Equity call/put ratio (equity PCR inverted)

vs

$GEX

correlation>54%

both at "maximum optimism" lvl

plus

NYSE short-interest at lowest level in the last 10 years as posted Sun

what could go wrong?🧐

No more shorts to squeeze

all traders are super bullish, all-in, fomo

👇👇

vs

$GEX

correlation>54%

both at "maximum optimism" lvl

plus

NYSE short-interest at lowest level in the last 10 years as posted Sun

what could go wrong?🧐

No more shorts to squeeze

all traders are super bullish, all-in, fomo

👇👇

https://twitter.com/kerberos007/status/1330349895853760520

Dec 16th:

from my magic screener:

STFR idea:

two super over-valued stocks

1 ACGL: close 35.40; high valuation & analysts downgrade

2 AAL: close 16.86; super over-valued; poor analyst rating

STFR & lotto tickets. 🧐👌

from my magic screener:

STFR idea:

two super over-valued stocks

1 ACGL: close 35.40; high valuation & analysts downgrade

2 AAL: close 16.86; super over-valued; poor analyst rating

STFR & lotto tickets. 🧐👌

Dec 16th:

SPX

vs

ISEE All Equity Call/Put ratio (20day-SMA) * 100

Maximum Optimism

all-in calls, euphoria, fomo.

what could go wrong? bullish++ 🔥

SPX

vs

ISEE All Equity Call/Put ratio (20day-SMA) * 100

Maximum Optimism

all-in calls, euphoria, fomo.

what could go wrong? bullish++ 🔥

Dec 16th:

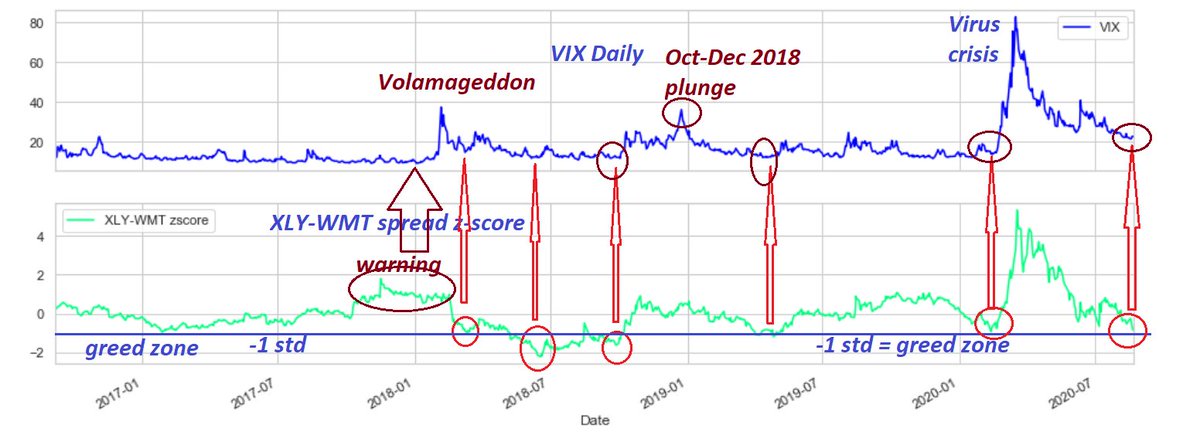

Watching XLY:WMT pair trading closely

Not yet in the "Greed" zone.

greed zone = -1 sigma

euphoria zone = -2 sigma

Watching XLY:WMT pair trading closely

Not yet in the "Greed" zone.

greed zone = -1 sigma

euphoria zone = -2 sigma

The market is super over-valued, time to contemplate STFR some potential "Enron" stocks in coming weeks.

Worst 42 stocks ( >$10) with poor fundamentals & analysts average ratings:

mechanical screener. do you own DD.🧐

if you spot a "good" one to STFR, let us know.

Worst 42 stocks ( >$10) with poor fundamentals & analysts average ratings:

mechanical screener. do you own DD.🧐

if you spot a "good" one to STFR, let us know.

• • •

Missing some Tweet in this thread? You can try to

force a refresh