It's a beautiful Saturday on this Corona riddled planet. It's a good day to do the following:

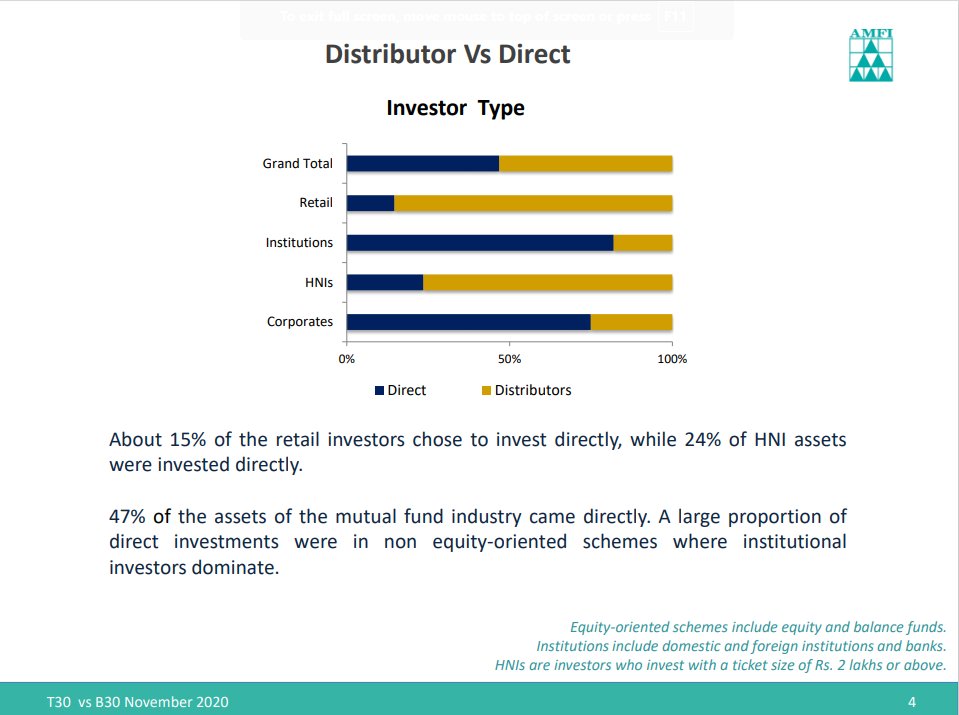

1. Open your account statement and find out how much commissions you are paying. You'd be paying anywhere between 0.7% to 1.3% extra over direct plans.

1. Open your account statement and find out how much commissions you are paying. You'd be paying anywhere between 0.7% to 1.3% extra over direct plans.

1.5 You can download your statement on CAMS, KARVY, NSDL etc.

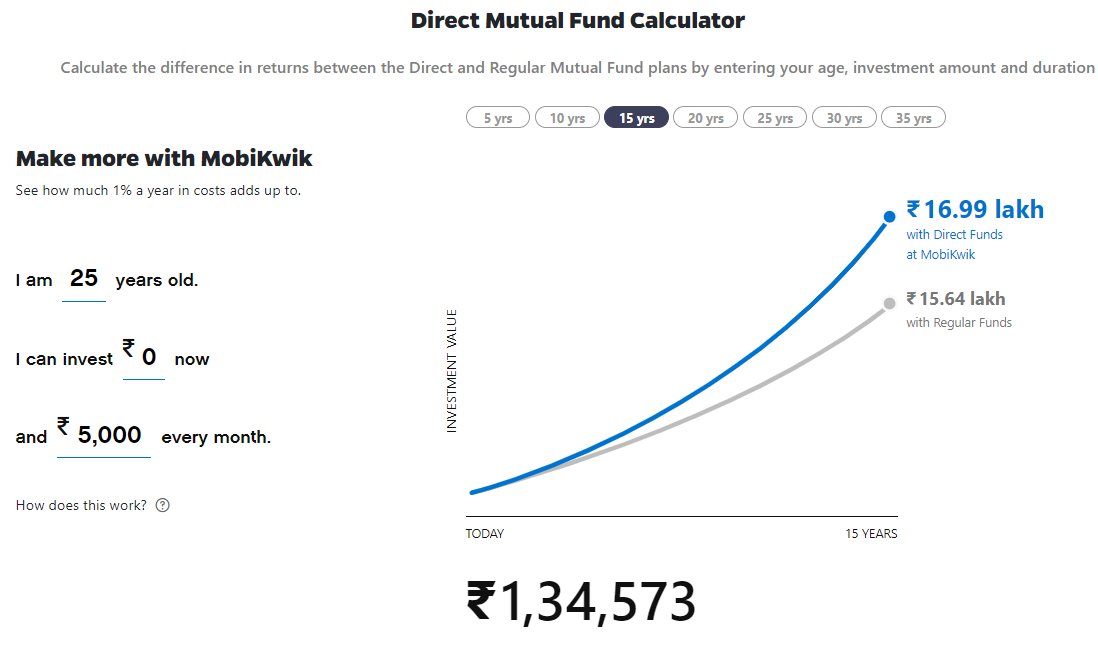

2. If you are one of those Robinhood Traders and you started mistakenly investing in mutual funds instead of trading mutual funds, commissions can kill you! A simple 1% difference in commissions can add over 10-15 years. This comparison has been done to death but once more.

3. Figure of if whoever sold you these things, be if your advisor or distributor are providing value equal those commissions or not. This is an incredibly hard thing to figure. You need to do deep research, understand money yourself and then ask your advisor/distributors

3.5 This is an incredibly hard thing to figure. You need to do deep research, understand money yourself and then ask your advisor/distributors the right questions. Beware these guys are prone to bullshitting. So, interrogate them as a cop would a criminal.

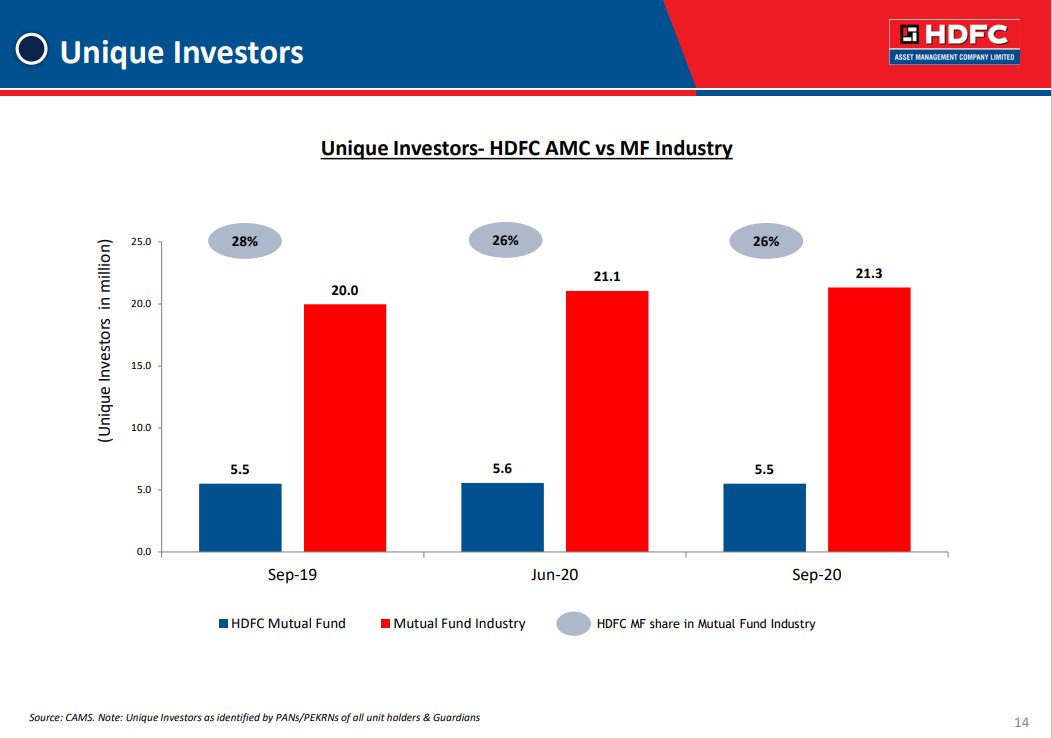

4. We don't have nearly enough good advisers in India, So if you were to look at the odds that you found a good adviser/distributors vs a sales guys who sold you high commissions garbage, the odds favor the sales guy selling costly garbage.

5. To understand if you've been sold some garbage, you need the ability to distinguish substance from garbage and that takes a lot of time as opposed to buying some Nifty Calls and watching them go up 100%. Or joining some fucking options seminar.

6. Buy any best selling personal finance book, sit your ass down, switch off Netflix, throw that blunt and read that book. You'll fell like committing suicide by the time you reach the insurance chapter. But stay strong, don't kill yourself

7. Now, if you don't want to read a book, read 100 posts on @FreeFinCal, @ZerodhaVarsity, @freefloatHQ, @StockViz, @capitalmind_in, @PortfolioYoga and learn thee goddamn basics.

7.5 Please don't read any of the mainstream financial or business publications. Avoid them.

AND DON"T FUCKING WATCH CNBC, Zee Biz and listen to those gurus. They're on for one reason - to make money

AND DON"T FUCKING WATCH CNBC, Zee Biz and listen to those gurus. They're on for one reason - to make money

https://twitter.com/passivefool/status/1349329464715431941?s=20

8. Now interrogate your adviser, waterboard him. And figure out if that 0.80% to 1.3% in commissions you are paying is worth it.

If it's worth stick with your adviser. the better adviser would be someone who charges a flat fee but there are 7 of those in India. Look for one.

If it's worth stick with your adviser. the better adviser would be someone who charges a flat fee but there are 7 of those in India. Look for one.

9. If you bought some financial product from a bank, or rather you were sold something, that means it's scammy. get rid of that mutual fund, insurance policy, like you would get rid of a torn underwear - IMMEDIATELY!

9.5 If you bought some investments that were recommended on some platforms, look closely. These platforms have an incentive to sell you garbage that give them the highest commissions.

nakedbeta.com/musings-rants/…

nakedbeta.com/musings-rants/…

10. When people say there are no get rich schemes, THEY ARE LYING. Of course there are get rich avenues like joining some options seminar. One guy was selling and I'm not kidding a "machine gun" Strategy. You can join them.

10.5 But the tiny problem is that your odds of getting rich by joining these seminars, paying 5 laks, trading options and then getting rich is about 1:50767364764. So if you like those odds, JOIN a MACHINE GUN SEMINAR now.

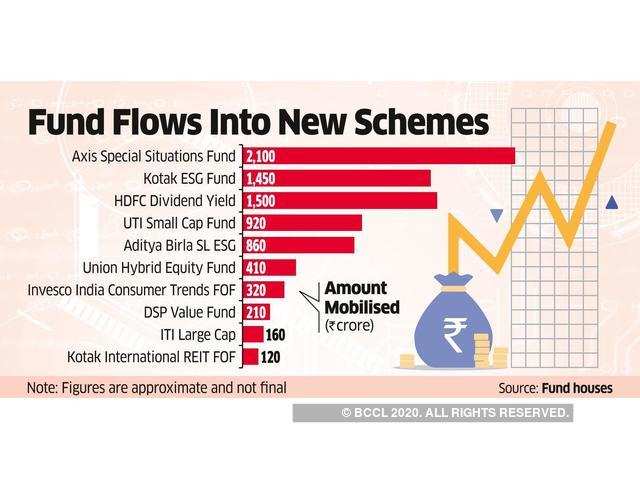

11. Don't fall for fancy bullshit and nonsense sold by AMCs. They'll sell you gabage in the name of AI/ML, Advanatge, Disadvanatge and so on. Be careful.

12. Assuming that you've done everything until 12 and you've built a decent portfolio. Be satisfied, don't mess it up by adding more shiny objects. The AMCs are very gracious and polite, they never say no to your money. Don't say yes!

indexheads.substack.com/p/without-this…

indexheads.substack.com/p/without-this…

13. Investing is just a small part of your personal finance checklist, in fact I'd say it's the most inconsequential one. Things like insurance, having the right career plans, having a will, making sure your family is taken care of etc matter a whole lot.

12.5 Oh on a side note, STOP LISTENING TO AMC CEOs. It won't work well for you.

14. Keep your money. Stop paying salesman needlessly. You won't get 80C tax benefits for paying pointless commissions. Or donating money to an NFO.

15. 99% of the financial services industry is meant to take your money and give nothing in return.

16. Uninstall your investing mobile application and do something worthwhile. Get drunk and read The Intelligent Investor by Benjamin Graham, or watch Ram Gopal Varma Ki Aag on mute.

17. Stop getting ripped off.

18. Have a good weekend.

forgot to add @deepakvenkatesh's blog and @abhishec_s's tweets.

• • •

Missing some Tweet in this thread? You can try to

force a refresh