R SYSTEMS INTERNATIONAL #Thread

#smallcap #stock

📌Presenting my study for educational purpose 👇

Will keep adding points to this #thread so you may bookmark & re-visit as you like !

1

#smallcap #stock

📌Presenting my study for educational purpose 👇

Will keep adding points to this #thread so you may bookmark & re-visit as you like !

1

R Systems International incorporated in 1993 as a consulting firm in California, US.

Started its India operations in 1997 in Noida.

Per latest AR Dec19

Currently provide services in 40+ Countries for 200+ Active Clients.

7 - $3 Million Clients

26 - $1 Million Clients

2

Started its India operations in 1997 in Noida.

Per latest AR Dec19

Currently provide services in 40+ Countries for 200+ Active Clients.

7 - $3 Million Clients

26 - $1 Million Clients

2

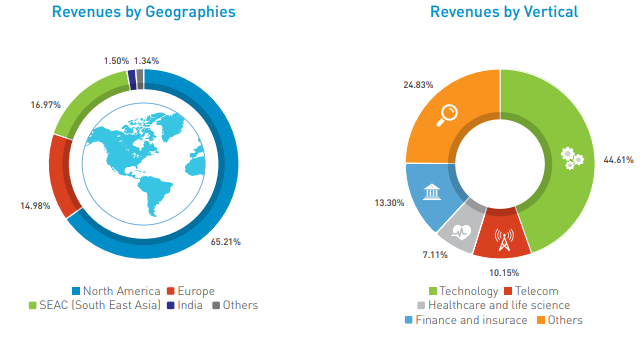

Highly Diversified portfolio across various business domains & Geographies👍

Largest Client Revenue 7-8%👌

No high client Concentration, so even if they lose few (highly unlikely explained 👇) it won't be big dent on balance sheet.

📌Very imp point especially for small cap.

4

Largest Client Revenue 7-8%👌

No high client Concentration, so even if they lose few (highly unlikely explained 👇) it won't be big dent on balance sheet.

📌Very imp point especially for small cap.

4

📌PARTNER List include quit prominent names ->

Oracle, Microsoft, Amazon, Google, SAP, Cloudera, Snowflake, DELL, Boomi, Automation Anywhere, UiPath, informatica, Information Builders, Alteryx.

5

Oracle, Microsoft, Amazon, Google, SAP, Cloudera, Snowflake, DELL, Boomi, Automation Anywhere, UiPath, informatica, Information Builders, Alteryx.

5

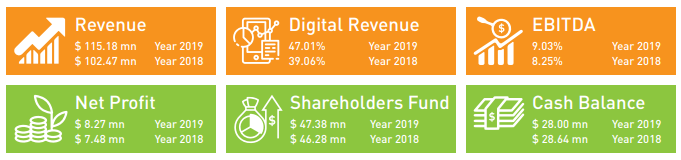

Financial Highlights !

Digital Revenue is 47% up from 39% in 2018.

Digital Transformation is continued to be Focus

Services in Cloud, Analytics, AI, Machine Learning,

Data & Speech Analytics, RPA(Robotics Process Automation), Salesforce

6

Digital Revenue is 47% up from 39% in 2018.

Digital Transformation is continued to be Focus

Services in Cloud, Analytics, AI, Machine Learning,

Data & Speech Analytics, RPA(Robotics Process Automation), Salesforce

6

📌As per Sep20 Con Call !

Major Traction in Cloud Space

Analytics continue to extend strength in MLAI (Machine Learning & Artificial Intelligence)

Continue to expand in Data & Speech Analytics currently serving many key clients in this space

7

Major Traction in Cloud Space

Analytics continue to extend strength in MLAI (Machine Learning & Artificial Intelligence)

Continue to expand in Data & Speech Analytics currently serving many key clients in this space

7

Mobility - work on wide range of technology devices such as Android, iOS, hybrid to webex right from App to Enterprise application

8

8

📌7 deal wins (Sep20)

Leading Real estate appraisal management company collaborated with R systems to digitize existing applications to move from monolithic to cloud multi-currency multi-language flavor.

9

Leading Real estate appraisal management company collaborated with R systems to digitize existing applications to move from monolithic to cloud multi-currency multi-language flavor.

9

Canada Based leading software solutions for water data management existing solutions to AWS cloud using micro-services architecture help in ensuring scalability & high availability of their products

10

10

Cloud based automative retail marketing solution provider engaged R systems to provide engineering & taxing services to enable automative retailer to

manage their service operations.

(R systems already have several clients in this space)

11

manage their service operations.

(R systems already have several clients in this space)

11

Largest Telecom Provider in Switzerland. They have engaged R Systems European subsidiary to develop a new voice services for their subscribers to enhance

their experiences.

In South-East Asia a Singapore based Vertical Farming company has awarded

12

their experiences.

In South-East Asia a Singapore based Vertical Farming company has awarded

12

Technical Headcount added 170+ technical associate

2335(Q2 FY20) to 2506(Q3 FY20) to take care of strong sales channel & growth in existing customer base.

They follow Dec Calendar not Mar Calendar.

📌90%+ Repeat Revenue Business

13

2335(Q2 FY20) to 2506(Q3 FY20) to take care of strong sales channel & growth in existing customer base.

They follow Dec Calendar not Mar Calendar.

📌90%+ Repeat Revenue Business

13

Utilization - Marked Peak Utilization(Sep20)

78.8% in IT up 1% visa vis last year Qtr

58.7% to 80% in BPO (Big Jump)

On Qtrly basis contribution

NAmerica - 66.7%

Europe - 13.3

S.East Asia - 17.8%

Rest of World - 2.1%

14

78.8% in IT up 1% visa vis last year Qtr

58.7% to 80% in BPO (Big Jump)

On Qtrly basis contribution

NAmerica - 66.7%

Europe - 13.3

S.East Asia - 17.8%

Rest of World - 2.1%

14

Regained momentum in Revenue & Margin growth in FY20. For YOY Sep20 grown about 8% in 9 months with Strong margin Improvement

📌Feels +ive for future growth

📌Business outlook has improved significantly on the back on renewed interest for Digital services in COVID pandemic

15

📌Feels +ive for future growth

📌Business outlook has improved significantly on the back on renewed interest for Digital services in COVID pandemic

15

Sep 20

EBITDA ~16% highest in several qtrs.

Business Revenue grew by 1.3 million

Utilization improved by 2% from last qtr

Cost reduced due to Pandemic

Travel cost will increase but it will not increase as much as pre-pandemic expect saving atleast of 40-50%.

16

EBITDA ~16% highest in several qtrs.

Business Revenue grew by 1.3 million

Utilization improved by 2% from last qtr

Cost reduced due to Pandemic

Travel cost will increase but it will not increase as much as pre-pandemic expect saving atleast of 40-50%.

16

Growth will be driving the margins

15-16% (+,-1%) Hopefully able to maintain EBITDA.

Have Strong Balance Sheet & Expanded (Associates & Infrastructure) as to meet strong demand.

17

15-16% (+,-1%) Hopefully able to maintain EBITDA.

Have Strong Balance Sheet & Expanded (Associates & Infrastructure) as to meet strong demand.

17

Largest client - 7-8% Good customer diversification.

Diversified services in several Sectors.

Long term contracts with Companies.

MD Rekhi - Client focus get Repeat business (90%+) & build repo to get new clients.

I feel Good safety in terms of Revenue (imp for #SmallCaps )

18

Diversified services in several Sectors.

Long term contracts with Companies.

MD Rekhi - Client focus get Repeat business (90%+) & build repo to get new clients.

I feel Good safety in terms of Revenue (imp for #SmallCaps )

18

📌R SYSTEMS Acquisitions!

Prominent are ->

Pune Based Indus Software

Singapore based ECnet

UK based Computaris

Innovizant LLC, USA Feb 2019

(Engaged in Analytical, data science, data engineering,

decision science services & solutions & other IT services)

IBIZ ,Singapore

19

Prominent are ->

Pune Based Indus Software

Singapore based ECnet

UK based Computaris

Innovizant LLC, USA Feb 2019

(Engaged in Analytical, data science, data engineering,

decision science services & solutions & other IT services)

IBIZ ,Singapore

19

📌Apart from various Acquisitions they also sold some businesses -

Jul 2015 Sales of its holding in R Systems Products & Technologies Pvt Ltd to BD Capital Partners Ltd., a Mauritius Company.

Nov 2014

R Systems sold Europe BPO Business 4 Million Euro.

Profitable sales !

20

Jul 2015 Sales of its holding in R Systems Products & Technologies Pvt Ltd to BD Capital Partners Ltd., a Mauritius Company.

Nov 2014

R Systems sold Europe BPO Business 4 Million Euro.

Profitable sales !

20

R SYSTEMS decided to pursue Digital & new Age Technology services hence sold its Product businesses.

The Sudden jump in profits in 2014 & 2015 (check sheet in #1 👆) is due to these profitable sales.

21

The Sudden jump in profits in 2014 & 2015 (check sheet in #1 👆) is due to these profitable sales.

21

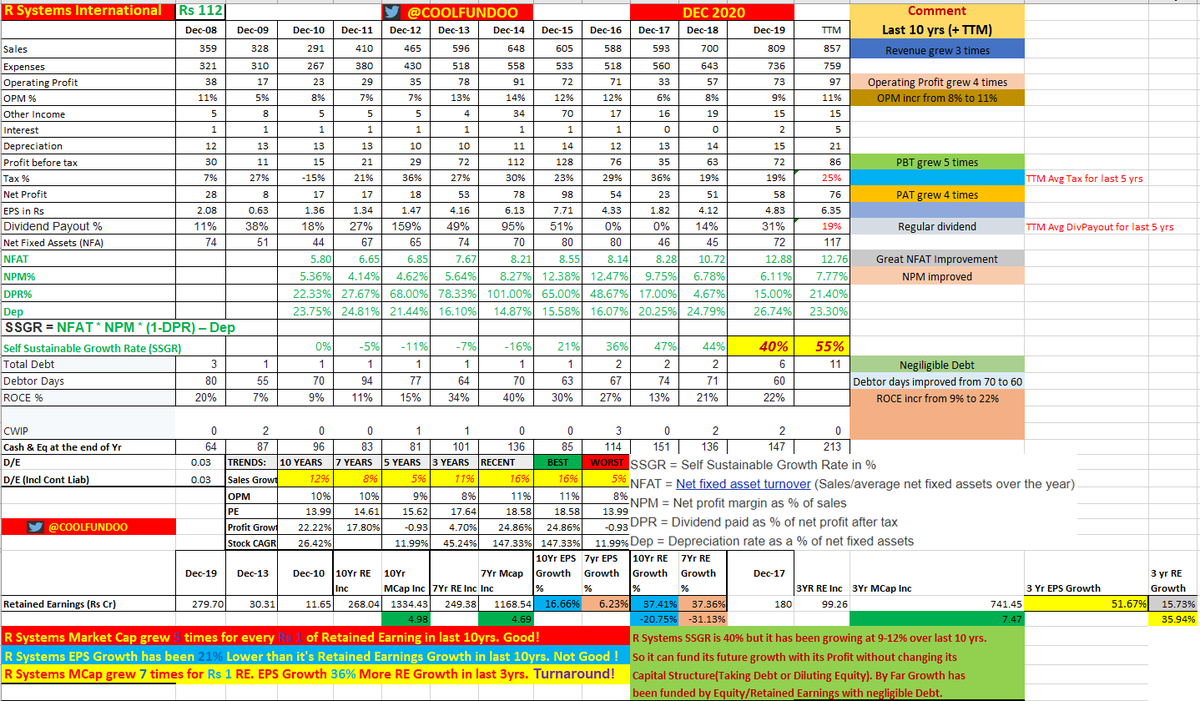

📌R SYSTEMS Highlights last 10 yrs!

Revenue grew 3 times

Operating Profit grew 4 times

OPM incr from 8% to 11%

PBT grew 5 times

PAT grew 4 times

Regular dividend

Great NFAT Improvement

NPM improved

Negligible Debt

Debtor days improved from 70 to 60

📌ROCE incr from 9% to 22%

22

Revenue grew 3 times

Operating Profit grew 4 times

OPM incr from 8% to 11%

PBT grew 5 times

PAT grew 4 times

Regular dividend

Great NFAT Improvement

NPM improved

Negligible Debt

Debtor days improved from 70 to 60

📌ROCE incr from 9% to 22%

22

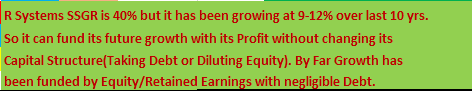

📌R SYSTEMS SSGR Analysis

SSGR = 40% much higher than Current Historical Sales Growth !

Business is not Capital Intensive at all !

23

SSGR = 40% much higher than Current Historical Sales Growth !

Business is not Capital Intensive at all !

23

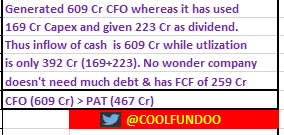

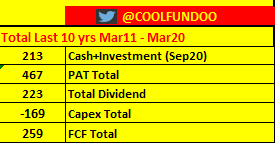

Last 10yr!

Generated 609 Cr CFO whereas it has used 169 Cr Capex and given 223 Cr dividend so Inflow of cash is 609 Cr while utilization is only 392 Cr(169+223).

No wonder company doesn't need much debt & has FCF of 259 Cr

CFO(609 Cr) >PAT(467 Cr)

NOT Capital Intensive!

24

Generated 609 Cr CFO whereas it has used 169 Cr Capex and given 223 Cr dividend so Inflow of cash is 609 Cr while utilization is only 392 Cr(169+223).

No wonder company doesn't need much debt & has FCF of 259 Cr

CFO(609 Cr) >PAT(467 Cr)

NOT Capital Intensive!

24

R SYSTEMS Retained Earnings Vs Market Cap & EPS Growth !

Last 3-4 yrs feels like TURNAROUND to me !

Based on this SSGR + RE Analysis & All the Points mentioned above I can't find a reason what could hamper this Growth !

25

Last 3-4 yrs feels like TURNAROUND to me !

Based on this SSGR + RE Analysis & All the Points mentioned above I can't find a reason what could hamper this Growth !

25

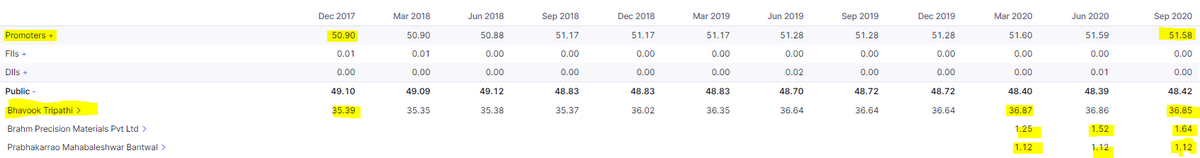

Promoter Holding is 51.58% & are gradually nibbling shares since last 2 yrs.

BHAVOOK TRIPATHI holds whopping 36.85% in Public Shares & has been nibbling along with Promoters.

2 other Public investors also incr stake.

Feels speculative but just stating facts as I see!

26

BHAVOOK TRIPATHI holds whopping 36.85% in Public Shares & has been nibbling along with Promoters.

2 other Public investors also incr stake.

Feels speculative but just stating facts as I see!

26

📌Who is BHAVOOK TRIPATHI?

Things get little interesting here !

Known for his concentrated bets especially Excel Crop Care & FAG Bearings

Invested 69 Cr in R systems now worth ~550 Cr

He holds 36.85% & is still hungry as he has increased his holdings by 1.5% in last 2yrs.

27

Things get little interesting here !

Known for his concentrated bets especially Excel Crop Care & FAG Bearings

Invested 69 Cr in R systems now worth ~550 Cr

He holds 36.85% & is still hungry as he has increased his holdings by 1.5% in last 2yrs.

27

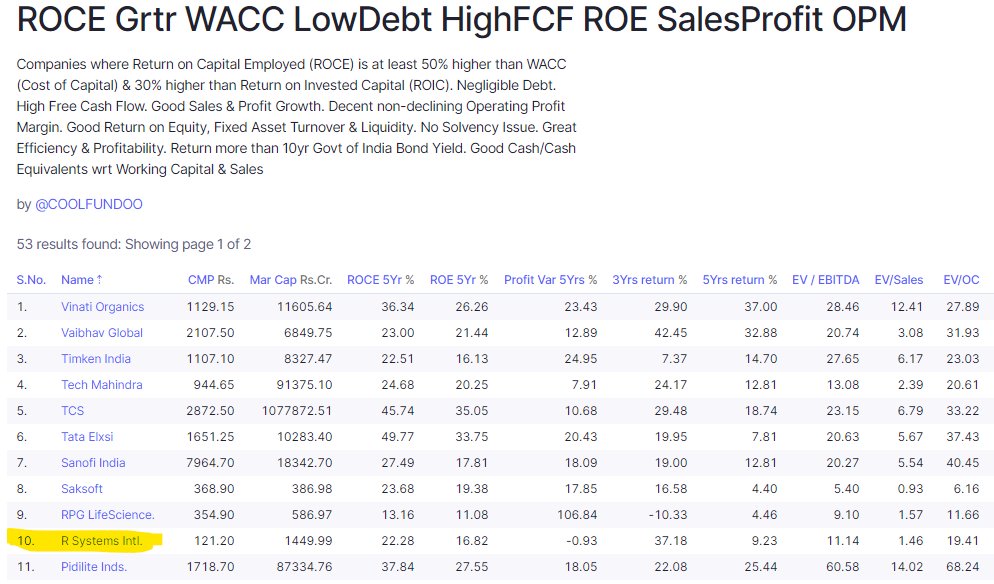

R SYSTEMS on my

"RISING STARS Sales&ProfitGrowth_GdValue_CashFlow" #screener.

28

"RISING STARS Sales&ProfitGrowth_GdValue_CashFlow" #screener.

https://twitter.com/Coolfundoo/status/1328917681559515136?s=20

28

R SYSTEMS on my

"InvestableSmallCapUniverse" #screener

31

"InvestableSmallCapUniverse" #screener

https://twitter.com/Coolfundoo/status/1332954547812175872?s=20

31

Another Interesting Observation about R SYSTEMS.

📌In my view R SYSTEMS qualifies as low Free Float.

Why ?

Bhavook share though public aren't traded. It's like an Institution holding.

So after removing his shares there are only 1.38 Cr shares available to be traded...

32

📌In my view R SYSTEMS qualifies as low Free Float.

Why ?

Bhavook share though public aren't traded. It's like an Institution holding.

So after removing his shares there are only 1.38 Cr shares available to be traded...

32

...

There is no FII & DII holding which makes things interesting for RETAIL...

33

There is no FII & DII holding which makes things interesting for RETAIL...

https://twitter.com/Coolfundoo/status/1309725613897527296?s=20

33

...

Being Low Free float, Nil FII & DII (Institutional Holding) a small interest from few interested players could move the price !

Read about Low Free Float & corresponding #screener in this #thread ->

34

Being Low Free float, Nil FII & DII (Institutional Holding) a small interest from few interested players could move the price !

Read about Low Free Float & corresponding #screener in this #thread ->

https://twitter.com/Coolfundoo/status/1309725614908243968?s=20

34

R SYSTEMS is also part of my Diwali picks for Next year ->

35

https://twitter.com/Coolfundoo/status/1328556433269534720?s=20

35

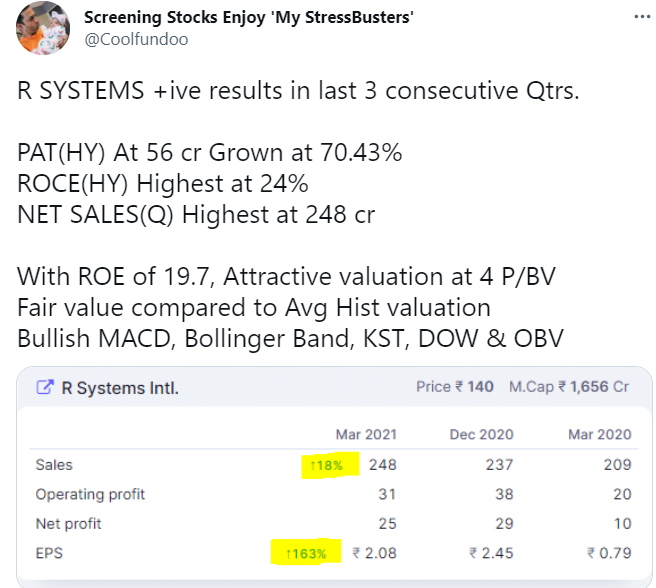

R Systems Qtr Ending Dec 2020 & Year Ended Dec 2020

Margin slight improvement 👍

Expenses good decline (greater control)👌

Profits substantial improvement (EBITDA, EBIT, PAT)👌

36

Margin slight improvement 👍

Expenses good decline (greater control)👌

Profits substantial improvement (EBITDA, EBIT, PAT)👌

36

Revenue from Client !

Diversifying & Reducing Concentration of Revenue from Top clients - Walk the Talk as they previously mentioned.

Largest Client revenue < 8%

37

Diversifying & Reducing Concentration of Revenue from Top clients - Walk the Talk as they previously mentioned.

Largest Client revenue < 8%

37

🚩R Systems has been on hiring spree in Dec 2020.

Their net employee count gone up by 310 (>10% addition) from Sep 2020.

This matrix for IT companies indicates that they are expecting good business growth hence hiring on the anticipation !

39

Their net employee count gone up by 310 (>10% addition) from Sep 2020.

This matrix for IT companies indicates that they are expecting good business growth hence hiring on the anticipation !

39

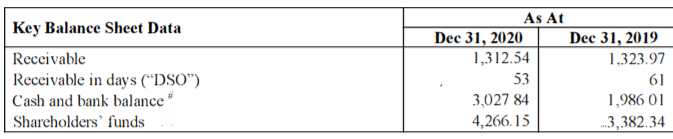

Fantastic Balance Sheet Improvement 👌👌

Debtor Days Declined 👍👍 Receivables almost as same level as last yr.

Cash & Shareholder funds 🚀🦸♂️

40

Debtor Days Declined 👍👍 Receivables almost as same level as last yr.

Cash & Shareholder funds 🚀🦸♂️

40

R Systems Result Highlight

Q4 Dec 2020 and FY Dec 2020

• Added 28 key accounts during the year 2020 including 8 key accounts in this quarter

42

Q4 Dec 2020 and FY Dec 2020

• Added 28 key accounts during the year 2020 including 8 key accounts in this quarter

42

R Systems Valuation - Attractive 🌟

Last 1 Yr Price Change (29%) < Earnings Growth(44%)

PE 17.74

P/BV 3.48

EV/EBIT 14.06

EV/EBITDA 9.57

EV/Cap Empl 7.69

EV/Sales 1.43

Dividend Yield 1.37%

43

Last 1 Yr Price Change (29%) < Earnings Growth(44%)

PE 17.74

P/BV 3.48

EV/EBIT 14.06

EV/EBITDA 9.57

EV/Cap Empl 7.69

EV/Sales 1.43

Dividend Yield 1.37%

43

R Systems Financial Trend - Very Positive 🌟

Positive results for the last 2 consecutive quarters (Sep20 & Dec 20)

ROCE Highest at 26.73 %

CASH AND CASH EQUIVALENTS Highest at Rs 250.28 Cr

NET SALES(Q) Highest at Rs 236.64 Cr

44

Positive results for the last 2 consecutive quarters (Sep20 & Dec 20)

ROCE Highest at 26.73 %

CASH AND CASH EQUIVALENTS Highest at Rs 250.28 Cr

NET SALES(Q) Highest at Rs 236.64 Cr

44

🚩Apart from Regular Dividend R Systems has done some timely Buy-backs too🔻

23Apr15 Rs 6cr

29Sep16 Rs 19.5cr

21Jan19 Rs 23.98cr

📍Buyback amount has been in increasing trend too!

We may see another buyback in 2022-23 if management thinks it is still undervalued ⁉️

46

23Apr15 Rs 6cr

29Sep16 Rs 19.5cr

21Jan19 Rs 23.98cr

📍Buyback amount has been in increasing trend too!

We may see another buyback in 2022-23 if management thinks it is still undervalued ⁉️

46

R Systems has climbed ladders on my #sceeners. Here is how it stands in July 2021 update ->

Link 🔗

47

Link 🔗

https://twitter.com/Coolfundoo/status/1414594899534663682?s=20

47

• • •

Missing some Tweet in this thread? You can try to

force a refresh