An extensive yet super simple thread to understand the role of @RBI and how it uses 'Repo Rate' and 'Reverse Repo Rate' 👇🧵

You may bookmark this for further use.

#economy #RBI #financialliteracy

You may bookmark this for further use.

#economy #RBI #financialliteracy

1. Let us first understand the role of Reserve Bank of India in managing the Indian economy.

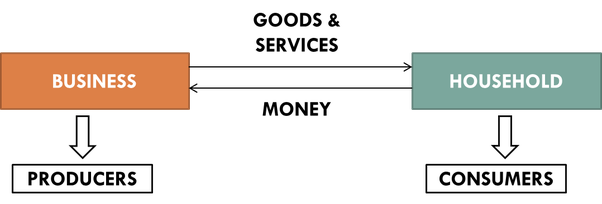

There are two major elements of the Indian economy.

There are two major elements of the Indian economy.

👉The Businesses:

They are the producers of the goods and services. Any business would be happy if it is growing and the prices of the goods and services sold are ever rising. They would be more interested in ‘Economic growth’.

They are the producers of the goods and services. Any business would be happy if it is growing and the prices of the goods and services sold are ever rising. They would be more interested in ‘Economic growth’.

👉 The Households: These are the people who are consumers and they spend the money to buy the goods and services which are sold by the businesses. Any consumer would be happy if the prices of the goods and services are low. Hence, they would be interested in ‘Less Inflation’.

2. As the prices of goods and services rise, there will be economic growth in nominal sense but then there will also be inflation which is perceived as a problem in developing countries like India.

3. Hence, there has to be a proper balance between these two: ‘Economic growth’ and ‘Inflation’.

It is the job of Reserve Bank of India to do this.

It is the job of Reserve Bank of India to do this.

4. Let us understand few more basic concepts before we dig in deeper.

A. More the demand of any commodity, the businessman will increase the price. Less the demand of any commodity, the businessman will decrease the price to attract the consumers.

A. More the demand of any commodity, the businessman will increase the price. Less the demand of any commodity, the businessman will decrease the price to attract the consumers.

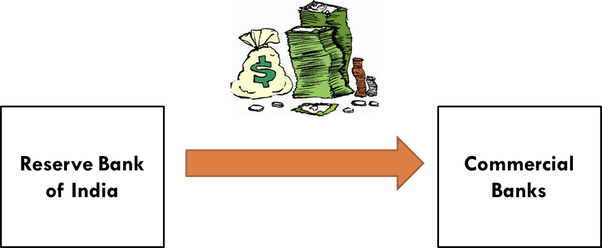

B. RBI is the apex bank and it controls the money supply in the economy. It basically mints the money and controls all the commercial banks.

C. More the money supply in the economy would mean more money in the hands of the people. More money would cause increase in the purchasing power and hence the demand would increase. Now, you know that this will cause the price to increase (read point A).

D. On the contrary, lesser money supply would cause the purchasing power of the people to fall. Hence, there will be fall in the demand. And fall in the demand will cause the prices to fall (read point A).

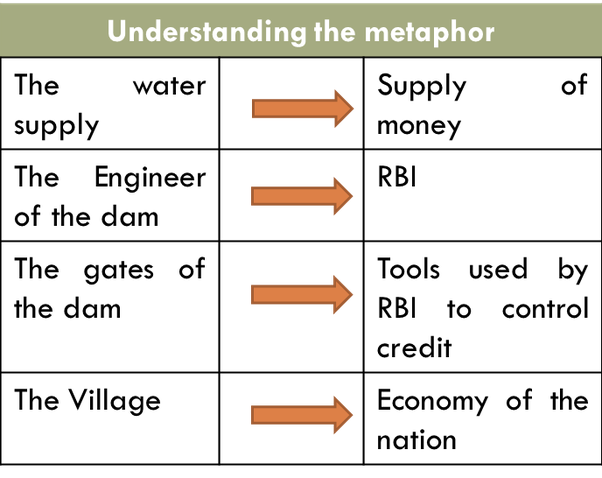

6. There is a flowing river whose water is being controlled by a dam. The engineer of the dam controls the gates of the dam to make sure that the water level is under control.

7. Whenever, there is lack of water in the village, the gates of the dam are opened by the engineer. This is to ensure that the people do not run out of water. Also, care has to be taken by the engineer as opening all the gates would cause flood like situation in the village.

8. Also, whenever, there is excessive rains, the engineer makes sure that the gates are well locked to avoid any excess supply of water.

9. This is how the economy of the country is being controlled by RBI. Here, the role of RBI is similar to that of the engineer of the dam. The water supply is akin to the money supply.

10. The gates of the dam are various tools used by RBI to control the money supply in the economy. The village here would be the economy of the nation.

11. So, basically RBI controls the money supply and maintains a balance between ‘Inflation’ and ‘Economic growth’.

This can be done using various tools. Let us discuss 'Repo Rate' and 'Reverse Repo Rate' here.

This can be done using various tools. Let us discuss 'Repo Rate' and 'Reverse Repo Rate' here.

12. ‘Repo Rate’ is the rate at which our banks borrow rupees from RBI. It is also called as repurchase rate.

13. Okay, lets have this analogy first,

You go to a friend and ask for money, say 100 Rs. He don’t trust you so he asks you for security. You give him your watch as a security.

You go to a friend and ask for money, say 100 Rs. He don’t trust you so he asks you for security. You give him your watch as a security.

14. However, you also enter into an agreement to buy back the watch at a predetermined rate of interest. This interest is known as ‘Repo Rate’. Your friend is ‘RBI’ and you are ‘Commercial Bank’.

15. Whenever the banks have any shortage of funds they can borrow it from RBI. RBI lends money to bankers against approved securities for meeting their day to day requirements or to fill short term gap.

16. Who decides ‘Repo Rate’?

‘Reserve Bank of India’ decides the ‘Repo Rate’ and it changes it as and when needed keeping in mind the inflation and the growth factor of the economy.

‘Reserve Bank of India’ decides the ‘Repo Rate’ and it changes it as and when needed keeping in mind the inflation and the growth factor of the economy.

17. What will happen if ‘Repo Rate’ is decreased?

👉 Decrease in ‘Repo Rate’ will make it easier for the Commercial Banks to lend money.

👉 Increased lending activity will cause an increase in the money supply.

👉 Decrease in ‘Repo Rate’ will make it easier for the Commercial Banks to lend money.

👉 Increased lending activity will cause an increase in the money supply.

18. What will happen if money supply is increased?

👉 If RBI makes money supply easy then it will become very easy for commercial banks to lend loan to general public.

👉 Lending loan to general public in excess will cause increase in the supply of money in the hands of people.

👉 If RBI makes money supply easy then it will become very easy for commercial banks to lend loan to general public.

👉 Lending loan to general public in excess will cause increase in the supply of money in the hands of people.

19. What will happen if people have more money?

👉 More money in the hands of people would imply more purchasing power.

👉 Increased purchasing power will lead to greater demand of goods and services. Hence, the prices will increase causing inflation to rise.

👉 More money in the hands of people would imply more purchasing power.

👉 Increased purchasing power will lead to greater demand of goods and services. Hence, the prices will increase causing inflation to rise.

20. What is 'Reverse Repo rate'?

The rate at which commercial banks lend money to RBI is called as Reverse Repo Rate.

The rate at which commercial banks lend money to RBI is called as Reverse Repo Rate.

21. Now, when the banks lend money to RBI, they will be left with less cash and this would mean less money as loan to public and again cause the prices to fall as there will be fall in the demand of goods and services.

22. RBI always tend to keep Repo rate higher than Reverse Repo rate as it do not want to end up paying more.

The End.

@finbloggers, @Dinesh_Sairam this can help beginners 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh