Peloton currently has over 3 million global members.

Their long-term goal?

100 million.

While most laugh, I actually think it's possible.

Time for a thread 👇👇👇

Their long-term goal?

100 million.

While most laugh, I actually think it's possible.

Time for a thread 👇👇👇

1) Since being founded by John Foley in 2012, Peloton has dominated the multi-year transition to at-home fitness.

The fitness equipment & media company has over 3 million members currently, but how do they get to 100 million?

Let's run through it…

The fitness equipment & media company has over 3 million members currently, but how do they get to 100 million?

Let's run through it…

2) First off, existing Peloton subscribers aren't going anywhere.

Here's a wild stat:

The average Peloton user is working out almost 21x per month, which is ~2x more often than they were in 2019.

The pandemic certainly helps, but don't forget:

Addictions are hard to break.

Here's a wild stat:

The average Peloton user is working out almost 21x per month, which is ~2x more often than they were in 2019.

The pandemic certainly helps, but don't forget:

Addictions are hard to break.

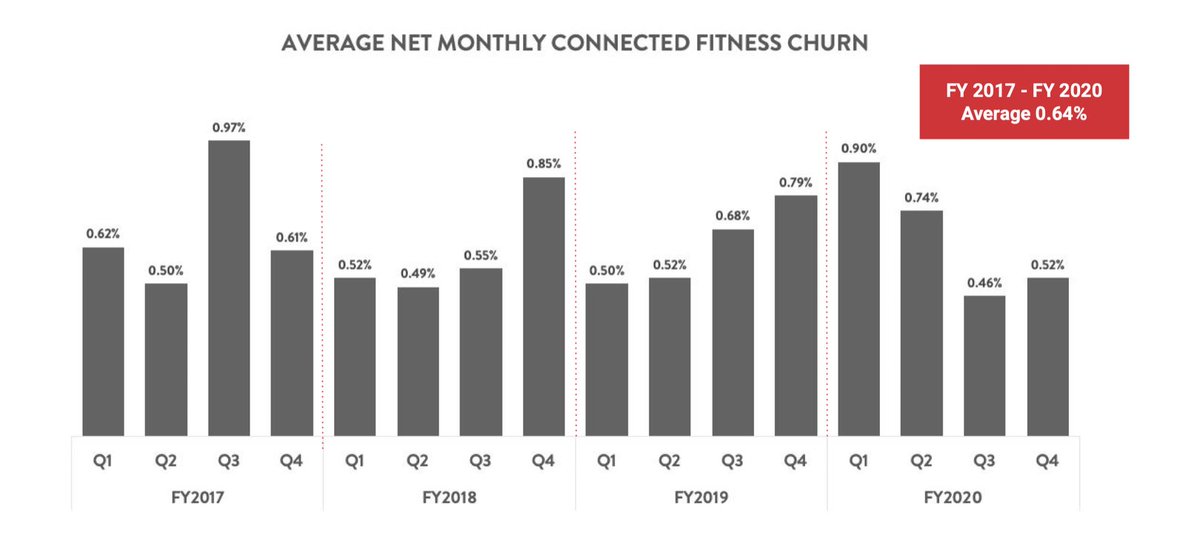

3) Through a combo of cult-like addiction & high entry costs, Peloton has a historically low churn rate.

How low?

A 3-yr average of .64% is lower than AT&T & Verizon, meaning you are more likely to switch cell-phone carriers than cancel your Peloton membership.

That's wild.

How low?

A 3-yr average of .64% is lower than AT&T & Verizon, meaning you are more likely to switch cell-phone carriers than cancel your Peloton membership.

That's wild.

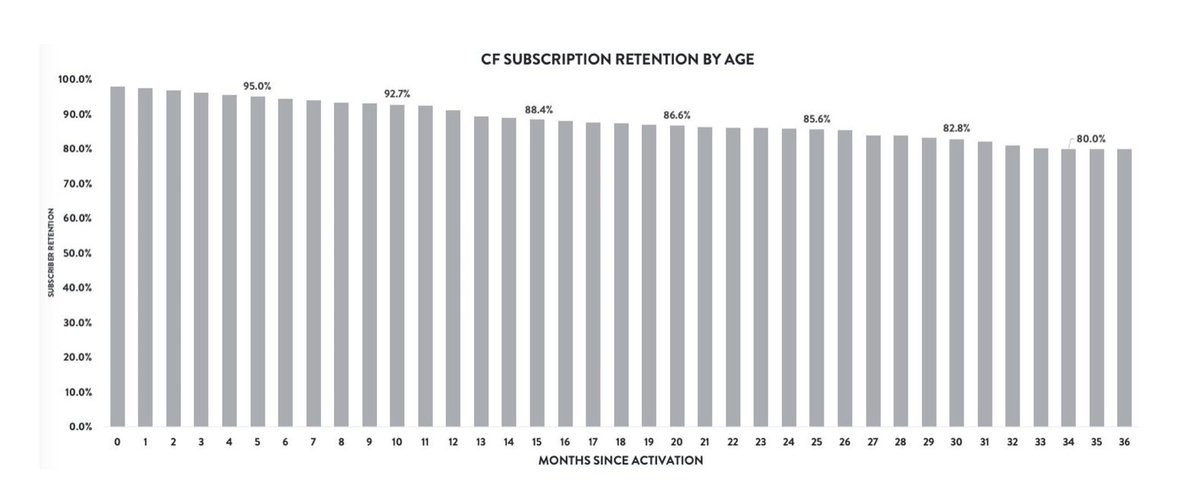

4) Going deeper on churn, check this out:

Over 90% of Peloton connected fitness subscribers keep their membership for 12 months or greater.

For traditional gyms, that number is closer to 60%.

My point?

Once a customer buys a Peloton, they aren’t leaving.

Over 90% of Peloton connected fitness subscribers keep their membership for 12 months or greater.

For traditional gyms, that number is closer to 60%.

My point?

Once a customer buys a Peloton, they aren’t leaving.

5) Now that we know Peloton's ability to retain customers, what about acquisition?

Here's Peloton's expansion playbook:

— Product Affordability

— Class Diversification

— Commercial & Geographic Expansion

The opportunity?

Disrupting the ~200M gym memberships worldwide.

Here's Peloton's expansion playbook:

— Product Affordability

— Class Diversification

— Commercial & Geographic Expansion

The opportunity?

Disrupting the ~200M gym memberships worldwide.

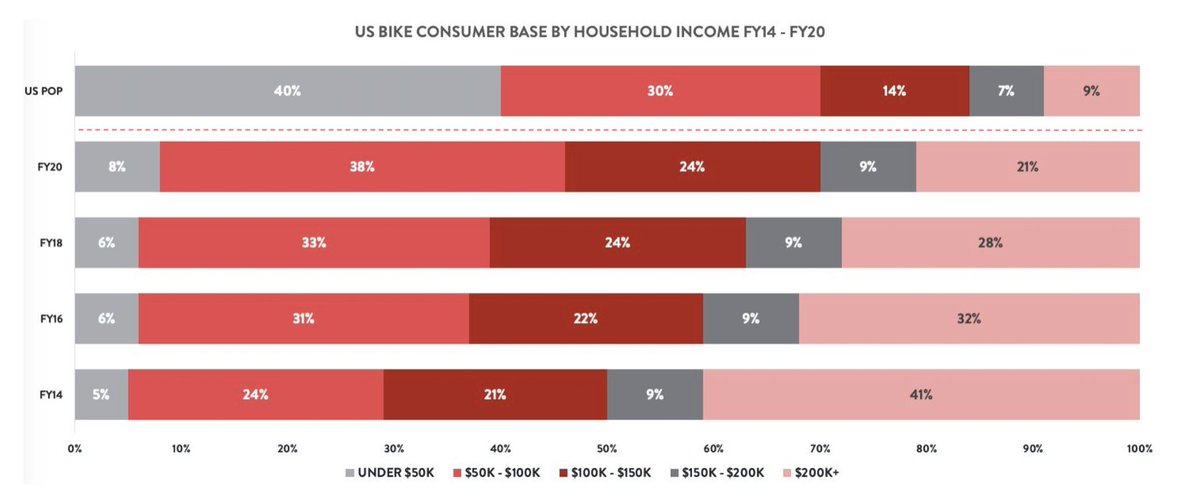

6) From an affordability standpoint, Peloton has already introduced new financing options.

— $0 Down

— 0% APR

— $49/month for 36 months

The best part? It's working.

In 2020, 50% of the Peloton's bikes have been sold to households with <$100k in income.

Affordability = Scale

— $0 Down

— 0% APR

— $49/month for 36 months

The best part? It's working.

In 2020, 50% of the Peloton's bikes have been sold to households with <$100k in income.

Affordability = Scale

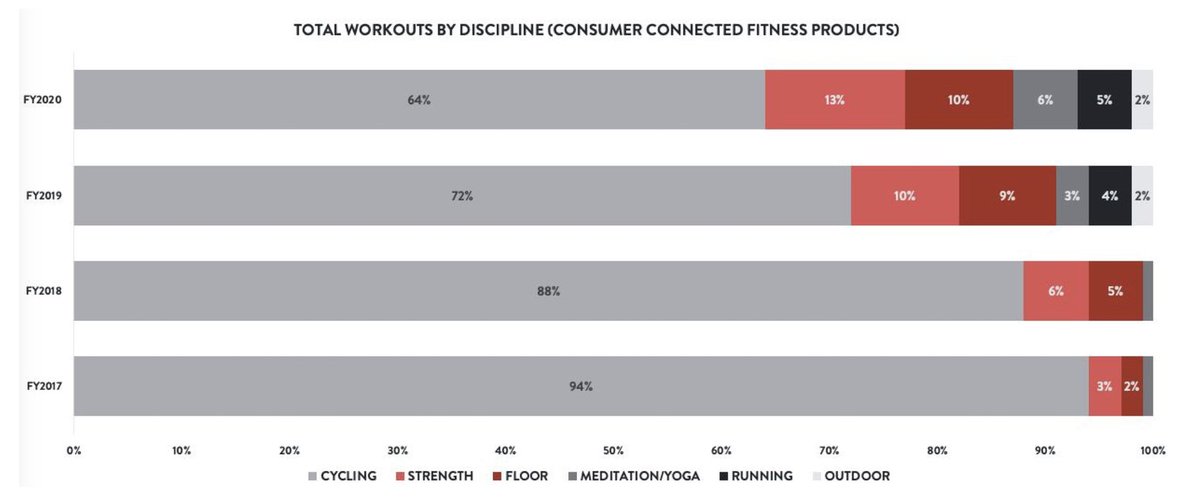

7) Along with making their products more affordable, Peloton has also expanded their content offering.

Current Offering:

— Cycling

— Running

— Bootcamp

— Strength

— Pilates

— Yoga

— Etc.

The result?

In 2017, ~95% of workouts were cycling — that number is now a more modest 64%.

Current Offering:

— Cycling

— Running

— Bootcamp

— Strength

— Pilates

— Yoga

— Etc.

The result?

In 2017, ~95% of workouts were cycling — that number is now a more modest 64%.

8) By improving financing & diversifying workouts, Peloton has seen their demand skyrocket — the pandemic simply served as an accelerant.

Subscriptions & revenue are up over 200%, causing multi-month delivery delays for new customers.

The solution?

Infrastructure investment.

Subscriptions & revenue are up over 200%, causing multi-month delivery delays for new customers.

The solution?

Infrastructure investment.

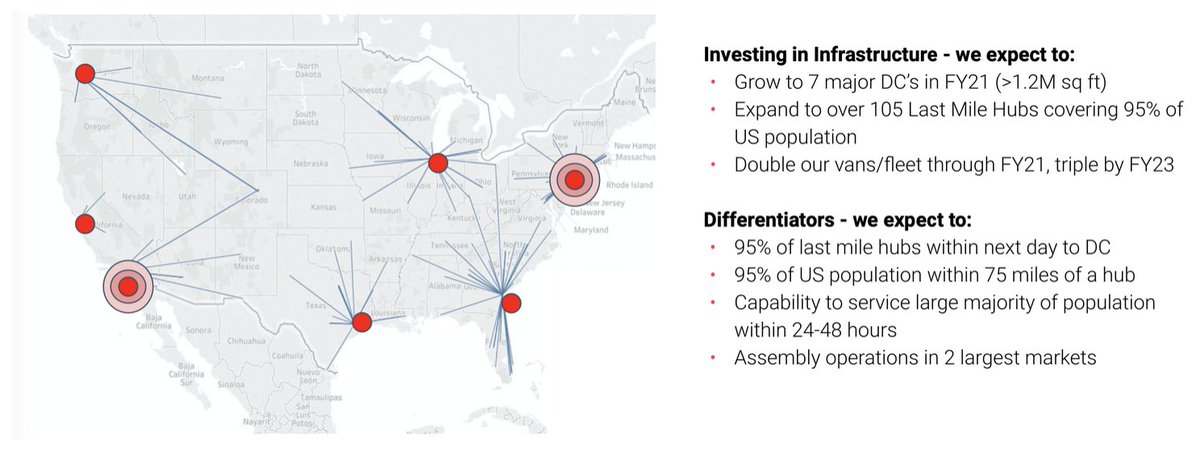

9) In addition to expanding in countries like Germany & Russia, Peloton is building out a collection of distribution centers in the US.

By 2022, Peloton expects to have the ability to service ~95% of the US population within 24-48 hours.

Even better, they're doubling down.

By 2022, Peloton expects to have the ability to service ~95% of the US population within 24-48 hours.

Even better, they're doubling down.

10) Peloton acquired fitness equipment manufacturer Precor for $420M yesterday — their largest acquisition ever.

Through the deal, Peloton will ease supply constraints by gaining access to over 600k sq-ft of manufacturing capacity in the US.

Next up - commercial expansion.

Through the deal, Peloton will ease supply constraints by gaining access to over 600k sq-ft of manufacturing capacity in the US.

Next up - commercial expansion.

11) Through their $420M acquisition of Precor, Peloton will aggressively accelerate their commercial expansion timeline.

With 100 additional engineers & existing products, Precor enables Peloton to infiltrate hotel, university and corporate gyms in 90 countries around the world.

With 100 additional engineers & existing products, Precor enables Peloton to infiltrate hotel, university and corporate gyms in 90 countries around the world.

12) In a world with ~200M active gym memberships, Peloton’s 3M+ subscribers represent substantial progress & a significant opportunity.

Investors are happy with subs growing 107% CAGR, successful acquisitions, and infrastructure investments paying off.

YTD $PTON is up over 440%

Investors are happy with subs growing 107% CAGR, successful acquisitions, and infrastructure investments paying off.

YTD $PTON is up over 440%

13) Peloton's goal of 100M subscribers is certainly lofty, but its not impossible.

At-home fitness is set to dominate as the world becomes more digital and more remote.

Never bet against innovation. The future is here.

At-home fitness is set to dominate as the world becomes more digital and more remote.

Never bet against innovation. The future is here.

14) If you enjoyed this thread, you should:

1. Follow me, I tweet cool sports business stories everyday.

2. Subscribe to my free daily newsletter where I give detailed analysis on topics involving the money and business behind sports.

readhuddleup.com

1. Follow me, I tweet cool sports business stories everyday.

2. Subscribe to my free daily newsletter where I give detailed analysis on topics involving the money and business behind sports.

readhuddleup.com

Also, don't forget @AthleticBrewing is the reason I'm able to create sports business content full-time.

If you want to support me, buy some beer - it's really great stuff.

Use code "JOE25" for 25% off at athleticbrewing.com

If you want to support me, buy some beer - it's really great stuff.

Use code "JOE25" for 25% off at athleticbrewing.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh