Two brothers teamed up with Wall Street to create the next great major US professional sports league.

Time for a thread 👇👇👇

Time for a thread 👇👇👇

1) First, some history...

Despite lacrosse being North America's oldest team sport—played by Native Americans throughout the 1400s—the US never developed a legitimate professional league.

That changed in 1999 when Jake Steinfeld, Dave Morrow & Tim Robertson founded the MLL.

Despite lacrosse being North America's oldest team sport—played by Native Americans throughout the 1400s—the US never developed a legitimate professional league.

That changed in 1999 when Jake Steinfeld, Dave Morrow & Tim Robertson founded the MLL.

2) Founded in 1999, Major League Lacrosse became the 1st outdoor professional lacrosse league.

The only problem?

Despite a decade straight of rising attendance—occasionally drawing 10,000+ fans—players weren't making any money.

The average MLL player made ~$10,000 annually.

The only problem?

Despite a decade straight of rising attendance—occasionally drawing 10,000+ fans—players weren't making any money.

The average MLL player made ~$10,000 annually.

3) As the MLL approached its 20th season, players grew frustrated with the leagues inability to capitalize financially.

“I was the No. 1 draft pick, but my rookie wage was $6,000,” Paul Rabil says.

With lacrosse as the fastest growing sport in the US, why weren't wages rising?

“I was the No. 1 draft pick, but my rookie wage was $6,000,” Paul Rabil says.

With lacrosse as the fastest growing sport in the US, why weren't wages rising?

4) Paul Rabil, who is one of the greatest lacrosse players of all-time, decided to confront the problem head on.

Rabil approached the MLL, looking to assist with changes he deemed necessary to increase the long-term viability of the league.

Their answer?

Get lost.

Rabil approached the MLL, looking to assist with changes he deemed necessary to increase the long-term viability of the league.

Their answer?

Get lost.

5) Armed with the belief that the MLL was not maximizing their value, Paul Rabil doubled down.

Rabil returned to the league office, this time looking to buy the business with serious investors behind him.

Still, he was denied.

Rabil's response?

The Premier Lacrosse League.

Rabil returned to the league office, this time looking to buy the business with serious investors behind him.

Still, he was denied.

Rabil's response?

The Premier Lacrosse League.

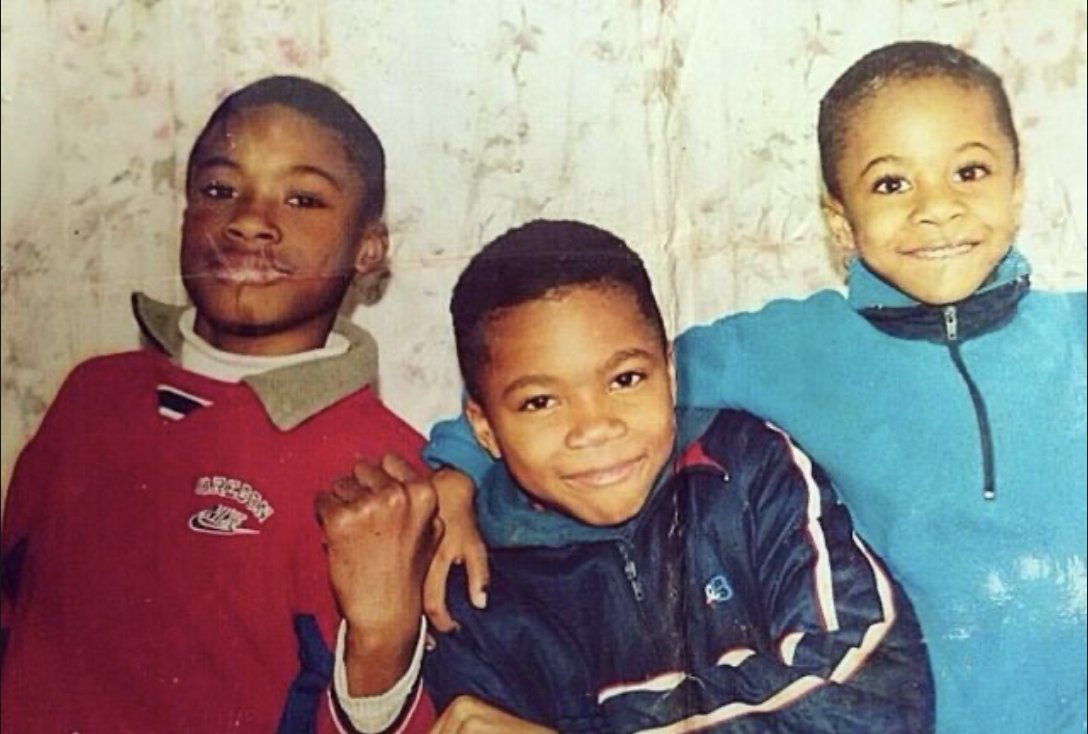

6) In 2018, @PaulRabil & @MichaelRabil cofounded the Premier Lacrosse League — an alternative to the MLL.

Their reasoning was simple.

If they could pay full-time wages, the on-field product would improve — allowing them to maximize value through an improved content strategy.

Their reasoning was simple.

If they could pay full-time wages, the on-field product would improve — allowing them to maximize value through an improved content strategy.

7) With the backing of investors like billionaire Nets owner Joseph Tsai & The Chernin Group, the Rabil's began to build out a talent pool.

Their offer?

— ~$35k+ salaries, compared to ~$10k in the MLL

— Health benefits

— Equity in the league

Now, it was truly a players league.

Their offer?

— ~$35k+ salaries, compared to ~$10k in the MLL

— Health benefits

— Equity in the league

Now, it was truly a players league.

8) After building a competitive talent pool, Paul & Mike Rabil secured the most important piece — a media deal.

The PLL signed an exclusive broadcasting deal with NBC, enabling their games to be shown in ~100M+ homes.

Even more interesting?

Their plan to increase viewership…

The PLL signed an exclusive broadcasting deal with NBC, enabling their games to be shown in ~100M+ homes.

Even more interesting?

Their plan to increase viewership…

9) In an effort to increase viewership, the PLL relied on social & changed the way lacrosse was broadcast.

— Removed wide-angled cameras

— Shortened the field of play

— Reduced the shot clock

— Yellow balls instead of white

— Intra-game interviews

The best part?

It's working.

— Removed wide-angled cameras

— Shortened the field of play

— Reduced the shot clock

— Yellow balls instead of white

— Intra-game interviews

The best part?

It's working.

10) Due to COVID-19, the PLL pivoted from their normal schedule to a single 16-day tournament in 2020.

The results were fantastic:

— TV ratings up 27%

— Sponsorship revenue up 59%

— League-wide revenue increased despite no fans

The only thing left?

Consolidation of talent.

The results were fantastic:

— TV ratings up 27%

— Sponsorship revenue up 59%

— League-wide revenue increased despite no fans

The only thing left?

Consolidation of talent.

11) With the Premier Lacrosse League headed north & Major League Lacrosse headed south, a consolidation of talent became inevitable.

Yesterday, the PLL & MLL announced a merger — creating one unified outdoor professional lacrosse league under the PLL brand.

Next up, expansion.

Yesterday, the PLL & MLL announced a merger — creating one unified outdoor professional lacrosse league under the PLL brand.

Next up, expansion.

12) As the PLL & MLL merge—moving front office personnel & increasing player talent—it’ll be interesting to see how the newly combined entity utilizes the additional talent to attract viewership.

With @PaulRabil & @MichaelRabil running the show, it’ll certainly be fun to watch.

With @PaulRabil & @MichaelRabil running the show, it’ll certainly be fun to watch.

13) Building a professional sports league is certainly not easy, but one thing is clear:

Teaming up with your brother to challenge convention, follow a lifelong passion, and change the sports industry forever...

Now that's f**king awesome.

Teaming up with your brother to challenge convention, follow a lifelong passion, and change the sports industry forever...

Now that's f**king awesome.

14) If you enjoyed this thread, you should:

1. Follow me, I tweet cool sports business stories everyday.

2. Subscribe to my free daily newsletter where I give detailed analysis on topics involving the money and business behind sports.

readhuddleup.com

1. Follow me, I tweet cool sports business stories everyday.

2. Subscribe to my free daily newsletter where I give detailed analysis on topics involving the money and business behind sports.

readhuddleup.com

Also, don't forget @AthleticBrewing is the reason I'm able to create sports business content full-time.

If you want to support me, buy some beer - it's really great stuff.

Use code "JOE25" for 25% off at athleticbrewing.com

If you want to support me, buy some beer - it's really great stuff.

Use code "JOE25" for 25% off at athleticbrewing.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh