @SushiSwap, etc.

👉 hold leveraged token to hedge existing position

👉 #AlphaHomora users can use #AlphaX to hedge risks

👉 Use lev. tokens in other #DeFi products

17/20) Apart from #AlphaHomoraV2 and #AlphaX, we are also working on a number of $ALPHA products that will be launched in 2021. 👀

What does this mean for the @AlphaFinanceLab ecosystem and the $ALPHA token? 🔥

What does this mean for the @AlphaFinanceLab ecosystem and the $ALPHA token? 🔥

18/20) Interoperability among $ALPHA products will be unlocked.

While each Alpha product solves its own market gap, it’ll bring synergy to other Alpha products and create a strong Alpha ecosystem that maximizes returns while minimizing downside risks.

While each Alpha product solves its own market gap, it’ll bring synergy to other Alpha products and create a strong Alpha ecosystem that maximizes returns while minimizing downside risks.

19/20) $ALPHA token will become the core of Alpha ecosystem.

ALPHA token holders will not only be able to govern the whole Alpha ecosystem, but also benefit from higher yields and unique functionalities only available to $ALPHA token holders.

ALPHA token holders will not only be able to govern the whole Alpha ecosystem, but also benefit from higher yields and unique functionalities only available to $ALPHA token holders.

20/20) For official blog post and a lot more details of 2020 review and 2021 preview, please refer to the link below.

blog.alphafinance.io/alpha-finance-…

blog.alphafinance.io/alpha-finance-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh