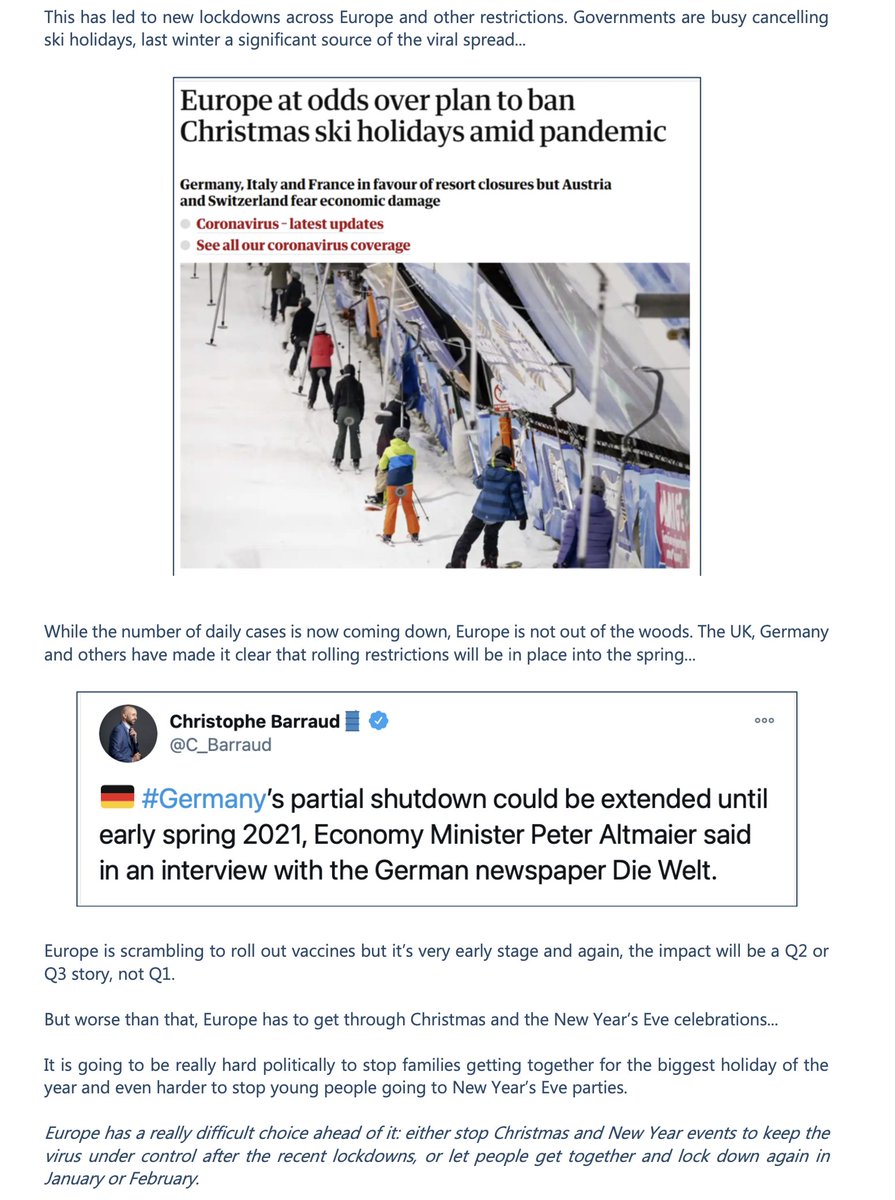

At the beginning of December I wrote about the economic impacts of potential covid restrictions over Christmas/New Year in Europe...

But Europe as a whole is going to move in this direction and New Years Eve parties are going to be off the agenda, along with seasonal vacations.

Most countries that don't restrict large groups over this period will end up paying the price in Jan and Feb and will suffer lockdowns then. (Regardless of whether you think they should or not - they are coming).

And that bring us on to the US...

And that bring us on to the US...

There is a extremely limited chance that the US government will try to impose broader resuctitions over the holidays. As ever some states will lock down and others won't. The net result will be continued rapid virus spread.

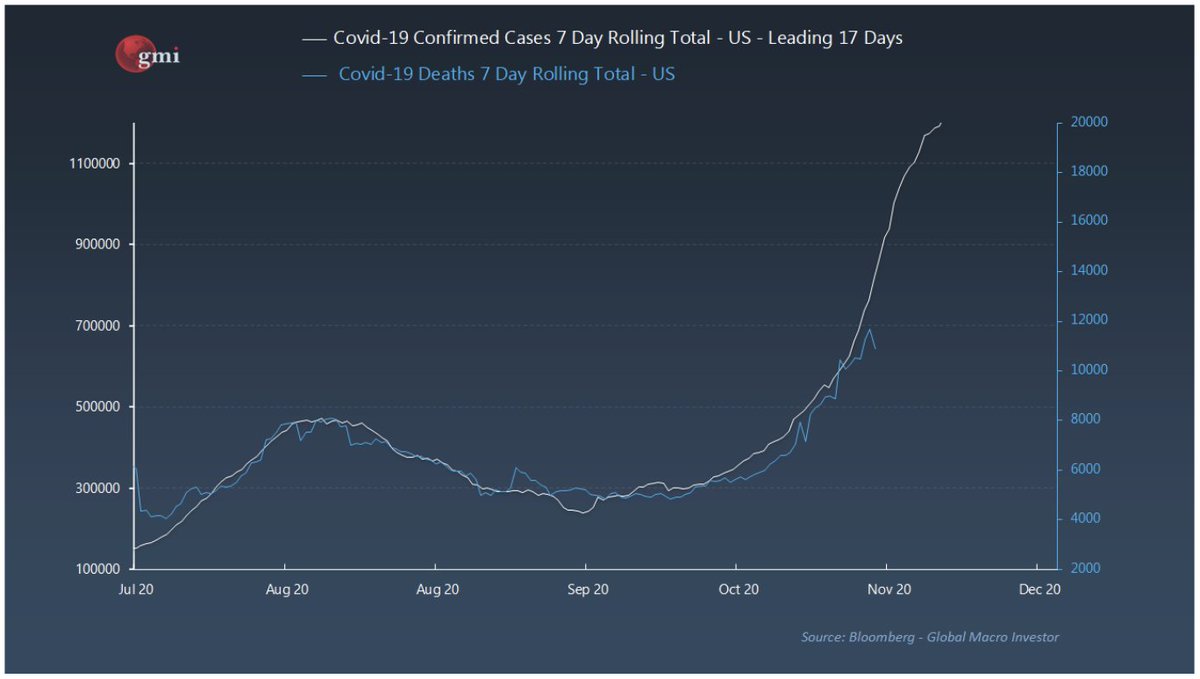

And death rates are near 100% correlated (this chart is 3 week old now but continues to the same pattern)

And that means that the Biden administration in January/February will probably take some tough measures, considering they fought the election on it (again, I don't care if you agree or not, it's about what is LIKELY to happen, not what you WANT to happen).

Globally, Christmas spending and New Years spending will be hugely hit and it's the biggest spending season of the year.

Restaurants and bars will again bear the brunt of the misery through no fault of their own.

Restaurants and bars will again bear the brunt of the misery through no fault of their own.

January sales will be a write-off too as Europe will be locked down and the US heading that way.

I think people are too early with the reflation trade and at may we'll get severely tested as insolvency events build.

I think people are too early with the reflation trade and at may we'll get severely tested as insolvency events build.

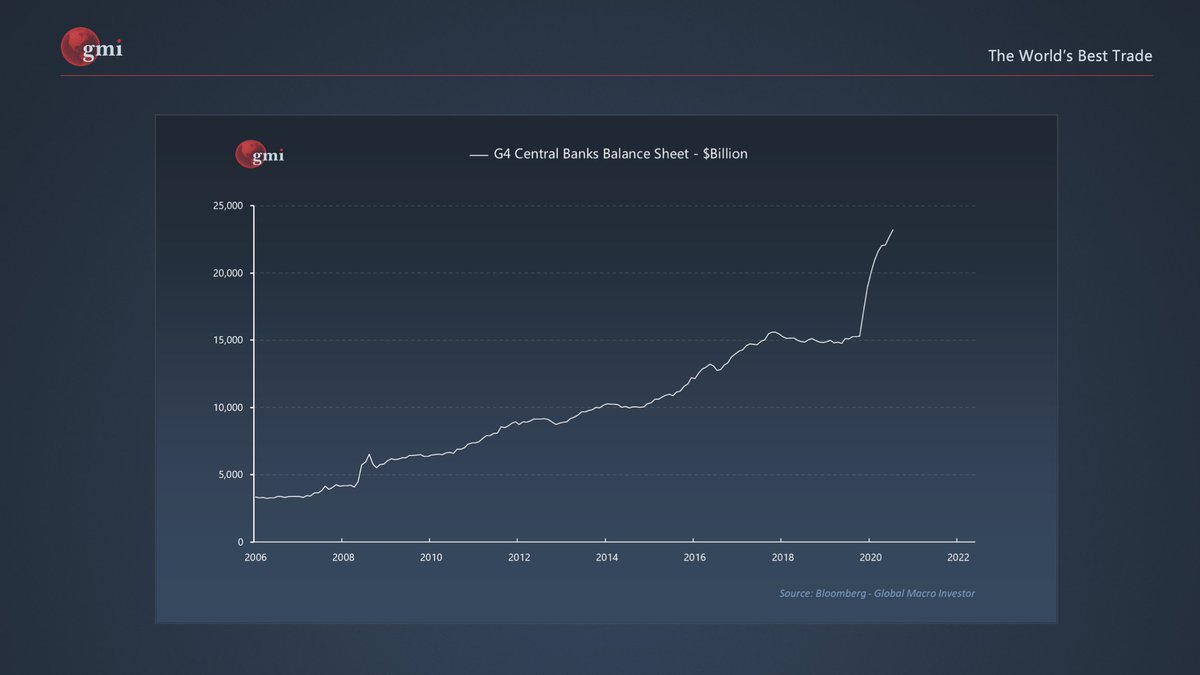

And by next March they will all be forced to do MOAR.

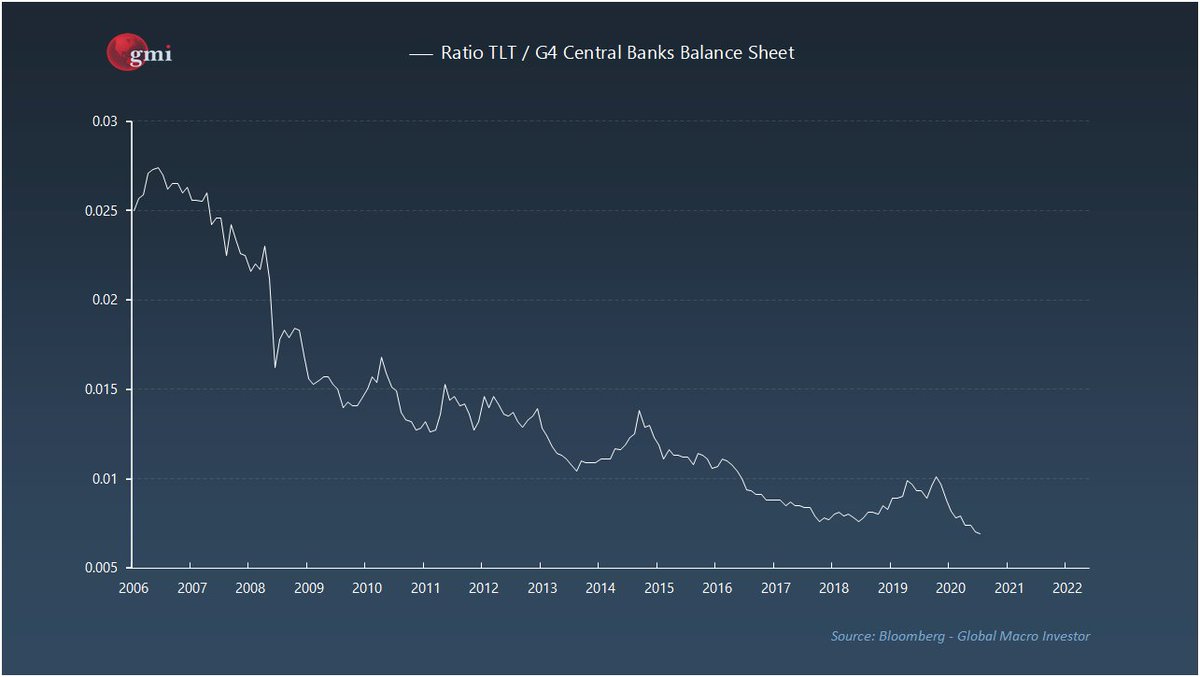

There is a growth cliff happening, the market may choose to look through it or not (I think risks are rising of a stumble) but all outcomes lead to further debasement.

There is a growth cliff happening, the market may choose to look through it or not (I think risks are rising of a stumble) but all outcomes lead to further debasement.

We can argue all day if its going to be inflation first or deflation but all roads lead to the same thing - Rising hard asset prices.

I remain in the deflation camp so I own some calls on bonds too.

I remain in the deflation camp so I own some calls on bonds too.

Music to accompany the tweet thread:

• • •

Missing some Tweet in this thread? You can try to

force a refresh