Ugh.

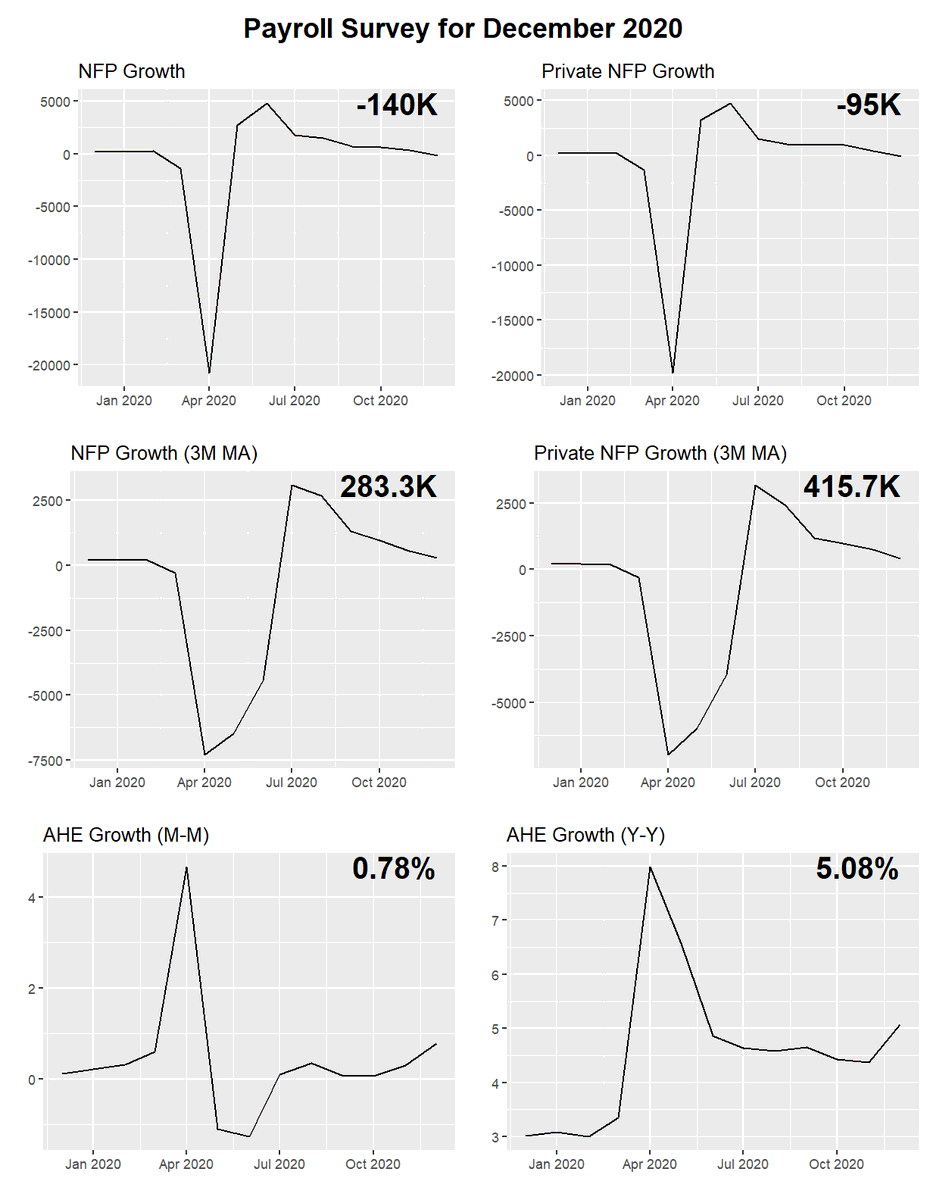

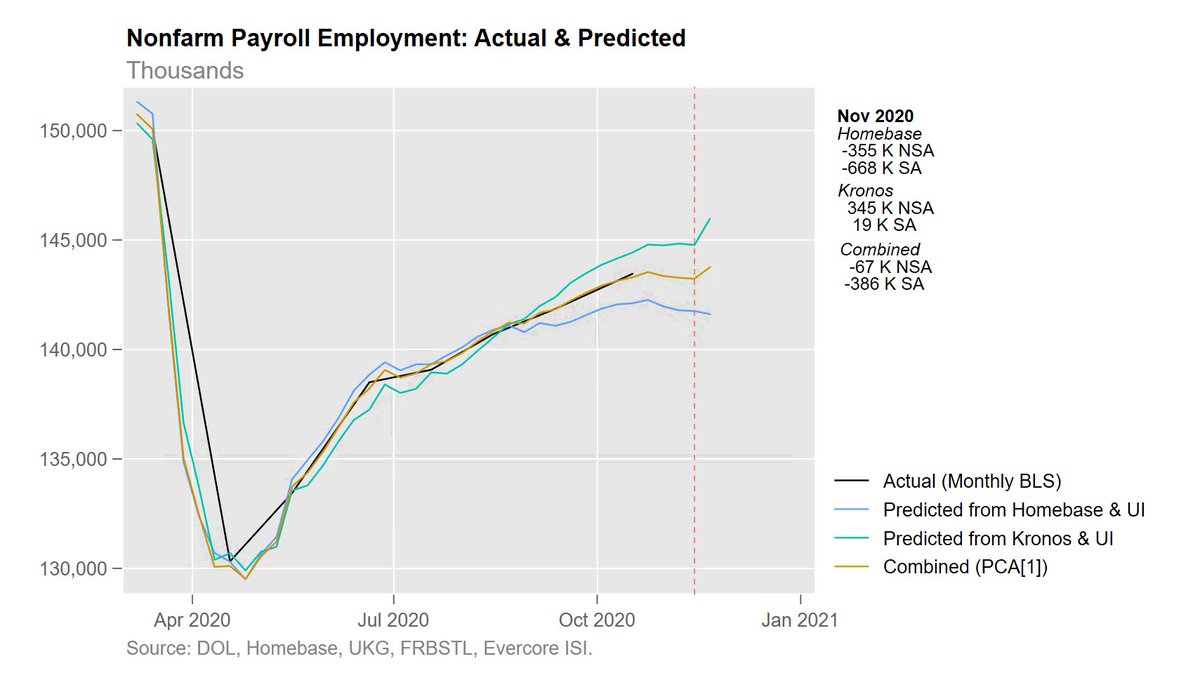

Interestingly, with the +135,000 revisions to Oct and Nov, employment was "only" down -5,000 from what we thought before.

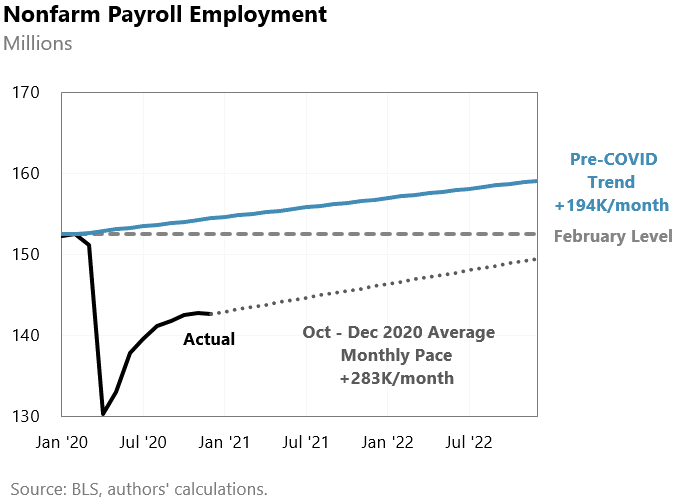

With today's -140,000 payroll read, the average monthly jobs growth over the last three months has been +283,000. That would normally be excellent performance. But not now. It means it'd take three years just to get back to Feb 2020 employment. Hopefully growth will accelerate.

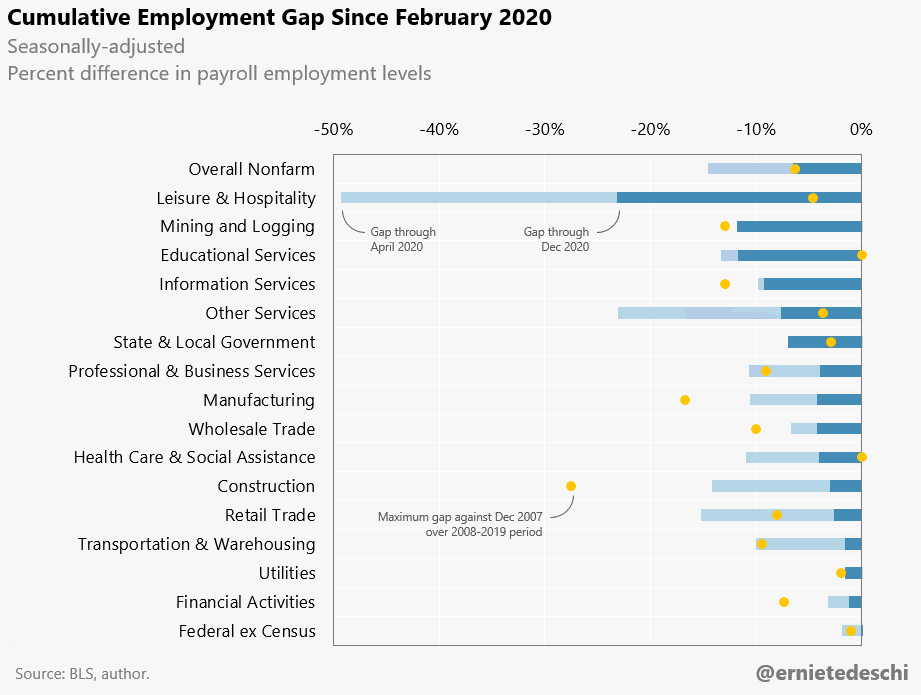

Overall employment is still -6 1/2 % down from where it was back in February, which is still a bit higher than the *worst* gap during the Great Recession.

Some sectors are even worse off. Leisure & Hospitality employment is still -23% down from February; its jobs declined in Dec

Some sectors are even worse off. Leisure & Hospitality employment is still -23% down from February; its jobs declined in Dec

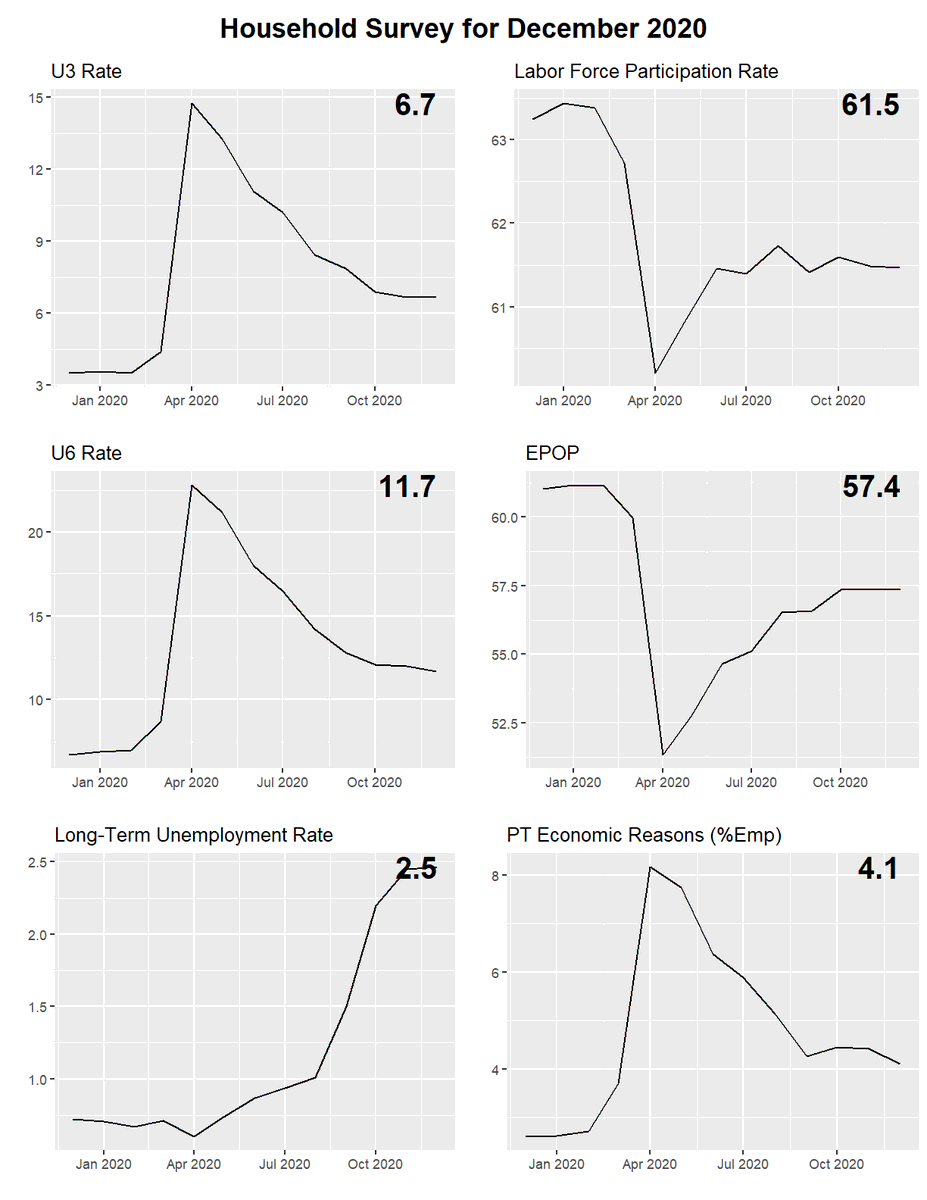

The Household Survey was remarkable with how frozen it was. The overall unemployment rate, labor force participation rate, and EPOP were all virtually identical to November, at 2-digit significance.

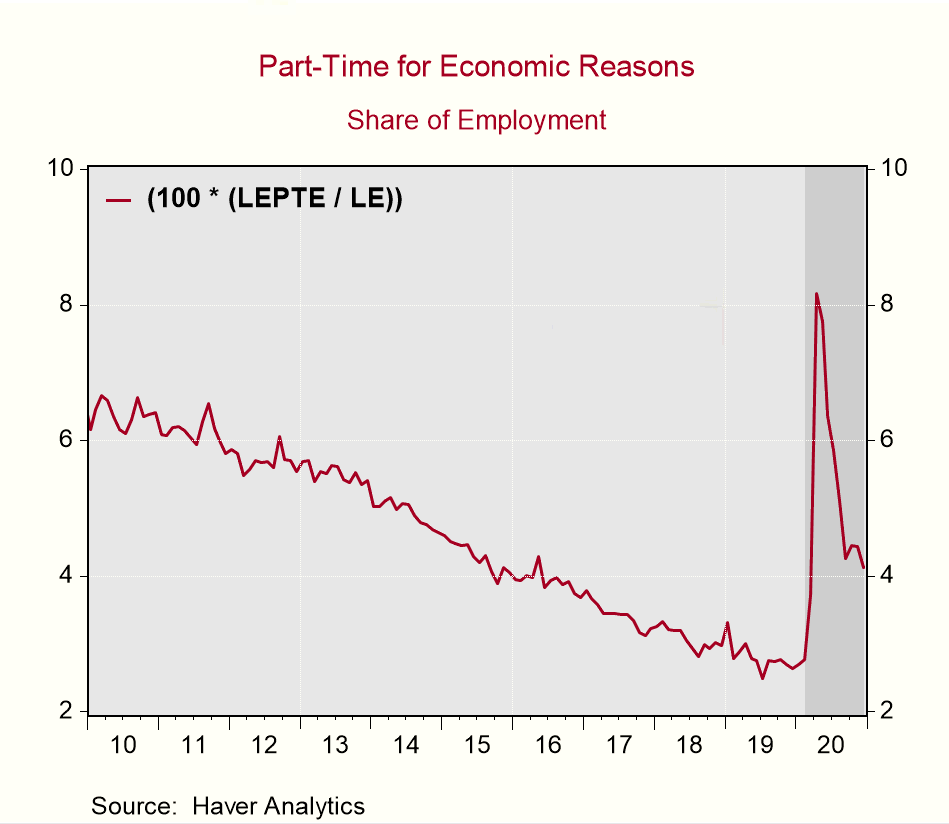

One good piece of news though: part-time for economic reasons fell by -30bp.

One good piece of news though: part-time for economic reasons fell by -30bp.

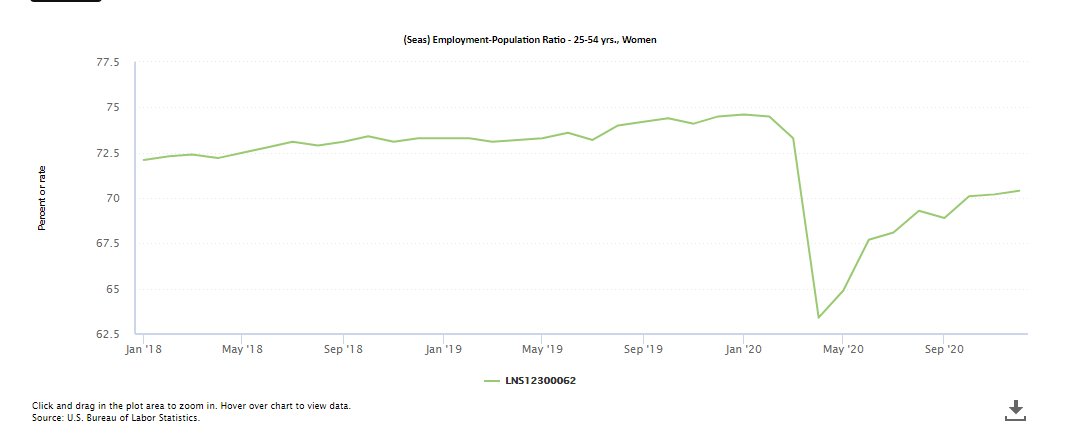

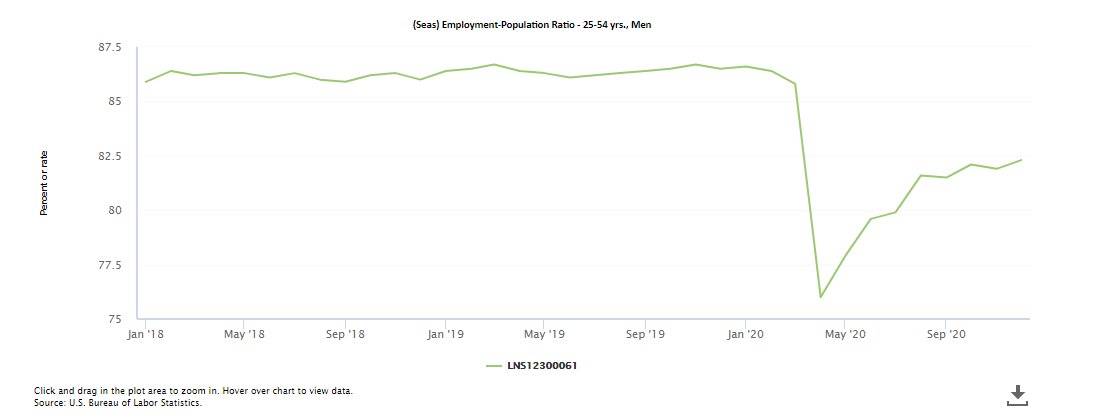

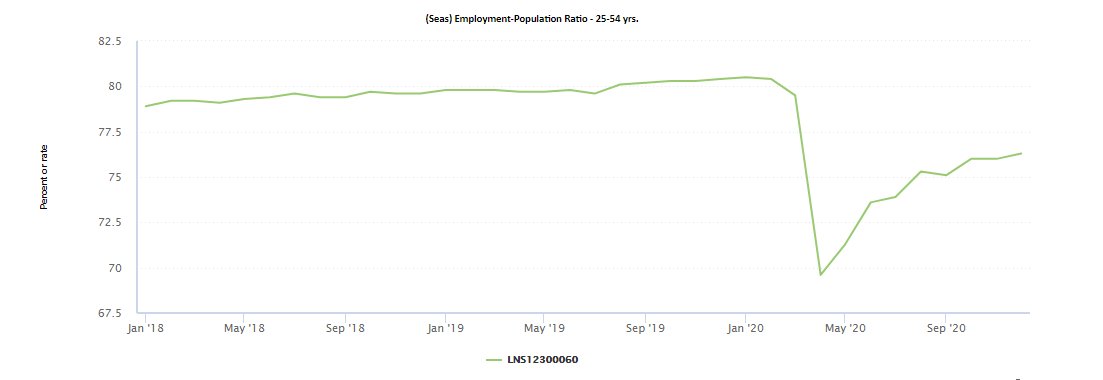

Also good news in the Household Survey: the prime-age (25-54) employment-to-population ratio rose by +30bp.

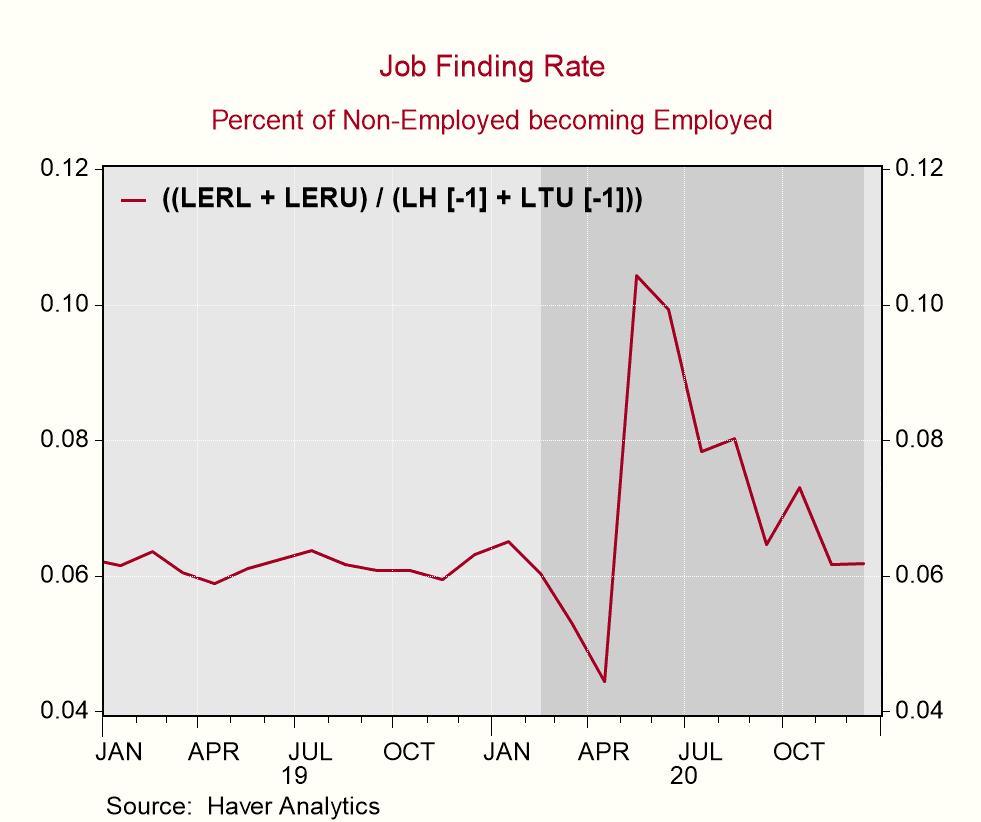

The rate at which the nonemployed found jobs in December was flat, and in line with pre-COVID trend. That's not good news: given the weak labor market we want this to be higher so we can make up lost ground faste.r

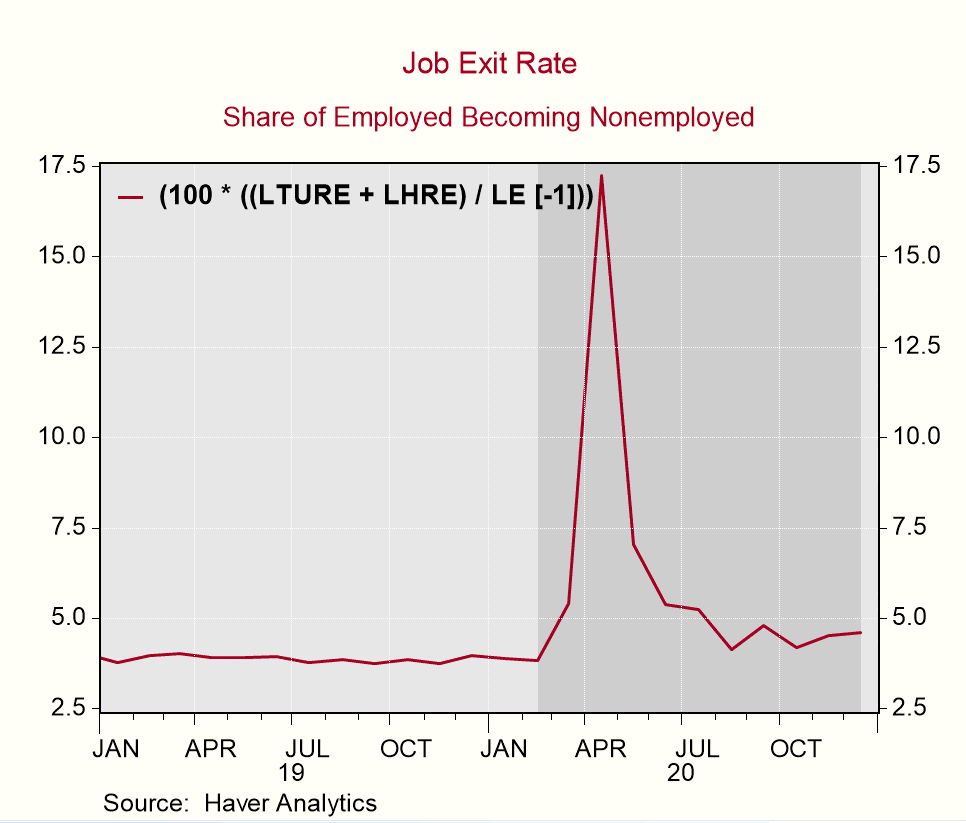

Meanwhile the job *exit* rate has risen slightly the last two months in a row, which is also not good news.

• • •

Missing some Tweet in this thread? You can try to

force a refresh