The world has 47m millionaires, 71% of them live in the US or EU, there's only 14.9m BTC in circulation, and only 4.1m BTC are liquid and therefore able to be bought.

HNW individuals just got notified they need an allocation, IMO this is the reason why BTC rocketed past 23k.

HNW individuals just got notified they need an allocation, IMO this is the reason why BTC rocketed past 23k.

Whale spawning season is here. (1000 BTC or more).

Very high net worth individuals are coming in, in droves.

This cycle is unlike any we've seen before.

Very high net worth individuals are coming in, in droves.

This cycle is unlike any we've seen before.

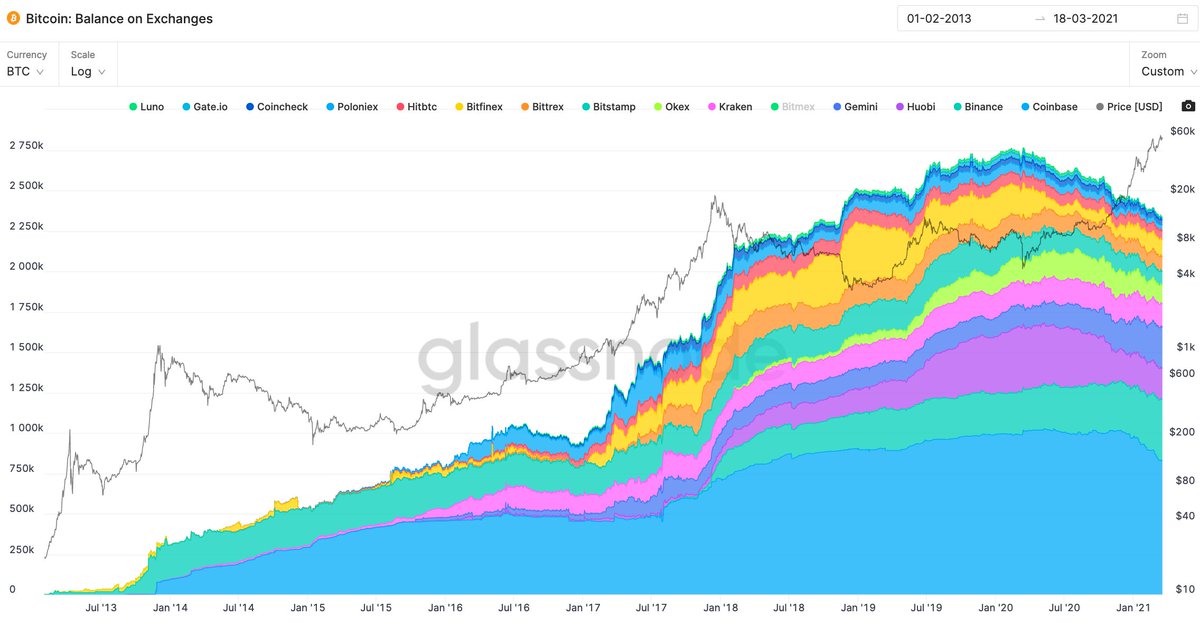

On-chain study of BTC that is liquid by @glassnode

Supply of BTC in circulation uses current supply minus 3.7m lost coins by Chainalysis

Supply of BTC in circulation uses current supply minus 3.7m lost coins by Chainalysis

And BTW, those 4.1m coins that are liquid and available is dropping really quickly ever since COVID bootstrapped this round of money printing.

• • •

Missing some Tweet in this thread? You can try to

force a refresh