1/ Term Structure of Short Selling Costs (Weitzner)

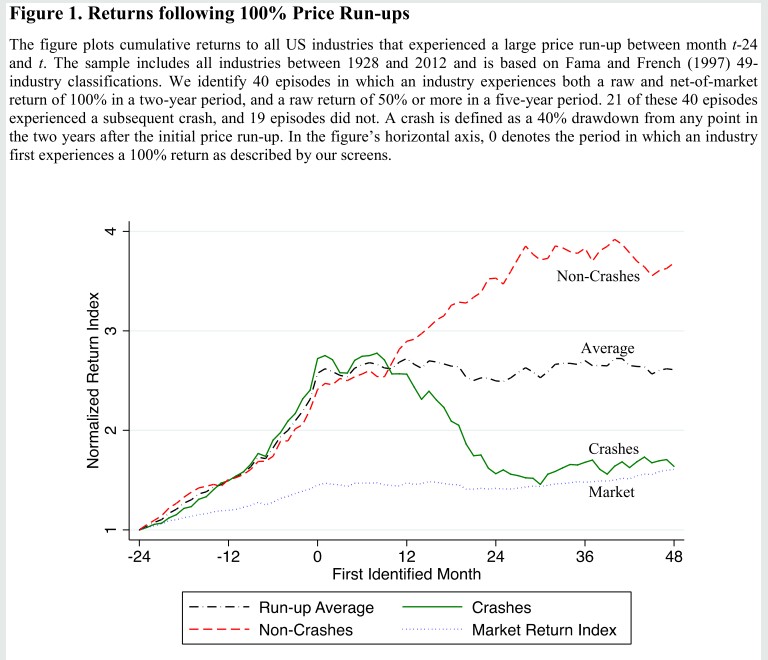

"Forward short selling costs (derived from put-call parity) predict future costs and stock returns. Short selling costs are higher over horizons when negative information is more likely to arrive."

papers.ssrn.com/sol3/papers.cf…

"Forward short selling costs (derived from put-call parity) predict future costs and stock returns. Short selling costs are higher over horizons when negative information is more likely to arrive."

papers.ssrn.com/sol3/papers.cf…

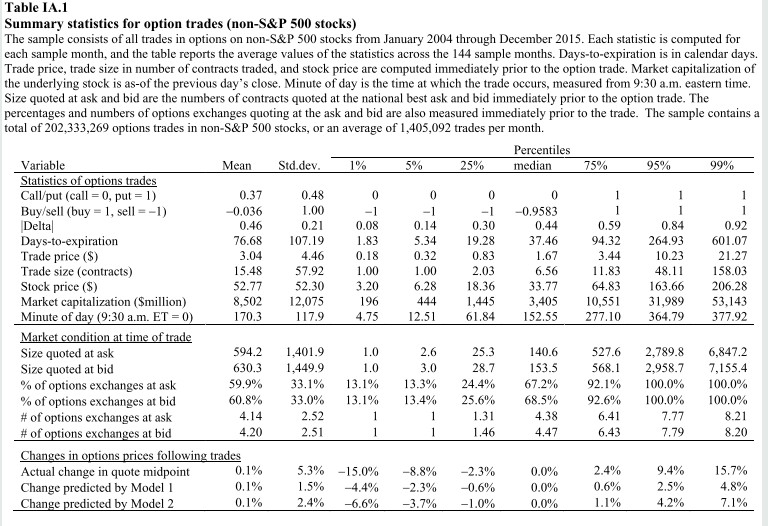

2/ * Dividend payers excluded

* Cost of shorting (median across strikes) over the term of the option is back-calculated using synthetic relationships, then forward rates are calculated

* Options with negative implied shorting costs are excluded

* Spot lending data is from Markit

* Cost of shorting (median across strikes) over the term of the option is back-calculated using synthetic relationships, then forward rates are calculated

* Options with negative implied shorting costs are excluded

* Spot lending data is from Markit

3/ "If earnings announcements are periods when negative information is more likely to arrive, then the term structure's shape should be affected by when an announcement takes place.

"Options that expire after the earnings announcements do have higher annualized shorting costs."

"Options that expire after the earnings announcements do have higher annualized shorting costs."

4/ "For options that expire within two weeks of each other, a 1 percentage point increase in the option shorting cost increases the probability of a negative earnings surprise by 0.97 pct points (3.2%); a 1 pct point increase in the slope increases it by 0.64 pct points (2.1%)."

5/ "Results are agnostic to pricing models and assumptions on stock return distributions. Simple no-arbitrage conditions predict negative earnings announcements. Market participants can observe options prices months in advance to assess the likelihood of a negative surprise."

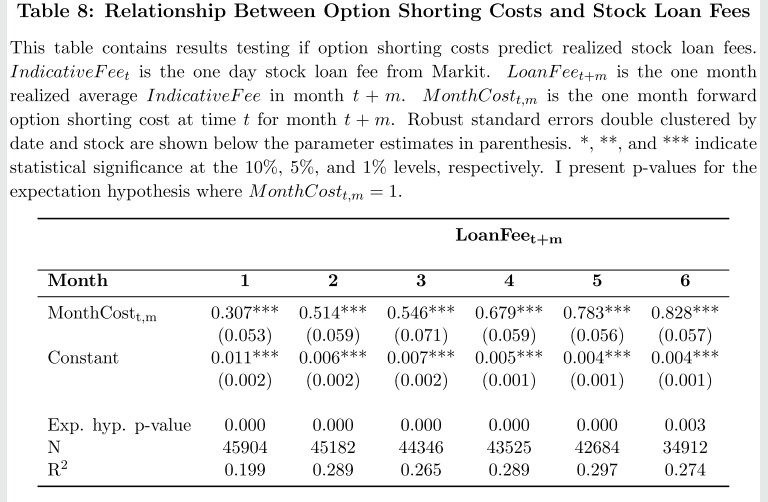

6/ "Forward shorting costs predict future shorting costs.

"However, using differences is a more powerful test because levels are highly autocorrelated. Differences in current option shorting costs do predict future changes in option shorting costs."

"However, using differences is a more powerful test because levels are highly autocorrelated. Differences in current option shorting costs do predict future changes in option shorting costs."

7/ "Forward shorting costs can predict excess returns several months in advance.

"The controls' coefficients are not significant; however, the sample is limited to firms without dividends and with options, excluding the stocks in which anomaly returns are often concentrated."

"The controls' coefficients are not significant; however, the sample is limited to firms without dividends and with options, excluding the stocks in which anomaly returns are often concentrated."

8/ "Forward costs seem to strongly predict the corresponding month of returns beyond the first month's option shorting cost, suggesting that the horizon of short selling costs matters for return predictability."

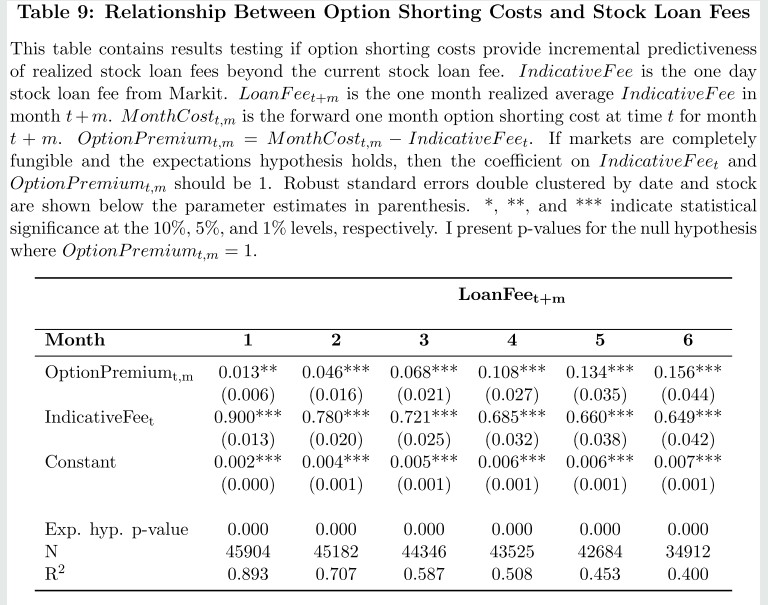

9/ "Option shorting costs contain additional information regarding expected returns beyond the current stock loan fee at least over one month.

"However, option shorting costs do not seem to predict changes in stock loan fees."

"However, option shorting costs do not seem to predict changes in stock loan fees."

10/ "This suggests arbitrageurs actively pay premiums to avoid the risk of recalls and offers a potential explanation as to why option shorting costs have minimal incremental predictive power for stock loan fees."

11/ Related research:

Short-Selling Risk

Borrowing Fees and Expected Stock Returns

Why Do Price and Volatility Information from the Options Market Predict Stock Returns?

Short-Selling Risk

https://twitter.com/ReformedTrader/status/1335084455023706113

Borrowing Fees and Expected Stock Returns

https://twitter.com/ReformedTrader/status/1328467331916316674

Why Do Price and Volatility Information from the Options Market Predict Stock Returns?

https://twitter.com/ReformedTrader/status/1332175279842725891

• • •

Missing some Tweet in this thread? You can try to

force a refresh