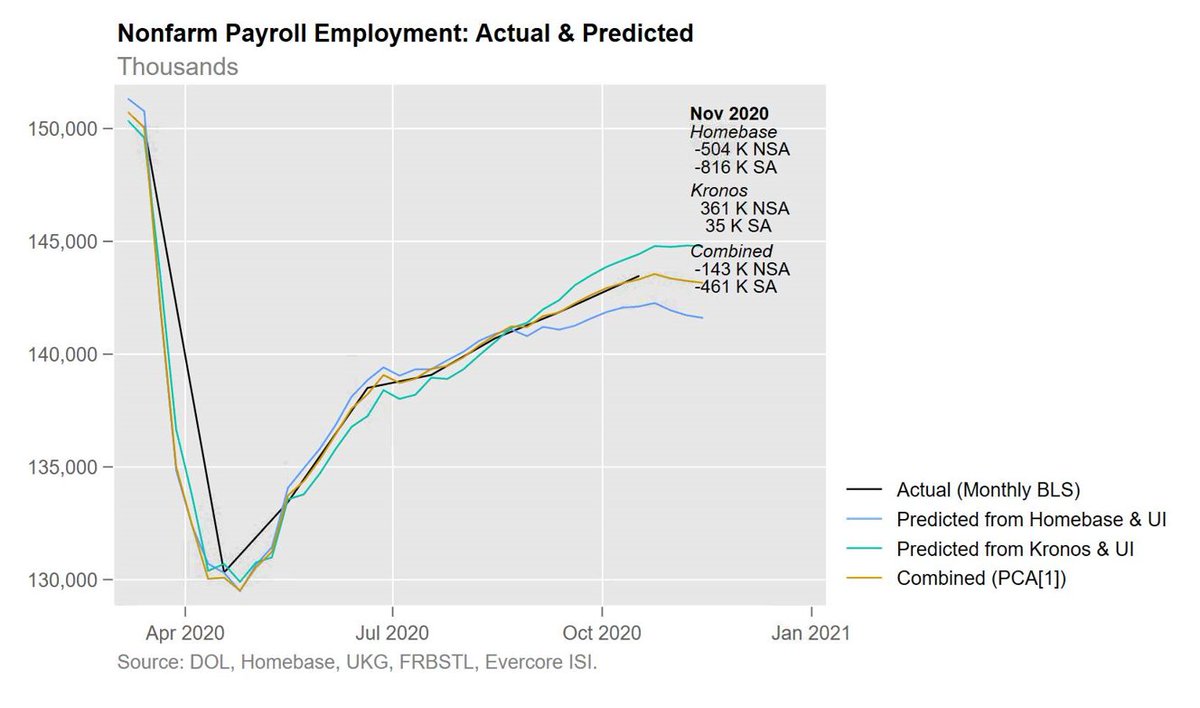

The good news is: payrolls grew. The bad news is: payrolls only grew +245K when we still have a ~10 mil jobs gap. At that pace it would take until the end of 2024 just to get back to where employment was in February.

We all hope & expect jobs will reaccelerate, but this is weak

We all hope & expect jobs will reaccelerate, but this is weak

And the gaps remain large. Leisure & hospitality employment remains more than 20% smaller than it was pre-COVID, even after recovering many of the initial jobs lost.

The overall gap is only now reaching its *greatest extent* during the Great Recession.

The overall gap is only now reaching its *greatest extent* during the Great Recession.

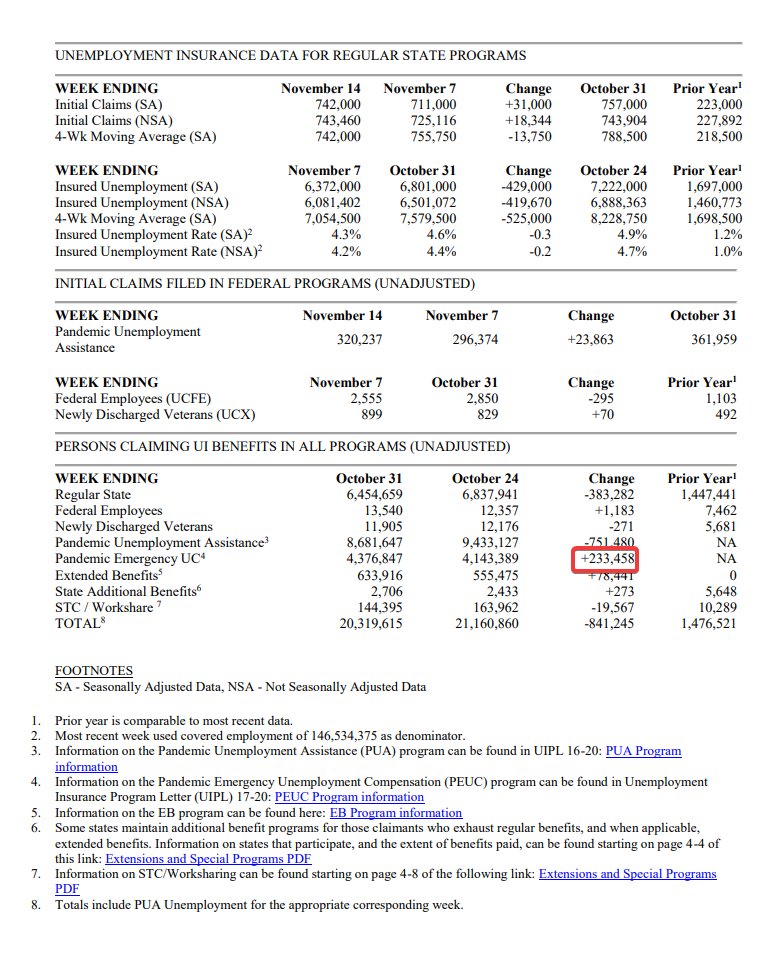

The share of the unemployed finding jobs fell in November, partly reflecting the weak labor market overall and partly reflecting the types of workers remaining unemployed and the difficulties they face.

The share of *any* nonemployed person (whether unemployed or out of the labor force) finding a job also fell in November, back to something looking like pre-COVID equilibrium. That's worrying given how many jobs are still lost.

• • •

Missing some Tweet in this thread? You can try to

force a refresh