1/💩ton

OK we have text of the new Stimulus bill... combined w/ a WHOLE lot of other legislation.

In all the PDF version of the full bill clocks in at 5593 pages. Can be found: docs.house.gov/floor/404-main…

Buckle up. This is gonna be a LONG ride!

OK we have text of the new Stimulus bill... combined w/ a WHOLE lot of other legislation.

In all the PDF version of the full bill clocks in at 5593 pages. Can be found: docs.house.gov/floor/404-main…

Buckle up. This is gonna be a LONG ride!

2/x

But before we dive into the bill, a quick note from my soap box… This whole process is absurd. They JUST released a 5k+ page bill, and they are going to vote on it TODAY.

They aren't even pretending to have time to read what they're voting on anymore.

*Steps off soap box*

But before we dive into the bill, a quick note from my soap box… This whole process is absurd. They JUST released a 5k+ page bill, and they are going to vote on it TODAY.

They aren't even pretending to have time to read what they're voting on anymore.

*Steps off soap box*

3/x

Ok... on to the meat. Let's start by answering the question that so many are already asking... “Will I be getting another #stimulus check?”

The answer, like last time, is “Maybe.”

Notably, the maximum stimulus amount per person this time around is $600.

Ok... on to the meat. Let's start by answering the question that so many are already asking... “Will I be getting another #stimulus check?”

The answer, like last time, is “Maybe.”

Notably, the maximum stimulus amount per person this time around is $600.

4/x

Under the CARES Act, adults got $1,200 for themselves, and $500 for children as a ‘base amount.’ This time, it’s $600 for each person.

So, for instance, a single filer w/ no kids starts w/ base of $600. Family of five, like this👇starts w/ a base amount of $600 x 5 = $3k

Under the CARES Act, adults got $1,200 for themselves, and $500 for children as a ‘base amount.’ This time, it’s $600 for each person.

So, for instance, a single filer w/ no kids starts w/ base of $600. Family of five, like this👇starts w/ a base amount of $600 x 5 = $3k

5/x

But those amounts" will be reduced once income exceeds the following thresholds:

Single: $75,000

Joint: $150,000

HOH: $112,500

As was the case under the CARES Act, the ‘base’ stimulus check will phase out by $5 for every $100 a taxpayer is over their applicable threshold.

But those amounts" will be reduced once income exceeds the following thresholds:

Single: $75,000

Joint: $150,000

HOH: $112,500

As was the case under the CARES Act, the ‘base’ stimulus check will phase out by $5 for every $100 a taxpayer is over their applicable threshold.

6/x

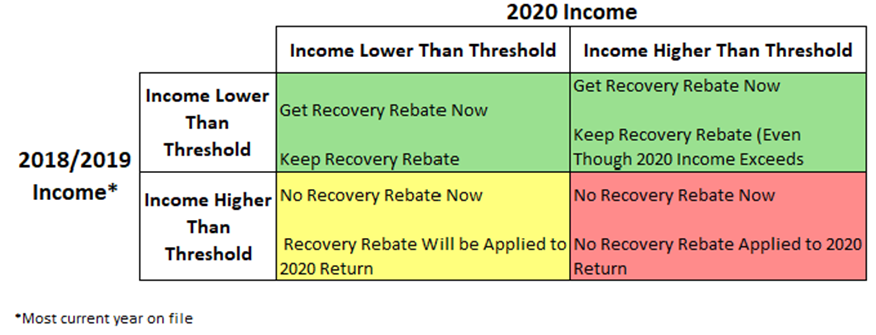

Some thoughts...

- This is another 2020 refundable credit

- The checks will be paid now based on 2019 AGI

- Qualifications look the same as CARES (e.g., kids STILL only count if they can be claimed for the Child Tax Credit)

If your income is much different than 2019, see👇

Some thoughts...

- This is another 2020 refundable credit

- The checks will be paid now based on 2019 AGI

- Qualifications look the same as CARES (e.g., kids STILL only count if they can be claimed for the Child Tax Credit)

If your income is much different than 2019, see👇

7/x

Congress also addressed a BIG issue w/ 1st payments. What happens to payments made to dead people?

In short, they EXPLICITLY state people who died before 2020 do NOT get stimulus checks. Reading between lines, that SHOULD mean those who died early this year DO get them🤷♂️

Congress also addressed a BIG issue w/ 1st payments. What happens to payments made to dead people?

In short, they EXPLICITLY state people who died before 2020 do NOT get stimulus checks. Reading between lines, that SHOULD mean those who died early this year DO get them🤷♂️

8/x

Ahhh... seems Congress further clarified this point for Round 1 checks as well.

For those who have been following me closely, you know this was my prediction. And why I urged people to consider waiting to refund checks sent to 2020 decedents, despite contrary IRS guidance.

Ahhh... seems Congress further clarified this point for Round 1 checks as well.

For those who have been following me closely, you know this was my prediction. And why I urged people to consider waiting to refund checks sent to 2020 decedents, despite contrary IRS guidance.

9/x

Moving on. You may recall that back in August, President Trump signed an Executive Order that allowed payroll taxes through the end of the year to be deferred (he wanted to eliminate them entirely, but lacked statutory authority).

Well, good news for some of those folks...

Moving on. You may recall that back in August, President Trump signed an Executive Order that allowed payroll taxes through the end of the year to be deferred (he wanted to eliminate them entirely, but lacked statutory authority).

Well, good news for some of those folks...

10/x

Originally, the amounts were to be repaid from Jan 21 - April 21. But the Act extends that to Dec 21.

Bottom line… deferrals still must be repaid, but can be spread over a longer time, so Q1 2021 cashflow will be a little bit better for those who deferred in Q4 2020.

Originally, the amounts were to be repaid from Jan 21 - April 21. But the Act extends that to Dec 21.

Bottom line… deferrals still must be repaid, but can be spread over a longer time, so Q1 2021 cashflow will be a little bit better for those who deferred in Q4 2020.

11/x

As to who this pertains to, notably, employers were given the OPTION to participate.

Some did, but most didn’t b/c it was complex and, frankly, wasn’t all that great of a benefit for workers🙄

BUT Fed employees were FORCED to participate. So that's a good starting point.

As to who this pertains to, notably, employers were given the OPTION to participate.

Some did, but most didn’t b/c it was complex and, frankly, wasn’t all that great of a benefit for workers🙄

BUT Fed employees were FORCED to participate. So that's a good starting point.

12/

Of note to educators, if you spend $ on PPE or cleaning supplies for the classroom, those expenses can be used towards your Educator Expense deduction.

Unfortunately, no change to the $250 limit.

(Side note: Teachers should not have to shell out $ to keep classrooms safe)

Of note to educators, if you spend $ on PPE or cleaning supplies for the classroom, those expenses can be used towards your Educator Expense deduction.

Unfortunately, no change to the $250 limit.

(Side note: Teachers should not have to shell out $ to keep classrooms safe)

13/

Back to BIG news... taxation (or rather, lack thereof) of forgiven #PaycheckProtectionProgram (#PPP) loans.

Mercifully, Congress has ended the debate. Businesses CAN deduct expenses paid w/ PPP funds. This DOES sort of provide a double benefit to business owners, but...

Back to BIG news... taxation (or rather, lack thereof) of forgiven #PaycheckProtectionProgram (#PPP) loans.

Mercifully, Congress has ended the debate. Businesses CAN deduct expenses paid w/ PPP funds. This DOES sort of provide a double benefit to business owners, but...

14/

It's worth noting many business owners kept employees on payroll ONLY b/c they had the #PPP loan.

Eliminating the deduction for those expenses would have resulted in potential hardship to those biz owners for doing what the law was designed to do... keep people on payroll.

It's worth noting many business owners kept employees on payroll ONLY b/c they had the #PPP loan.

Eliminating the deduction for those expenses would have resulted in potential hardship to those biz owners for doing what the law was designed to do... keep people on payroll.

15/

Nice little nugget here for #CPAs. Looks like Congress is going to let lenders forgo issuing a 1099 for forgiven PPP debt.

One less entry to make on the return, and 1,454,882 questions about why the client received a 1099 for a non-taxable event avoided!

Nice little nugget here for #CPAs. Looks like Congress is going to let lenders forgo issuing a 1099 for forgiven PPP debt.

One less entry to make on the return, and 1,454,882 questions about why the client received a 1099 for a non-taxable event avoided!

16/

Wasn't aware this was really up for debate before, but Act clarifies that Coronavirus-Related Distributions CAN be made from Money Purchase plans.

Reminder: These distributions are allowed through 12/31/20. A similar provision is included though (more on this in a bit)

Wasn't aware this was really up for debate before, but Act clarifies that Coronavirus-Related Distributions CAN be made from Money Purchase plans.

Reminder: These distributions are allowed through 12/31/20. A similar provision is included though (more on this in a bit)

17/

Employers: The refundable payroll tax credits for sick + family leave created by Families First Act (pre-CARES Act legislation) are extended through March 2021.

Self-employed individuals are also given the option to use prior-year's net earnings instead of current year.

Employers: The refundable payroll tax credits for sick + family leave created by Families First Act (pre-CARES Act legislation) are extended through March 2021.

Self-employed individuals are also given the option to use prior-year's net earnings instead of current year.

18/

OK... Let's get back to another BIG TICKET ITEM; the extension and expansion of the Paycheck Protection Program...

Perhaps the craziest thing in this bill... Congress just gave SBA 10 DAYS to write Regs... over Christmas. Somebody was clearly on Congress's naughty list.

OK... Let's get back to another BIG TICKET ITEM; the extension and expansion of the Paycheck Protection Program...

Perhaps the craziest thing in this bill... Congress just gave SBA 10 DAYS to write Regs... over Christmas. Somebody was clearly on Congress's naughty list.

19/

There's A LOT here on PPP.

For starters, all sorts of new qualifying expenses, including COVERED:

- Operations Expenditures

- Property Damage Costs

- Supplier Costs

- Worker Protection Expenditures

Also, PPP loans may have long-term legs. Officially moved to SBA Act...

There's A LOT here on PPP.

For starters, all sorts of new qualifying expenses, including COVERED:

- Operations Expenditures

- Property Damage Costs

- Supplier Costs

- Worker Protection Expenditures

Also, PPP loans may have long-term legs. Officially moved to SBA Act...

20/

I'd surmise that part of this is that Congress may want to use some PPP loans as a tool in future disaster scenarios without having to literally re-write

the book again.

May we all be so lucky as to never need to take a PPP loan at any point in the future.

I'd surmise that part of this is that Congress may want to use some PPP loans as a tool in future disaster scenarios without having to literally re-write

the book again.

May we all be so lucky as to never need to take a PPP loan at any point in the future.

21/

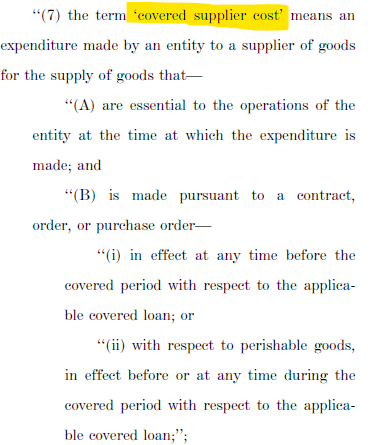

Now... about those new eligible PPP expenses, what exactly are all those "Covered" expenses?🤔

Easier to show you than to tell you on this one.

See below👇

Now... about those new eligible PPP expenses, what exactly are all those "Covered" expenses?🤔

Easier to show you than to tell you on this one.

See below👇

22/

Tangent: Going through this Section of the Act is a royal pain in the butt.

Not only is it a monstrous amount of legalese, but SO MUCH of it refers back to the CARES Act, so you kind of have to look at this bill, and splice it into the CARES Act to figure out what's up.

Tangent: Going through this Section of the Act is a royal pain in the butt.

Not only is it a monstrous amount of legalese, but SO MUCH of it refers back to the CARES Act, so you kind of have to look at this bill, and splice it into the CARES Act to figure out what's up.

23/

Continuing the 2020 theme of making the shelf-life of my writing that of warm milk in the sun, Congress has also updated the choice of Covered Periods for PPP borrowers.

Now ALL borrowers can choose 8-week or 24-week period (choice was only allowed for pre-6/5/20 loans)

Continuing the 2020 theme of making the shelf-life of my writing that of warm milk in the sun, Congress has also updated the choice of Covered Periods for PPP borrowers.

Now ALL borrowers can choose 8-week or 24-week period (choice was only allowed for pre-6/5/20 loans)

24/

BTW... did you notice the chalkboard on the last tweet. Not bad, eh?

I digress (this bill is 5,000+ pages, so that'll happen a few more times. You'll just have to bear w/ me)...

Back to work... While there has been speculation about potentially letting small(ish) PPP...

BTW... did you notice the chalkboard on the last tweet. Not bad, eh?

I digress (this bill is 5,000+ pages, so that'll happen a few more times. You'll just have to bear w/ me)...

Back to work... While there has been speculation about potentially letting small(ish) PPP...

25/

loans receive automatic forgiveness, it appears that won't happen.

BUT, the Act mandates SBA create a 1-page-or-less Forgiveness App for PPP borrowers of less than $150k.

Ironic Congress instructed SBA to make a 1-page form via a 5k+ page law🤣

BTW, SBA has 24 days⏱️

loans receive automatic forgiveness, it appears that won't happen.

BUT, the Act mandates SBA create a 1-page-or-less Forgiveness App for PPP borrowers of less than $150k.

Ironic Congress instructed SBA to make a 1-page form via a 5k+ page law🤣

BTW, SBA has 24 days⏱️

26/

OK... after reading a bit further, the 1-Page Forgiveness Appl (what I called it) is less of an application, and more of a Form to get automatic forgiveness.

The Act goes on to explicitly state that lenders cannot require ANY additional application or documentation...

OK... after reading a bit further, the 1-Page Forgiveness Appl (what I called it) is less of an application, and more of a Form to get automatic forgiveness.

The Act goes on to explicitly state that lenders cannot require ANY additional application or documentation...

27/

Gotta admit, I'm super torn about how I feel about this one. On one hand, small businesses have been crushed, and don't have the time to deal w/ endless pages of bureaucracy.

On the other hand, REQUIRING no documentation kinda invites fraud.🤷♂️

For reference, the vast...

Gotta admit, I'm super torn about how I feel about this one. On one hand, small businesses have been crushed, and don't have the time to deal w/ endless pages of bureaucracy.

On the other hand, REQUIRING no documentation kinda invites fraud.🤷♂️

For reference, the vast...

28/

majority of loans by volume were for under $150k. In fact, the new simplified certification process will cover almost 90% of all PPP borrowers.

But, in terms of total $ lent, loans that were <$150k accounted for only about 1/4 of total funds lent.

(See chart below)

majority of loans by volume were for under $150k. In fact, the new simplified certification process will cover almost 90% of all PPP borrowers.

But, in terms of total $ lent, loans that were <$150k accounted for only about 1/4 of total funds lent.

(See chart below)

29/

Hey, guess what? Group life, disability, vision and dental insurance are all payroll costs.

Finally, we've reached the PPP Section I've been hankering to dissect... PPP Part Deux

1st big change: Deux only applies to businesses w/ 300 or fewer employees...

Hey, guess what? Group life, disability, vision and dental insurance are all payroll costs.

Finally, we've reached the PPP Section I've been hankering to dissect... PPP Part Deux

1st big change: Deux only applies to businesses w/ 300 or fewer employees...

30/

2nd big change: Generally need at least a 25% drop in revenue during ANY 2020 quarter as compared to the prior year's same quarter.

I'd think that leaves a LOT of businesses eligible.

💡Ooo! Thought just occurred to me. There's the real potential for planning and/or...

2nd big change: Generally need at least a 25% drop in revenue during ANY 2020 quarter as compared to the prior year's same quarter.

I'd think that leaves a LOT of businesses eligible.

💡Ooo! Thought just occurred to me. There's the real potential for planning and/or...

31/

funny business here (depending on your POV). Unless something later in bill to stop this, cash businesses on edge of qualification for Q4 may want to do everything possible from now through year-end to delay receipt of $ so they qualify for PPP Deux if needed.

Very sneaky.

funny business here (depending on your POV). Unless something later in bill to stop this, cash businesses on edge of qualification for Q4 may want to do everything possible from now through year-end to delay receipt of $ so they qualify for PPP Deux if needed.

Very sneaky.

32/

Key changes to loan amount

1) Generally going to be 2.5 X avg monthly payroll (like V1) based on 2019 calendar year or fiscal year from date of loan (sep rules for seasonal ERs (again).

2) Capped at $2MM (vs $10MM in V1)

Key changes to loan amount

1) Generally going to be 2.5 X avg monthly payroll (like V1) based on 2019 calendar year or fiscal year from date of loan (sep rules for seasonal ERs (again).

2) Capped at $2MM (vs $10MM in V1)

33/

3) Biz w/ NAICS code starting w/ 72 (Accommodation and Food Services) get have max loans of 3.5X avg monthly payroll. Same $2MM max cap though.

That's a BIG deal for small many family-owned restaurants.

Also, these biz can have up to 500 employees instead of 300.

3) Biz w/ NAICS code starting w/ 72 (Accommodation and Food Services) get have max loans of 3.5X avg monthly payroll. Same $2MM max cap though.

That's a BIG deal for small many family-owned restaurants.

Also, these biz can have up to 500 employees instead of 300.

34/

Tangent (again): Ugh! Just realized that my dragging and dropping of GIFs - or at least what I thought were GIFs - didn't work initially.

Truly only one appropriate reaction to that at this point...

Tangent (again): Ugh! Just realized that my dragging and dropping of GIFs - or at least what I thought were GIFs - didn't work initially.

Truly only one appropriate reaction to that at this point...

35/

Anyway... PPP Part Deux mirrors V1 in that you can only get one loan. So... obvious planning point...

Apply. For. The. Maximum. Available. Amount.

If you don't need/use it, you can always pay it back.

Separately, I've already been peppered w/ questions about whether...

Anyway... PPP Part Deux mirrors V1 in that you can only get one loan. So... obvious planning point...

Apply. For. The. Maximum. Available. Amount.

If you don't need/use it, you can always pay it back.

Separately, I've already been peppered w/ questions about whether...

36/

a biz can apply now for PPP loan and PPP Deux loan. I don't think so. In fact, I don't see anything that opens up the OG PPP program to new borrowers.

Just looked 5x but my eyes are already starting to beg for mercy.

(If I'm missing that somewhere, please let me know)

a biz can apply now for PPP loan and PPP Deux loan. I don't think so. In fact, I don't see anything that opens up the OG PPP program to new borrowers.

Just looked 5x but my eyes are already starting to beg for mercy.

(If I'm missing that somewhere, please let me know)

Oof! Came across what's going to be a real swift kick in the pants to some small biz owners.

Apparently, you can only get in on PPP Deux if you got a V1 loan (+ spent it)!

But what if you didn't need a loan then but you do now!?

Lots of places in peak shut/slowdown right now☹️

Apparently, you can only get in on PPP Deux if you got a V1 loan (+ spent it)!

But what if you didn't need a loan then but you do now!?

Lots of places in peak shut/slowdown right now☹️

38/ (forgot to number last post).

Well... I'm in GREAT company. Seems the incomparable @nittiaj and I have arrived at the same "Huh!? moment.

Well... I'm in GREAT company. Seems the incomparable @nittiaj and I have arrived at the same "Huh!? moment.

https://twitter.com/nittiaj/status/1341167837356802048?s=20

39/

But I THINK I know what's going on now. Very confusing b/c current bill rescinds initial PPP funds. But then talks about new (36) loans (V1 loans). How do you make loans if you have no $?

Well, page 2119 of PDF appears to hold answer w/ re-funding PPP1 w/ min of $35 billion

But I THINK I know what's going on now. Very confusing b/c current bill rescinds initial PPP funds. But then talks about new (36) loans (V1 loans). How do you make loans if you have no $?

Well, page 2119 of PDF appears to hold answer w/ re-funding PPP1 w/ min of $35 billion

40/

Hat tip @plan4dough for that spot. Though I will note that this is STILL HIGHLY problematic.

We blew through $300+ billion FAST when CARES Act was first released. So if new borrowers don't get part of guaranteed $35 billion now, they may not be able to get PPP Deux either!

Hat tip @plan4dough for that spot. Though I will note that this is STILL HIGHLY problematic.

We blew through $300+ billion FAST when CARES Act was first released. So if new borrowers don't get part of guaranteed $35 billion now, they may not be able to get PPP Deux either!

41/

FYI... We are a LONG way from being done here. Tweet speed will ebb and flow as I continue to digest, but if I stop tweeting by 3AM, I'll be thrilled!😜

FYI... We are a LONG way from being done here. Tweet speed will ebb and flow as I continue to digest, but if I stop tweeting by 3AM, I'll be thrilled!😜

42/

OK...🧠needs a PPP break (good, b/c that was pretty much all the 'good stuff' anyway).

🚨Let's talk Tax Extenders!🚨

Technically, this portion is called "The Taxpayer Certainty and Disaster Tax Relief Act of 2020."

Bit of a misnomer, no? Temp extensions≠Certainty🤦♂️

OK...🧠needs a PPP break (good, b/c that was pretty much all the 'good stuff' anyway).

🚨Let's talk Tax Extenders!🚨

Technically, this portion is called "The Taxpayer Certainty and Disaster Tax Relief Act of 2020."

Bit of a misnomer, no? Temp extensions≠Certainty🤦♂️

43/

Sweet merciful lord! They FINALLY made health expense hurdle rate 7.5% of AGI. It had been oscillating back and forth between 10% and 7.5% for some folks. Finally, an end to the stupidity here.

New rule: 7.5% AGI hurdle is "Permanent"... at least as much as tax law can be.

Sweet merciful lord! They FINALLY made health expense hurdle rate 7.5% of AGI. It had been oscillating back and forth between 10% and 7.5% for some folks. Finally, an end to the stupidity here.

New rule: 7.5% AGI hurdle is "Permanent"... at least as much as tax law can be.

44/

Interesting. We're getting rid of the Student Tuition and Related Expense Above-the-Line deduction.

Of course, Congress doesn't say they. They don't "get rid" of tax breaks. They "transition" from them! LOL (see 👇)

In place, we get higher AGI limits for LLC and AOC.

Interesting. We're getting rid of the Student Tuition and Related Expense Above-the-Line deduction.

Of course, Congress doesn't say they. They don't "get rid" of tax breaks. They "transition" from them! LOL (see 👇)

In place, we get higher AGI limits for LLC and AOC.

45/

Under the new AGI thresholds, the credits begin to phase out when income exceeds the following thresholds:

Single filer: $80K

Joint filer: $160k

Under the new AGI thresholds, the credits begin to phase out when income exceeds the following thresholds:

Single filer: $80K

Joint filer: $160k

46/

LOTs of booze-related stuff here. Highlights include:

🟠CERTAIN PROVISIONS RELATED TO BEER, WINE, AND DISTILLED SPIRITS

🟠REFUNDS IN LIEU OF REDUCED RATES FOR CERTAIN CRAFT BEVERAGES PRODUCED OUTSIDE THE UNITED STATES

Pgs 4877-4900 of PDF.

LOTs of booze-related stuff here. Highlights include:

🟠CERTAIN PROVISIONS RELATED TO BEER, WINE, AND DISTILLED SPIRITS

🟠REFUNDS IN LIEU OF REDUCED RATES FOR CERTAIN CRAFT BEVERAGES PRODUCED OUTSIDE THE UNITED STATES

Pgs 4877-4900 of PDF.

47/

Back to relevant stuff...

We're now moving on to items that have been extended through 2025 (which is better than the 1-2 years we typically get in extenders) and coincide w/ sunsetting person income tax provisions of TCJA.

- Forgiven housing debt remains nontaxable but...

Back to relevant stuff...

We're now moving on to items that have been extended through 2025 (which is better than the 1-2 years we typically get in extenders) and coincide w/ sunsetting person income tax provisions of TCJA.

- Forgiven housing debt remains nontaxable but...

48/

The limits have been lowered to a maximum of 750k for joint filers and 375k for single filers. Sadly, this may have renewed importance given current crisis.

- Nice unexpected one here. Employers' ability to give employees $5,250 per year for TAX-FREE student loan payments!

The limits have been lowered to a maximum of 750k for joint filers and 375k for single filers. Sadly, this may have renewed importance given current crisis.

- Nice unexpected one here. Employers' ability to give employees $5,250 per year for TAX-FREE student loan payments!

49/

B/c I know I'm going to get asked... "NO. YOU CAN'T DO THIS FOR YOURSELF (sole prop, significant ownership/interst in S corp/partnership).

But if you have employees w/ debt, this could be better than a $5k salary bump (now). Income tax-free to them. No FICA for you!

B/c I know I'm going to get asked... "NO. YOU CAN'T DO THIS FOR YOURSELF (sole prop, significant ownership/interst in S corp/partnership).

But if you have employees w/ debt, this could be better than a $5k salary bump (now). Income tax-free to them. No FICA for you!

50/

OK... Now onto the shorter-term extensions...

- Energy credit gets extended through 2024

- Mortgage insurance premiums through 2021

- Non-Business Energy Property, Energy Efficient Homes and assorted Electric Vehicle credits all through 2021

Employee Retention Credit...

OK... Now onto the shorter-term extensions...

- Energy credit gets extended through 2024

- Mortgage insurance premiums through 2021

- Non-Business Energy Property, Energy Efficient Homes and assorted Electric Vehicle credits all through 2021

Employee Retention Credit...

51/

is also extended... for 6 months🙃

But SUBSTANTIALLY improved otherwise. New rules include:

- The credit equals 70% of wages (up from 50%)

- The credit is allowed on $10k wages per QUARTER instead of total.

- Revenue only needs to drop below 80% of referenced '19 quarter😮

is also extended... for 6 months🙃

But SUBSTANTIALLY improved otherwise. New rules include:

- The credit equals 70% of wages (up from 50%)

- The credit is allowed on $10k wages per QUARTER instead of total.

- Revenue only needs to drop below 80% of referenced '19 quarter😮

52/

There's also something that allows businesses to use the immediate prior calendar quarter instead of the current quarter. I'll figure that mess out later.

State-run universities + hospitals also now qualify.

And the definition of large (which controls what wages count)...

There's also something that allows businesses to use the immediate prior calendar quarter instead of the current quarter. I'll figure that mess out later.

State-run universities + hospitals also now qualify.

And the definition of large (which controls what wages count)...

53/

is now an employer w/ > 500 employees (was 100).

And here’s 1 for those of you who like to dine out (or enjoy t̴h̴e̴ ̴o̴c̴c̴a̴s̴s̴i̴o̴n̴a̴l̴ ̴ Happy Hour)… For 2021 + 2022 ONLY, 100% of biz meals will be deductible.

So, drinks on me y’all… as long as we talk about taxes

is now an employer w/ > 500 employees (was 100).

And here’s 1 for those of you who like to dine out (or enjoy t̴h̴e̴ ̴o̴c̴c̴a̴s̴s̴i̴o̴n̴a̴l̴ ̴ Happy Hour)… For 2021 + 2022 ONLY, 100% of biz meals will be deductible.

So, drinks on me y’all… as long as we talk about taxes

54/

Note: To receive 100% deductibility, the food or beverages must be provided by a "restaurant."

I see challenges. What exactly is "a restaurant?"

If I'm traveling (🙏) and I eat at the hotel restaurant, that counts, right? But not if I order room service?

Guidance needed!

Note: To receive 100% deductibility, the food or beverages must be provided by a "restaurant."

I see challenges. What exactly is "a restaurant?"

If I'm traveling (🙏) and I eat at the hotel restaurant, that counts, right? But not if I order room service?

Guidance needed!

55/

Another big one for those unemployed for much of 2020...

For 2020, the Earned Income Tax Credit and the Enhanced Child Tax Credit (the refundable part), you can use 2019 earnings to calculate your credit.

Significant as unemployment comp ≠EARNED income (which is needed).

Another big one for those unemployed for much of 2020...

For 2020, the Earned Income Tax Credit and the Enhanced Child Tax Credit (the refundable part), you can use 2019 earnings to calculate your credit.

Significant as unemployment comp ≠EARNED income (which is needed).

56/

Practical note: This means a significant revision of these forms is going to be required by an already-depleted IRS before we can kick off tax season 2021.

#CPAs... prepare yourselves for a delayed start to "Opening Day."

Practical note: This means a significant revision of these forms is going to be required by an already-depleted IRS before we can kick off tax season 2021.

#CPAs... prepare yourselves for a delayed start to "Opening Day."

57/

And hey, remember that dumb above-the-line deduction for charity that was part of the CARES Act (not dumb b/c of charity... but b/c it capped out at $300.. which is a MAXIMUM tax savings of a whopping $36 for someone the 12% bracket)?

Well... modestly less dumb now b/c...

And hey, remember that dumb above-the-line deduction for charity that was part of the CARES Act (not dumb b/c of charity... but b/c it capped out at $300.. which is a MAXIMUM tax savings of a whopping $36 for someone the 12% bracket)?

Well... modestly less dumb now b/c...

58/

1) It's going to be here for 2021

2) Joint filers will now cap out at $600. So that a tax savings of $72 for the typical family, and a maximum tax savings of $222. The $600 for MFJ does NOT apply to 2020🤦♂️

...

1) It's going to be here for 2021

2) Joint filers will now cap out at $600. So that a tax savings of $72 for the typical family, and a maximum tax savings of $222. The $600 for MFJ does NOT apply to 2020🤦♂️

...

59/

Continuing w/ our charitable planning theme, the ability to give up to 100% of your AGI away in "Qualified Charitable Contributions" is also extended through 2021.

Remember, this sounds awesome, but isn't exactly great for tax planning. Because you end up offsetting...

Continuing w/ our charitable planning theme, the ability to give up to 100% of your AGI away in "Qualified Charitable Contributions" is also extended through 2021.

Remember, this sounds awesome, but isn't exactly great for tax planning. Because you end up offsetting...

60/

your income at your highest brackets, but also income taxed at the lowest rates. Tax-wise, likely better off spreading the deduction over multiple years!

Btw this doesn't mean don't give to charity. The 100% of AGI is an option. Not required! Can opt for carryover instead!

your income at your highest brackets, but also income taxed at the lowest rates. Tax-wise, likely better off spreading the deduction over multiple years!

Btw this doesn't mean don't give to charity. The 100% of AGI is an option. Not required! Can opt for carryover instead!

61/

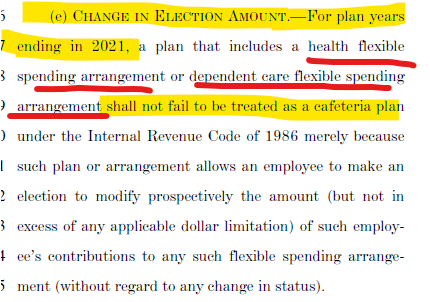

And now on to the news that I have personally been waiting for... more relief for FSAs (I was getting ready to have to buy some VERY expensive prescription glasses... which I may need anyway after reading this bill)!

Here's the deal in a nutshell... BOTH Dependent Care...

And now on to the news that I have personally been waiting for... more relief for FSAs (I was getting ready to have to buy some VERY expensive prescription glasses... which I may need anyway after reading this bill)!

Here's the deal in a nutshell... BOTH Dependent Care...

62/

AND Healthcare FSA funds that are unused can be carried over from 2020 to 2021. And b/c so many people have likely already made irrevocable decisions for 2021, the same will be true at the end of 2021 into 2022.

That's awesome.

But I'll not that based on the way this...

AND Healthcare FSA funds that are unused can be carried over from 2020 to 2021. And b/c so many people have likely already made irrevocable decisions for 2021, the same will be true at the end of 2021 into 2022.

That's awesome.

But I'll not that based on the way this...

63/

...provision is worded, I'm about 99.99% sure this remains an employer option. So theoretically, if your employer does not have or adopt a grace period, the funds still could be forfeited.

If your employer does this, your employer suc... is less than optimal.

For those...

...provision is worded, I'm about 99.99% sure this remains an employer option. So theoretically, if your employer does not have or adopt a grace period, the funds still could be forfeited.

If your employer does this, your employer suc... is less than optimal.

For those...

64/

...employers who use the grace period option instead of the carryover option, the grace period for $ left in the plan at the end of 2020 or 2021 can be extended to up to 12 months.

Again, this would appear to be a choice. And again, if your employer doesn't do so...

Ok...

...employers who use the grace period option instead of the carryover option, the grace period for $ left in the plan at the end of 2020 or 2021 can be extended to up to 12 months.

Again, this would appear to be a choice. And again, if your employer doesn't do so...

Ok...

65/

Ooo. Bonus!

They directly address FSA 2021 elections already made as well. Simply put, employers can allow you to modify your election for 2021 now or during next year (even though doing so would NORMALLY disqualify the plan - these aren't normal times).

Ooo. Bonus!

They directly address FSA 2021 elections already made as well. Simply put, employers can allow you to modify your election for 2021 now or during next year (even though doing so would NORMALLY disqualify the plan - these aren't normal times).

66/

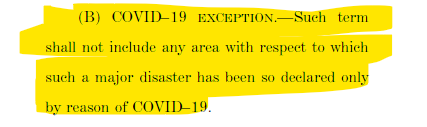

Andddd we're on to "Disaster Tax Relief"... not to be66/ confused w/ COVID-19 tax relief🤦♂️

First interesting note... Congress explicitly carved OUT COVID (only)-related disaster areas (Pres Trump declared nationwide disaster area on March 13th. Still, this seems odd...

Andddd we're on to "Disaster Tax Relief"... not to be66/ confused w/ COVID-19 tax relief🤦♂️

First interesting note... Congress explicitly carved OUT COVID (only)-related disaster areas (Pres Trump declared nationwide disaster area on March 13th. Still, this seems odd...

67/

Essentially, Congress decided to play bouncer at the new Disaster Tax Relief 'club' and is requiring everyone to have two forms of ID to enter.

"Sorry buddy, COVID's not enough by itself."

I digress...

Two qualify the not-COVID-related disaster area had to be declared...

Essentially, Congress decided to play bouncer at the new Disaster Tax Relief 'club' and is requiring everyone to have two forms of ID to enter.

"Sorry buddy, COVID's not enough by itself."

I digress...

Two qualify the not-COVID-related disaster area had to be declared...

68/

in 2020 or in 2021, but only if it's within 60 days of this law's enactment.

The first provision up is one that many advisors will be familiar with from this year... Qualified Disaster Distributions are back.

Essentially, these are Coronavirus-Related Distributions made...

in 2020 or in 2021, but only if it's within 60 days of this law's enactment.

The first provision up is one that many advisors will be familiar with from this year... Qualified Disaster Distributions are back.

Essentially, these are Coronavirus-Related Distributions made...

69/

to people in disaster areas. Same basic rules apply.

- Up to $100k total from retirement accts.

- No 10% penalty

- Can include income over 3 years

- Can repay for up to 3 years

Also plan loan benefits

- 100k max

- 100% of vested balance

- Payments can be delayed 1 year

to people in disaster areas. Same basic rules apply.

- Up to $100k total from retirement accts.

- No 10% penalty

- Can include income over 3 years

- Can repay for up to 3 years

Also plan loan benefits

- 100k max

- 100% of vested balance

- Payments can be delayed 1 year

70/

Reminder.. those IRA rules are NOT for 'just' COVID victims anymore. The Coronavirus-Related Distribution and COVID-related plan loan enhancements still expire at midnight on 12/31/20.

So if you think you MAY need one, now is the time!

Do not wait until the last minute!

Reminder.. those IRA rules are NOT for 'just' COVID victims anymore. The Coronavirus-Related Distribution and COVID-related plan loan enhancements still expire at midnight on 12/31/20.

So if you think you MAY need one, now is the time!

Do not wait until the last minute!

71/

YES! Finally found something I've been looking forward to spotting all day. Had heard rumors of this yesterday.

The FAFSA is getting a MASSIVE makeover... though not right away. Currently, that clusterf%$k of a form has 108 "Questions."

It's gonna have much fewer come 2023

YES! Finally found something I've been looking forward to spotting all day. Had heard rumors of this yesterday.

The FAFSA is getting a MASSIVE makeover... though not right away. Currently, that clusterf%$k of a form has 108 "Questions."

It's gonna have much fewer come 2023

72/

The "Expected Family Contribution" will be going the way of the Dodo Bird. Instead, it will be replaced with the "Student Aid Index."

It's a cosmetic change but one I really like. "EXPECTED family contribution" sounded awful. My wife and I have made the choice to try and...

The "Expected Family Contribution" will be going the way of the Dodo Bird. Instead, it will be replaced with the "Student Aid Index."

It's a cosmetic change but one I really like. "EXPECTED family contribution" sounded awful. My wife and I have made the choice to try and...

73/

fund college education at any school for our 3 boys, but that's our CHOICE. It should not be "expected."

"Student aid index" (SAI)sounds SO much better.

Full Pell Grant recipients automatically get an SAI of $0 (unless actual is less than $0) If you don't file a tax...

fund college education at any school for our 3 boys, but that's our CHOICE. It should not be "expected."

"Student aid index" (SAI)sounds SO much better.

Full Pell Grant recipients automatically get an SAI of $0 (unless actual is less than $0) If you don't file a tax...

74/

...in the 2nd year before filing the FAFSA, they will use

NEGATIVE $1,500 as a default amount.

There are updated formulas for "Available Assets" and "Available Income." Not gonna go into detail about those here now, but you can find it all beginning on page 5148 of PDF.

...in the 2nd year before filing the FAFSA, they will use

NEGATIVE $1,500 as a default amount.

There are updated formulas for "Available Assets" and "Available Income." Not gonna go into detail about those here now, but you can find it all beginning on page 5148 of PDF.

75/

And then we get to what's actually ON the new FAFSA. In other words, what questions will be there and what info needs to be reported?

I haven't added up all the items, but it's definitely less than 108. Heard 'only' 36 Qs, but I haven't verified.

Sometimes they lie😜

And then we get to what's actually ON the new FAFSA. In other words, what questions will be there and what info needs to be reported?

I haven't added up all the items, but it's definitely less than 108. Heard 'only' 36 Qs, but I haven't verified.

Sometimes they lie😜

76/

And as I sit here now, at about 11:45PM EDT, I note that Congress has officially passed this behemoth, and it's off to the White House to be signed.

Those mandatory speed-reading classes Congress took REALLY paid off.

And as I sit here now, at about 11:45PM EDT, I note that Congress has officially passed this behemoth, and it's off to the White House to be signed.

Those mandatory speed-reading classes Congress took REALLY paid off.

77/

We've reached the MTV reality show (so, I probably could have just left it at just "MTV") portion of the Act👇

Previews look exciting🤡

We've reached the MTV reality show (so, I probably could have just left it at just "MTV") portion of the Act👇

Previews look exciting🤡

78/

Just about to the home stretch, and WELL before I expected. Gonna be an early night😉

Fortunately (or unfortunately), we're left w/ talking about something that so many have needed this year, and many for the first time in their entire life...

Unemployment Compensation...

Just about to the home stretch, and WELL before I expected. Gonna be an early night😉

Fortunately (or unfortunately), we're left w/ talking about something that so many have needed this year, and many for the first time in their entire life...

Unemployment Compensation...

79/

The Act extends most of the key programs first created by CARES Act, with some modifications. Specifically:

- Starting Dec 26th there will be an additional $300/week Fed unemployment benefit tacked on to the state benefit. NO RETRO benefit ($600 amt expired weeks ago)...

The Act extends most of the key programs first created by CARES Act, with some modifications. Specifically:

- Starting Dec 26th there will be an additional $300/week Fed unemployment benefit tacked on to the state benefit. NO RETRO benefit ($600 amt expired weeks ago)...

80/

- 11 more weeks of Federally funded unemployment benefits are added

- Pandemic Unemployment Insurance is extended to March 14th (benefits can continue to be paid through April 5th). This is CRITICAL for unemployed previous self-employed persons.

- 11 more weeks of Federally funded unemployment benefits are added

- Pandemic Unemployment Insurance is extended to March 14th (benefits can continue to be paid through April 5th). This is CRITICAL for unemployed previous self-employed persons.

81/

And for those who enjoy museums (I do!), looks as though we're getting two new Smithsonian Museums:

- The American Women's History Museum

and

- The National Museum of the American Latino

I look forward to both (though nothing will ever beat Air and Space IMO✈️🚀)

And for those who enjoy museums (I do!), looks as though we're getting two new Smithsonian Museums:

- The American Women's History Museum

and

- The National Museum of the American Latino

I look forward to both (though nothing will ever beat Air and Space IMO✈️🚀)

82/

Phew! Thank goodness. They've authorized intelligence for 2021.

If only we'd had some this year🤪

Phew! Thank goodness. They've authorized intelligence for 2021.

If only we'd had some this year🤪

83/

There's a whole section on curbing surprise medical bills, which sounds good, and is, but (while medical billing isn't my bag) best I can tell it's full of loopholes and concessions to lobbyists.

Example: Ambulances are a huge surprise med bill for many. They're exluded.😠

There's a whole section on curbing surprise medical bills, which sounds good, and is, but (while medical billing isn't my bag) best I can tell it's full of loopholes and concessions to lobbyists.

Example: Ambulances are a huge surprise med bill for many. They're exluded.😠

84/

Some other notes on the curtailing of surprise medical bills...

- It doesn't start until 2022. So be careful, still legal for you to be ripped off for a 'routine' ER trip (example) in 2021.

- Providers will have to negotiate w/ insurers. Disputes handled by arbitrators.

Some other notes on the curtailing of surprise medical bills...

- It doesn't start until 2022. So be careful, still legal for you to be ripped off for a 'routine' ER trip (example) in 2021.

- Providers will have to negotiate w/ insurers. Disputes handled by arbitrators.

85/

Another thing that could be really important to some who are struggling this holiday season... The nationwide eviction moratorium is extended through the end of January.

By then, Pres-Elect Biden will be in office and I wouldn't be surprised to see some efforts made here.

Another thing that could be really important to some who are struggling this holiday season... The nationwide eviction moratorium is extended through the end of January.

By then, Pres-Elect Biden will be in office and I wouldn't be surprised to see some efforts made here.

86/

If you've stuck w/ me this far, thanks.

But good news, the end is near!

Obviously tons - literally THOUSANDS - of pages we didn't cover.

But I've glanced through and I'm pretty sure we covered just about all matters relevant to Personal Financial Planning.

Of course...

If you've stuck w/ me this far, thanks.

But good news, the end is near!

Obviously tons - literally THOUSANDS - of pages we didn't cover.

But I've glanced through and I'm pretty sure we covered just about all matters relevant to Personal Financial Planning.

Of course...

87/

It's worth pointing out, too, that despite being over 5,000 pages (!), there's a bunch of stuff that didn't make the cut...

- No major aid for failing state budgets

- No COVID-19 hold harmless for employers

- No extension of deferment for Studen Loans

In the end...

It's worth pointing out, too, that despite being over 5,000 pages (!), there's a bunch of stuff that didn't make the cut...

- No major aid for failing state budgets

- No COVID-19 hold harmless for employers

- No extension of deferment for Studen Loans

In the end...

88/

Congress will probably pat themselves on the back and say "Job well done." But none of this had to wait until now.

Americans under unprecedented stress didn't need to wonder whether a Congress that remains woefully out of touch w/ reality would finally get its act together.

Congress will probably pat themselves on the back and say "Job well done." But none of this had to wait until now.

Americans under unprecedented stress didn't need to wonder whether a Congress that remains woefully out of touch w/ reality would finally get its act together.

89/

But late is better than never. We have it now.

I sincerely hope that if you took the time to read this absurdly long string of tweets, it's helped you in some way, or will help you help others.

Best for a healthy, happy remainder of 2020 and beyond.

And now... Good night

But late is better than never. We have it now.

I sincerely hope that if you took the time to read this absurdly long string of tweets, it's helped you in some way, or will help you help others.

Best for a healthy, happy remainder of 2020 and beyond.

And now... Good night

• • •

Missing some Tweet in this thread? You can try to

force a refresh