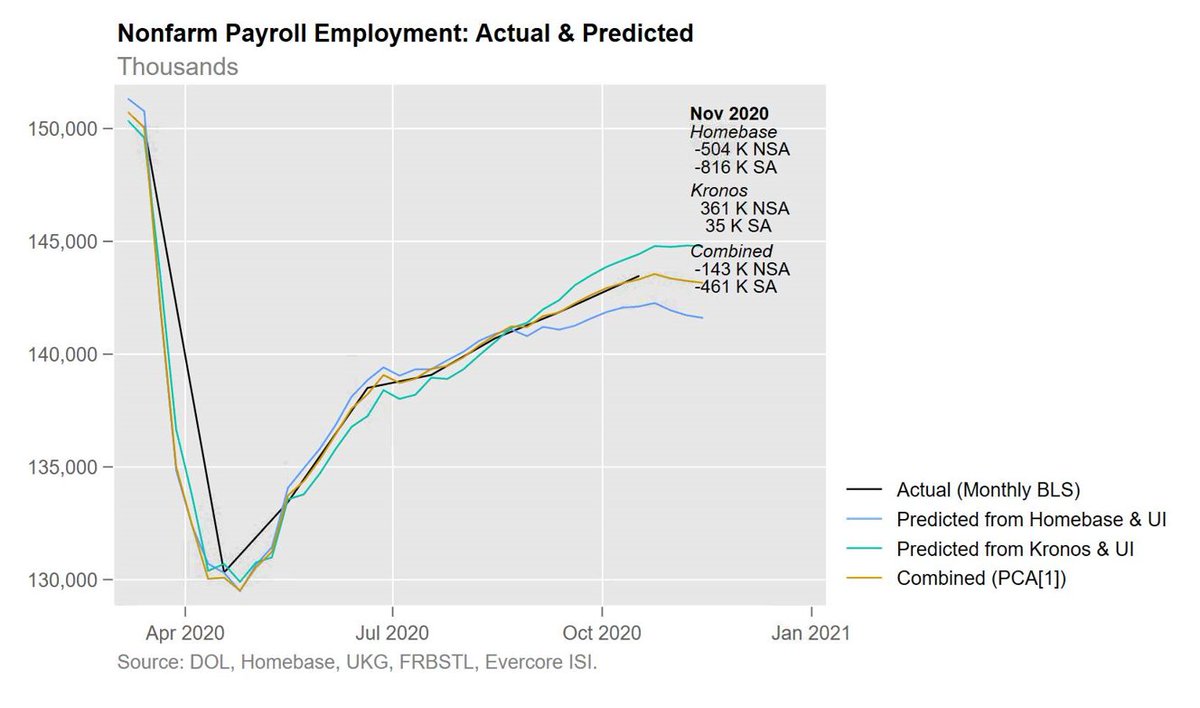

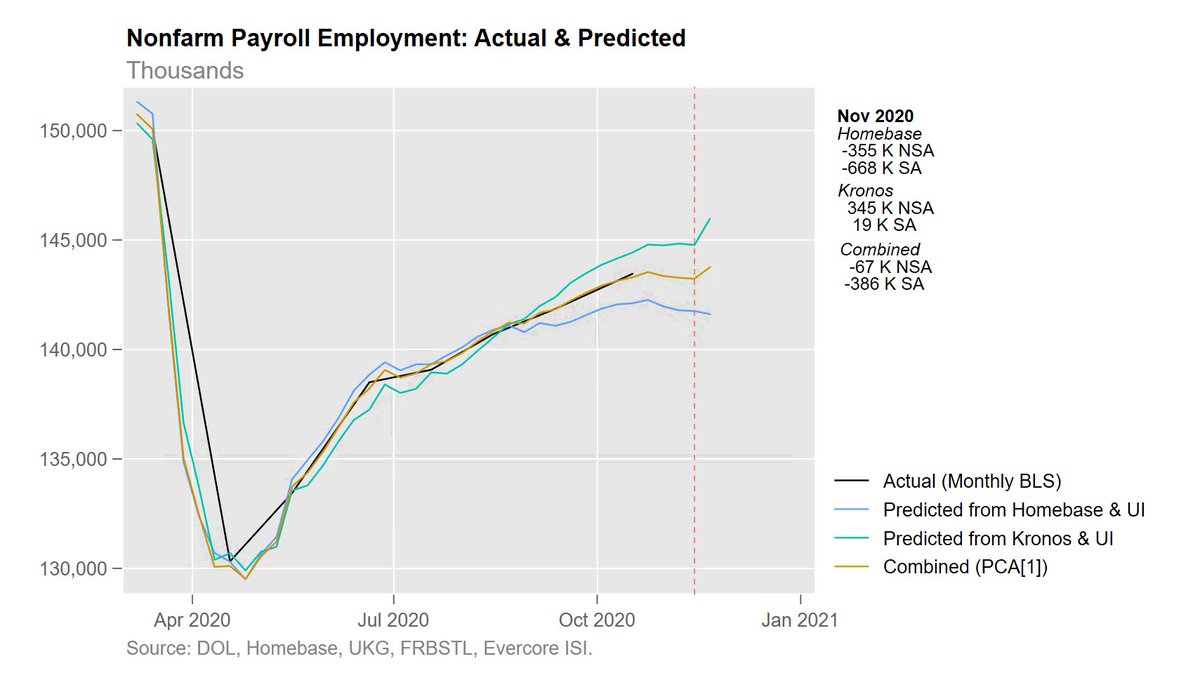

The latest UI claims, Homebase, & Kronos numbers are consistent with payrolls coming in at -67K not-seasonally-adjusted for November, and -386K seasonally-adjusted.

There was a "pop" in the latest week of the Kronos data, but 1) it was the week after the reference week, and 2) because Kronos allows its sample to change over time, it may reflect new customers rather than employment changes at existing ones.

The St. Louis Fed uses Kronos microdata to calculate a "chained" version that keeps sample composition constant, but they don't have the latest week yet. Will be interesting to see if that rise is robust.

Just as a robustness check, I ran my model as if the week of Nov 21 were the CPS/CES reference week. Predicted jobs shifts to positive, but still very weak (+138K SA).

These are not the only metrics we have, and some data is coming in more positively, e.g. Markit PMIs. We also don't have this data for last year, so we can't be confident that Homebase & Kronos are picking up holiday-related hiring up.

But it's a cautious signal nonetheless.

But it's a cautious signal nonetheless.

• • •

Missing some Tweet in this thread? You can try to

force a refresh