1/ US Dollar Thread.

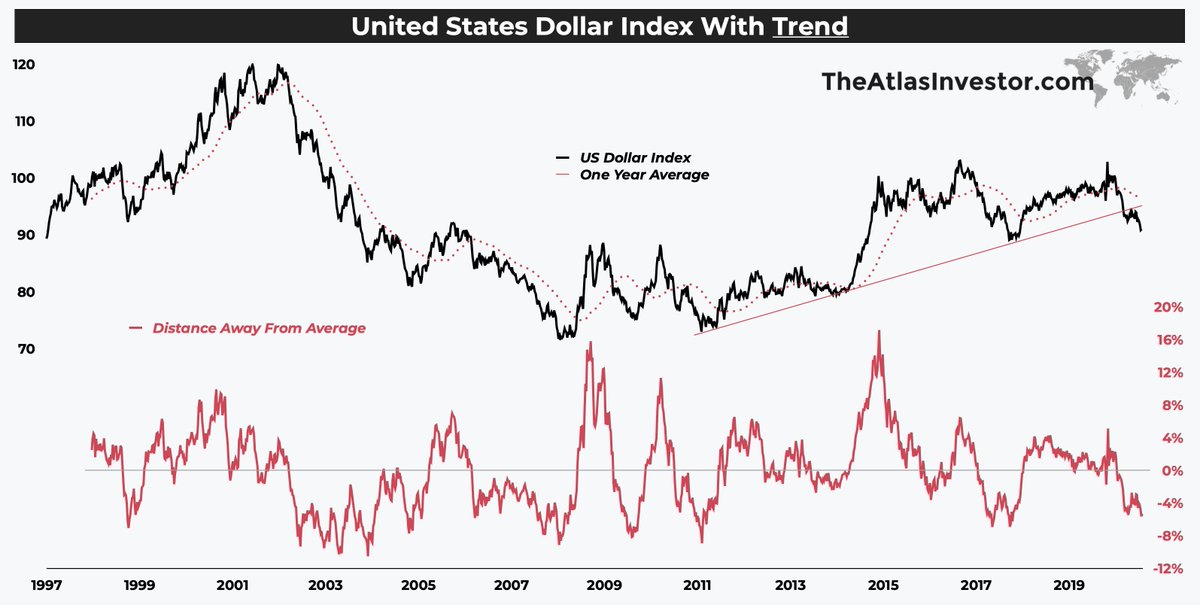

The medium-term technical picture shows the bull market (uptrend) — which started in the 2008/11 period — has come to an end with a recent break down of an important trend line support.

The trend is now clearly down.

The medium-term technical picture shows the bull market (uptrend) — which started in the 2008/11 period — has come to an end with a recent break down of an important trend line support.

The trend is now clearly down.

2/ Why is this important?

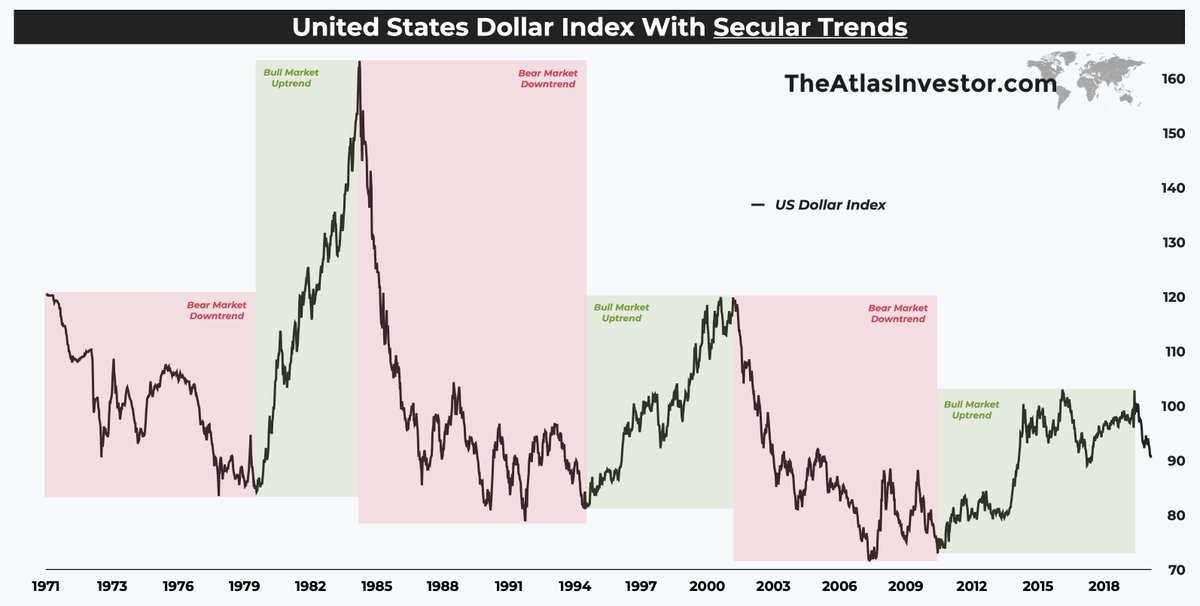

Since President Nixon took off the Gold standard, floating the $USD in 1971, it has gone through 3 secular bull & bear markets.

History shows that currencies enter multi-year trends & the probability is high $USD is entering a multi-year downtrend now.

Since President Nixon took off the Gold standard, floating the $USD in 1971, it has gone through 3 secular bull & bear markets.

History shows that currencies enter multi-year trends & the probability is high $USD is entering a multi-year downtrend now.

3/ What does this mean for global investors?

• exit $USD denominated assets

• increase stock exposure Asia Pacific & EM countries

• focus on small & value, not large & growth

• become a real estate LP in EU & UK deals

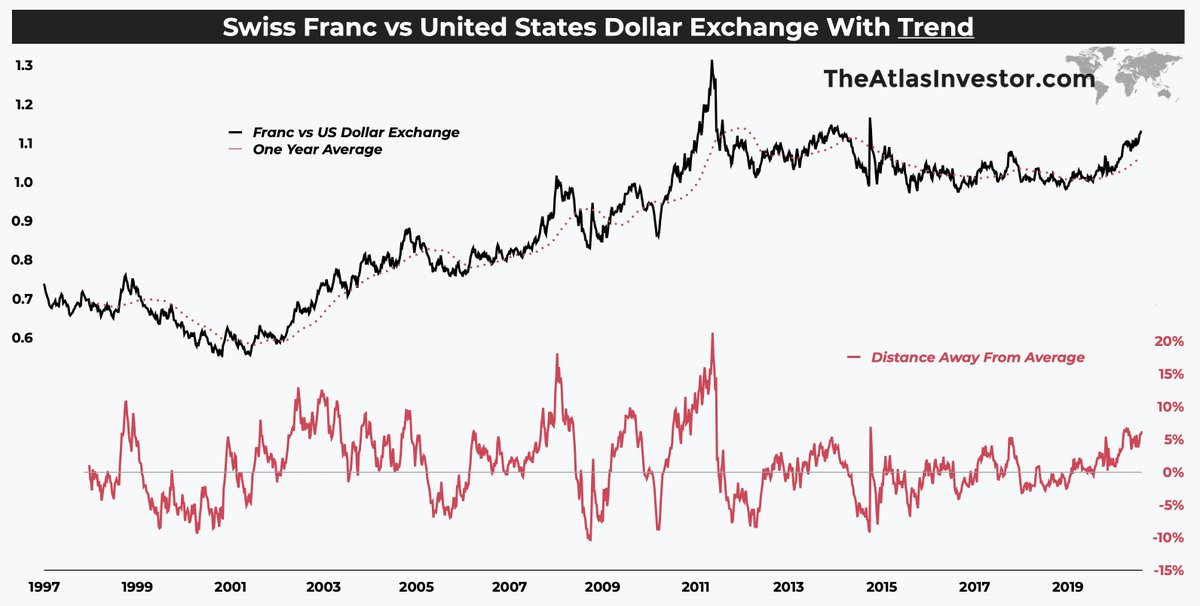

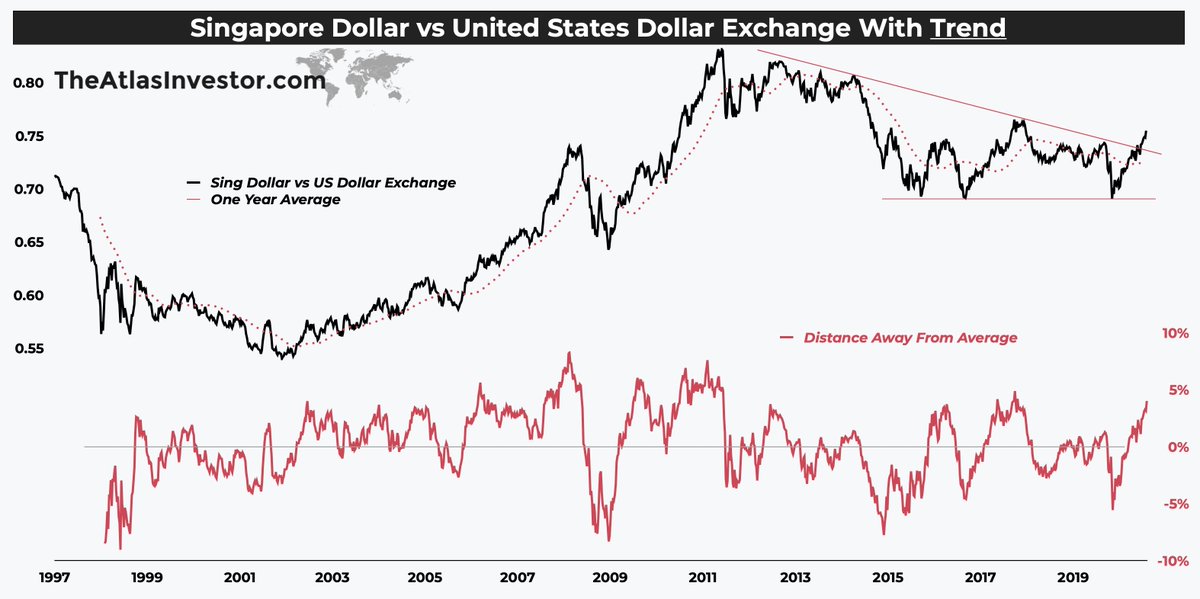

• hold cash reserves in Singapore Dollar & Swiss Franc

• exit $USD denominated assets

• increase stock exposure Asia Pacific & EM countries

• focus on small & value, not large & growth

• become a real estate LP in EU & UK deals

• hold cash reserves in Singapore Dollar & Swiss Franc

4/ What would be the catalyst?

First of all, we don't know if it will decline (unlike every other Twitter guru predicting the future), but we can discuss probabilities.

More & more international heavyweights are moving away from the greenback!

First of all, we don't know if it will decline (unlike every other Twitter guru predicting the future), but we can discuss probabilities.

More & more international heavyweights are moving away from the greenback!

https://twitter.com/TihoBrkan/status/1339582977920004098?s=20

5/ Swiss Franc is one of the few stronger currencies which never really lost any ground vs the greenback over the last decade — unlike the Pound or the Euro.

6/ Singapore is probably the best city/country in the world right now,

And as a financial center, it is becoming perceived as Switzerland of Asia.

Sing Dollar ferocious break out vs $USD in the chart below!

And as a financial center, it is becoming perceived as Switzerland of Asia.

Sing Dollar ferocious break out vs $USD in the chart below!

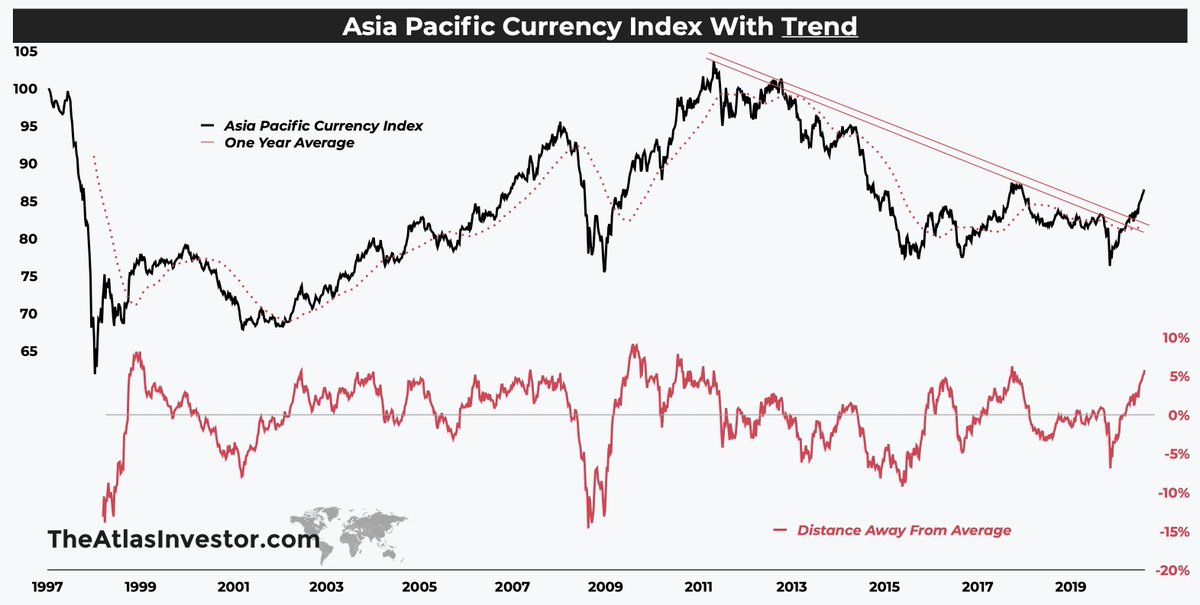

7/ In general, I am very optimistic on the Asia Pacific currencies.

After all, this is the Asian century where economic growth, growth of HNWIs & the middle class is on steroids.

Our own proprietary index below includes the Aussie & Sing Dollars, Korean Won, Ringgit & others.

After all, this is the Asian century where economic growth, growth of HNWIs & the middle class is on steroids.

Our own proprietary index below includes the Aussie & Sing Dollars, Korean Won, Ringgit & others.

• • •

Missing some Tweet in this thread? You can try to

force a refresh