1/10 My 10 charts on energy, transport, emissions, e-commerce, and sustainable finance to put paid to 2020 (and look ahead to 2021).

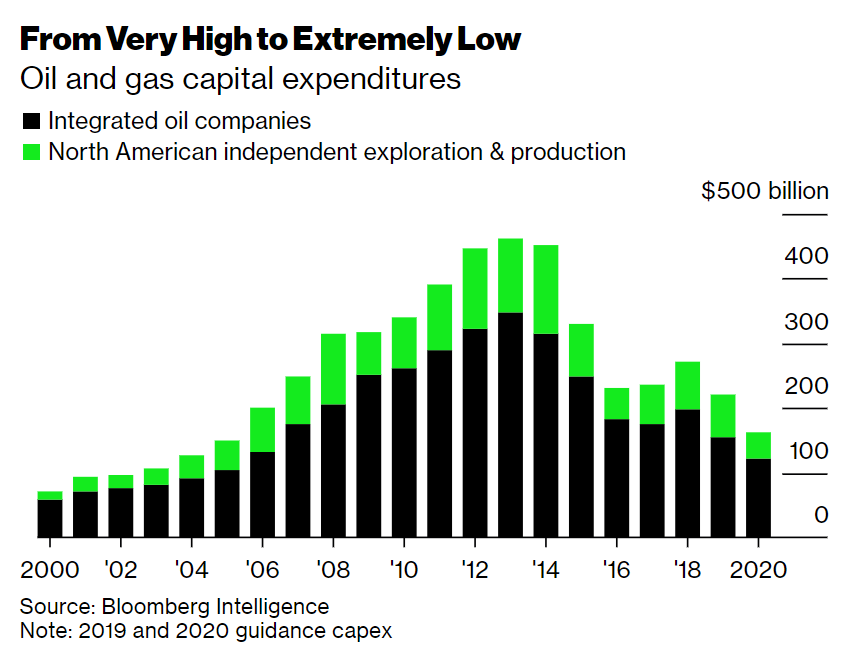

No. 1: Energy became the smallest component of S&P500 bloomberg.com/opinion/articl…

No. 1: Energy became the smallest component of S&P500 bloomberg.com/opinion/articl…

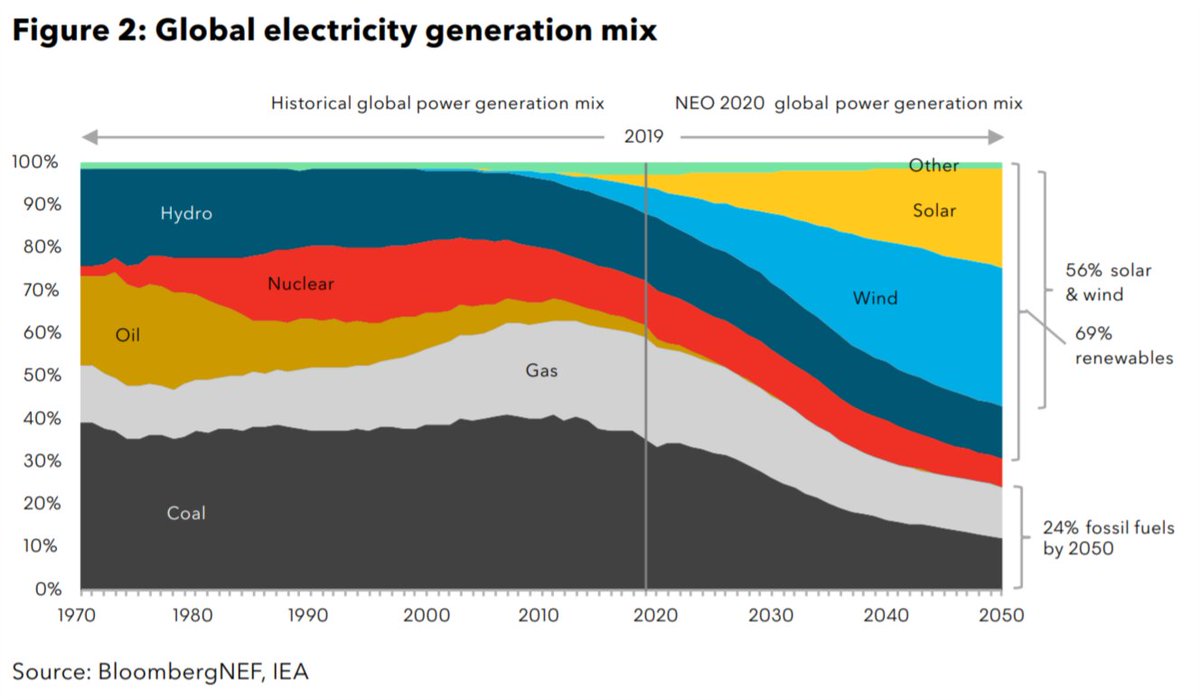

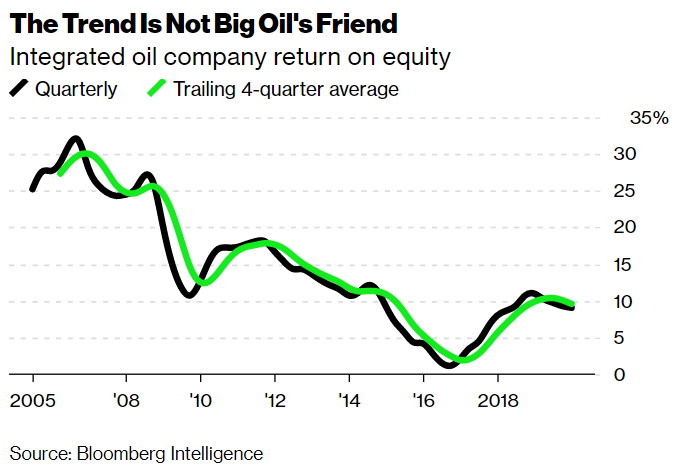

2/10 Renewable power gen is the cheapest new source of electrons almost anywhere and (related to above) does so with a higher return on equity than most oil supermajors bloomberg.com/opinion/articl…

3/10 Electric vehicles have already vaporized a million barrels per day of oil demand. Most of that demand erosion isn't from cars, or even buses - it's from 2- and 3-wheelers. bloomberg.com/opinion/articl…

4/10 Electric vehicle sales are outperforming - not just relative to (dismal) passenger vehicle sales in general, but in absolute terms. Sales will be up year-on-year. bloomberg.com/opinion/articl…

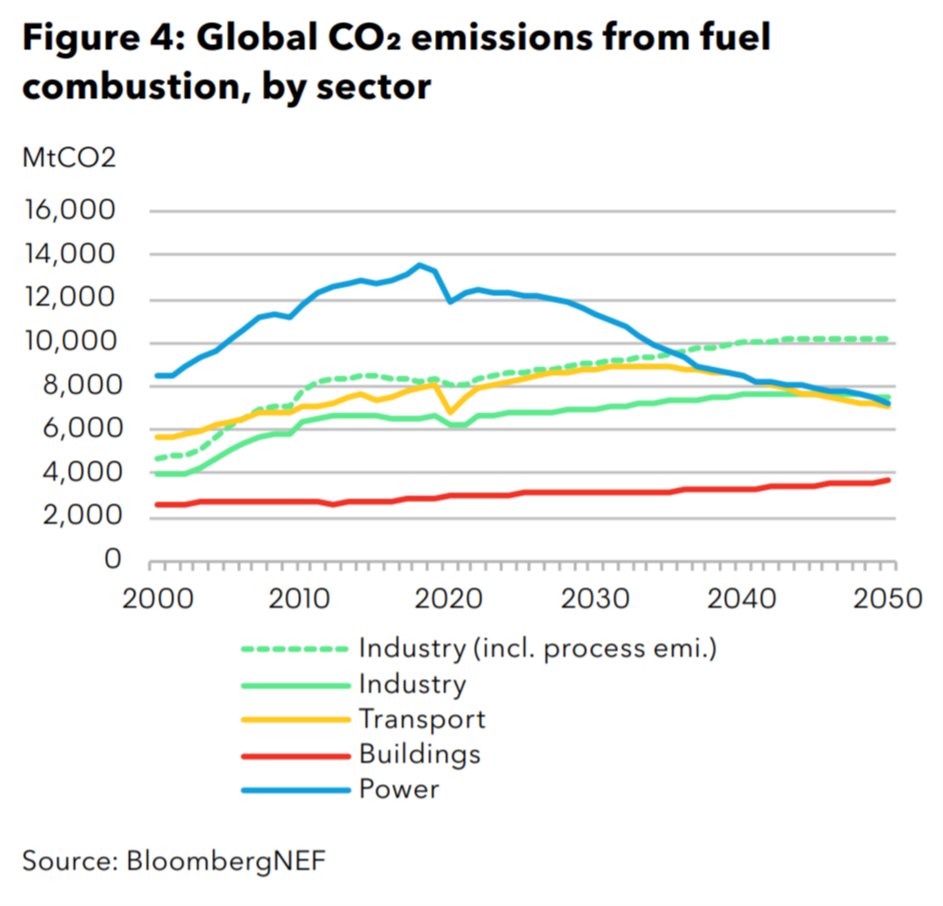

6/10 CO2 emissions from fuels burned for power, transportation, industry and building-related applications probably peaked in 2019. The future for power looks like 11-12% each coal and gas, and 20%+ each for solar and wind. bloomberg.com/opinion/articl…

7/10 U.S. greenhouse gas emissions dropped 9.2% this year. Biggest drop on record, back to 1982 levels when the economy was 40% of today's size. bloomberg.com/opinion/articl…

8/10 For the first time in at least 60 years, U.S. consumers spent more on electricity than on gasoline and diesel. Thanks, pandemic + working from home + reduced driving. Still, it's a glimpse of what an EV-filled future could be. bloomberg.com/opinion/articl…

9/10 E-commerce as a % of total sales expanded as much in six months as it once did in seven years. I don't think it has to be a complete climate disaster. bloomberg.com/opinion/articl…

10/10 We've passed $1T in green bonds. Not bad progress, but more work to be done. All respect to Drizzy and the late T. Boone Pickens, but the first trillion is the hardest.

That's almost it for 2020. See you in 2021. bloomberg.com/opinion/articl…

That's almost it for 2020. See you in 2021. bloomberg.com/opinion/articl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh