What a story this is. Global ETF and ETP assets at US$7.99 trillion. Millions of small investors across the world getting low-cost diversified access to stocks, bonds and Marijuana ETFs and savings billions in fees.

etfgi.com/news/press-rel…

etfgi.com/news/press-rel…

Although ETFs are orphan products in India, one day in the next 7 to 10 years, ETFs will surely see growth in India. Won't happen before the next beat market happens though.

From about 50 ETFs 2-3 years ago, we're ate 100 ETFs now. We're seeing new bond ETFs aper from those 10 year gilt ones, we now have an emerging line up of smart beta ETFs. That's progress.

Post covid, the volumes have also gone up 3-4 times. And most of this is all retail volumes. I rememner about year and a half ago, LIQUIDBEES was about 15crs a day.

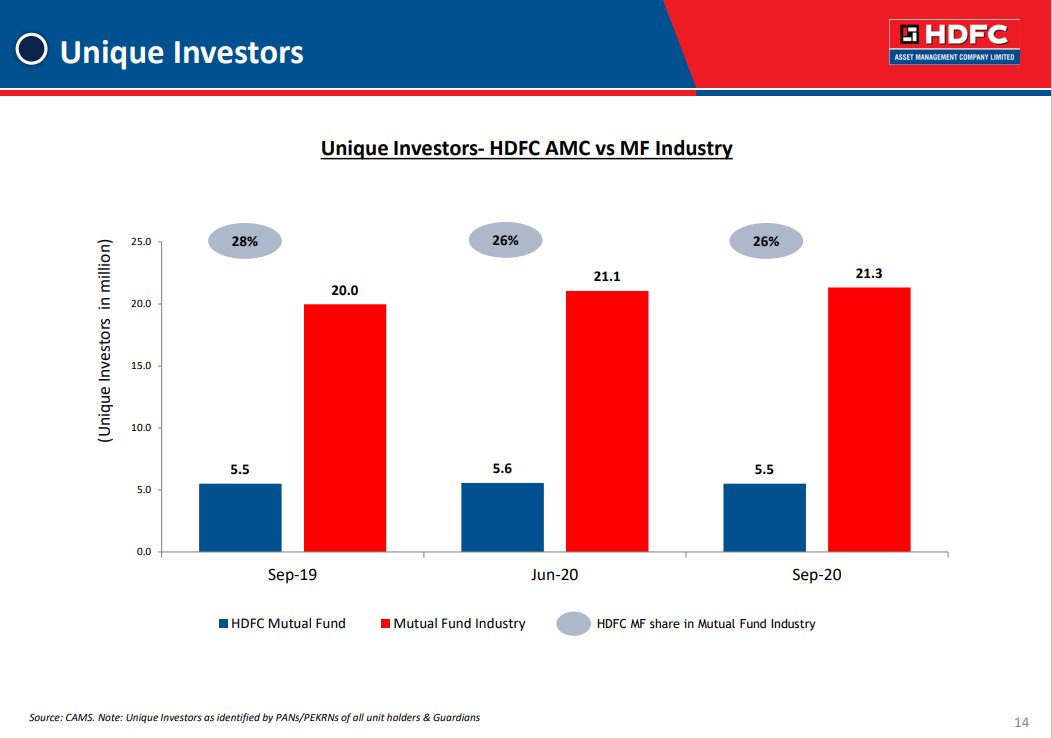

The reason why ETFs are abandoned ducklings of indian AMCs is because there are just about 1.5cr active demat accounts. If you check unique demat, maybe 50% of that. Until then index funds make all the sense.

• • •

Missing some Tweet in this thread? You can try to

force a refresh