1/ Option Trading Costs Are Lower than You Think (Muravyev, Pearson)

"Options price changes are predictable at high frequency. Effective spreads of traders who time executions are less than 40% of the size given by conventional measures."

papers.ssrn.com/sol3/papers.cf…

"Options price changes are predictable at high frequency. Effective spreads of traders who time executions are less than 40% of the size given by conventional measures."

papers.ssrn.com/sol3/papers.cf…

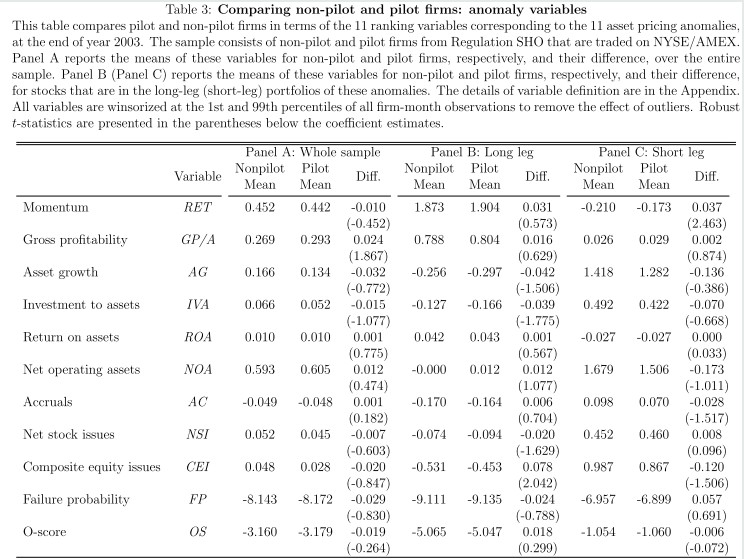

2/ * Trades and intraday bid/ask at one-minute frequencies for all U.S. listed equity options and the underlying stocks

* Option trades ≤ 10 cents, trades for which trade direction cannot be determined, and trades during the first and last five minutes of the day are removed

* Option trades ≤ 10 cents, trades for which trade direction cannot be determined, and trades during the first and last five minutes of the day are removed

3/ "Conventional measures of transactions costs are large: The effective spreads are about 80% of the size of the quoted spreads. The price impacts are also large.

"ITM options have relative (dollar) spreads that are smaller (larger) than those of options in the full sample."

"ITM options have relative (dollar) spreads that are smaller (larger) than those of options in the full sample."

4/ "The fact that the conventional measure decreased only slightly is puzzling, as option markets adopted technologies (such as algorithmic trading) that are known to have reduced transactions costs in the equity market, and equity option volume tripled during the sample period."

5/ "The BSM value [30-min MA] will differ from the midpoint if the stock price has changed but option price quotes have not been updated or if a trader is temporarily quoting aggressively.

"The difference between the BSM value and current midpoint does predict stock returns."

"The difference between the BSM value and current midpoint does predict stock returns."

6/ "Overall, option price predictability as measured by R² is persistent and remains large for every month in the sample.

"Prices are less predictable when volatility is high and on earnings announcement/pre-announcement days, which are often associated with higher volatility."

"Prices are less predictable when volatility is high and on earnings announcement/pre-announcement days, which are often associated with higher volatility."

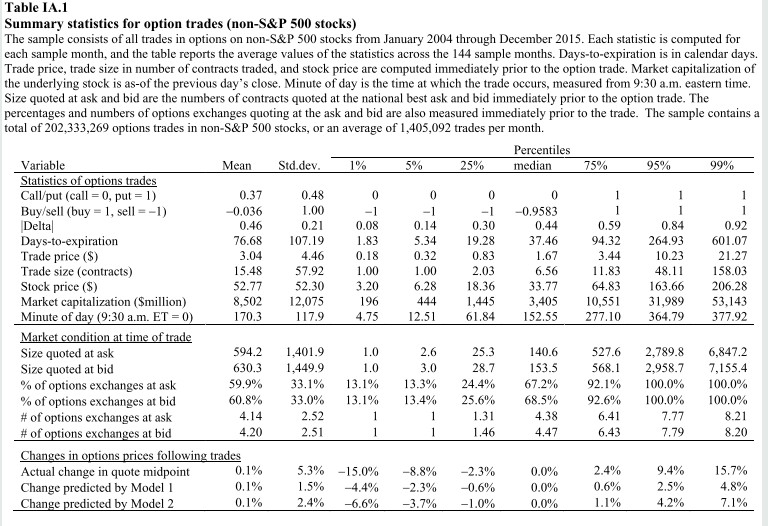

7/ "We also explore the out-of-sample performance of the predictive models. Here, we do not condition on trade direction or use any other future information.

"Results indicate significant out-of-sample predictability. (At the daily horizon, R²s of more than 2% or 3% are rare.)

"Results indicate significant out-of-sample predictability. (At the daily horizon, R²s of more than 2% or 3% are rare.)

8/ "Overall, the analyses show that high-frequency intraday option price changes can be predicted using readily available public information. The predictability is consistent for both predictive models and is robust across moneyness categories and stocks, and over time."

9/ "Investors do actively engage in executing timing: they buy right before the price is expected to increase and sell before it is about to decrease.

"The black line shows the change in the option price midpoint from the time of a trade until ten minutes after."

"The black line shows the change in the option price midpoint from the time of a trade until ten minutes after."

10/ "Conventional measures do a poor job of estimating costs of taking liquidity for traders who time executions. (Non-timers pay the entire conventional effective half-spread.)

"Trading costs for execution timers are similar (about three cents) for all moneyness categories."

"Trading costs for execution timers are similar (about three cents) for all moneyness categories."

11/ From 2004-2015, "conventional effective spreads decreased only slightly. Quoted spreads increased despite improvements in technology."

"Costs for investors who time executions decreased markedly, but the cost for non-timers such as retail investors stayed flat or increased."

"Costs for investors who time executions decreased markedly, but the cost for non-timers such as retail investors stayed flat or increased."

12/ "Half-spreads for execution timers are low for the high-liquidity portfolios: 0.3% vs. conventional effective half-spreads of 4.0%.

"Execution timing is important in all of the sorted portfolios (regardless of stock market cap, stock volatility, or quoted spread width)."

"Execution timing is important in all of the sorted portfolios (regardless of stock market cap, stock volatility, or quoted spread width)."

13/ This table, from the Internet Appendix, is not directly discussed in the paper. It suggests that execution timing also matters for all the option maturities examined (from 5 to 251 trading days).

14/ "If stock volatility doubles, conventional half-spreads increase by 0.2%, but algo-adjusted half-spreads decrease by 0.1% (but not economically large; stronger for non-S&P500 stocks)."

"Controlling for day-to-day differences in option characteristics do not change results."

"Controlling for day-to-day differences in option characteristics do not change results."

15/ "If the price would have changed even absent the trade, only part of the price movement can be attributed to the trade itself."

"Estimates of the fair value computed using simple regression models result in price impact estimates that are smaller than conventional measures."

"Estimates of the fair value computed using simple regression models result in price impact estimates that are smaller than conventional measures."

16/ "The volatility of portfolio 5 is five times that of portfolio 1, but the adjusted price impact is only one third larger.

"The adjusted price impact is also much less sensitive to the quoted spread than the adjusted effected spread is."

"The adjusted price impact is also much less sensitive to the quoted spread than the adjusted effected spread is."

17/ "Execution timing can make a difference for the after-transaction cost profitability of options trading strategies.

"Transaction costs equal to the conventional effective (algo effective) half spread consume about 80% (40%) of the very high pre-trading cost returns."

"Transaction costs equal to the conventional effective (algo effective) half spread consume about 80% (40%) of the very high pre-trading cost returns."

• • •

Missing some Tweet in this thread? You can try to

force a refresh