Giannis Antetokounmpo signed a $228 million dollar extension with the Milwaukee Bucks yesterday — the richest contract in NBA history.

The craziest part?

It was a bargain.

Time for a thread 👇👇👇

The craziest part?

It was a bargain.

Time for a thread 👇👇👇

1) First, some history...

Giannis Antetokounmpo was born in Athens, Greece, shortly after his parents immigrated from Nigeria in search of a better life.

But as immigrants situated in a small town with a floundering economy, Giannis and his brothers had a rough childhood.

Giannis Antetokounmpo was born in Athens, Greece, shortly after his parents immigrated from Nigeria in search of a better life.

But as immigrants situated in a small town with a floundering economy, Giannis and his brothers had a rough childhood.

2) As a child, with his parents unable to find consistent work due to their immigration status, Giannis had to help provide for the family.

How?

Giannis & his brothers spent hours each day selling watches & CDs in the streets of Athens.

"I was good at it. I didn't give up.”

How?

Giannis & his brothers spent hours each day selling watches & CDs in the streets of Athens.

"I was good at it. I didn't give up.”

3) In 2007, now 13-years-old standing over 6ft tall, Giannis played basketball for the 1st time.

Falling in love with the game, Giannis worked out multiple times a day for 2-years straight.

"I’m working to be in the NBA … because I know, at some point, I’m gonna be in the NBA”

Falling in love with the game, Giannis worked out multiple times a day for 2-years straight.

"I’m working to be in the NBA … because I know, at some point, I’m gonna be in the NBA”

4) After years of training by himself, Giannis joined the Filathlitikos’ youth team — eventually moving to the men's team a year later.

Now 15-yrs old—playing against men in their 30s—Giannis showed immense potential.

By 17, now 6-foot-7, the gym was packed with NBA scouts.

Now 15-yrs old—playing against men in their 30s—Giannis showed immense potential.

By 17, now 6-foot-7, the gym was packed with NBA scouts.

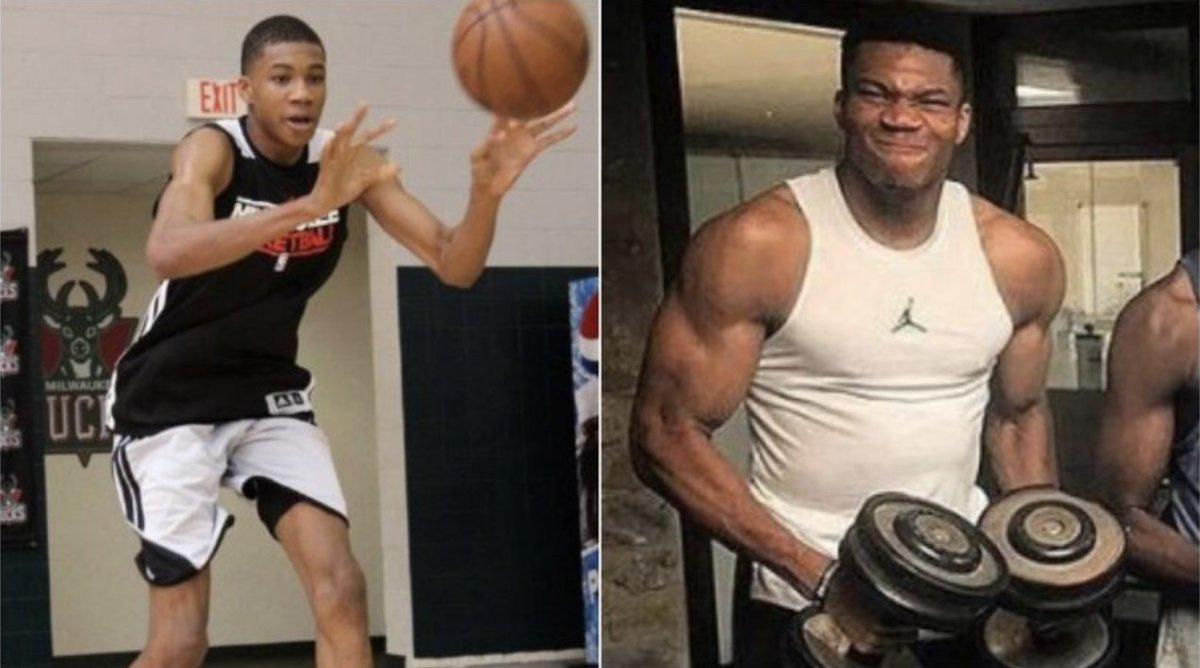

5) In 2013, as a skinny 18-yr old that had never been to the United States, Giannis Antetokounmpo was selected 15th overall by the Milwaukee Bucks.

The #1 pick that year?

Anthony Bennet.

Seen as a developmental prospect by most, @Giannis_An34 went straight to the weight room.

The #1 pick that year?

Anthony Bennet.

Seen as a developmental prospect by most, @Giannis_An34 went straight to the weight room.

6) After putting on over 50 pounds of muscle, Giannis Antetokounmpo has turned into a generational talent.

— 2x MVP

— 4x All-Star

— NBA DPOY

The best part?

Giannis was rewarded with a $255M extension yesterday, the richest contract in NBA history.

Even better, it's a bargain.

— 2x MVP

— 4x All-Star

— NBA DPOY

The best part?

Giannis was rewarded with a $255M extension yesterday, the richest contract in NBA history.

Even better, it's a bargain.

7) From a local economic standpoint, @Giannis_An34 has carried his weight in gold.

A Bucks playoff game brings:

— $3M in economic activity

— 2,500 hotel room nights

— 700 jobs

Remember, the @Bucks have made the playoffs 5/7 years with Giannis — compared to just 2/7 prior.

A Bucks playoff game brings:

— $3M in economic activity

— 2,500 hotel room nights

— 700 jobs

Remember, the @Bucks have made the playoffs 5/7 years with Giannis — compared to just 2/7 prior.

8) From an attendance perspective, the Milwaukee Bucks have seen an increase since Giannis joined the team.

Avg Attendance:

2013: 13,487

2019: 17,602

In 2019, the Bucks had 36 sellout games—their most all-time—while TV ratings were up 32%.

Without Giannis, that doesn’t happen.

Avg Attendance:

2013: 13,487

2019: 17,602

In 2019, the Bucks had 36 sellout games—their most all-time—while TV ratings were up 32%.

Without Giannis, that doesn’t happen.

9) Aside from attendance, Giannis Antetokounmpo has provided great value from a merchandising standpoint.

An example?

In 2019, not a single NBA player outside of LeBron James sold more jerseys than Giannis Antetokounmpo — including superstars like Stephen Curry & James Harden.

An example?

In 2019, not a single NBA player outside of LeBron James sold more jerseys than Giannis Antetokounmpo — including superstars like Stephen Curry & James Harden.

10) Aside from personal jersey sales, Giannis Antetokounmpo has also lifted the value of the entire @Bucks brand.

Merch Sales:

1. Lakers

2. Celtics

3. 76ers

4. Raptors

5. Bucks

For a small market team like Milwaukee, being ahead of the Warriors & Knicks is extremely impressive.

Merch Sales:

1. Lakers

2. Celtics

3. 76ers

4. Raptors

5. Bucks

For a small market team like Milwaukee, being ahead of the Warriors & Knicks is extremely impressive.

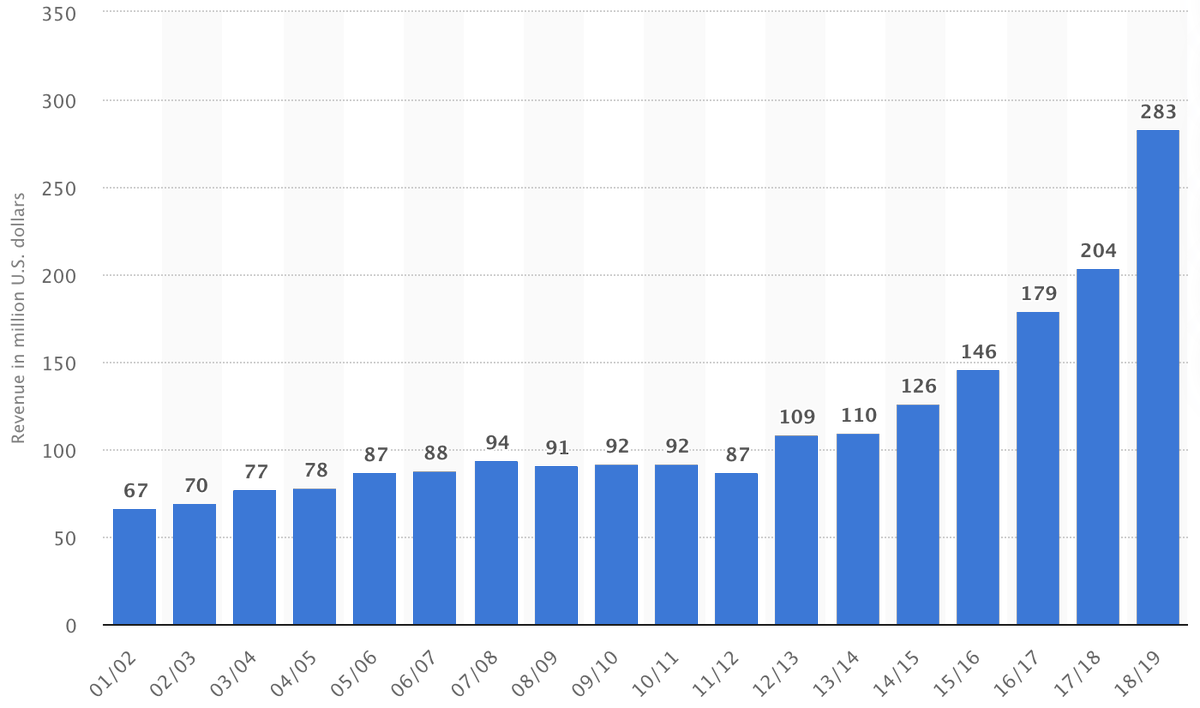

11) The combination of Giannis’ ability to increase local economic activity, fill the seats at their new $550M arena, and consistently sell merchandise, has had a direct financial impact on the Milwaukee Bucks.

Bucks Revenue:

2013: $110M

2019: $283M

That's a ~160% increase.

Bucks Revenue:

2013: $110M

2019: $283M

That's a ~160% increase.

12) New media deals have obviously helped, but considering the Milwaukee Bucks consistently stayed between ~$70M and ~$90M in revenue throughout the prior decade, the impact of Giannis Antetokounmpo is undeniable.

And unsurprisingly, the franchise valuation has exploded.

And unsurprisingly, the franchise valuation has exploded.

13) From a franchise valuation standpoint, check this out:

Bucks Valuation

2013: $312M

2020: $1.58B

But hasn't every franchise gone up?

Consider this...

The average NBA franchise has appreciated ~300% since 2013, while the Milwaukee Bucks have seen a ~400% increase.

Bucks Valuation

2013: $312M

2020: $1.58B

But hasn't every franchise gone up?

Consider this...

The average NBA franchise has appreciated ~300% since 2013, while the Milwaukee Bucks have seen a ~400% increase.

14) Not only is @Giannis_An34 a great player & person, but he provides tremendous financial value to the city of Milwaukee & the Bucks.

Giannis went from selling DVDs & CDs on the streets of Athens to support his family to the highest paid player in NBA history.

That's amazing.

Giannis went from selling DVDs & CDs on the streets of Athens to support his family to the highest paid player in NBA history.

That's amazing.

15) If you enjoyed this thread, you should:

1. Follow me, I tweet cool sports business stories everyday.

2. Subscribe to my free daily newsletter where I give detailed analysis on topics involving the money and business behind sports.

readhuddleup.com

1. Follow me, I tweet cool sports business stories everyday.

2. Subscribe to my free daily newsletter where I give detailed analysis on topics involving the money and business behind sports.

readhuddleup.com

Also, don't forget @AthleticBrewing is the reason I'm able to create sports business content full-time.

If you want to support me, buy some beer - it's really great stuff.

Use code "JOE25" for 25% off at athleticbrewing.com

If you want to support me, buy some beer - it's really great stuff.

Use code "JOE25" for 25% off at athleticbrewing.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh