I am going to pull the curtain back a bit on some ‘inside baseball’ currently happening in our local financial markets around the Derrimon $DTL.ja APO.

This is ‘dot connecting’ on corporate maneuvering.

Read below, there is a lot going on.

//Mini-Thread

#FinanceTwitterJa

This is ‘dot connecting’ on corporate maneuvering.

Read below, there is a lot going on.

//Mini-Thread

#FinanceTwitterJa

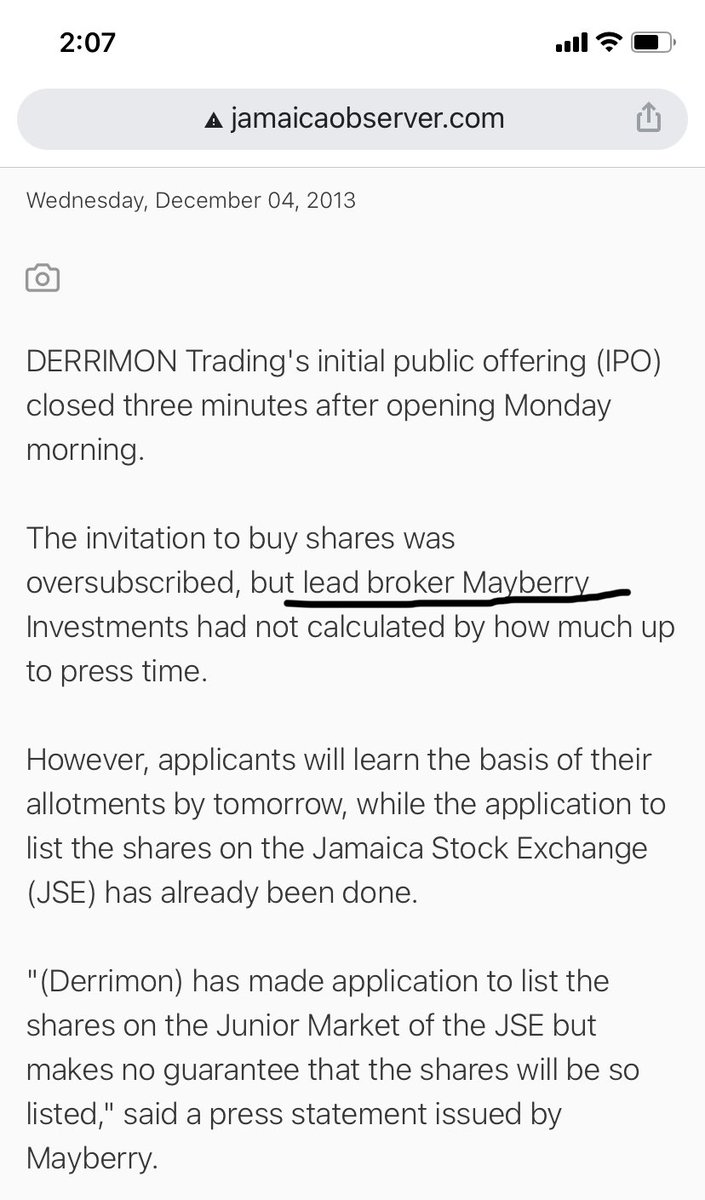

So let’s go back to the early days of 2013 when $DTL.ja initially went public.

The lead broker was Mayberry Investments at the time.

The listing was very successful and the offer closed within 3 minutes of opening.

jamaicaobserver.com/business/Overs…

The lead broker was Mayberry Investments at the time.

The listing was very successful and the offer closed within 3 minutes of opening.

jamaicaobserver.com/business/Overs…

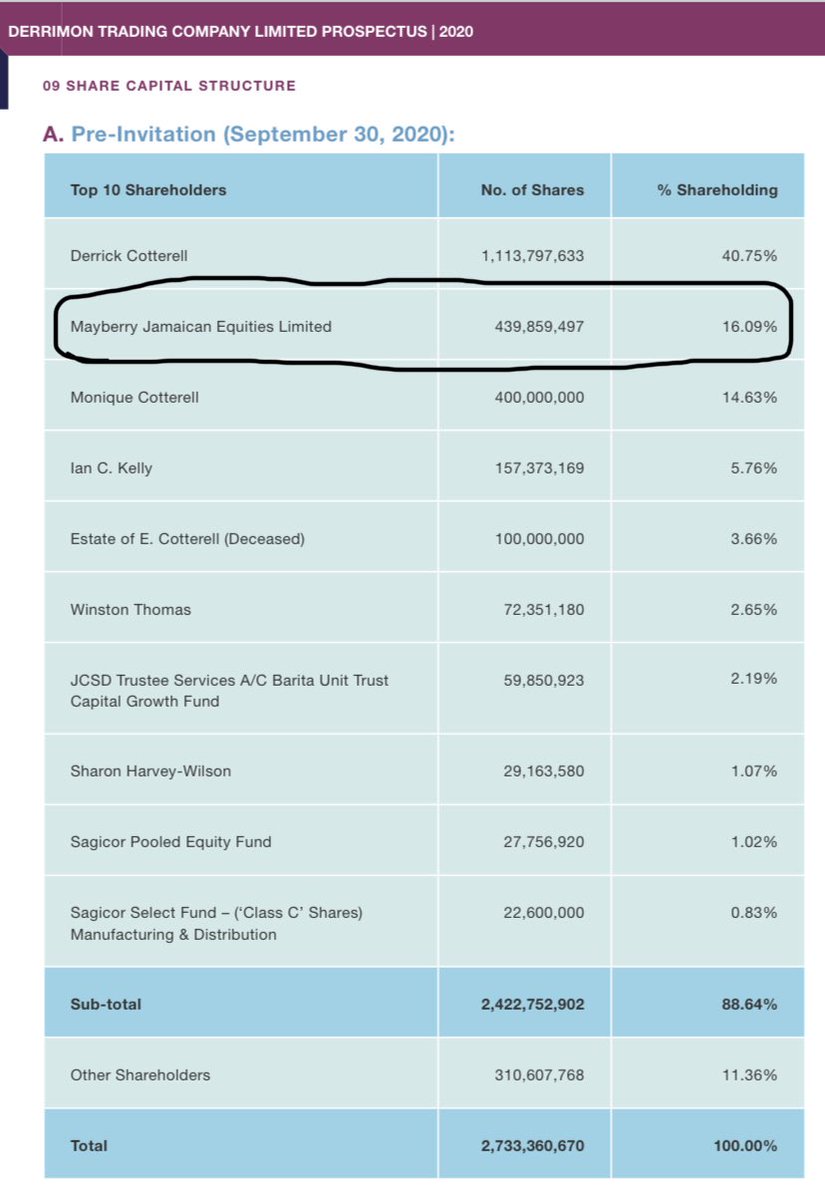

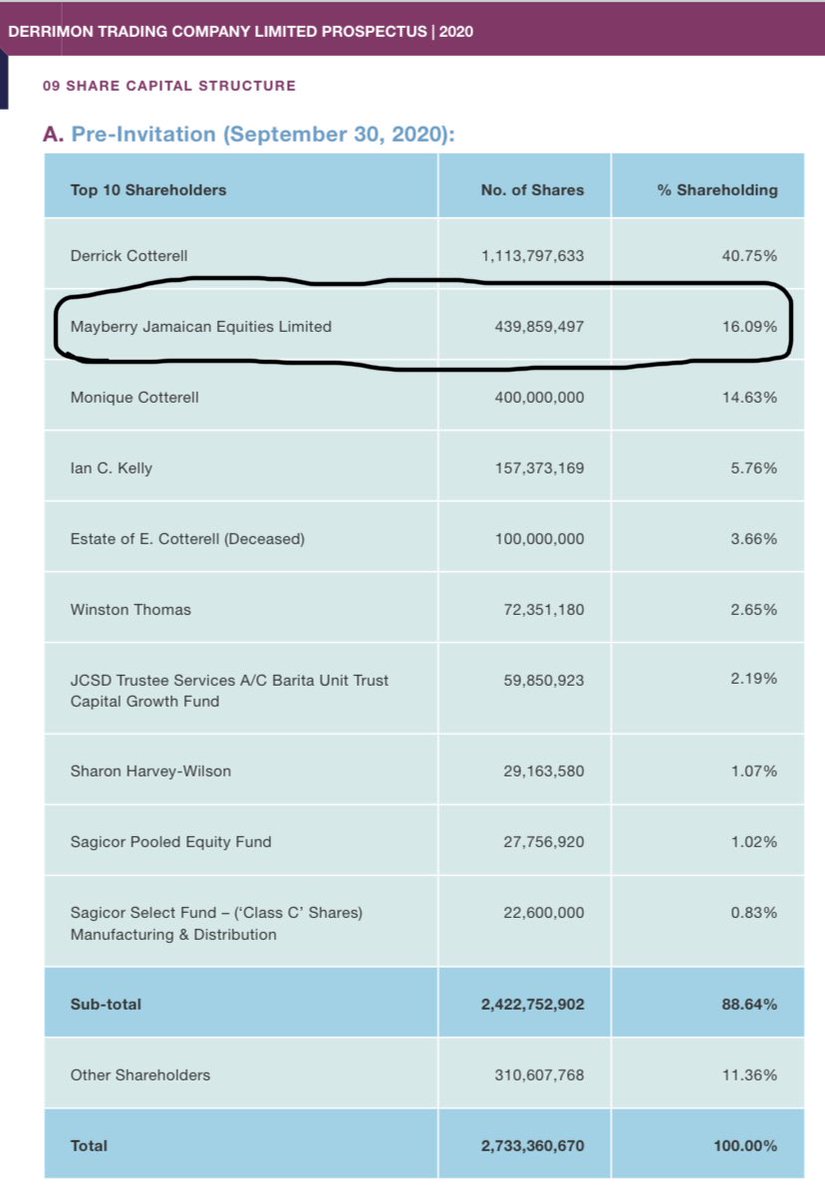

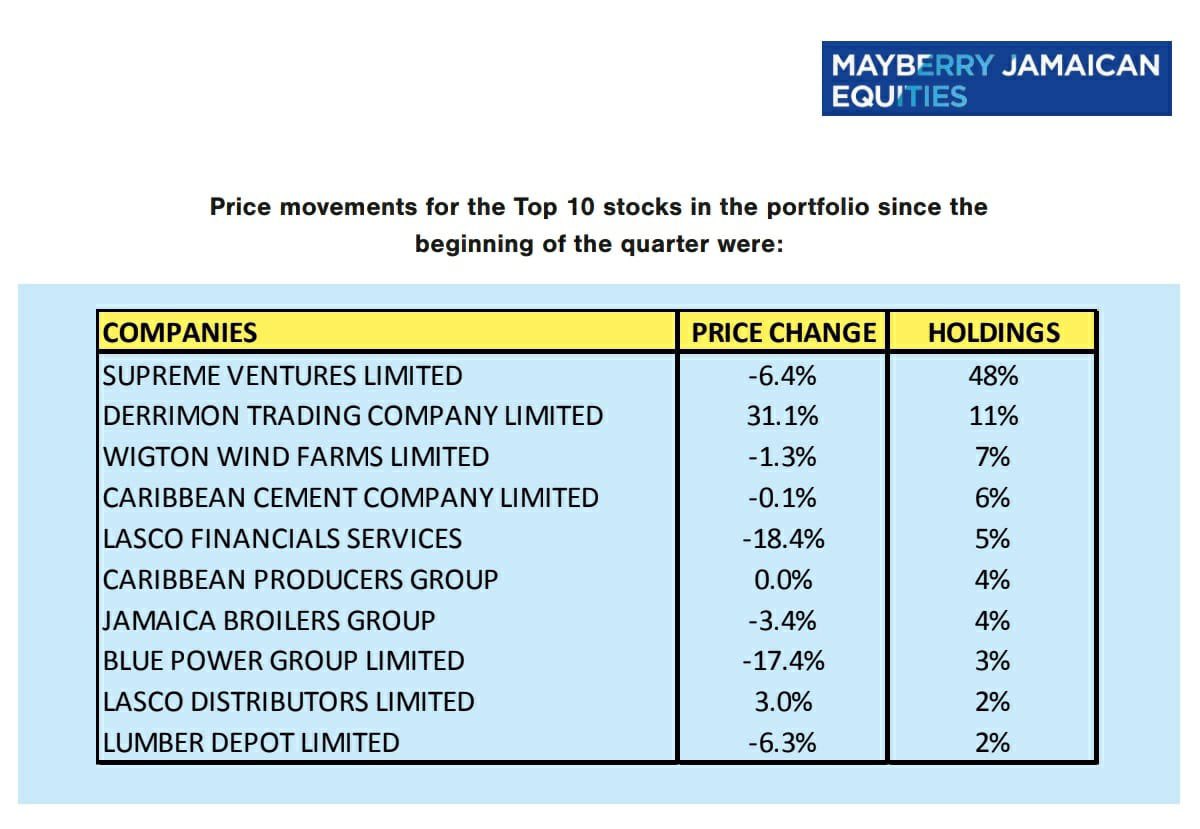

Mayberry Jamaican Equities ( $MJE.ja) took a big position in $DTL.ja.

In fact, they are the second largest shareholder as of today.

In fact, they are the second largest shareholder as of today.

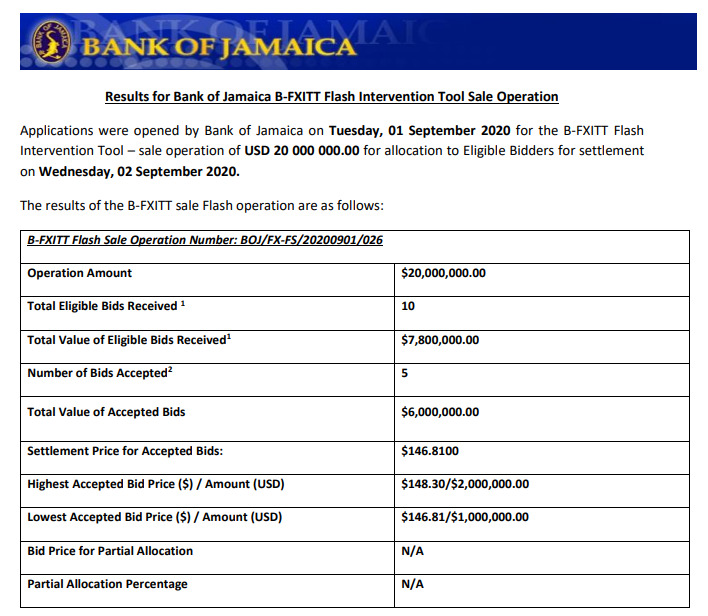

Fast forward to this year and $DTL.ja wants to do an APO, and curiously Mayberry is no longer the lead broker, Barita is.

In fact, they aren’t even a selling agent.

In fact, they aren’t even a selling agent.

At first glance, that feels a bit rough but such is life. Business is business.

Assuming it’s just business, $DTL.ja clearly believed they got a better deal from Barita.

Barita is fully underwriting the entire $3.5B offer....

Assuming it’s just business, $DTL.ja clearly believed they got a better deal from Barita.

Barita is fully underwriting the entire $3.5B offer....

Ie they are essentially guaranteeing $DTL.ja that they will buy the full $3.5B regardless. So Derrimon can rest assured that if it fails, they get their $3.5B.

So Barita has every incentive to sell it to investors to make sure other investors take it off their hands.

So Barita has every incentive to sell it to investors to make sure other investors take it off their hands.

So far everything is fairly straightforward.

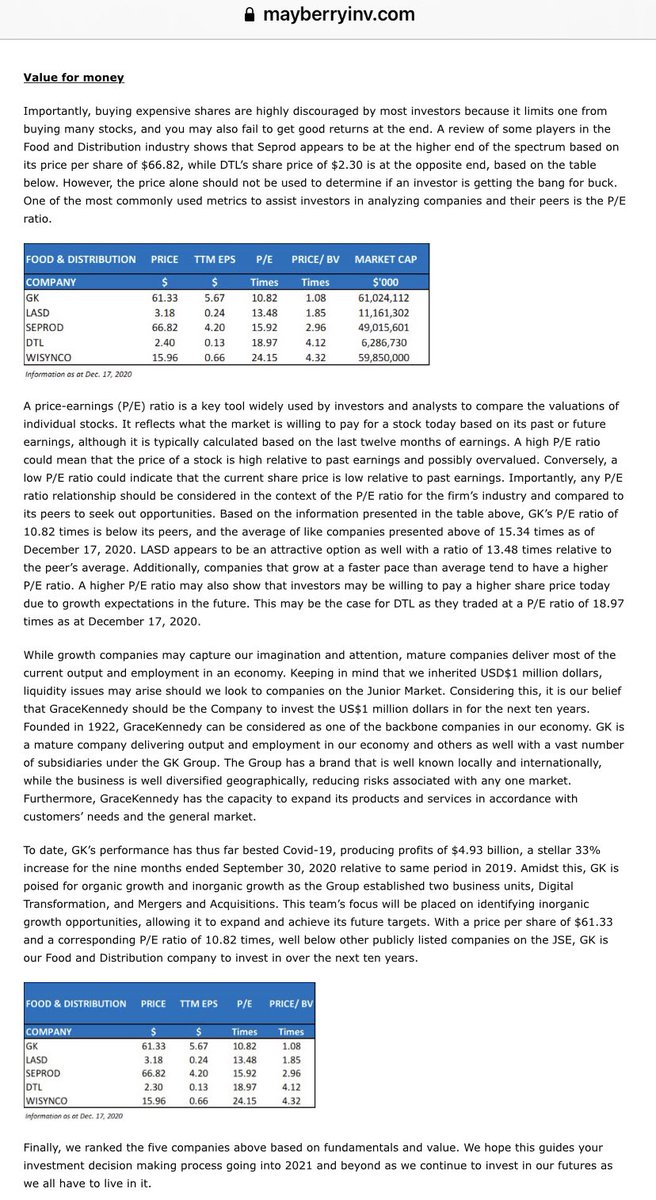

Fast forward to this sponsored post the other day, talking about the “best food & distribution company to invest in today” and they are referring to $GK.ja.

They publish an article outlining their thinking.

mayberryinv.com/the-best-food-…

Fast forward to this sponsored post the other day, talking about the “best food & distribution company to invest in today” and they are referring to $GK.ja.

They publish an article outlining their thinking.

mayberryinv.com/the-best-food-…

When I first saw this I read the analysis and thought it seemed relatively reasonable, but the timing seemed a bit off.....errr....deliberate.

I found it strange that Mayberry would be pushing an alternative food & distro company in the same week/mth as the $DTL.ja APO.

I found it strange that Mayberry would be pushing an alternative food & distro company in the same week/mth as the $DTL.ja APO.

But I shrugged it off and moved on.

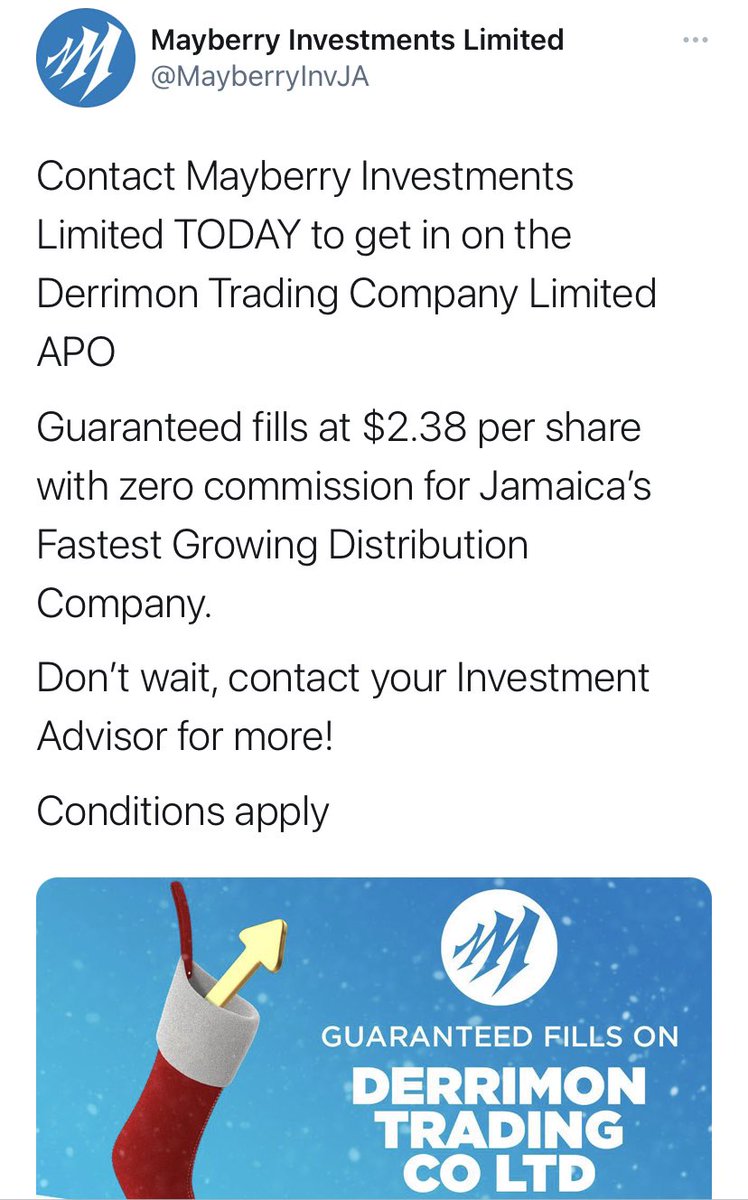

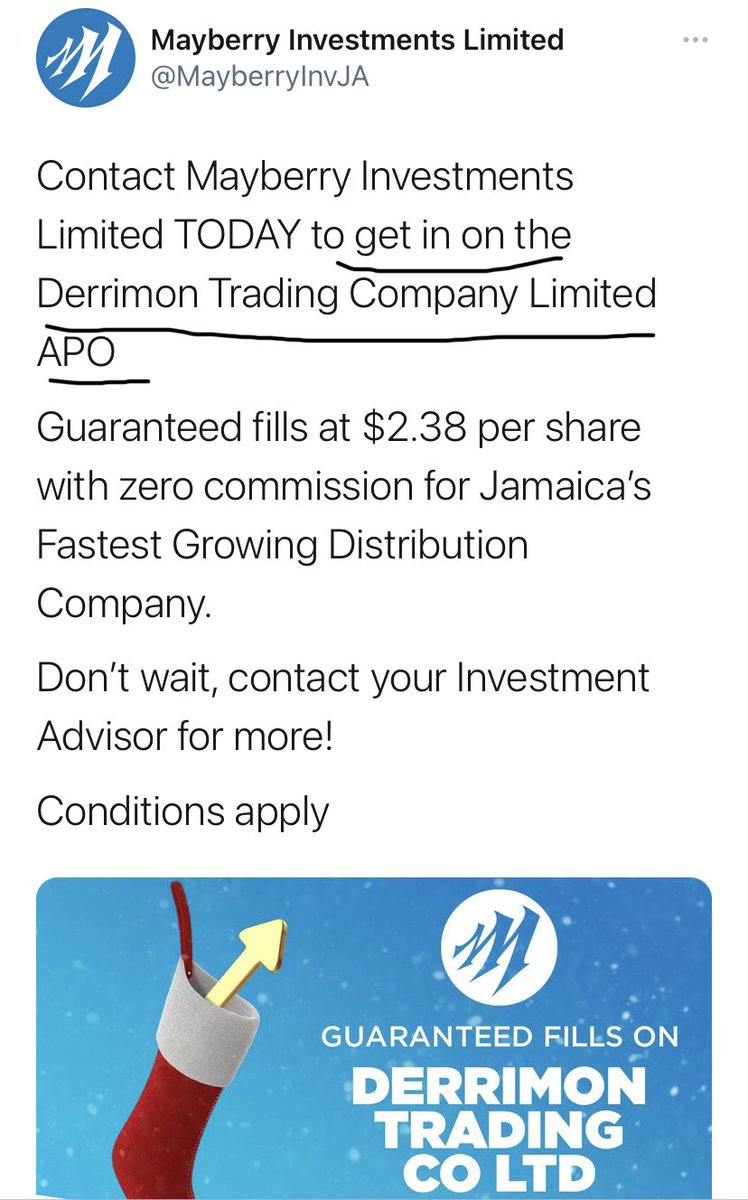

Then today now, Mayberry drops this tweet and it’s clear there is a strategy behind this.

Remember I highlighted above that Mayberry isn’t a selling agent?!?

So what’s happening here?

Then today now, Mayberry drops this tweet and it’s clear there is a strategy behind this.

Remember I highlighted above that Mayberry isn’t a selling agent?!?

So what’s happening here?

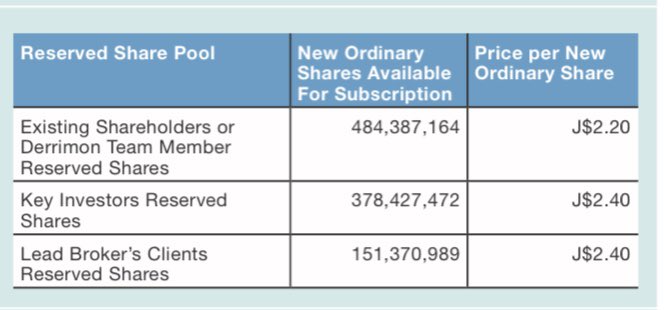

If we look at the price, it is very...uhmmm....deliberate.

$2.38 offer by Mayberry of “Guaranteed Fills” is literally $0.02 below the General Public price of the APO.

Again...very deliberate.

$2.38 offer by Mayberry of “Guaranteed Fills” is literally $0.02 below the General Public price of the APO.

Again...very deliberate.

Remember that $MJE.ja is the 2nd largest shareholder. They can guarantee fills up to 439M shares.

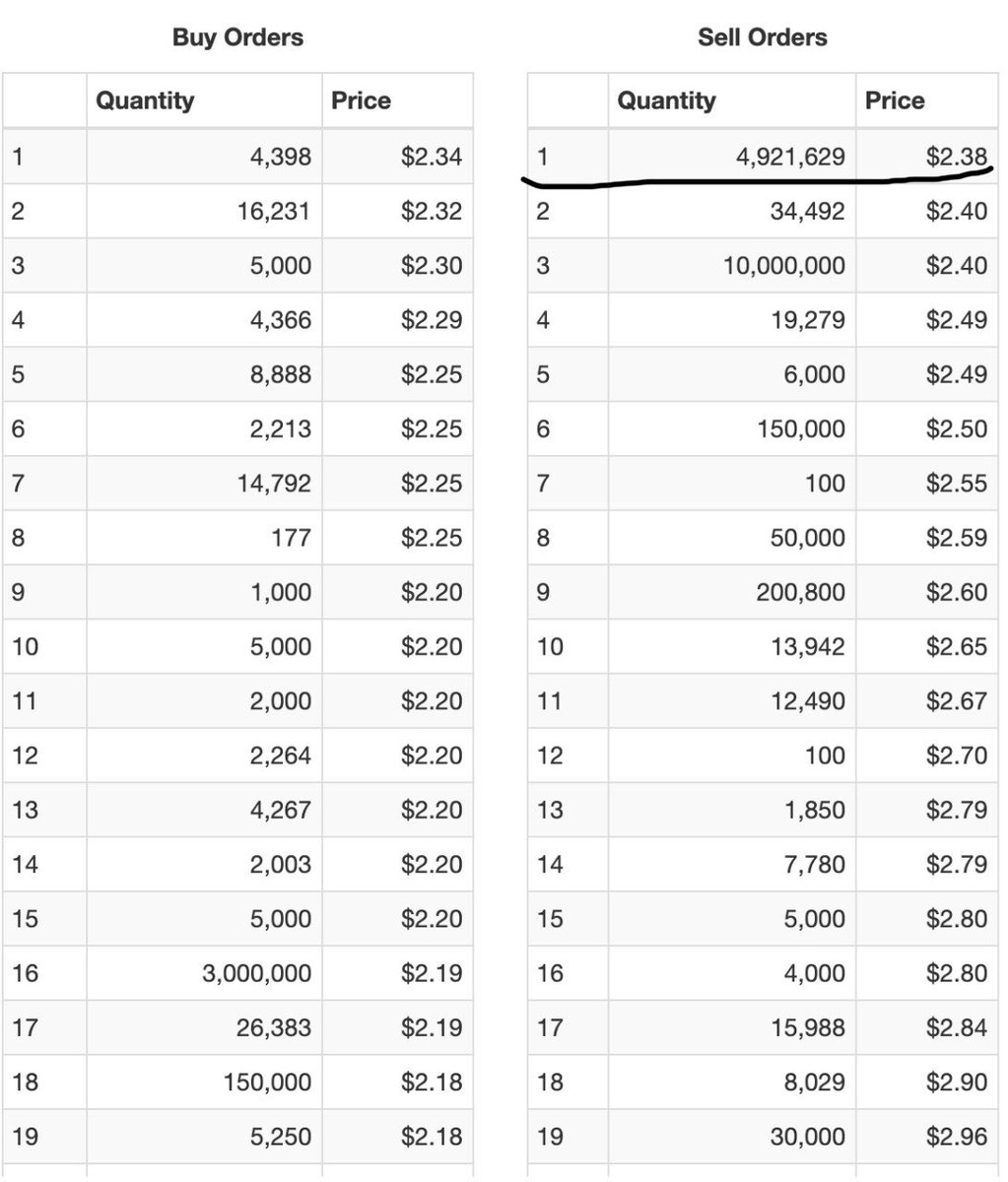

I took a look at the queues for $DTL.ja and the top sell order is ~5M units for $2.38.

We can’t know for certain if that’s $MJE.ja, but if it isn’t, it is having the same effect.

I took a look at the queues for $DTL.ja and the top sell order is ~5M units for $2.38.

We can’t know for certain if that’s $MJE.ja, but if it isn’t, it is having the same effect.

There are many aspects of this to be analyzed (which I won’t dive into), eg from the competitive perspective within the industry, or from DTL’s perspective, and others.

I just wanted to lay out the facts of what’s going on so you guys can have the data you need to be informed.

I just wanted to lay out the facts of what’s going on so you guys can have the data you need to be informed.

One last thing I would add to this is, watch the Top 10 Shareholders List for the next few reports.

That will tell us a more full story about what exactly happened then, and we can look back at this tweet and put 2 and 2 together.

That will tell us a more full story about what exactly happened then, and we can look back at this tweet and put 2 and 2 together.

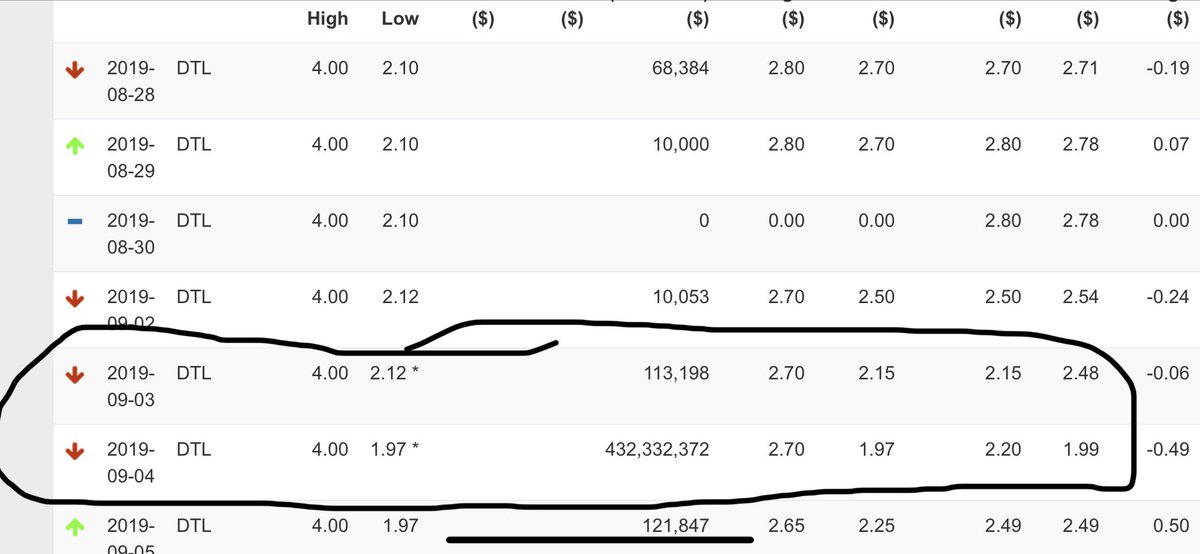

Update: I got a tip from a birdie re: Mayberry’s transaction last September 2019.

They bought 420M shares.

This article says a price of $2.48 on Sept 3, but JSE’s website posts it on Sept 4 at a close price of $1.99.

See next tweet...

jamaica-gleaner.com/article/busine…

They bought 420M shares.

This article says a price of $2.48 on Sept 3, but JSE’s website posts it on Sept 4 at a close price of $1.99.

See next tweet...

jamaica-gleaner.com/article/busine…

Here is the JSE price history for $DTL.ja.

So it’s unclear the exact price they got, but we know it’s somewhere in that range.

Chances are they are still making a profit at $2.38.

jamstockex.com/market-data/do…

So it’s unclear the exact price they got, but we know it’s somewhere in that range.

Chances are they are still making a profit at $2.38.

jamstockex.com/market-data/do…

Another Update:

So MJE’s top performing stock, and by their own admission the “Fastest Growing Distribution Company” which this APO will be used to drive further growth, is potentially being dumped?!?

Very curious. 🧐🤔

This is $MJE.ja ‘s holdings as at September 2020.

So MJE’s top performing stock, and by their own admission the “Fastest Growing Distribution Company” which this APO will be used to drive further growth, is potentially being dumped?!?

Very curious. 🧐🤔

This is $MJE.ja ‘s holdings as at September 2020.

Yet Another Update:

My DMs are on fire 🔥 🔥 🔥 lol.

A few people pointed this out to me, that I missed in the first go around, the wording of the tweet today.

If Mayberry isn’t a selling agent, how can this language be accurate?

Keep the observations coming peeps.

My DMs are on fire 🔥 🔥 🔥 lol.

A few people pointed this out to me, that I missed in the first go around, the wording of the tweet today.

If Mayberry isn’t a selling agent, how can this language be accurate?

Keep the observations coming peeps.

• • •

Missing some Tweet in this thread? You can try to

force a refresh