Ahead of the ADP release at 8:15am, a brief thread on what high-frequency private data is suggesting we'll get for November payrolls, why it might be right, and why it might be wrong. /1

Note that I've augmented my high-frequency payrolls model to more explicitly address autocorrelation. /2

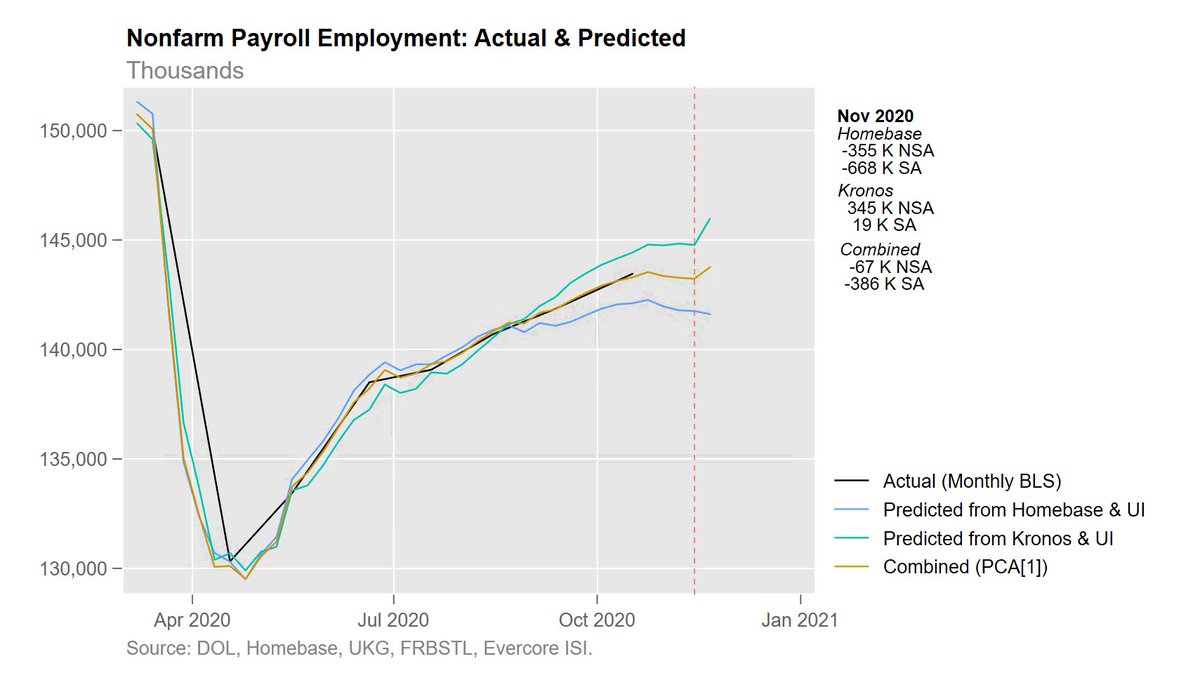

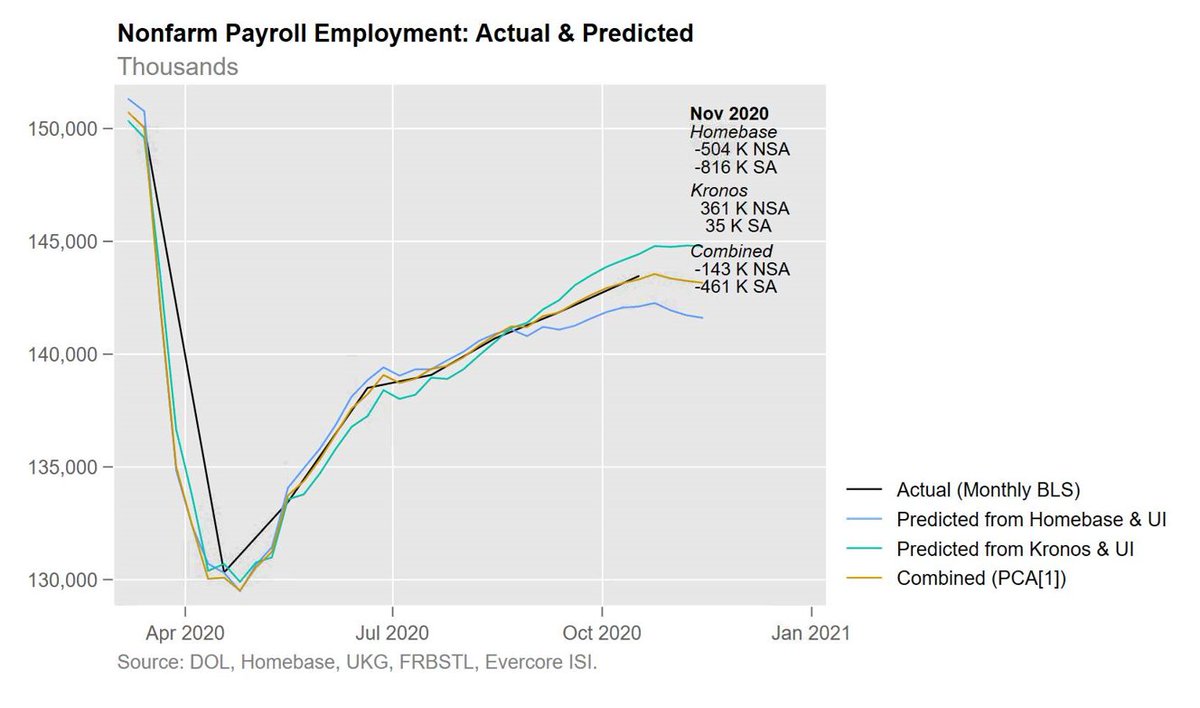

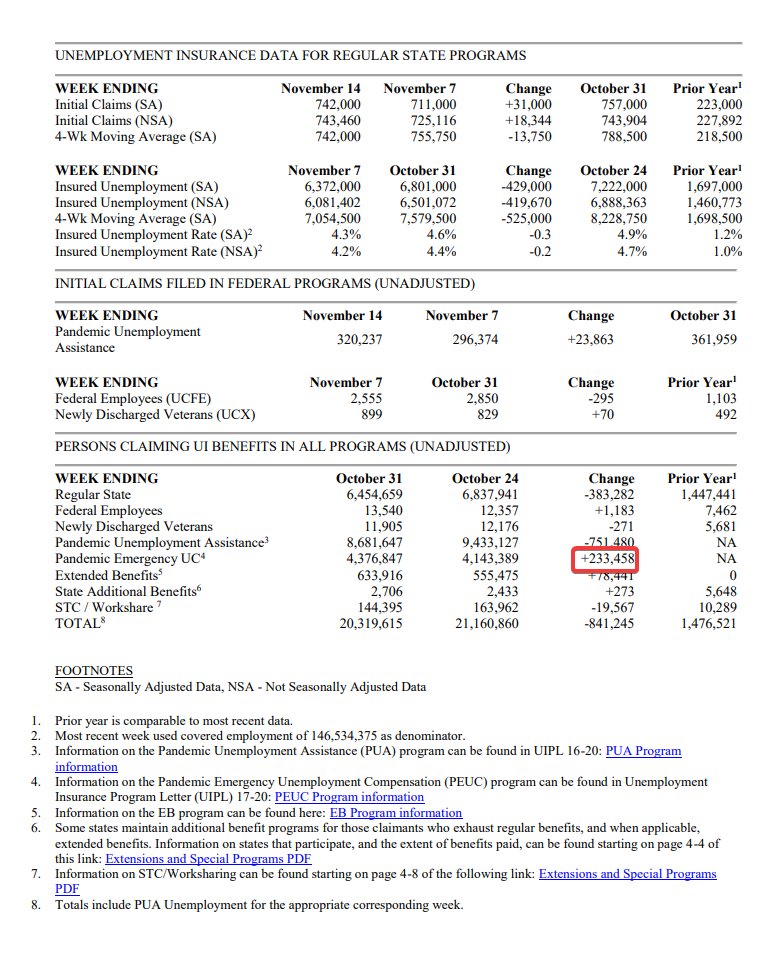

Data from Homebase, Kronos/UKG, and UI claims is consistent with November payroll employment growing at -515K to -228K seasonally-adjusted (-198K to +93K non-seasonally-adjusted). /3

This approach has been decent in one-step forecasts in the past. For example, using just data through September, this approach would have predicted +574K to +839K SA for October out-of-sample (actual was +638K SA), and +1,353K to +1,621K NSA (actual was +1,605K NSA). /4

But I think it's also useful to play the mental exercise of waking up & finding out your model is wrong, forcing thoughts a priori about why that might happen. Some metrics such as the Markit PMI and the Real-Time Population Survey suggest jobs growth in November. /5

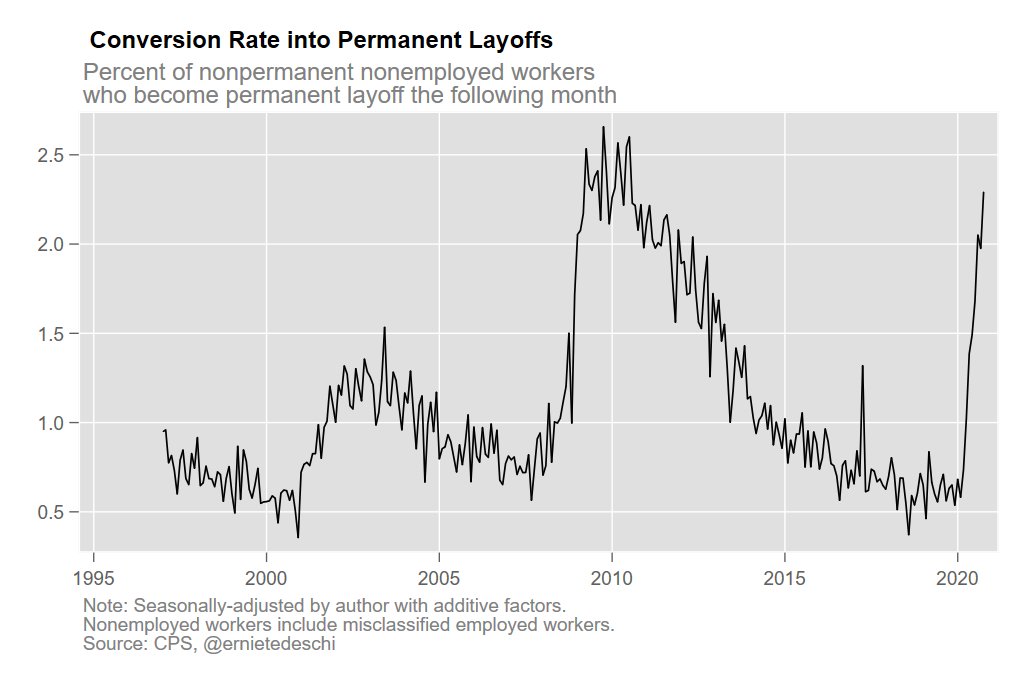

I think there are 2 main possibilities for why Homebase & Kronos might be off this month. One is gradual drift: as the composition of the recovery shifts over time, firms that specialize in small business scheduling become less and less representative of the whole economy. /6

I wouldn't expect this data to suddenly become massively unrepresentative over the course of just one month, but perhaps the labor market has shifted enough that, say, a weak positive in reality gets picked up as a modest negative in Homebase & Kronos. The signs might switch. /7

A bit more worrying is seasonal composition: not necessarily seasonality itself (I adjusted for typical seasonality) but the possibility that this small business data is missing, say, holiday hiring. /8

https://twitter.com/crampell/status/1333828756998397953

However, some other data sources that explicitly try to correct for overly-narrow composition, such as Opportunity Insights (left) and the @uscensusbureau Household Pulse Survey (right) are also showing job loss in November. /9

For more on these issues, check out these two threads of mine from last week. /10

https://twitter.com/ernietedeschi/status/1330855722175913988

https://twitter.com/ernietedeschi/status/1330898234009669632

Finally, note that the current market consensus (pre-ADP) is +486K SA for payrolls in November. So a negative read would be quite a shock.

I'm in the unusual position of hoping I'm wrong & others are right. Either way, we'll learn a great deal about data signal this month. /FIN

I'm in the unusual position of hoping I'm wrong & others are right. Either way, we'll learn a great deal about data signal this month. /FIN

• • •

Missing some Tweet in this thread? You can try to

force a refresh