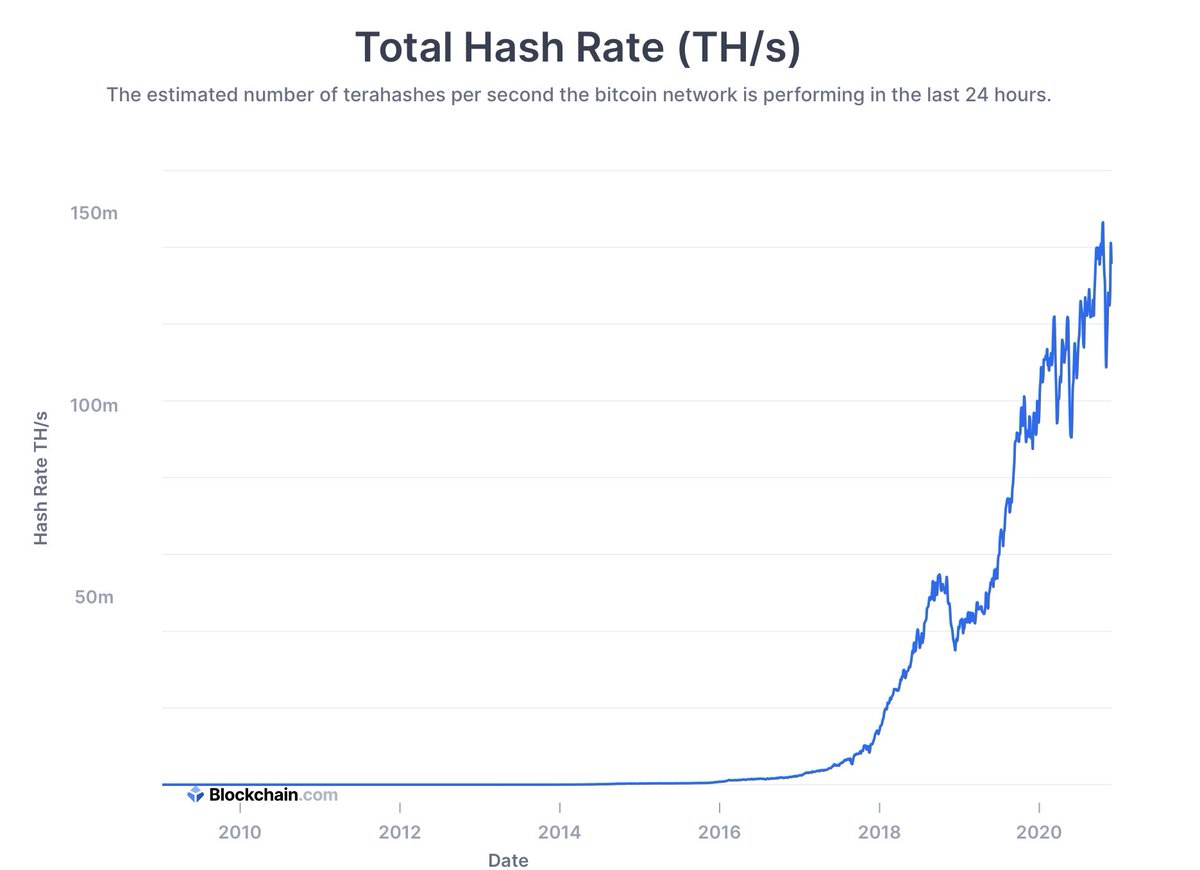

Well, today seems fitting for an update on this chart from August. It'll be interesting to see if it continues to keep pace. #Bitcoin

H/T: @100trillionUSD

H/T: @100trillionUSD

Update to August Chart.

Things continue to progress as expected. But it appears I might have been a bit bearish back in the summer.

H/T: @100trillionUSD

Things continue to progress as expected. But it appears I might have been a bit bearish back in the summer.

H/T: @100trillionUSD

Update to August Chart.

The recent consolidation appears to be subsiding - it was similar to consolidations we have seen historically during bull runs. The light blue lines remain from August. The purple is my updated expectations thru Q2 2021. tradingview.com/chart/BTCUSD/d…

The recent consolidation appears to be subsiding - it was similar to consolidations we have seen historically during bull runs. The light blue lines remain from August. The purple is my updated expectations thru Q2 2021. tradingview.com/chart/BTCUSD/d…

Update to August chart.

I'm sorry. Even my tripled-down update appears to not be bullish enough. I'll try harder in future updates.

I'm sorry. Even my tripled-down update appears to not be bullish enough. I'll try harder in future updates.

• • •

Missing some Tweet in this thread? You can try to

force a refresh