1/ If you are getting sick and tired of the same old pitch decks from the USA,

Which just about every man and his dog are talking about,

And go something along the lines of:

"4.5% CAP rate, we will bump up the rents, blah blah blah"

then should you consider the UK market.

Which just about every man and his dog are talking about,

And go something along the lines of:

"4.5% CAP rate, we will bump up the rents, blah blah blah"

then should you consider the UK market.

2/ This is where we have been investing over the last few years and achieving fantastic rates of return.

The narrative on the surface is bad with Brexit & loss of confidence.

Bank funding is as depressed as the GFC of 2009, basically "blood on the streets" kind of a scenario.

The narrative on the surface is bad with Brexit & loss of confidence.

Bank funding is as depressed as the GFC of 2009, basically "blood on the streets" kind of a scenario.

3/ Lack of funding supply, means demand for capital is willing to pay far higher rates of compensation for the relative risk taken.

In the construction finance area we operate & invest in, we are noticing the following:

Senior loans @ 8-11%

Mezz loans @ 15-22%

JV equity @ 25%+

In the construction finance area we operate & invest in, we are noticing the following:

Senior loans @ 8-11%

Mezz loans @ 15-22%

JV equity @ 25%+

4/ UK market valuations have improved from the 2014/15 period — especially for foreign investors and $USD holders.

Rates of return are far, far higher than in the US.

London is the mecca of global real estate, which can only really be matched by the greater Manhattan/NYC area.

Rates of return are far, far higher than in the US.

London is the mecca of global real estate, which can only really be matched by the greater Manhattan/NYC area.

5/ The best part?

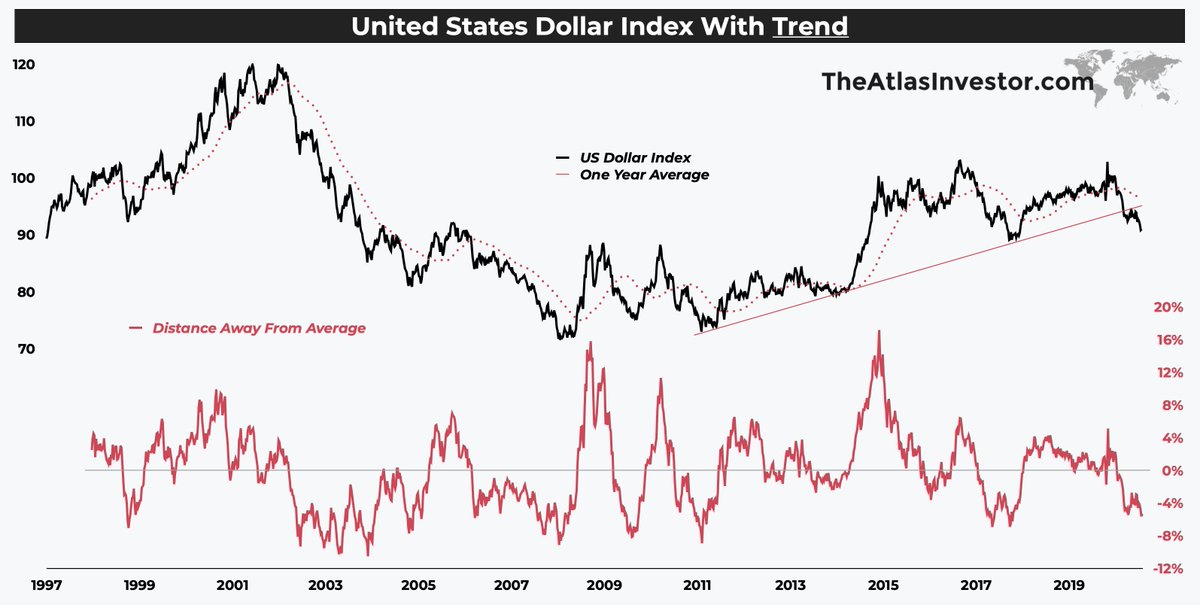

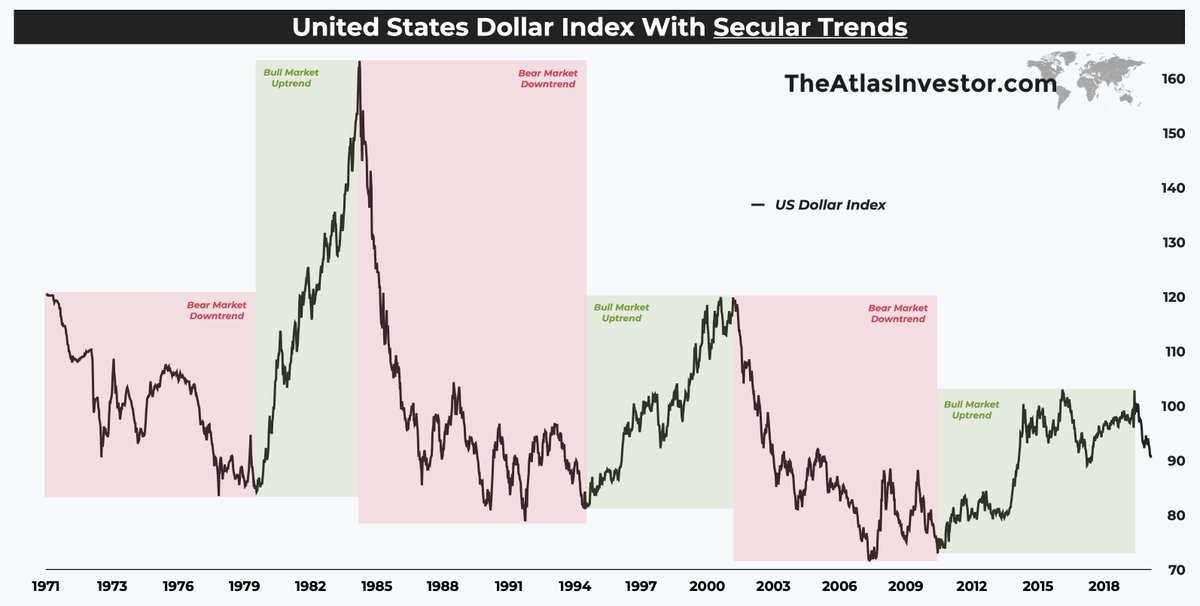

The $USD bull market has probably come to an end.

Our average entry into the UK market over the last few years has happened around $1.25 USD per £.

We are hopeful the exchange rate will normalize around $1.50 with #Brexit finished & Covid vaccine.

The $USD bull market has probably come to an end.

Our average entry into the UK market over the last few years has happened around $1.25 USD per £.

We are hopeful the exchange rate will normalize around $1.50 with #Brexit finished & Covid vaccine.

6/ Verdict?

Not only is an investor being compensated with far higher rates of return for an equivalent amount of risk taken, as the credit crunch lingers on

But the benefit from the exchange rate increases isthere, as the Pound breaks out of a 13-year long downtrend this week.

Not only is an investor being compensated with far higher rates of return for an equivalent amount of risk taken, as the credit crunch lingers on

But the benefit from the exchange rate increases isthere, as the Pound breaks out of a 13-year long downtrend this week.

• • •

Missing some Tweet in this thread? You can try to

force a refresh