#WeekendMusings

Post on #Nifty 500 valuations wrt to its own history.

Why Nifty 500 and not Nifty50?

1) Because Nifty500 represents >95% mkt cap of India

2) Doesn't suffer from historical composition bias

As of 31st Dec20, the index has following statistical data.

Post on #Nifty 500 valuations wrt to its own history.

Why Nifty 500 and not Nifty50?

1) Because Nifty500 represents >95% mkt cap of India

2) Doesn't suffer from historical composition bias

As of 31st Dec20, the index has following statistical data.

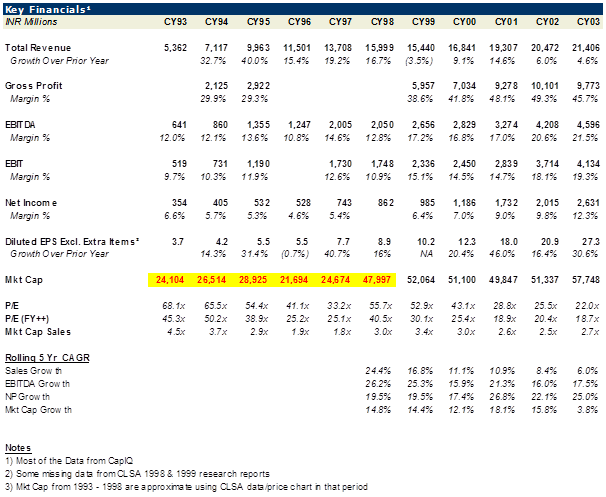

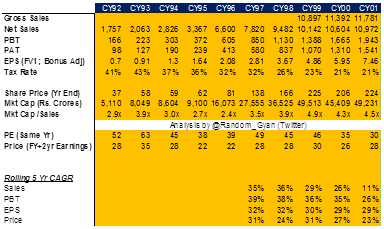

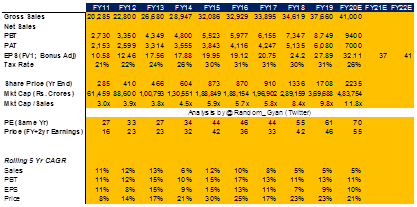

Without adjustments the index on 31st Dec trading at PE of 43x / PB of 3.7x / Div Yield of 1.2%. Assuming a normal curve there represents following percentiles 100% (PE), 87% (PB) , 77% (Div Yield)

However earnings are depressed because of Covid. Current implied EPS is at ~265.

However earnings are depressed because of Covid. Current implied EPS is at ~265.

During Dec'19 the implied EPS was ~330. Assuming the same today the PE is at 34x ( 99%ile!!). Say the best case scenario that normalized EPS is 400 area, the PE would still be 29x (or 93%ile).

Clearly basis last 25 yr history markets today is top 5%-10% most expensive.

Clearly basis last 25 yr history markets today is top 5%-10% most expensive.

The risk reward appears unfavorable. Manage your asset allocations judiciously

Equity exposure should be reduced to reflect this reality. Even for most aggressive investors, the equity exposure shouldn't be more than 25-40%

Equity exposure should be reduced to reflect this reality. Even for most aggressive investors, the equity exposure shouldn't be more than 25-40%

• • •

Missing some Tweet in this thread? You can try to

force a refresh