if our beloved $SPX tanks 20-30% from here, I would post a looooong BTFD list 😉

stay tuned.

it is coming 🤣

stay tuned.

it is coming 🤣

https://twitter.com/kerberos007/status/1339742953716199425

$USD up

$VIX up

$USD up

$VIX up

$SPX down

the correlation between $USD and $VIX > 50%,

since March

If USD == up and SPX == up

STFR 👌

if USD ~= 85:

sky is falling 🤣

Plus $JPY correlation,

$VIX up

$USD up

$VIX up

$SPX down

the correlation between $USD and $VIX > 50%,

since March

If USD == up and SPX == up

STFR 👌

if USD ~= 85:

sky is falling 🤣

Plus $JPY correlation,

$JPYAUD up

$VIX up

$VIX up

$JPYAUD up

$SPX down

$JPYAUD and $VIX correlation > 60%

$JPY up

$VIX up

$SPX down

super leading indicator.. 👌🧐

$VIX up

$VIX up

$JPYAUD up

$SPX down

$JPYAUD and $VIX correlation > 60%

$JPY up

$VIX up

$SPX down

super leading indicator.. 👌🧐

$CHFEUR up

$VIX up

$VIX up

$CHFEUR up

$SPX down

Hence,

$USD up &

$JPYAUD up &

$CHFEUR up

==>

$VIX spike secured 🔥

$SPX down secured

Super leading indicators 👌🧐

$VIX up

$VIX up

$CHFEUR up

$SPX down

Hence,

$USD up &

$JPYAUD up &

$CHFEUR up

==>

$VIX spike secured 🔥

$SPX down secured

Super leading indicators 👌🧐

In summary:

A. risk-off, #Volmageddon, safe-haven & the sky is falling currencies:

1 $USD

2 $JPY

3 $CHF

B, commodity, speculation, euphoria, all-in, stonks always go up currencies.

1 $EUR

2 $AUD

3 $NZD

Trading accordingly. 🧐😉

A. risk-off, #Volmageddon, safe-haven & the sky is falling currencies:

1 $USD

2 $JPY

3 $CHF

B, commodity, speculation, euphoria, all-in, stonks always go up currencies.

1 $EUR

2 $AUD

3 $NZD

Trading accordingly. 🧐😉

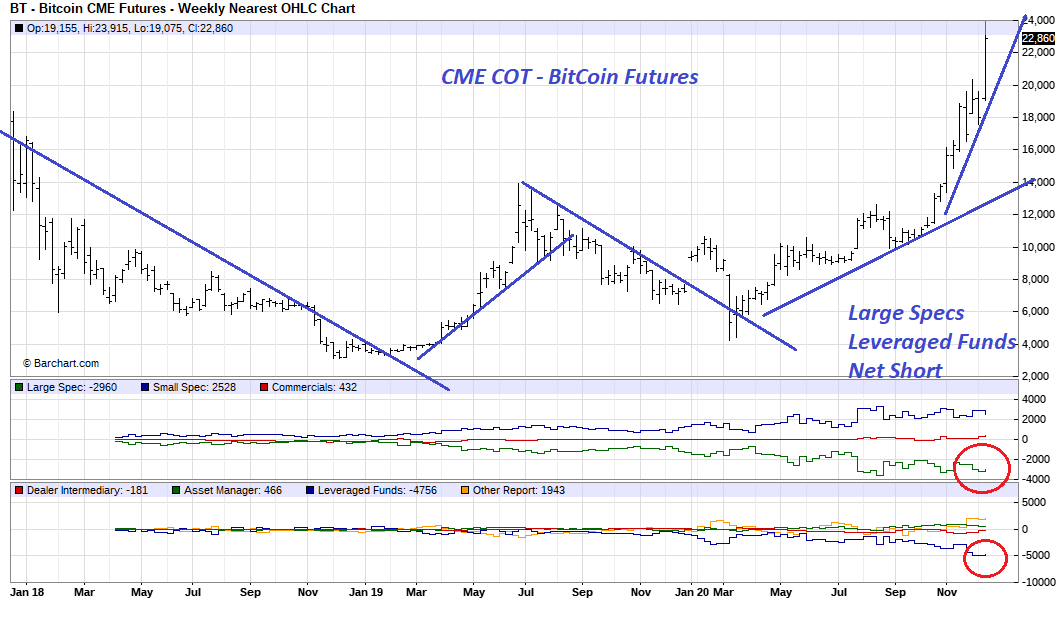

ICYMI.

CME $COT - BT (BitCoin)

large specs = dumb money

small specs = smart money

post in Oct.

guess what the large specs & leveraged funds' positioning looked like last week as #BitCoin surging above $24,000

CME $COT - BT (BitCoin)

large specs = dumb money

small specs = smart money

post in Oct.

guess what the large specs & leveraged funds' positioning looked like last week as #BitCoin surging above $24,000

https://twitter.com/kerberos007/status/1318912825142743040

#BitCoin COT

large specs and leveraged fund net short positioning increased again last week.

large specs = dumb money

small specs = smart money (???)

the battle between the large specs vs small retails @ CME.

large specs and leveraged fund net short positioning increased again last week.

large specs = dumb money

small specs = smart money (???)

the battle between the large specs vs small retails @ CME.

Amazing high correlation:

$SPX vx Equity Call/Put Ratio Smoothed Z-Score

call/put ratio = put/pall ratio inverted.

maximum optimism > 3 sigma = what could go wrong?

capitulation zone < -2 sigma

trading accordingly.😉

$SPX vx Equity Call/Put Ratio Smoothed Z-Score

call/put ratio = put/pall ratio inverted.

maximum optimism > 3 sigma = what could go wrong?

capitulation zone < -2 sigma

trading accordingly.😉

CPR from a historical perspective:

2011 - 2020

$SPX vs Equity Call/Put Ratio Smoothed Z-Score

human traders' sentiment never change,

"maximum optimism" as world CB "go brrrrr" gone mad, especially after March Pandemic

high density "all-in calls" after March.

too obvious

2011 - 2020

$SPX vs Equity Call/Put Ratio Smoothed Z-Score

human traders' sentiment never change,

"maximum optimism" as world CB "go brrrrr" gone mad, especially after March Pandemic

high density "all-in calls" after March.

too obvious

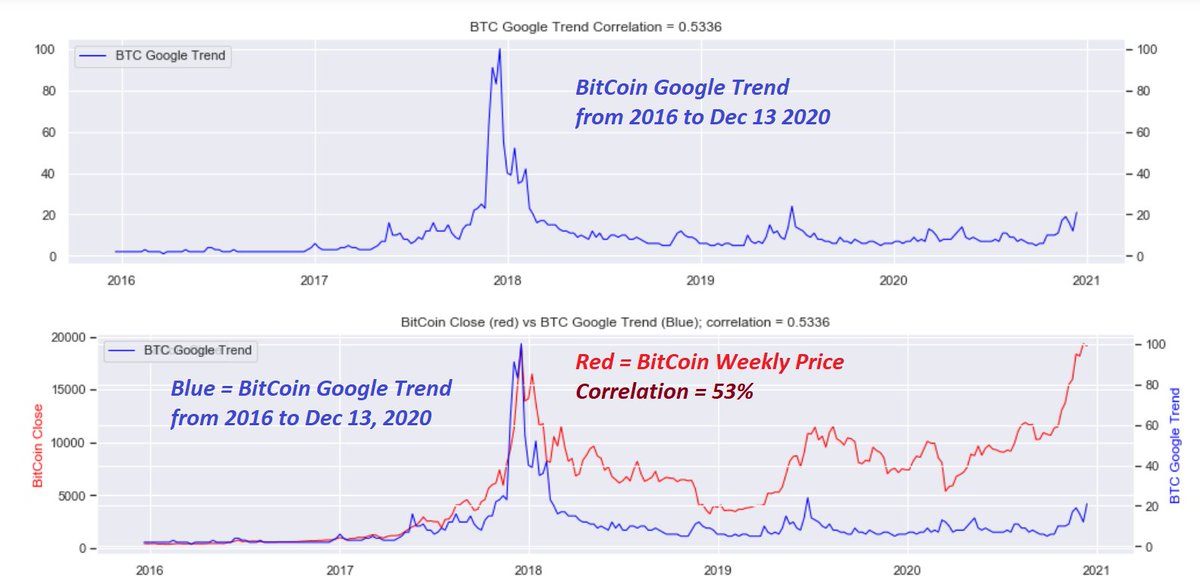

"alternative data" investing:

sentiment:

Google trend analysis for #BitCoin trading

below is the Google weekly trend chart for $BitCoin

since 2016

blue = Google trend for #Bitcoin (2016 to Dec 13 2020)

red = #BitCoin price

correlation = 53%;

great leading indicator👌😉

sentiment:

Google trend analysis for #BitCoin trading

below is the Google weekly trend chart for $BitCoin

since 2016

blue = Google trend for #Bitcoin (2016 to Dec 13 2020)

red = #BitCoin price

correlation = 53%;

great leading indicator👌😉

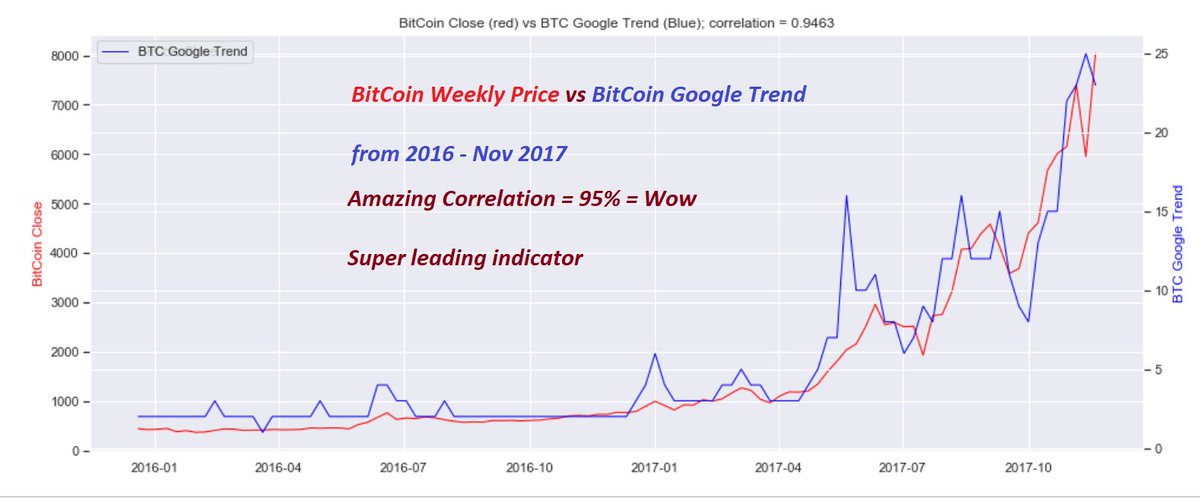

#BitCoin and Google Trend: Shocking correlation:

from 2016 to Nov 2017

Correlation = 95% ==> wow, amazing 🤣

leading indicator? 🧐😉

from 2016 to Nov 2017

Correlation = 95% ==> wow, amazing 🤣

leading indicator? 🧐😉

#BitCoin and Google Trend: Shocking correlation:

from Jan 2017 to Dec 2018

The "rise and fall" of #BitCoin regime

Correlation = 75%

leading indicator..

from Jan 2017 to Dec 2018

The "rise and fall" of #BitCoin regime

Correlation = 75%

leading indicator..

#BitCoin and Google Trend: Shocking correlation:

from July 2019 to Dec 13, 2020

The "rise" of #BitCoin

Correlation = 63% still good 😉🧐

from July 2019 to Dec 13, 2020

The "rise" of #BitCoin

Correlation = 63% still good 😉🧐

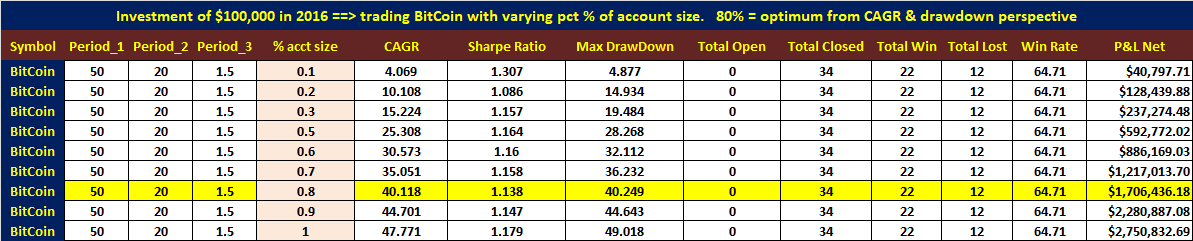

to prove "effectiveness" of trend data with high corr with price. is it leading? or lagging?

I did a quick ML algo backtest using one of my strategies

1 initial= $100,000

2 strategy parameters not optimized

3 good on both training & testing data

4 80% of acct sizing: CAGR = 40%

I did a quick ML algo backtest using one of my strategies

1 initial= $100,000

2 strategy parameters not optimized

3 good on both training & testing data

4 80% of acct sizing: CAGR = 40%

Busy working on a long-term trend indi

& short-term trading breadth indi

top pane = long term trend

middle pane = short-term swing breadth

when long-term == green

BTFD on short-term red-bar uptick

when long-term == pink

STFR on short-term green-bar downtick

2016 to 2010 🧐😉

& short-term trading breadth indi

top pane = long term trend

middle pane = short-term swing breadth

when long-term == green

BTFD on short-term red-bar uptick

when long-term == pink

STFR on short-term green-bar downtick

2016 to 2010 🧐😉

From May 2009 to May 2013

Uptrend 99% of the time:

So, only BTFD on all red histogram upticks.

I am still amazed 😉that both the long-term trend and short-term trading histograms are so smooth, with almost zero delays. unpossible.

super leading indicators. 🧐🍻

Uptrend 99% of the time:

So, only BTFD on all red histogram upticks.

I am still amazed 😉that both the long-term trend and short-term trading histograms are so smooth, with almost zero delays. unpossible.

super leading indicators. 🧐🍻

from Feb 2012 to June 2015 = Uptrend = BTFD only

from July 2015 to Mar 2016 = Downtrend = STFR only

from April 2014 to Feb 2017 = Uptrend = BTFD only

that's it for today.... 😉🤣

from July 2015 to Mar 2016 = Downtrend = STFR only

from April 2014 to Feb 2017 = Uptrend = BTFD only

that's it for today.... 😉🤣

Breaking: getting rich index

follow the leader to da Moon.

Micro-cap penny stock index

straight up from Nov 1

super leading indicator

99% of these $600 Covid check went directly to the Ponzi penny stonks

what could go wrong?

penny stonks only go up. all-in, fomo 🍻😉

follow the leader to da Moon.

Micro-cap penny stock index

straight up from Nov 1

super leading indicator

99% of these $600 Covid check went directly to the Ponzi penny stonks

what could go wrong?

penny stonks only go up. all-in, fomo 🍻😉

one more😉

To simply the trading logic:

1 long when Trend turning Green (risk-on)

2 exit long & short when Trend turning Pink (risk-off)

3 Since 2006💯

A a total of 5 long trades = winners

B one short trade in 2007 to 2009 = winner

C three short & long trades = wash trades

To simply the trading logic:

1 long when Trend turning Green (risk-on)

2 exit long & short when Trend turning Pink (risk-off)

3 Since 2006💯

A a total of 5 long trades = winners

B one short trade in 2007 to 2009 = winner

C three short & long trades = wash trades

Merry xRiskfreeMas quiz😉

1 two highly correlated green indictors:

2 given the Risk-Free 🤣 "mean reversion" nature of these two green indicators, can we predict the short-term VIX directions?

3 "mean reversion" risk-free 🔥 means employing both long and short VIX trades.

1 two highly correlated green indictors:

2 given the Risk-Free 🤣 "mean reversion" nature of these two green indicators, can we predict the short-term VIX directions?

3 "mean reversion" risk-free 🔥 means employing both long and short VIX trades.

Same indicators on the chart from 2012 to 2019

same high correlations,

for $VIX and two green indicators.

same high correlations,

for $VIX and two green indicators.

Same indicators on the chart from 2014 to Dec. 2020

same high correlations,

for $VIX and two green indicators.

hint:

the slow green indicator trended in the opposite direction of SPX.

slope matters.

same high correlations,

for $VIX and two green indicators.

hint:

the slow green indicator trended in the opposite direction of SPX.

slope matters.

Long-Short VIX strategy

new VRP = VRP normalized by Equity PCR

new-VRP> 0 => VIX overpriced = > short VIX/long SVXY

new-VRP< 0 => VIX underpriced => long VIX/VXX

for lotto tickets & hedging for long SPX (stocks) portfolio

new-VRP hedging strategy alone outperformed SPX B&H

new VRP = VRP normalized by Equity PCR

new-VRP> 0 => VIX overpriced = > short VIX/long SVXY

new-VRP< 0 => VIX underpriced => long VIX/VXX

for lotto tickets & hedging for long SPX (stocks) portfolio

new-VRP hedging strategy alone outperformed SPX B&H

nVRP hedging strategy vs SPX buy & Hold

since Nov 2011

nVRP hedging outperforming SPX by a factor of 2.

SPX Buy & Hold

vs

nVRP long & short strategy (always in the market with proper hedging ratio & leverage applied)

👌past performance does not guarantee future returns😉

since Nov 2011

nVRP hedging outperforming SPX by a factor of 2.

SPX Buy & Hold

vs

nVRP long & short strategy (always in the market with proper hedging ratio & leverage applied)

👌past performance does not guarantee future returns😉

Happy xRiskFreeMas.

Merry xMaxOptimismMas

the ultimate risk-off & risk on indicators.

= safe-haven / maximum optimism ratio indicator

= IEF / SPHB ratio

Happy All-in FOMO holidays!

what could go wrong? enjoy it while it lasts 🍻

not sustainable

what goes up must come down😉

Merry xMaxOptimismMas

the ultimate risk-off & risk on indicators.

= safe-haven / maximum optimism ratio indicator

= IEF / SPHB ratio

Happy All-in FOMO holidays!

what could go wrong? enjoy it while it lasts 🍻

not sustainable

what goes up must come down😉

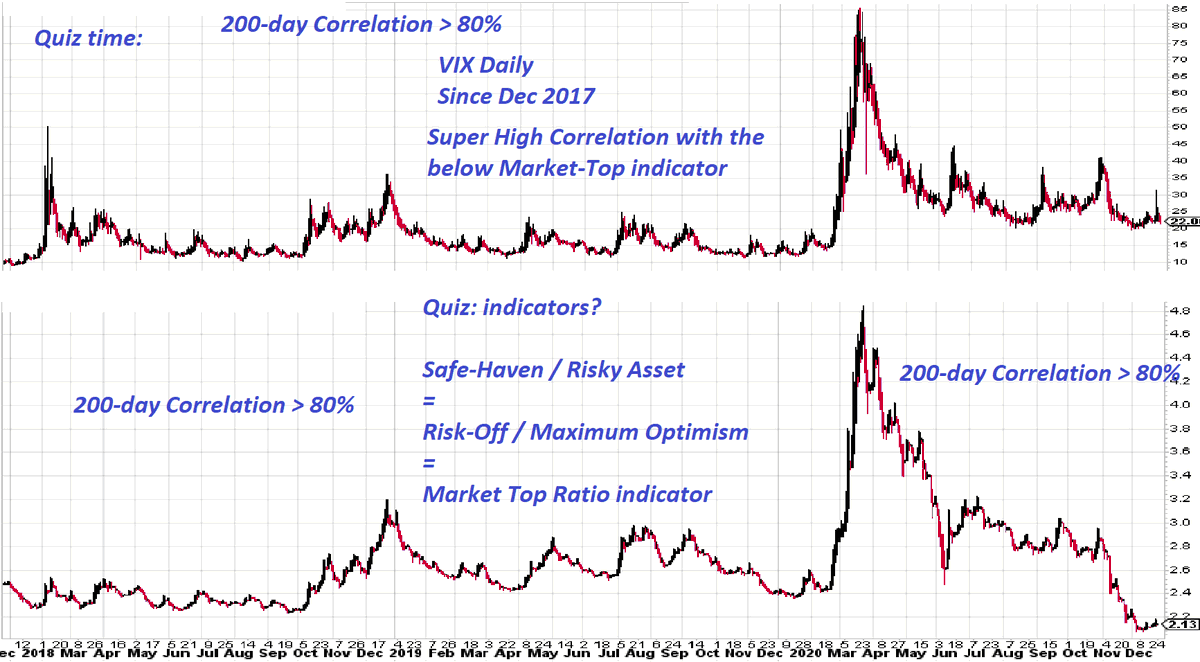

Happy xMarketTopMas indicator

easy quiz for xMas

super high correlation: 200-day corr > 80%

super leading when at extremes

$VIX

vs

Market-Top ratio indicator

= safe-haven/maximum optimism

= risk-off/risk-on

what could go wrong? all-in FOMO

enjoy it while it lasts🍻

Quiz😉

easy quiz for xMas

super high correlation: 200-day corr > 80%

super leading when at extremes

$VIX

vs

Market-Top ratio indicator

= safe-haven/maximum optimism

= risk-off/risk-on

what could go wrong? all-in FOMO

enjoy it while it lasts🍻

Quiz😉

$SPHB vs $IEF Spread Z-score

Euphoria Zone >= +2 Sigma

Greed Zone >= +1 Sigma

Neutral Zone = between +1 & -1 Sigma

Fear Zone <= -1 Sigma

Capitulation Zone <= -2 Sigma

the verdict = euphoria, all-in, fomo, what could go wrong?

Euphoria Zone >= +2 Sigma

Greed Zone >= +1 Sigma

Neutral Zone = between +1 & -1 Sigma

Fear Zone <= -1 Sigma

Capitulation Zone <= -2 Sigma

the verdict = euphoria, all-in, fomo, what could go wrong?

Fun Chart

Renko $SPX trend finder chart from 1997 to 2020

the "duration" is dependent upon the points moved.

the entire year of 2015 was shorter than Feb/Mar 2020 in terms of points transversed 🧐

Renko intraday chart would be very useful for staying on the right side.

Renko $SPX trend finder chart from 1997 to 2020

the "duration" is dependent upon the points moved.

the entire year of 2015 was shorter than Feb/Mar 2020 in terms of points transversed 🧐

Renko intraday chart would be very useful for staying on the right side.

#BitCoin Renko Chart from Dec 2016 to 2020

#BitCoin is approaching $27,000 wow.

Merry xBitCoinMas !! 🍻🔥

Similarity?

from late 2016 to Dec 2017

and

From Mar 2020 to Dec 2020

Go burrrrrrrrr 4ever 🧨💣🔥

#BitCoin is approaching $27,000 wow.

Merry xBitCoinMas !! 🍻🔥

Similarity?

from late 2016 to Dec 2017

and

From Mar 2020 to Dec 2020

Go burrrrrrrrr 4ever 🧨💣🔥

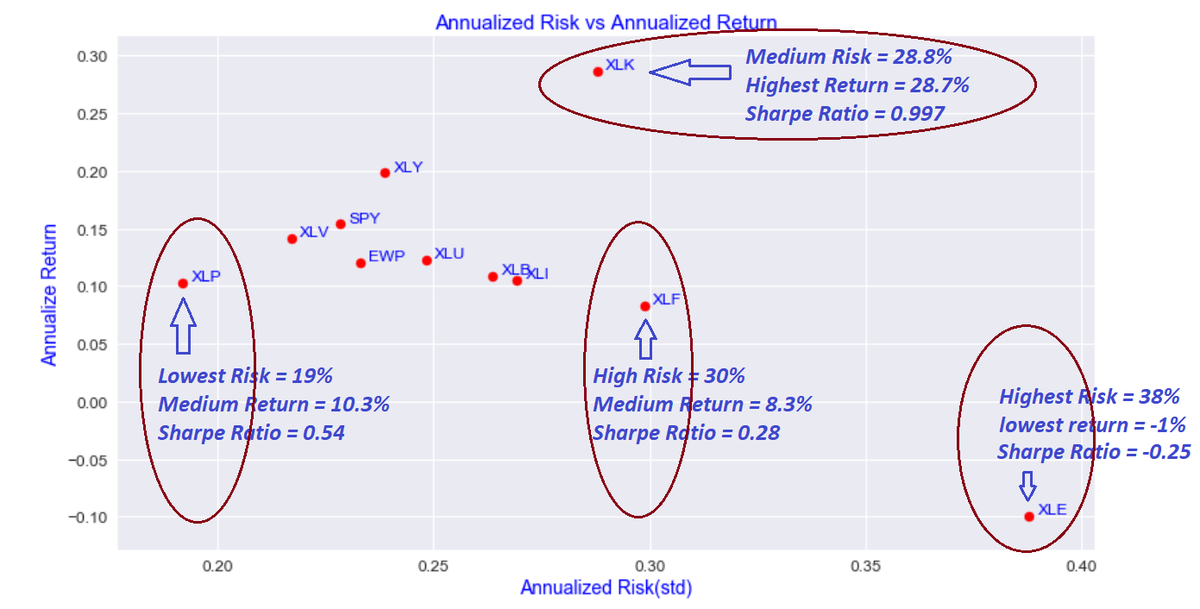

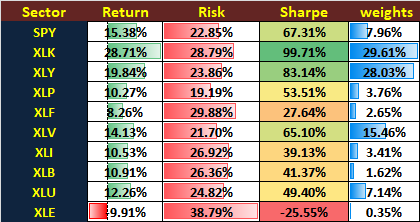

New Year performance and Sharpe Ratio analysis for SPY & SPY sectors:

3 year performance: from Jan 2, 2018 to Dec 31, 2020

3 year Annualized Return and Annualized Risk (Sigma)

Sharpe Ratio = (A-Return - risk-free rate) / A-Risk

One picture is worth a million words 😉

3 year performance: from Jan 2, 2018 to Dec 31, 2020

3 year Annualized Return and Annualized Risk (Sigma)

Sharpe Ratio = (A-Return - risk-free rate) / A-Risk

One picture is worth a million words 😉

A table is worth a thousand words.

SPY & SPY Sector performance (3 years) annualized

with Equal Weight Portfolio (EWP) performance calculated.

EWP for portfolio diversification analysis

SPY & SPY Sector performance (3 years) annualized

with Equal Weight Portfolio (EWP) performance calculated.

EWP for portfolio diversification analysis

Modern Portfolio Theory (MPT)

&

the efficient frontier

MPT is the set of weighted portfolios that satisfy the condition that no other portfolio exists with a higher annualized return but with the same annualized risk (std)

first attempt: 100,000 random weighted portfolios (red)

&

the efficient frontier

MPT is the set of weighted portfolios that satisfy the condition that no other portfolio exists with a higher annualized return but with the same annualized risk (std)

first attempt: 100,000 random weighted portfolios (red)

Color coded Sharpe-Ratio of 100,000 random weighted portfolio

Red dots = Hot Sharpe Ratio portfolio

==>hi-return & lo risk

Blue dots =Cool Sharpe Ratio portfolio

==> lo return & hi risk

which red dot (portfolio) achieves the best return per risk taken?

beware

past != future😉

Red dots = Hot Sharpe Ratio portfolio

==>hi-return & lo risk

Blue dots =Cool Sharpe Ratio portfolio

==> lo return & hi risk

which red dot (portfolio) achieves the best return per risk taken?

beware

past != future😉

Star portfolio = Maximum Sharpe Ratio Portfolio among 100,000 random weighted portfolio

beware:

backward looking portfolio optimization

past performance != future returns

but could be used as a bench mark for 1 M hedge funds' year-end performance🧐

beware:

backward looking portfolio optimization

past performance != future returns

but could be used as a bench mark for 1 M hedge funds' year-end performance🧐

Max Sharpe Ratio Portfolio weights

This best weighted portfolio assumes that the portfolio did not perform re-balancing (since Jan 2018)

not a realistic assumption

the question is:

what is the best re-balancing period to maintain the best weights for highest Sharpe-Ratio?

This best weighted portfolio assumes that the portfolio did not perform re-balancing (since Jan 2018)

not a realistic assumption

the question is:

what is the best re-balancing period to maintain the best weights for highest Sharpe-Ratio?

Capital Asset Pricing Model (CAPM)

Capital Market Line from efficient frontier

2 funds risk-parity portfolio construction

optimizations

1 best portfolio weights

2 best re-balancing period (weekly, monthly, quarterly) to maintain best portfolio weights for best Sharpe-Ratio

Capital Market Line from efficient frontier

2 funds risk-parity portfolio construction

optimizations

1 best portfolio weights

2 best re-balancing period (weekly, monthly, quarterly) to maintain best portfolio weights for best Sharpe-Ratio

From CAPM theory

many modern financial terms are based open

A alpha & beta derived/defined

B systematic risk vs unsystematic risk defined

C unsystematic risk from assets' internal risk (acct fraud) can be diversified away

D systematic risk can only be hedged

more later 😉

many modern financial terms are based open

A alpha & beta derived/defined

B systematic risk vs unsystematic risk defined

C unsystematic risk from assets' internal risk (acct fraud) can be diversified away

D systematic risk can only be hedged

more later 😉

What Is the Capital Asset Pricing Model?

especially useful in a Fed driven "FrankenBull" market.🤣

investopedia.com/terms/c/capm.a…

especially useful in a Fed driven "FrankenBull" market.🤣

investopedia.com/terms/c/capm.a…

In case you haven't noticed this correlation.

The Fed's QE4ever & NIRP since March driving USD into the abyss, in the mean time:

$USD driving $SPX to da Moon.

$USD & $SPX since March, 2020

200 day Correlation >= -95% amazing.

mirror image. tick for tick

unsustainable

The Fed's QE4ever & NIRP since March driving USD into the abyss, in the mean time:

$USD driving $SPX to da Moon.

$USD & $SPX since March, 2020

200 day Correlation >= -95% amazing.

mirror image. tick for tick

unsustainable

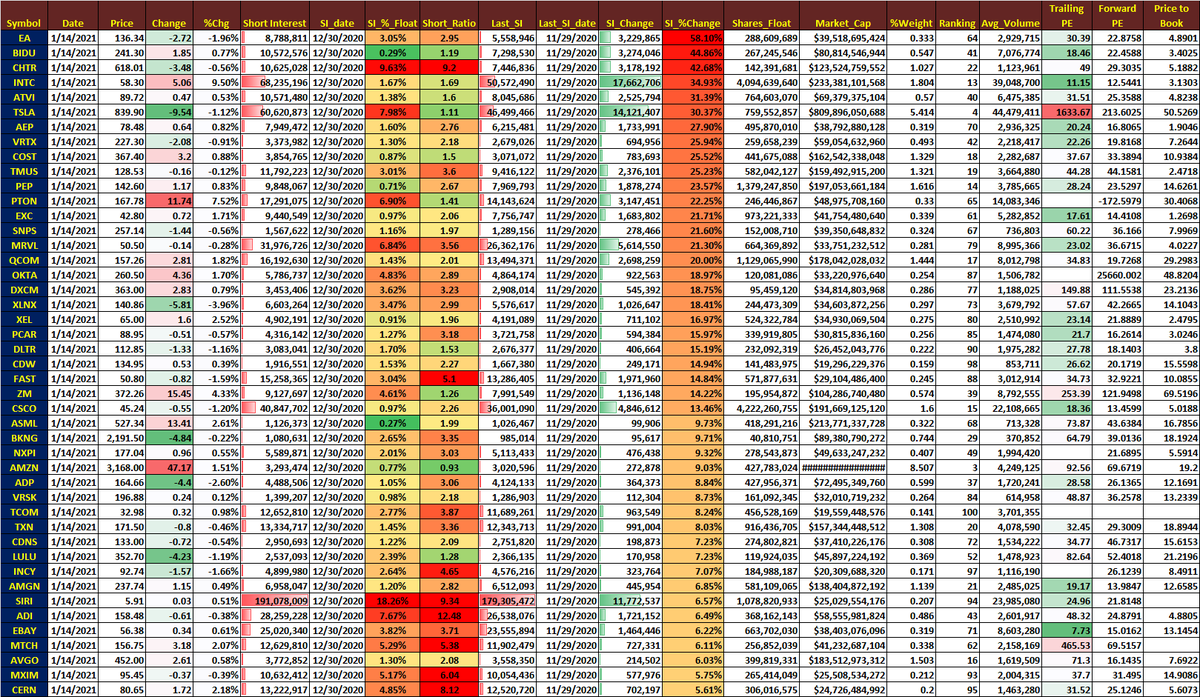

Need a magnifier

since March:

200-day Corre matrix among world indices, FX & Gold (XAU)

SPX positive corr = risk-on FX cur

SPX negative corr = risk-off FX cur

the diagonal corre always = 1, self to self corre

upper & lower triangle=mirror image

USD:SPX corr = SPX:USD corr

since March:

200-day Corre matrix among world indices, FX & Gold (XAU)

SPX positive corr = risk-on FX cur

SPX negative corr = risk-off FX cur

the diagonal corre always = 1, self to self corre

upper & lower triangle=mirror image

USD:SPX corr = SPX:USD corr

In case you haven't noticed this correlation? 😉

#BTC and $SPX on the same linear scale.

#BitCoin since mid 2017 breakout to almost $20,000 by Dec 2017

#BitCoin > $40,000 intraday today.

#BTC and $SPX on the same linear scale.

#BitCoin since mid 2017 breakout to almost $20,000 by Dec 2017

#BitCoin > $40,000 intraday today.

Fun & amazing performance stats.

#Bitcoin

$TSLA

$AAPL

buy & hold since 2011-6-13

#BitCoin

total return = 203,865%

CAGR = 121.65%

max drawdown = -91%

$TSLA

total return = 15,377%

CAGR = 69.3%

max drawdown = -60.6%

one table is worth a million words😉

#Bitcoin

$TSLA

$AAPL

buy & hold since 2011-6-13

#BitCoin

total return = 203,865%

CAGR = 121.65%

max drawdown = -91%

$TSLA

total return = 15,377%

CAGR = 69.3%

max drawdown = -60.6%

one table is worth a million words😉

SPY, QQQ, IWM and SP-500 Sectors

Performance stats since Feb 2007 ==> GFC included

$XLF only up 20% since 2007🧐

$QQQ up 701%

$XLE down -3.9% ( #GS Oil to $200 call in 2008 )😉

Performance stats since Feb 2007 ==> GFC included

$XLF only up 20% since 2007🧐

$QQQ up 701%

$XLE down -3.9% ( #GS Oil to $200 call in 2008 )😉

Risky FX currency vs risky FrankenBull market

$AUDUSD vs $QQQ

225-day Corr = 96.6%;

amazing

one-sided & crowded trades:

Short $USD & Long $AUD

carry trade

unsuatainable.

wait for the carry trade to unwind in times of stress

snowball😉🧐

bubble everywhere

&

everything bubble

$AUDUSD vs $QQQ

225-day Corr = 96.6%;

amazing

one-sided & crowded trades:

Short $USD & Long $AUD

carry trade

unsuatainable.

wait for the carry trade to unwind in times of stress

snowball😉🧐

bubble everywhere

&

everything bubble

I have to steal this chart for the record

Citi: The Panic/Euphoria Model

Maximum Optimism: off the chart.

looks like a 10 sigma event? once in a billion years?🤣

What could go wrong? BTF-ATH; BTF-Euphoria fomo

Citi: The Panic/Euphoria Model

Maximum Optimism: off the chart.

looks like a 10 sigma event? once in a billion years?🤣

What could go wrong? BTF-ATH; BTF-Euphoria fomo

For the record:

from 2018 Citi Panic/Euphoria sentiment indicator:

Jan 2018

Sep 2018

Euphoria.

what happened 1-2 months later?

from 2018 Citi Panic/Euphoria sentiment indicator:

Jan 2018

Sep 2018

Euphoria.

what happened 1-2 months later?

For the record:

from 2018 - 2019 Citi Panic/Euphoria sentiment indicator:

Sep 2018 - Euphoria

Dec 2018 - Panic/Capitulation

April 2019 - Euphoria

June 2019 - Panic

super leading contrarian indicator.

what happened 1-2 months later?

from 2018 - 2019 Citi Panic/Euphoria sentiment indicator:

Sep 2018 - Euphoria

Dec 2018 - Panic/Capitulation

April 2019 - Euphoria

June 2019 - Panic

super leading contrarian indicator.

what happened 1-2 months later?

For the record:

from 2019 - 2020 Citi Panic/Euphoria sentiment indicator:

Jan 2020- Euphoria

Feb 2020 - Euphoria

Mar 2020 - Panic/Capitulation

Aug 2020 - Euphoria++

Nov/Dec 2020 - Euphoria++++ (^n)

Jan 2021 - need a new scale; 2 sigma

super leading contrarian indicator.

from 2019 - 2020 Citi Panic/Euphoria sentiment indicator:

Jan 2020- Euphoria

Feb 2020 - Euphoria

Mar 2020 - Panic/Capitulation

Aug 2020 - Euphoria++

Nov/Dec 2020 - Euphoria++++ (^n)

Jan 2021 - need a new scale; 2 sigma

super leading contrarian indicator.

for the record: top secret indicators.

posted on Feb 16th.

see my market top indicator (top one) aligned with Citi indicator perfectly.

also my market crash indicator (bottom: probability > 90%)

In Jan 2018 and

Feb 2020.

perfect. 👌🍻 for the record

posted on Feb 16th.

see my market top indicator (top one) aligned with Citi indicator perfectly.

also my market crash indicator (bottom: probability > 90%)

In Jan 2018 and

Feb 2020.

perfect. 👌🍻 for the record

https://twitter.com/kerberos007/status/1229194103356887041

futures #COT positioning update

VX🔥

Comm & dealer = huge long

Lg/sm specs & lev funds = huge short

NQ👌

Comm & dealer = net short

Lg/sm specs = net long

Rut🧐

Comm & dealer = huge short

Lg/Sm specs = net long

USD💣

Comm & dealer = net long

Lg specs = net short

ES😴

mixed

VX🔥

Comm & dealer = huge long

Lg/sm specs & lev funds = huge short

NQ👌

Comm & dealer = net short

Lg/sm specs = net long

Rut🧐

Comm & dealer = huge short

Lg/Sm specs = net long

USD💣

Comm & dealer = net long

Lg specs = net short

ES😴

mixed

Current Shiller PE Ratio: 34.77 +0.19 (0.55%)

Mean: 6.78

Median: 15.81

Min: 4.78 (Dec 1920)

Max: 44.19 (Dec 1999)

Schiller PE still below Dec 1999😉

S&P-500 super-duper under-valued?

BTF-ATH

what could go wrong? go burrrr 4ever

Schiller PE magnet = 100🤣🔥

Mean: 6.78

Median: 15.81

Min: 4.78 (Dec 1920)

Max: 44.19 (Dec 1999)

Schiller PE still below Dec 1999😉

S&P-500 super-duper under-valued?

BTF-ATH

what could go wrong? go burrrr 4ever

Schiller PE magnet = 100🤣🔥

Current S&P 500 Price to Book: 4.24 +0.02 (0.55%)

Mean: 2.84

Median: 2.78

Min: 1.78(Mar 2009)

Max: 5.06(Mar 2000)🔥

PB ratio still below Mar 2000

S&P-500 super-duper under-valued

BTF-ATH

what could go wrong? go burrrr 4ever

PB ratio magnet= 10 🧐🍻

Mean: 2.84

Median: 2.78

Min: 1.78(Mar 2009)

Max: 5.06(Mar 2000)🔥

PB ratio still below Mar 2000

S&P-500 super-duper under-valued

BTF-ATH

what could go wrong? go burrrr 4ever

PB ratio magnet= 10 🧐🍻

Current S&P 500 Price to Sales Ratio: 2.79 +0.02 (0.55%)

Mean: 1.57

Median: 1.50

Min: 0.80(Mar 2009)

Max: 2.79(Jan 2021)🔥

PS ratio ATH👍

BTF-ATH

what could go wrong? go burrrr 4ever

The Fed mandate/target: PS ratio = 10🤣

Mean: 1.57

Median: 1.50

Min: 0.80(Mar 2009)

Max: 2.79(Jan 2021)🔥

PS ratio ATH👍

BTF-ATH

what could go wrong? go burrrr 4ever

The Fed mandate/target: PS ratio = 10🤣

If all of above do not matter:

how about Earnings Yield?

Current S&P 500 Earnings Yield: 2.59% -1.42 bps

I miss 1917🍻 with avg Earnings Yield of 18.8%

mean = 7.3% is fair

Mean: 7.32%

Median: 6.74%

Min: 0.81% (May 2009)

Max: 18.82% (Dec 1917)

magnet = 0😉

how about Earnings Yield?

Current S&P 500 Earnings Yield: 2.59% -1.42 bps

I miss 1917🍻 with avg Earnings Yield of 18.8%

mean = 7.3% is fair

Mean: 7.32%

Median: 6.74%

Min: 0.81% (May 2009)

Max: 18.82% (Dec 1917)

magnet = 0😉

beware

enjoy the party (party like 1999 with virus masks on) while it lasted

all bubbles would always burst

this time is different?

human greed never changes

when in times of stress, Fed can't fix it with go burr4ever

point of diminishing return

it is just a matter of time🧐

enjoy the party (party like 1999 with virus masks on) while it lasted

all bubbles would always burst

this time is different?

human greed never changes

when in times of stress, Fed can't fix it with go burr4ever

point of diminishing return

it is just a matter of time🧐

Busy day-trading/scalping to fund my long-term put lotto tickets

Below: one of my fav charts for day trading

Confluence is KEY

Gold stair line= 10 day SMA on an hourly chart

Short-term trend: strong support if price abovet

Confluence:: Blue (or Red ) waves & FX same direction

Below: one of my fav charts for day trading

Confluence is KEY

Gold stair line= 10 day SMA on an hourly chart

Short-term trend: strong support if price abovet

Confluence:: Blue (or Red ) waves & FX same direction

4-Hour $SPX and FX major currencies since Mar 2020

Safe-haven (risk-off) = $USD & $JPY dumped since Mar

Risky FX (risk-on) = $AUD & $NZD surged since Mar

$SPX (bottom) surged.

All about Fed driven risky assets & FX currencies bubble.

plus #BitCoin & housing bubble

FrankenBull

Safe-haven (risk-off) = $USD & $JPY dumped since Mar

Risky FX (risk-on) = $AUD & $NZD surged since Mar

$SPX (bottom) surged.

All about Fed driven risky assets & FX currencies bubble.

plus #BitCoin & housing bubble

FrankenBull

Maximum Optimism:

Russell-3000 stocks trading above 200-day SMA = 90.45%

A chart is worth a million words

Jan 2018

Aug/Sep 2018

Jan/Feb 2020

=> around 70% of Rut 3000 stocks above 200d SMA

today = 90.45% Euphoria, fomo, maximum optimism

what could go wrong?

Greed is good 🍻😉

Russell-3000 stocks trading above 200-day SMA = 90.45%

A chart is worth a million words

Jan 2018

Aug/Sep 2018

Jan/Feb 2020

=> around 70% of Rut 3000 stocks above 200d SMA

today = 90.45% Euphoria, fomo, maximum optimism

what could go wrong?

Greed is good 🍻😉

Another super duper leading contrarian indicator:

I have a screener, scanning from over 4000+ stocks including penny stocks

The 1st criteria is:

price > $10

2-3 months ago ==> around 3000 stocks

today ==> almost 3500 stocks

tons of penny stocks, now trading above $10🧐🍻😉

I have a screener, scanning from over 4000+ stocks including penny stocks

The 1st criteria is:

price > $10

2-3 months ago ==> around 3000 stocks

today ==> almost 3500 stocks

tons of penny stocks, now trading above $10🧐🍻😉

Micro-Cap Index vs S&P-500 Index

Since July 2020:

S&P-500 =====> Up 20%

Micro-Cap -===> Up 50%

Micro-Cap all-in, euphoria, maximum optimism.

Penny stonks only go UP 🧨💣🔥

what could go wrong?

Greed is good 🍻😉

Since July 2020:

S&P-500 =====> Up 20%

Micro-Cap -===> Up 50%

Micro-Cap all-in, euphoria, maximum optimism.

Penny stonks only go UP 🧨💣🔥

what could go wrong?

Greed is good 🍻😉

CBOE Equity PCR=0.34🍻

Euphoria, all-in calls

lowest 12 PCR since 2010:

2021-01-12 0.34🔥

2020-12-03 0.35

2010-12-13 0.35

2020-12-07 0.37

2020-12-22 0.37

2020-12-01 0.37

2011-01-14 0.37

2020-11-09 0.37

2020-12-17 0.37

2020-06-08 0.37

2020-08-27 0.38

2021-01-07 0.38

Euphoria, all-in calls

lowest 12 PCR since 2010:

2021-01-12 0.34🔥

2020-12-03 0.35

2010-12-13 0.35

2020-12-07 0.37

2020-12-22 0.37

2020-12-01 0.37

2011-01-14 0.37

2020-11-09 0.37

2020-12-17 0.37

2020-06-08 0.37

2020-08-27 0.38

2021-01-07 0.38

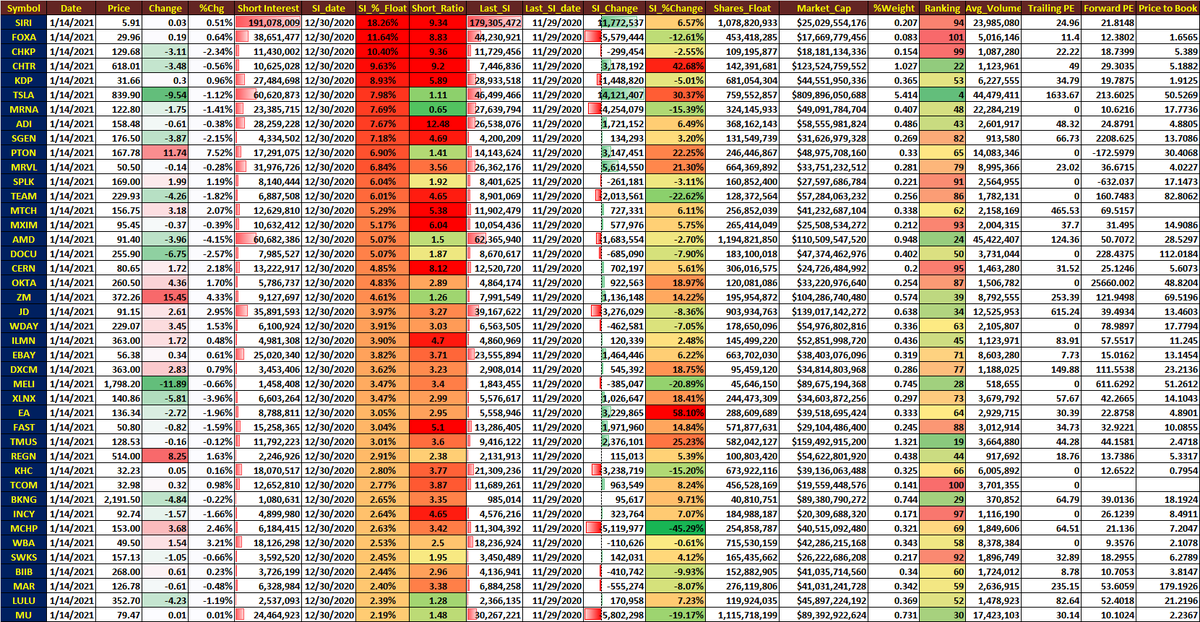

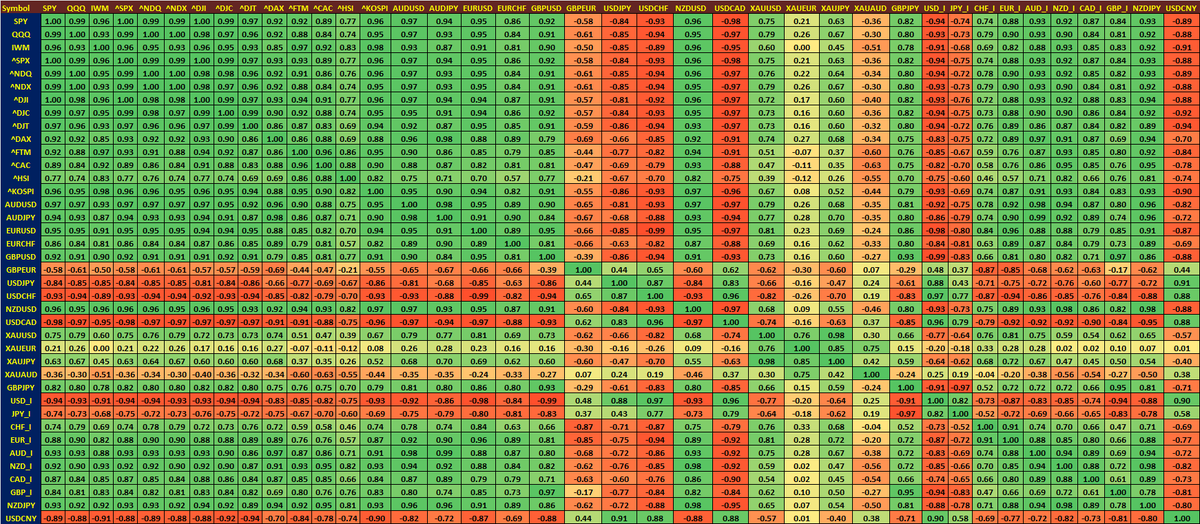

QQQ-100 Short Interest as of Dec 30:

Top 45 Short-Interest SI_%change from Nov 29

$EA = 58%

$BIDU = 44.8%

$CHTR = 42%

$INTC = 35%

Top 45 Short-Interest SI_%change from Nov 29

$EA = 58%

$BIDU = 44.8%

$CHTR = 42%

$INTC = 35%

$TSLA: Mother of all Short Squeezes.

Short Interest since Aug 2019

5:1 split adjusted Short Interest and Daily Volume

SI & volume multiplied by 5 for SI prior to Aug 5:1 split

Days to cover from 6 days to 1 day.

Short Interest since Aug 2019

5:1 split adjusted Short Interest and Daily Volume

SI & volume multiplied by 5 for SI prior to Aug 5:1 split

Days to cover from 6 days to 1 day.

Top 42 QQQ-103 stocks in terms of Market-Cap & % weights in NDX

top 10 stocks = 51.85% weights for NDX-100 Index

$AAPL ranked #1 with 11.9% weight 👌

$TSLA ranked #4 in terms of market-cap weight = 5.4%

top 10 stocks = 51.85% weights for NDX-100 Index

$AAPL ranked #1 with 11.9% weight 👌

$TSLA ranked #4 in terms of market-cap weight = 5.4%

Indices and major Sector rotation heat map.

$QQQ & $XLK ranking dropping fast

$IWM still near the top

$XLU & $XLP near the bottom

Ranked by my quant momentum scoring system

QWSR scoring & % change from 1-day to 1-year

$QQQ & $XLK ranking dropping fast

$IWM still near the top

$XLU & $XLP near the bottom

Ranked by my quant momentum scoring system

QWSR scoring & % change from 1-day to 1-year

top 22 and bottom 22 S&P-500 stocks and QQQ stocks

bottom stocks mostly green today

top stocks mostly red today

interesting rotation.

sell winners (profit taking)

buy losers (mean reversion)

bottom stocks mostly green today

top stocks mostly red today

interesting rotation.

sell winners (profit taking)

buy losers (mean reversion)

Growth vs Value ETFs

Sector Rotation

1. IWM vs SPY

2. SP500 Growth vs SPY Value (SPYG vs SPYV)

3. SP400 Growth vs SP400 Value (MDYG vs MDYV)

4. SP600 Growth vs SP600 Value (SLYG vs SLYV)

Sector Rotation

1. IWM vs SPY

2. SP500 Growth vs SPY Value (SPYG vs SPYV)

3. SP400 Growth vs SP400 Value (MDYG vs MDYV)

4. SP600 Growth vs SP600 Value (SLYG vs SLYV)

$VIX vs

CBOE Put/Call Ratio (10-day MA)

both are standardized for comparison purposes

Since March 2020,

PCRs have been consistently below -2 sigma, only had seen a couple of times in 2011.

euphoria

all-in stonk calls with stimulus checks & borrowed money

what could go wrong?

CBOE Put/Call Ratio (10-day MA)

both are standardized for comparison purposes

Since March 2020,

PCRs have been consistently below -2 sigma, only had seen a couple of times in 2011.

euphoria

all-in stonk calls with stimulus checks & borrowed money

what could go wrong?

Equity PCR (10-day SMA) since 2004

vs

$VIX

linear scale

not standardized

left axis = VIX

right axis = PCR

without standardization, it is hard to compare.

super important for all ML algos to standardize/normalize all inputs to the same scale prior to the training of Neurons

vs

$VIX

linear scale

not standardized

left axis = VIX

right axis = PCR

without standardization, it is hard to compare.

super important for all ML algos to standardize/normalize all inputs to the same scale prior to the training of Neurons

some useful stats for

1 VIX

2 PCR

3 PCR-SMA(10)

A. VIX mean = 17.88; today > 24

B. PCR mean = 0.63; since March mostly below 0.4

C. PCR min = 0.35; yep, achieved last week 2 days in a row

D. euphoria; all-in stonk calls

E. what could go wrong?

F BTF-ATH🔥

1 VIX

2 PCR

3 PCR-SMA(10)

A. VIX mean = 17.88; today > 24

B. PCR mean = 0.63; since March mostly below 0.4

C. PCR min = 0.35; yep, achieved last week 2 days in a row

D. euphoria; all-in stonk calls

E. what could go wrong?

F BTF-ATH🔥

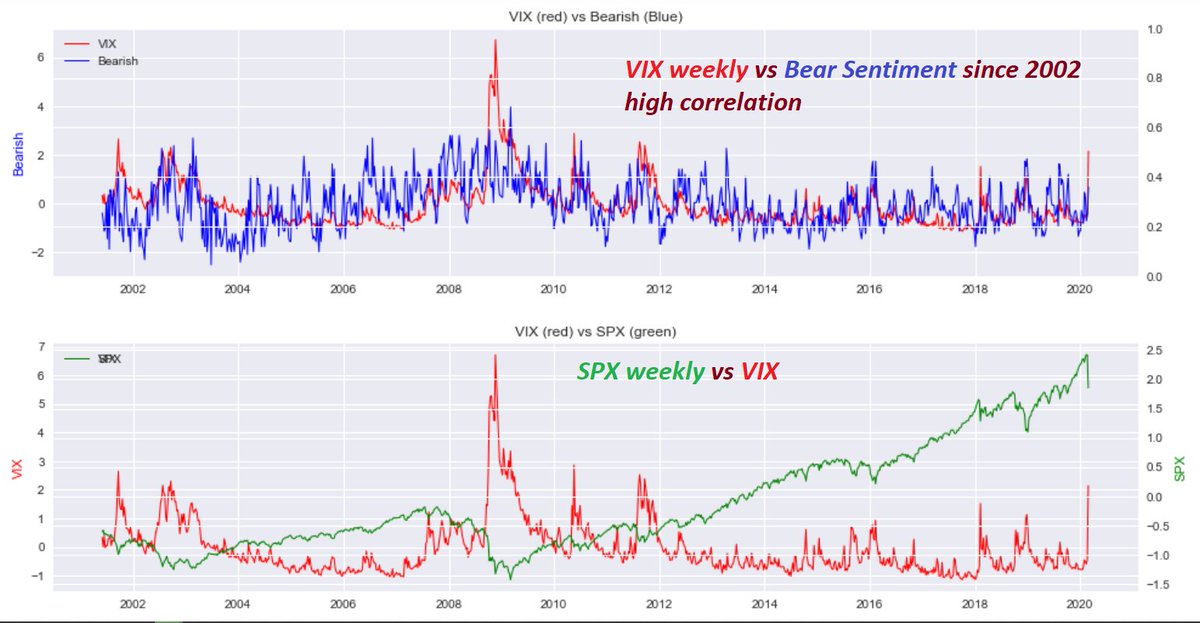

AAII Sentiment: Chart from 2010

Green = Bullish

Red = Bearish

Blue = bull - bear Spread

bull- bear spread = a good contrarian indicator

not as good as Equity PCR

but

when aligned and confluent with other breadth inds, high probability contrarian ind

accurate capitulation zone

Green = Bullish

Red = Bearish

Blue = bull - bear Spread

bull- bear spread = a good contrarian indicator

not as good as Equity PCR

but

when aligned and confluent with other breadth inds, high probability contrarian ind

accurate capitulation zone

VIX weekly vs Bear-Sentiment since 2002

High Correlation.

red line = $VIX

blue line = bear-sentiment

green line = $SPX

bear-sentiment => positive correlation with $VIX

is better than bull-sentiment => pos. correlation with $SPX

High Correlation.

red line = $VIX

blue line = bear-sentiment

green line = $SPX

bear-sentiment => positive correlation with $VIX

is better than bull-sentiment => pos. correlation with $SPX

Last post on AAII

Updated:

with projections 🤣😉

top = $VIX vs Bear-10d-SMA

bottom = $SPX vs Bull-Bear-Spread-10d-SMA

with projections

Updated:

with projections 🤣😉

top = $VIX vs Bear-10d-SMA

bottom = $SPX vs Bull-Bear-Spread-10d-SMA

with projections

bonus: the mother of all JAWS?

6 Jaws (divergence at the top) since Jan 2018, resulted huge drawdowns; plunge would soon ensue

so far so good,100% accuracy since Feb 2018

pinpointed all 6 ATHs w/ trend line break

the 7th time is different?

what could go wrong? all-in calls🍻

6 Jaws (divergence at the top) since Jan 2018, resulted huge drawdowns; plunge would soon ensue

so far so good,100% accuracy since Feb 2018

pinpointed all 6 ATHs w/ trend line break

the 7th time is different?

what could go wrong? all-in calls🍻

Support and resistance levels +- 5 pts

==>

bulls & bears stop loss levels

Ponzi algos targeting these congested stop loss levels day & night

super leading S-R levels, written on the wall days/weeks ahead

KEY to win🧐

front-run the algo stop run

fade the algo after the stop run

==>

bulls & bears stop loss levels

Ponzi algos targeting these congested stop loss levels day & night

super leading S-R levels, written on the wall days/weeks ahead

KEY to win🧐

front-run the algo stop run

fade the algo after the stop run

Shocking Stats

QQQ from 1999-3-11 to 2021-1-19

Overnight ret=buy at close & sell at next day open

Intraday ret=buy at open & sell at close the same day

Buy & Hold ret=buy on 1999-3-11 & hold

overnight= 1024%; Max = -38%

Intraday= -65%; max DD = -88%

B&H= 608%; Max DD = -83%

QQQ from 1999-3-11 to 2021-1-19

Overnight ret=buy at close & sell at next day open

Intraday ret=buy at open & sell at close the same day

Buy & Hold ret=buy on 1999-3-11 & hold

overnight= 1024%; Max = -38%

Intraday= -65%; max DD = -88%

B&H= 608%; Max DD = -83%

A picture is worth a million words:

study conclusion:😉

Algos have been super busy "BTFD" at night.🐵

Real traders have been super busy "STFR" intraday👌

shocking?

🧐🍻

study conclusion:😉

Algos have been super busy "BTFD" at night.🐵

Real traders have been super busy "STFR" intraday👌

shocking?

🧐🍻

QQQ overnight BTFD Seasonality..

July seemed to be a good overnight BTFD

3 negative return years

one flat year

17 positive return years

not bad.

Algos Holy Grail trading strategy 🐵🤣

July seemed to be a good overnight BTFD

3 negative return years

one flat year

17 positive return years

not bad.

Algos Holy Grail trading strategy 🐵🤣

strategy summary

from my intensive study on portfolio opt:

best portfolio construction

A pick 5 strategies (below table) with positive expected ret

B correlation of strategies should be low or negative

C monthly rebalance among 5 strategies using risk-parity allocation algo

from my intensive study on portfolio opt:

best portfolio construction

A pick 5 strategies (below table) with positive expected ret

B correlation of strategies should be low or negative

C monthly rebalance among 5 strategies using risk-parity allocation algo

D. by monthly rebalancing among 5 strategies based on risk-parity allocation algo

E. achieving portfolio diversification among 5 strategies

F. reduce overall portfolio risk (vol), minimize DD & increase Sharpe & Sortino ratios

G. enhance overall portfolio return with less risk

E. achieving portfolio diversification among 5 strategies

F. reduce overall portfolio risk (vol), minimize DD & increase Sharpe & Sortino ratios

G. enhance overall portfolio return with less risk

SPY & Micro-Cap relative performance

52 week:

all-in Penny Stock and Micro-Cap;

plus

#BitCoin and OTM calls.

what could go wrong?🍻 Booyah.

Booyah. Euphoria. Booyah

52 week:

all-in Penny Stock and Micro-Cap;

plus

#BitCoin and OTM calls.

what could go wrong?🍻 Booyah.

Booyah. Euphoria. Booyah

more & more

Booyah. Euphoria. Booyah

including $TSLA & $GME..

Speechless. Booyah. Euphoria. Booyah

the Mother of all infinity short squeezes

Off the chart. to Da Moon

what could go wrong?

when it rains it pours.

the new regime.

the Robinhooder regime. 🍻🔥

Booyah. Euphoria. Booyah

including $TSLA & $GME..

Speechless. Booyah. Euphoria. Booyah

the Mother of all infinity short squeezes

Off the chart. to Da Moon

what could go wrong?

when it rains it pours.

the new regime.

the Robinhooder regime. 🍻🔥

Super trend detection indi's

Stay with the trend until it breaks

Bottom (yellow arrows) = BTFD when Red color turned Green

potential STFR when Green turned Red;

STFR when SPX trendline break w/ Jaws (Pink arrows)

super trend detection with high prob entry & exit & Jaws

Stay with the trend until it breaks

Bottom (yellow arrows) = BTFD when Red color turned Green

potential STFR when Green turned Red;

STFR when SPX trendline break w/ Jaws (Pink arrows)

super trend detection with high prob entry & exit & Jaws

$VIX percent Change close to close.

since 1990

top 37 $VIX percent change (close to close) since 1990 inception

#Volmageddon = Ranked #1 up 115.6% in one day

today = ranked #2

$VIX = 37.21 up 61.64% in one day.

booyah.. 🧐🍻

since 1990

top 37 $VIX percent change (close to close) since 1990 inception

#Volmageddon = Ranked #1 up 115.6% in one day

today = ranked #2

$VIX = 37.21 up 61.64% in one day.

booyah.. 🧐🍻

With $VIX up 61% today

and

$SPX down almost 100 points

the Equity Put/Call ratio still <= 0.40 (yellow)

all-in call buying continued.

what fear? still Euphoria, greed & Maximum Optimism

$VIX spike today was just a huge "short-squeeze".

Short Squeeze infinity everywhere.

and

$SPX down almost 100 points

the Equity Put/Call ratio still <= 0.40 (yellow)

all-in call buying continued.

what fear? still Euphoria, greed & Maximum Optimism

$VIX spike today was just a huge "short-squeeze".

Short Squeeze infinity everywhere.

#ES_F: Ping-pong competition continues

🤣

Perfect "Head and Shoulder" & middle finger formation🐵

super duper Bullish++

Magnet = 3730

Magnet = 3700

next magnet = ???? use your imagination.🧐

🤣

Perfect "Head and Shoulder" & middle finger formation🐵

super duper Bullish++

Magnet = 3730

Magnet = 3700

next magnet = ???? use your imagination.🧐

Sector rotation:

Useful S&P-500 & Major Sector Relative performance stats

Surprising stats from Jan 2000 to Jan 2022

22 years

XLY = Best = growth

XLV = 2nd = value

XLU = 3rd = value

XLP = 4th = value

XLB = 5th

XLI = 6th

QQQ = 7th

SPY = 8th

XLK = 9th

XLE = 10th

XLF = 11th

Useful S&P-500 & Major Sector Relative performance stats

Surprising stats from Jan 2000 to Jan 2022

22 years

XLY = Best = growth

XLV = 2nd = value

XLU = 3rd = value

XLP = 4th = value

XLB = 5th

XLI = 6th

QQQ = 7th

SPY = 8th

XLK = 9th

XLE = 10th

XLF = 11th

above performance stats:

from my study/backtest, the best sector rotation in times of euphoria & stress

==>

XLY (euphoria) &

XLP (stress)

from max-dd, risk (vol) & Sharpe-R perspective

find an risk-on/off algo

to rotate b/w XLP & XLY: risk-parity

better than SPY & TLT (60/40)

from my study/backtest, the best sector rotation in times of euphoria & stress

==>

XLY (euphoria) &

XLP (stress)

from max-dd, risk (vol) & Sharpe-R perspective

find an risk-on/off algo

to rotate b/w XLP & XLY: risk-parity

better than SPY & TLT (60/40)

XLY & XLP corr>97%

to hedge the high corr portf, it is advised to add another strategy in the portf w/ low/neg corr

below is one of many good strategies that have neg corr with risky assets

stress: VRP & XLP

euphoria: VRP & XLY

both risk-parity allo

to hedge the high corr portf, it is advised to add another strategy in the portf w/ low/neg corr

below is one of many good strategies that have neg corr with risky assets

stress: VRP & XLP

euphoria: VRP & XLY

both risk-parity allo

https://twitter.com/kerberos007/status/1342695657707081729

1 million $ question

how to determine the risk-on & risk-off regime?

so, the sector rotation plus nVRP hedging strat would perform the best in time of stress & euphoria with nVRP hedging?

below thread is a super accurate risk-on & risk off indicator

how to determine the risk-on & risk-off regime?

so, the sector rotation plus nVRP hedging strat would perform the best in time of stress & euphoria with nVRP hedging?

below thread is a super accurate risk-on & risk off indicator

https://twitter.com/kerberos007/status/1341214113956061186

I always post bearish Jaws (diverg at the top) for market crash warnings

today I present both Bearish &

Bullish Jaws at the bottom for the BTFD'ers🍻

below risk-on/risk-off ratio

1. predicted 2007 top with bearish Jaws

2. 2009 bottom with huge Bullish Jaws in Mar 2009 @ 666

🧐

today I present both Bearish &

Bullish Jaws at the bottom for the BTFD'ers🍻

below risk-on/risk-off ratio

1. predicted 2007 top with bearish Jaws

2. 2009 bottom with huge Bullish Jaws in Mar 2009 @ 666

🧐

The same Risk-On/Risk-Off chart as above, with zoomed in version for Jan/Feb Jaws

The Jan/Feb bearish Jaws perfectly predicted the pandemic crash

100-day correlation is shocking=96%

Totally different asset class ratio

super leading indicator

Cross-asset correlation works.🍻🧐

The Jan/Feb bearish Jaws perfectly predicted the pandemic crash

100-day correlation is shocking=96%

Totally different asset class ratio

super leading indicator

Cross-asset correlation works.🍻🧐

For 96% correlated pairs &

1 ADF test p_value<0.05=stationary spread time series

2 COI test p_value<0.05=Co-integrated pairs

3 all 3 condi's signifying pair spread would converge over time

4 hence, pair trading or

5 STFR if SPX > ratio

6 BTFD if SPX < ratio

or use Z-score

👌🍻

1 ADF test p_value<0.05=stationary spread time series

2 COI test p_value<0.05=Co-integrated pairs

3 all 3 condi's signifying pair spread would converge over time

4 hence, pair trading or

5 STFR if SPX > ratio

6 BTFD if SPX < ratio

or use Z-score

👌🍻

The lowest CBOE Equity Put/Call ratio since `2010

lowest 38 equity PCRs from my database

Super bullish++

burrrrrr4ever & equity PCR (pink cells) & below are highly correlated🤣

all-in OTM calls

$GME to da Moon

buy bankrupt comp OTM calls

Gamma squeeze

what could go wrong?

lowest 38 equity PCRs from my database

Super bullish++

burrrrrr4ever & equity PCR (pink cells) & below are highly correlated🤣

all-in OTM calls

$GME to da Moon

buy bankrupt comp OTM calls

Gamma squeeze

what could go wrong?

super bullish trend in Insider selling activities

total $amount$ sell/buy ratio

A 1 day = 17.1

B 1 week = 44.2 ==> wow🍻 wealth-transfer🤣😉

C 1 month = 6.8

D 3 month = 9.3

E 6 month = 9.8

F 1 year = 3.8

G 2 year = 4.6

are you buying?🍻

the Fed & Robinhooters are buying?👌

total $amount$ sell/buy ratio

A 1 day = 17.1

B 1 week = 44.2 ==> wow🍻 wealth-transfer🤣😉

C 1 month = 6.8

D 3 month = 9.3

E 6 month = 9.8

F 1 year = 3.8

G 2 year = 4.6

are you buying?🍻

the Fed & Robinhooters are buying?👌

Crypto Market Fear and Greed index.

seems to be an excellent contrarian sentiment indicator,

waiting for 100 to starting shorting..🤣

"Amazon accepting $BitCoin news" would do it.😉

hurry up. $1,000,000 = Magnet

seems to be an excellent contrarian sentiment indicator,

waiting for 100 to starting shorting..🤣

"Amazon accepting $BitCoin news" would do it.😉

hurry up. $1,000,000 = Magnet

Super accurate Crypto Fear-greed index

Euphoria= 95 - 100

Over-Bought= 80 - 95

Over-Sold= 40 - 20

Fear= 20 - 10

Capitulation= below 10

super accurate BTFD & STFR se3ntiment indicator

perfectly aligned with the #BitCoin price action since Jan 2018

writing a new app🍻🧐😉

Euphoria= 95 - 100

Over-Bought= 80 - 95

Over-Sold= 40 - 20

Fear= 20 - 10

Capitulation= below 10

super accurate BTFD & STFR se3ntiment indicator

perfectly aligned with the #BitCoin price action since Jan 2018

writing a new app🍻🧐😉

Trillion dollar sell-at-the-top strategy.

These guys at TSLA knew exactly when to sell at the top.

follow the insider strategy. 🤣🤣

Kimbal Musk has been a super leading indicator since 2019.

when Kimbal sell, we all sell. 🍻

These guys at TSLA knew exactly when to sell at the top.

follow the insider strategy. 🤣🤣

Kimbal Musk has been a super leading indicator since 2019.

when Kimbal sell, we all sell. 🍻

Micro-cap

small-cap

mid-cap

large-cap

getting there?

still a long way to go.

bubbles everywhere

Valuation Reset is healthy to the economy in the long-term, avoiding a sudden market crash & prolonged recession

small-cap

mid-cap

large-cap

getting there?

still a long way to go.

bubbles everywhere

Valuation Reset is healthy to the economy in the long-term, avoiding a sudden market crash & prolonged recession

Real-world application:

for educational purposes, using just 2 assets for illustration

QQQ and TLT (neg correlation)

from Aug 2002 to Feb 2021 = 20 yrs back-testing

1 re-balance the asset weights at month-end

2 using different optimization algos for comparison purposes

conti

for educational purposes, using just 2 assets for illustration

QQQ and TLT (neg correlation)

from Aug 2002 to Feb 2021 = 20 yrs back-testing

1 re-balance the asset weights at month-end

2 using different optimization algos for comparison purposes

conti

suing the below 5 opt strategies:

1 rp_erc= risk-parity, equal-risk-contribution with std co-variance matrix est

2 rp_erc_lw= same as above with Ledoit-Wolf co-variance est

3 IVWP=inverse volatility opt

4 MVP=minimum variance (risk) opt

5 M-VAR=mean-variance (Share-Ratio) opt

1 rp_erc= risk-parity, equal-risk-contribution with std co-variance matrix est

2 rp_erc_lw= same as above with Ledoit-Wolf co-variance est

3 IVWP=inverse volatility opt

4 MVP=minimum variance (risk) opt

5 M-VAR=mean-variance (Share-Ratio) opt

I believe most people would think

M-VAR optimization monthly would generate highest alpha

M-VAR=mean-variance optimization

=maximize the mean-return with minimum variance constraints maximize the Sharpe-Ratio portfolio

M-VAR is the the most popular momo portfolio optimization

M-VAR optimization monthly would generate highest alpha

M-VAR=mean-variance optimization

=maximize the mean-return with minimum variance constraints maximize the Sharpe-Ratio portfolio

M-VAR is the the most popular momo portfolio optimization

I have just proved that the most popular Mean-variance optimization strategy would generate the worst alpha from my back-testing results on 5 different popular algorithms

shocking

the momentum driven (Sharpe-Ratio) mean-variance optimization would be the worse strategy.👌🧐🤣

shocking

the momentum driven (Sharpe-Ratio) mean-variance optimization would be the worse strategy.👌🧐🤣

below is the comparison among 5 opt stategies:

1 QQQ:TLT 20 yrs

2 monthly optimization & re-balancing

3 at month-end, optimize the assets weights using the same method for all 5 for fairness

4 optimization based on the past month

a. returns

b. corre

c. co-variance

d. volatility

1 QQQ:TLT 20 yrs

2 monthly optimization & re-balancing

3 at month-end, optimize the assets weights using the same method for all 5 for fairness

4 optimization based on the past month

a. returns

b. corre

c. co-variance

d. volatility

the results were expected

the last strategy = mean-variance optimization lagging the other 4 strategies by a mile

the momentum/Performance based optimization generated worst result in past 20 yrs for QQQ:TLT monthly re-balancing portfolio

same result for SPY:IEF or SPY:TLT

the last strategy = mean-variance optimization lagging the other 4 strategies by a mile

the momentum/Performance based optimization generated worst result in past 20 yrs for QQQ:TLT monthly re-balancing portfolio

same result for SPY:IEF or SPY:TLT

Due to the extreme low variance (risk) in other 4 strategies, using the leverage from 1, 1.5, to 2 would be justified in a ultra-low-interest regime to augment alpha with targeted risk (variance)

below bar chart illustrates the magic of diversification & compounding returns

below bar chart illustrates the magic of diversification & compounding returns

By increase the leverage:

1 the total returns are exponentially increased to da Moon for all 4 strategies

2 but, the Sharpe Ratio stayed flat above 1

3 in a non-diversified portfolio, the higher the leverage, higher the risk, the lower the Sharpe-Ratio

4 magic optimization

1 the total returns are exponentially increased to da Moon for all 4 strategies

2 but, the Sharpe Ratio stayed flat above 1

3 in a non-diversified portfolio, the higher the leverage, higher the risk, the lower the Sharpe-Ratio

4 magic optimization

the portfolio optimization goals for all assets managers

1 CAGR> 12%

2 Sharpe Ratio> 1 (upside & downside risk adjusted)

3 Sortino Ratio> 2 (downside risk adjusted only)

4 Maximum drawdown< -30%

if a portfolio can achieve the above 4 factors, the manager would be super happy.

1 CAGR> 12%

2 Sharpe Ratio> 1 (upside & downside risk adjusted)

3 Sortino Ratio> 2 (downside risk adjusted only)

4 Maximum drawdown< -30%

if a portfolio can achieve the above 4 factors, the manager would be super happy.

the magic of diversification & compounding with leverage while keeping risk at minimum with negligible Sharpe-Ratio penalties

the magic of "monthly optimization & re-balancing" and "volatility targeting" portfolio

see below linear growth on CAGR but exponentially total returns

the magic of "monthly optimization & re-balancing" and "volatility targeting" portfolio

see below linear growth on CAGR but exponentially total returns

With leverage from 1, 1.5, to 2 in real-world app

1 CAGR grow linearly with higher leverage

2 but, total returns grow exponentially (magic of compounding)

3 Sharpe-Ratio stayed flat above 1.2

4 Sortino ratio suffered just a bit, above 7 (WOW)

5 volatility & DD rising marginally

1 CAGR grow linearly with higher leverage

2 but, total returns grow exponentially (magic of compounding)

3 Sharpe-Ratio stayed flat above 1.2

4 Sortino ratio suffered just a bit, above 7 (WOW)

5 volatility & DD rising marginally

Summary of all 5 portfolio re-balancing & optimization strategies for QQQ;TLT asset from Aug 2002 to Feb 2021

all KPI key performance metrics are calculated for comparison purposes with leverage from 1, 1.5, to 2.5 to 3

leverage of 1.5 to 2 might be optimum perf/risk portfolio

all KPI key performance metrics are calculated for comparison purposes with leverage from 1, 1.5, to 2.5 to 3

leverage of 1.5 to 2 might be optimum perf/risk portfolio

For a realistic back-testing, I even included the leverage borrowing cost based on Interactive Brokers' overnight lending rate (averaged yearly Libor rate)

deducing the leverage cost, the back-testing reflected the real-world application

The commissions are so low, negligible

deducing the leverage cost, the back-testing reflected the real-world application

The commissions are so low, negligible

For comparison;

SPX - CAGR averaged around 8% in the past 20 years

SPX - Sharpe-Ratio around 0.8 < 1

SPX - Sortino Ratio about 1.2 < 2

SPX - Max DD = -54%

no comparison.

see other KPI from above table for the diversified & optimized & monthly re-balancing portfolio

SPX - CAGR averaged around 8% in the past 20 years

SPX - Sharpe-Ratio around 0.8 < 1

SPX - Sortino Ratio about 1.2 < 2

SPX - Max DD = -54%

no comparison.

see other KPI from above table for the diversified & optimized & monthly re-balancing portfolio

All portfolio optimizations are based on the:

MMT = Modern Portfolio Theory

&

Efficient Frontier

higher the expected return

=

higher the portfolio risk (Variance or Stdev)

Optimization & re-balancing are meant to achieve the optimum portfolio given a risk level & return exp

MMT = Modern Portfolio Theory

&

Efficient Frontier

higher the expected return

=

higher the portfolio risk (Variance or Stdev)

Optimization & re-balancing are meant to achieve the optimum portfolio given a risk level & return exp

Massive sector rotation: in S&P-500 Sectors & Sub-Groups:

XLY #Automobile used to be the top 3 sub-groups in almost a year due to insane $TSLA valuation

now, it dropped to #52 ranks among 104 sub-groups... also due to $TSLA

tech wreck continued

Gold & mining carnage continued

XLY #Automobile used to be the top 3 sub-groups in almost a year due to insane $TSLA valuation

now, it dropped to #52 ranks among 104 sub-groups... also due to $TSLA

tech wreck continued

Gold & mining carnage continued

FX currency vs Risky Assets

$USD vs $SPX (or $NDX)

perfectly negatively correlated since March 2020 Pandemic

Correlation = -95%

$USD plunging drives $SPX surging

Day traders' paradise with $JPY and $AUD FX indices.

I reposted tons of FX leading indicators over the weekend.

$USD vs $SPX (or $NDX)

perfectly negatively correlated since March 2020 Pandemic

Correlation = -95%

$USD plunging drives $SPX surging

Day traders' paradise with $JPY and $AUD FX indices.

I reposted tons of FX leading indicators over the weekend.

Nobody commented on this chart?

$USD getting stronger: super bullish++ 🤣🍻

the Divergence (Jaws) started to form.

does not bode well for the risky assets.🧐

JAWS 🤣

$USD getting stronger: super bullish++ 🤣🍻

the Divergence (Jaws) started to form.

does not bode well for the risky assets.🧐

JAWS 🤣

A quiz.

What has the below arrows hinted us?

hint:

if the below perfect correlation persists in the future, what does the arrow predict?

haha..

What has the below arrows hinted us?

hint:

if the below perfect correlation persists in the future, what does the arrow predict?

haha..

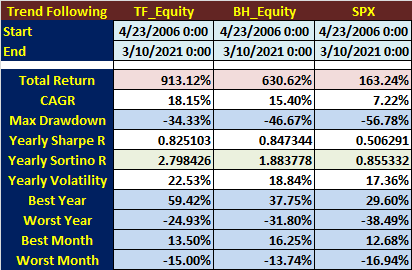

Ha. the below "Trend following Turtle trading" strategy ran almost 12 hrs, just finished. super time consuming

At month end, among 500 stocks, selecting/rotating highest 50 momentum stocks of last 3 month, using trend following Turtle strategy with 12% trailing stops

from 2006

At month end, among 500 stocks, selecting/rotating highest 50 momentum stocks of last 3 month, using trend following Turtle strategy with 12% trailing stops

from 2006

Performance Metrics for the "trend following Turtle" strategy.

1 CAGR = 18.15% (good) since 2007

2 Sharpe Ratio = 0.82 (okay)

3 Sortino Ratio = 2.79 (great)

4 Max DD = -34% (marginal)

but, much better than $SPX buy & hold, and best momentum stocks buy & hold. for one month

1 CAGR = 18.15% (good) since 2007

2 Sharpe Ratio = 0.82 (okay)

3 Sortino Ratio = 2.79 (great)

4 Max DD = -34% (marginal)

but, much better than $SPX buy & hold, and best momentum stocks buy & hold. for one month

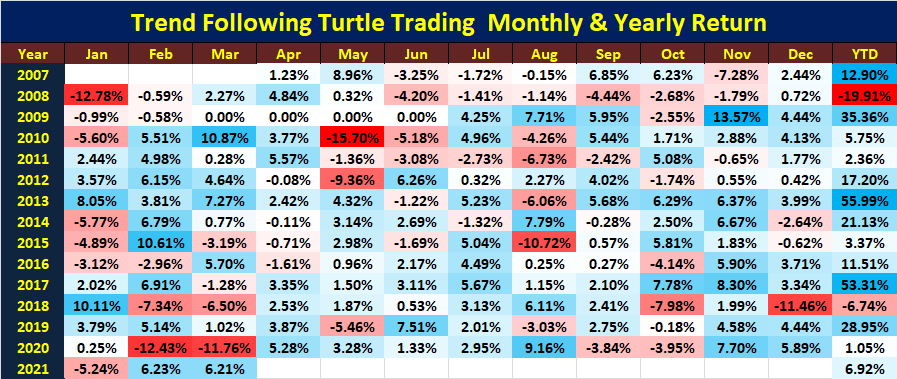

The Turtle trading monthly & yearly returns

with minor enhancements to the original Turtle entry/exit rules, below results are not bad at all by all measures.

suffering 2 losing years only (2008, yeah. of course 😉) and 12 winning years, including 2020.👌

with minor enhancements to the original Turtle entry/exit rules, below results are not bad at all by all measures.

suffering 2 losing years only (2008, yeah. of course 😉) and 12 winning years, including 2020.👌

KPI performance metrics

superior KPI for Kerb-1.5 ERC ETF🍻👍

1 CAGR= 17% (excellent: compound yearly growth)

2 Total Return= 1,151% since 2005 (wow)

3 Max Drawdown= -25.2% (good)

4 Sharpe Ratio= 1.23 (excellent)

5 Annualize Volatility (risk)= 13.1% (super)

SPY B&H = not good

superior KPI for Kerb-1.5 ERC ETF🍻👍

1 CAGR= 17% (excellent: compound yearly growth)

2 Total Return= 1,151% since 2005 (wow)

3 Max Drawdown= -25.2% (good)

4 Sharpe Ratio= 1.23 (excellent)

5 Annualize Volatility (risk)= 13.1% (super)

SPY B&H = not good

SPYV = S&P-500 Value Stocks

SPYG = S&P-500 Growth Stocks

rotation into "Value" stocks started since Mid Feb -

when $TSLA insider selling ring the Bell at the TOP 🤣

SPYV/SPYG ratio surging

SPYG = S&P-500 Growth Stocks

rotation into "Value" stocks started since Mid Feb -

when $TSLA insider selling ring the Bell at the TOP 🤣

SPYV/SPYG ratio surging

Ding ding ding bell-rang indicator:

IWD = Small-Cap (IWM) Value Stocks

IWF = Small-Cap Growth Stocks

rotation into "Value" stocks started since Mid Feb -

when $TSLA insider selling rang the "Bell" at the TOP 🐵

ding ding ding

IWD / IWF ratio surging

unpossible.

IWD = Small-Cap (IWM) Value Stocks

IWF = Small-Cap Growth Stocks

rotation into "Value" stocks started since Mid Feb -

when $TSLA insider selling rang the "Bell" at the TOP 🐵

ding ding ding

IWD / IWF ratio surging

unpossible.

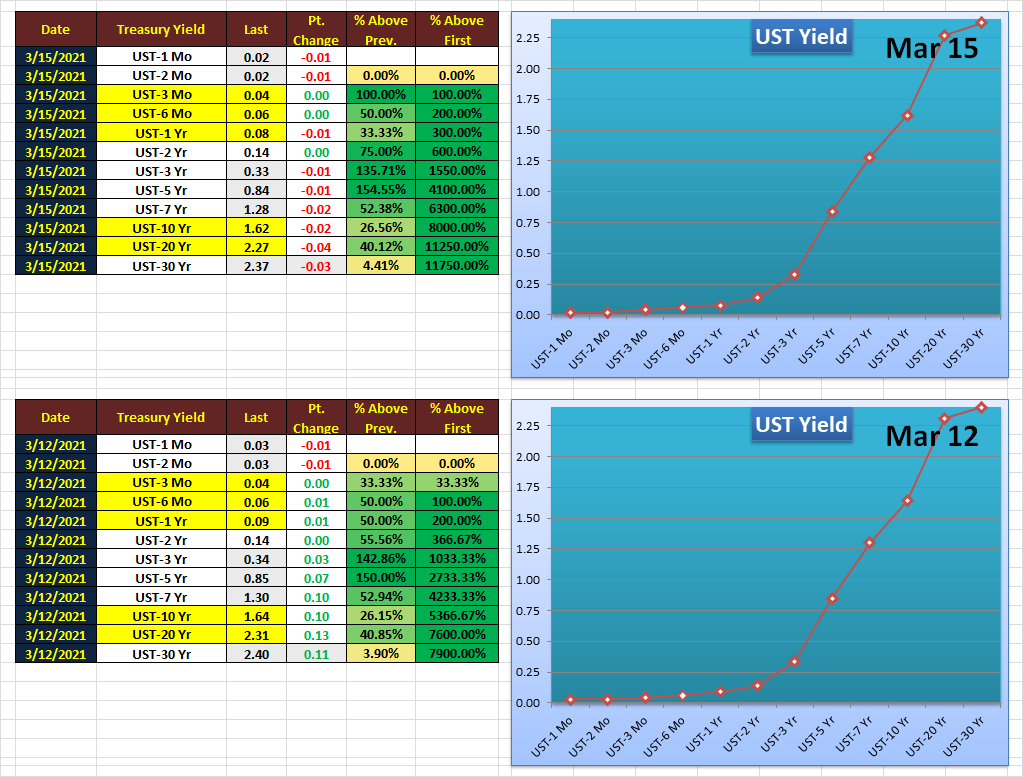

$USD (Inverted)

and

#UST-10Yr Yield

highly Correlated

Below Chart

#UST10Yr-Yield

Magnet = 1.60 (today, super accurate)

What is the next Magnet? 3.0 ? 👌

super bullish++

Hyper-Stagflation🤣

Prediction

If (10Yr >= 2.0):

$SPX tanks 20-30% secured

Rate Hike secured

and

#UST-10Yr Yield

highly Correlated

Below Chart

#UST10Yr-Yield

Magnet = 1.60 (today, super accurate)

What is the next Magnet? 3.0 ? 👌

super bullish++

Hyper-Stagflation🤣

Prediction

If (10Yr >= 2.0):

$SPX tanks 20-30% secured

Rate Hike secured

Kerb-X update😉

5 multi-asset hedged strategies form a single portfolio

the magic of

diversification

CAGR compound &

monthly re-balancing/opt

Kerb-Comb:

1 highest Sharpe-Ratio

2 lowest max-drawdowns

3 lowest portfolio risk (vol)

4 near highest CAGR

than individual Kerb-X🍻

5 multi-asset hedged strategies form a single portfolio

the magic of

diversification

CAGR compound &

monthly re-balancing/opt

Kerb-Comb:

1 highest Sharpe-Ratio

2 lowest max-drawdowns

3 lowest portfolio risk (vol)

4 near highest CAGR

than individual Kerb-X🍻

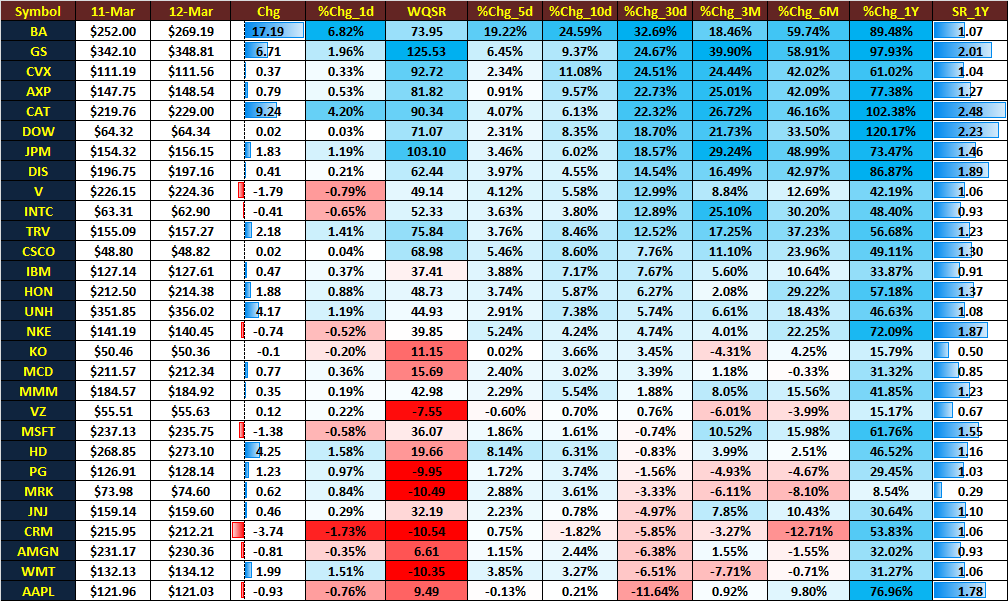

What rotation to "value"?

DJI-30 hitting all time highs day after day last week.

just pump one company in 30 stonks would be enough to melt-up to da Moon

see below pct change performance table

from 1-day to 1-year %change

ranked by 10-day %chg

$BA up 24.6% in 10 days🍻

DJI-30 hitting all time highs day after day last week.

just pump one company in 30 stonks would be enough to melt-up to da Moon

see below pct change performance table

from 1-day to 1-year %change

ranked by 10-day %chg

$BA up 24.6% in 10 days🍻

ranked by 10-day percent change

$BA up 19.22% in 5-day

$BA up 24.59% in 10-day

while $AAPL down -11.64% in 30-days.

super bullish ++

$BA up 19.22% in 5-day

$BA up 24.59% in 10-day

while $AAPL down -11.64% in 30-days.

super bullish ++

DJI_30 is price weighted Index

$BA is currently #4 in the weight rank as indicated by its price level = $273

=5.1% weight

Don't like the price weighted index

$AAPL with a price of $122, ranked around #22

=2.4% weight

market-Cap weighted index ( $SPX, $NDX) makes more sense

$BA is currently #4 in the weight rank as indicated by its price level = $273

=5.1% weight

Don't like the price weighted index

$AAPL with a price of $122, ranked around #22

=2.4% weight

market-Cap weighted index ( $SPX, $NDX) makes more sense

NDX-100

vs

SPX

from Mar 1993 to Mar 2000 - dot.com bubble/tulips

a picture is worth a gazillion words. 🍻

you know what is coming next? 🤣🤣🤣

vs

SPX

from Mar 1993 to Mar 2000 - dot.com bubble/tulips

a picture is worth a gazillion words. 🍻

you know what is coming next? 🤣🤣🤣

to da Moon:

NDX CAGR = 42.5% Compound Annual Growth Rate

from 1993 to 2000

Max-Drawdown < 23%

super duper bullish++ (^Moon)

what could possibly go wrong?

Tech IPOs always go up. 🍻🤣🤣

NDX CAGR = 42.5% Compound Annual Growth Rate

from 1993 to 2000

Max-Drawdown < 23%

super duper bullish++ (^Moon)

what could possibly go wrong?

Tech IPOs always go up. 🍻🤣🤣

Ready for this?

NDX-100 vs SPX

from Mar 1993 to Mar 2003

Gravity

what goes up,

must come down.

From Euphoria to Capitulation in 2 years. 🤣🤣

NDX-100 vs SPX

from Mar 1993 to Mar 2003

Gravity

what goes up,

must come down.

From Euphoria to Capitulation in 2 years. 🤣🤣

S&P-500 Sub-industry group rank

pay attention to

A. "change" &

B. "% change column"

top 40 sub-industry groups on the left

bottom 40 sub-industry groups on the right

stealthy rotation to "value"?

stealthy rotation from top performing groups to "value" sub-groups😉

bullish++

pay attention to

A. "change" &

B. "% change column"

top 40 sub-industry groups on the left

bottom 40 sub-industry groups on the right

stealthy rotation to "value"?

stealthy rotation from top performing groups to "value" sub-groups😉

bullish++

More NDX & SPX perf metrics

a fair comparison

we'll start just after the GFC that almost blew up the entire planet,

and the Fed & world CBs had gone mad ever since, burrr$4ever to infinity, getting ready to blow up the Galaxy this time🤣😉

From Mar 2009 to Mar 2021

bullish++

a fair comparison

we'll start just after the GFC that almost blew up the entire planet,

and the Fed & world CBs had gone mad ever since, burrr$4ever to infinity, getting ready to blow up the Galaxy this time🤣😉

From Mar 2009 to Mar 2021

bullish++

Bulls - bewarte

Shocking similarity? 🍻

Chart 1= NDX vs SPX from Mar 1993 to March 2000

Chart 2= NDX vs SPX from Mar 2009 to March 2021

History repeats itself? Hmm

They never learn?

super bullish++(^Moon)🤣🤣

what could possibly go wrong?

fomo buy the ATHs w/ free money

Shocking similarity? 🍻

Chart 1= NDX vs SPX from Mar 1993 to March 2000

Chart 2= NDX vs SPX from Mar 2009 to March 2021

History repeats itself? Hmm

They never learn?

super bullish++(^Moon)🤣🤣

what could possibly go wrong?

fomo buy the ATHs w/ free money

Alert: "Breaking news" while updating alert. 😉

the UST yield curve is literally off-the-chart.🍻

super bullish++

kick the can....

the UST yield curve is literally off-the-chart.🍻

super bullish++

kick the can....

Sector/Sub-industry group ranking

notice the top 1 & 2 subgroups within the XLB sector?

up there for a while now

canary in a coal mine

no inflation?

breakout in all major Aluminum stocks in Nov-Dec

Alu stocks

AA, KALU, CENX, ACH, CSTM

sector rotation is super important🍻

notice the top 1 & 2 subgroups within the XLB sector?

up there for a while now

canary in a coal mine

no inflation?

breakout in all major Aluminum stocks in Nov-Dec

Alu stocks

AA, KALU, CENX, ACH, CSTM

sector rotation is super important🍻

Alu stocks: ranked #1 among 104 sub-groups for a while now:

AA, KALU, CENX, ACH, CSTM

all breaking out since Nov 1st, 2020; left most level..

predicting hyper-inflation.

confirmed by the latest UST yields surge.

kick the can.

AA, KALU, CENX, ACH, CSTM

all breaking out since Nov 1st, 2020; left most level..

predicting hyper-inflation.

confirmed by the latest UST yields surge.

kick the can.

QQQ-100 ugly day - down more than -3%

ranked by the worst 30-day percent change.

$TSLA down -22.66% in 30-days.

in bear market

super-bullish++🍻

p.s. (for the bears)

ranked by the worst 30-day percent change.

$TSLA down -22.66% in 30-days.

in bear market

super-bullish++🍻

p.s. (for the bears)

Micro-Cap

Small-Cap

Mid-Cap

Large-Cap

QQQ

relative perf since Nov 1, 2020 in that order

QQQ underperforming BIGLY

Micro-Cap continues to outperform with massive Helicopter money in coming weeks, months, years, decades, forever to infinity🍻

Party like 1999

felt like Mar 2000

Small-Cap

Mid-Cap

Large-Cap

QQQ

relative perf since Nov 1, 2020 in that order

QQQ underperforming BIGLY

Micro-Cap continues to outperform with massive Helicopter money in coming weeks, months, years, decades, forever to infinity🍻

Party like 1999

felt like Mar 2000

I believe some people already noticed that I've included WQSR ranking in my previous posts

It used to run very slowly, taking half hour for 1000+ tickers with 100,000 daily prices each

Now, I re-wrote the code, taking advantage of super fast & optimized Numpy Vector, Matrix op

It used to run very slowly, taking half hour for 1000+ tickers with 100,000 daily prices each

Now, I re-wrote the code, taking advantage of super fast & optimized Numpy Vector, Matrix op

Now, for1000+ tickers with daily price back to 1998, the entire vector/matrix manipulation of the whole data would finish in less than 5 min.

Numpy is super optimized for the ML/Deep learning vector/matrix/tensor operation

AI is all about tensor calculus= N-dimensional matrix

Numpy is super optimized for the ML/Deep learning vector/matrix/tensor operation

AI is all about tensor calculus= N-dimensional matrix

WQSR ranking system is a normalized momentum/trend/sharpe-ratio/linear-regression slope combined ind that can be used to compare RS/ranking among cross-assets

below is a sample of AAPL WQSR ranking on the bottom

at major inflection points, WQSR is bounded & slightly leading👌

below is a sample of AAPL WQSR ranking on the bottom

at major inflection points, WQSR is bounded & slightly leading👌

March 19: Major sectors and sub-industry groups

for your weekend study.

biggest winner:

XLRE Renewable Energy Equipment (+3.82%)

biggest loser:

XLF Consumer Finance(-3.74%)

for your weekend study.

biggest winner:

XLRE Renewable Energy Equipment (+3.82%)

biggest loser:

XLF Consumer Finance(-3.74%)

burrrr$4ever regime over-valuation estimation based on last 10 year avg PE ratio for S&P-500 companies

if SPX back to 5-yr PE ratio (TTM)

target=2700

if SPX back to 10-yr PE ratio (TTM)

target=2100

like 2002 & 2008

eventually, fundamentals do matter

a matter of time

bullish++

if SPX back to 5-yr PE ratio (TTM)

target=2700

if SPX back to 10-yr PE ratio (TTM)

target=2100

like 2002 & 2008

eventually, fundamentals do matter

a matter of time

bullish++

High WQSR sub-industries

Banks in XLF sector

a rising tide lifts all boats

a tradeable pattern for all these over-valued bank stocks; WQSR>100

all of the price actions crossed-over 50d & 200d SMAs almost simultaneously in Nov-Dec (breakout)

red-line: 200d SMA

blue: 50d SMA

Banks in XLF sector

a rising tide lifts all boats

a tradeable pattern for all these over-valued bank stocks; WQSR>100

all of the price actions crossed-over 50d & 200d SMAs almost simultaneously in Nov-Dec (breakout)

red-line: 200d SMA

blue: 50d SMA

• • •

Missing some Tweet in this thread? You can try to

force a refresh