1. The recent rise in BTC spot and implied volatility has led me to re-read @SinclairEuan's book, “Positional Options Trading”. I found the chapter on volatility positions quite interesting with some useful parallels for crypto vol markets.

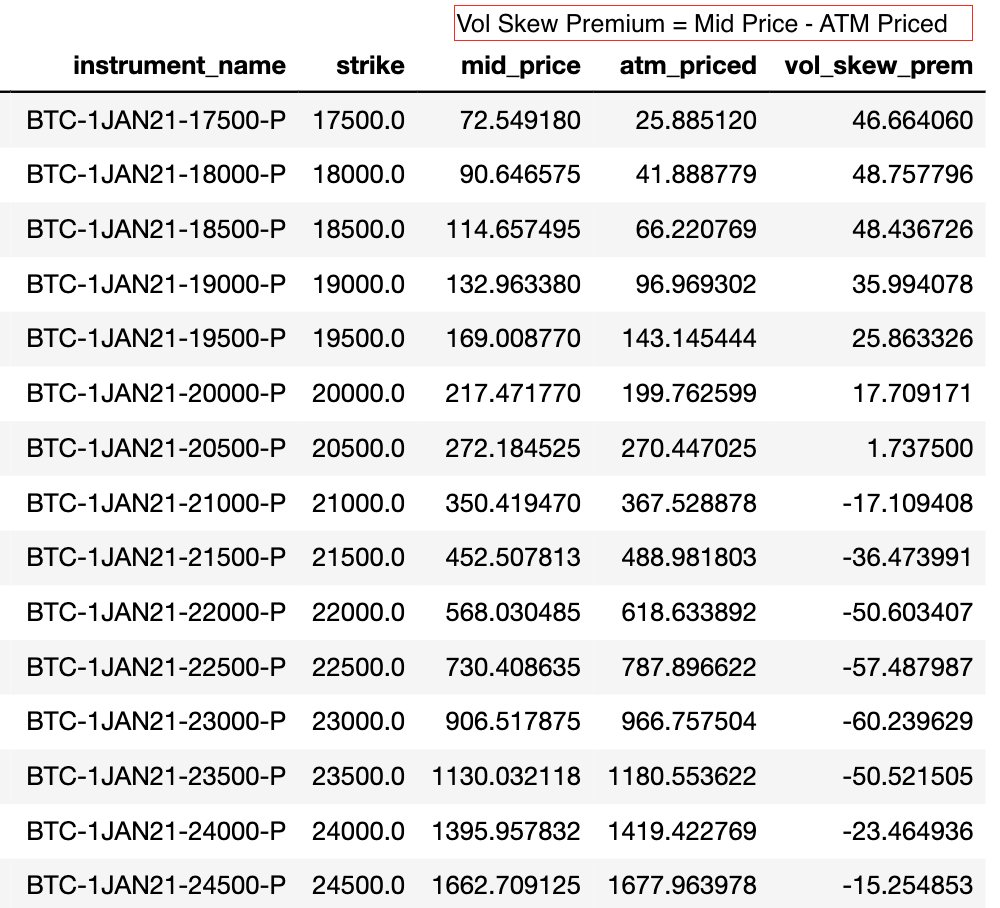

2. If we're shorting IV, ideally we want a strike with the largest vol premium. Although deep OTM puts tend to have the highest IV, we need to sell a lot of these options b/c their vega is low. As a result, selling these teeny options in size based only on high IV is dangerous.

3. Another method is to “sell options with the greatest dollar premium over what the option would be worth if it were priced with ATM IV". This allows us to quantify how much of the premium in dollars we are collecting in terms of skew.

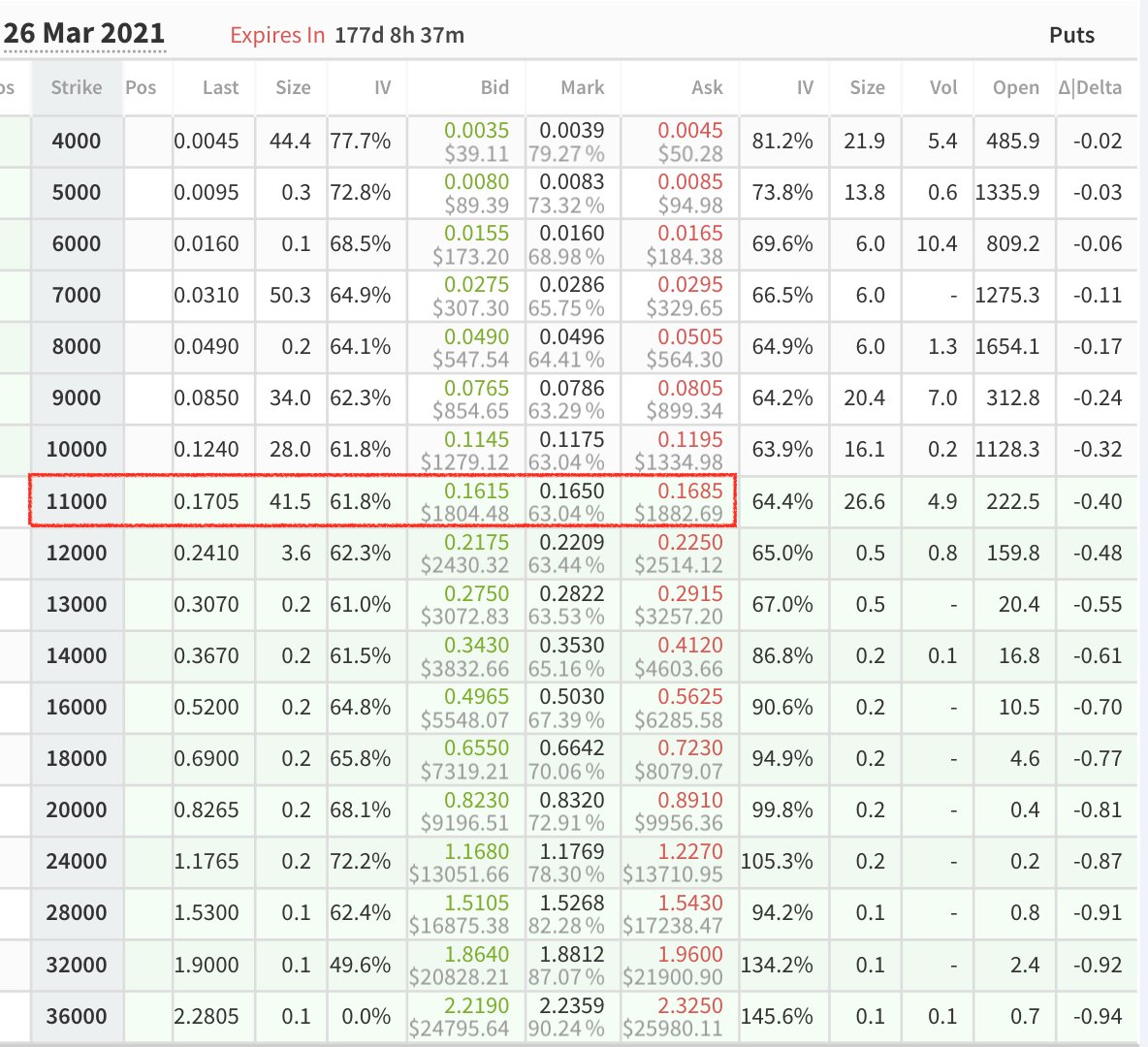

4. As an example, below is a table outlining the BTC-JAN1-2021 put strikes. We have the market price, value of the option priced with ATM volatility, and the volatility skew premium. The difference between the market price and ATM price gives us our vol skew premium in dollars.

5. Throughout this analysis I only focused on OTM calls/puts as they have better liquidity (puts are below spot and calls above spot). Short-term BTC maturities seem to have a negative put vol skew premium for strikes slightly below ATM but a positive premium for deep OTM puts.

6. As we move to longer-dated expiries, the put vol skew premium decreases across all strikes and becomes even more negative. The calls across all maturities, however, have a positive vol skew premium which appears to be increasing.

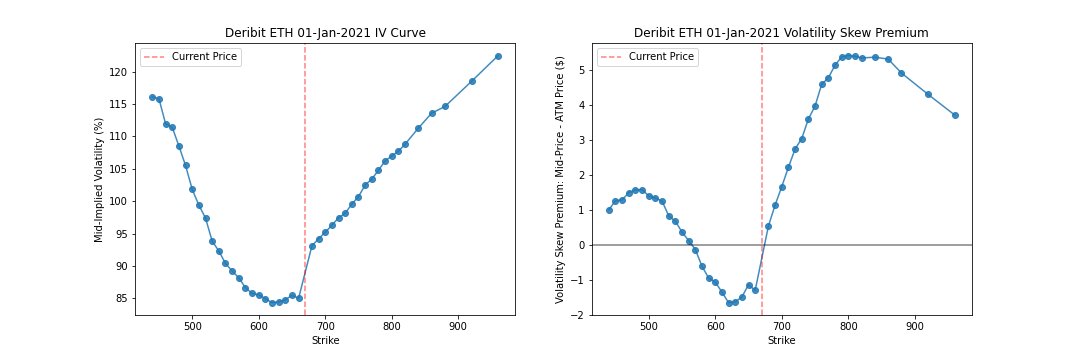

7. We can see similar behaviour in ETH. Short-term put vol skew premium starts off similar to BTC, but it declines and goes negative as we move forward in time (w/ exception of Jan 8 maturity). Across all maturities, the vol skew premium is much greater for calls than puts.

8. Below are the longer-dated ETH options. Put vol skew premiums tend to be much lower relative to shorter-dated maturities.

9. Based on this I’d consider calls to be richly valued w.r.t puts. A reason may be people selling puts for cash-flow which dampens low strike vols while also aggressively buying OTM calls with hopes of higher prices. Both cases suggest the market is expecting higher prices.

10. What do you folks think? Do you think the vol skew premium is justified here to buy up "cheap" puts? Also, in this case, to get +delta exposure would you rather sell a put or long a call? @SinclairEuan @MMKustermann @darshanvaidya @kyled116 @OrthoTrading @BitcoinMises

• • •

Missing some Tweet in this thread? You can try to

force a refresh