1/ Daniel Ades writes:

"What makes a country wealthier is not the valuation of the companies going higher, but companies producing a greater quantity or potentially more valuable products, which is generally reflected in rising profits or sales."

"What makes a country wealthier is not the valuation of the companies going higher, but companies producing a greater quantity or potentially more valuable products, which is generally reflected in rising profits or sales."

2/ "This is why we tend to associate the rising value of stocks with a greater net worth as a stock market generally grows in line with increased profits. The same is true for an entire economy."

3/ "It is the economy’s ability to generate more value that makes it richer, not its abstract measure of money. If the government intervenes to ensure a buoyant stock market or fewer bond defaults, it is not creating wealth: it is simply removing accurate price discovery."

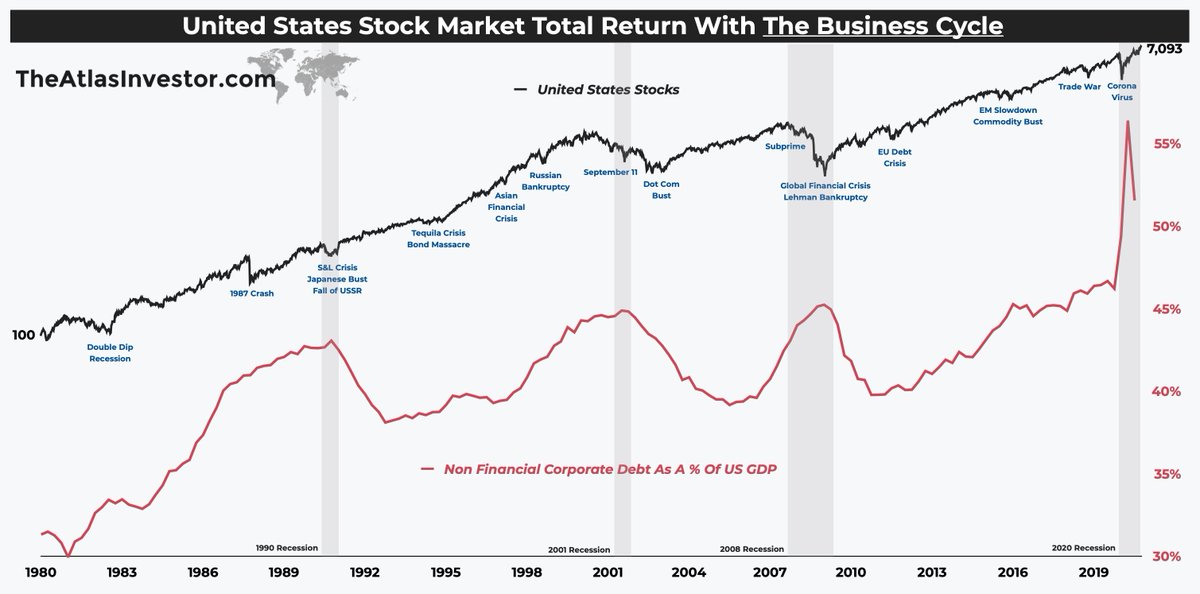

4/ Today, the supply of money is rising faster than at any point in time since World War II to shore up the potential defaults in over-levered system.

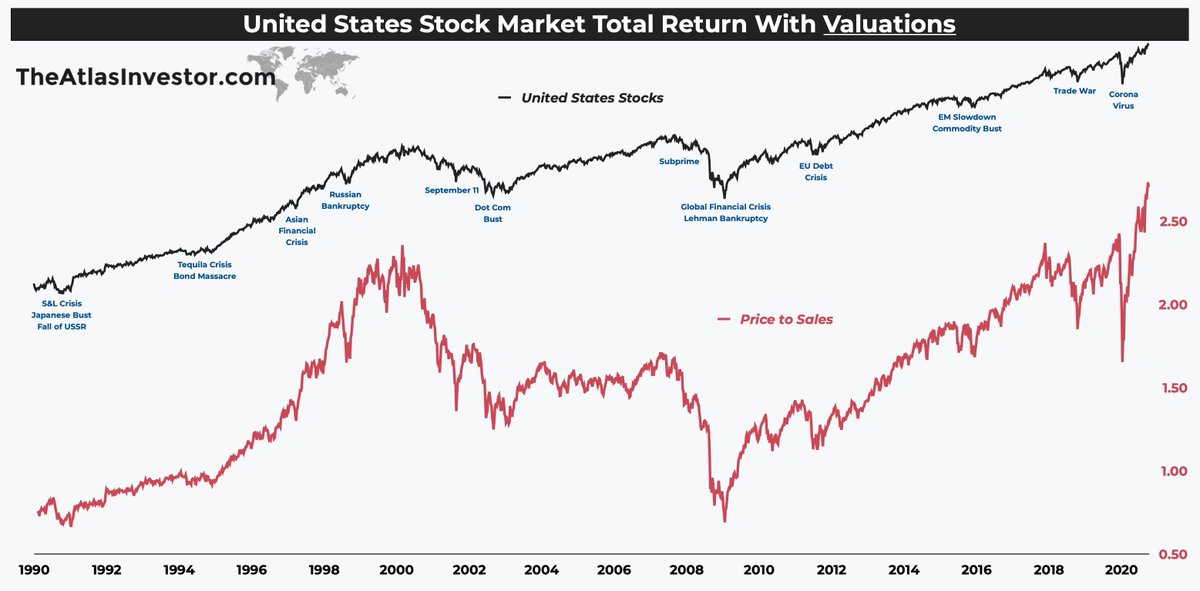

Today, the prices of assets are rising faster than sales/income they produce, thus increasing valuations to unsuitable levels.

Today, the prices of assets are rising faster than sales/income they produce, thus increasing valuations to unsuitable levels.

5/ Daniel Ades continues: "Like every trend in financial markets, the last move is generally exponential, and we are living it today: the endless supply of free money is going parabolic."

The proof is in the pudding as governments spend almost $30 trillion in 2020 alone!

The proof is in the pudding as governments spend almost $30 trillion in 2020 alone!

• • •

Missing some Tweet in this thread? You can try to

force a refresh