1) Let's talk about the State of Chinese Cloud. It's a nascent but very interesting market. All our favourite players are there, Alibaba, Huawei, Tencent and JD. AWS is still lurking around the corner hoping to get in.

But who will come out on top?

But who will come out on top?

2) Cloud and the general SaaS category (which PaaS and IaaS, we can debate about this later) in China is between $3.7bn - $6bn in 2019, which is still less than 6% of the total world SaaS market size.

3) The reason for the lack of adoption are numerous:

- SMBs don't want to pay for software (lack of cash for investment, also piracy means they think software = free)

- Enterprises do, but digitalisation is hard and requires a lot of hand-holding

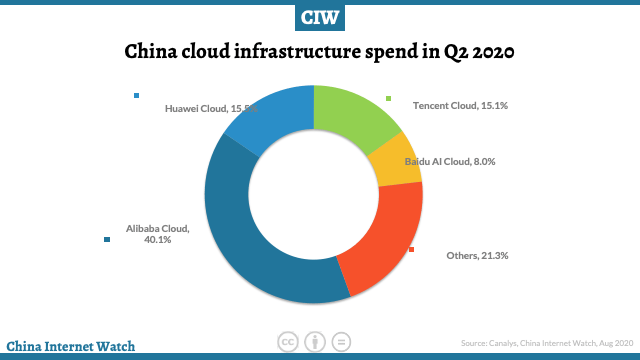

- Cloud security concerns.

- SMBs don't want to pay for software (lack of cash for investment, also piracy means they think software = free)

- Enterprises do, but digitalisation is hard and requires a lot of hand-holding

- Cloud security concerns.

4) Some of these are China-specific issues but a fair amount I think is general development stage issues. I wrote more about it here if you're interested:

lillianli.substack.com/p/why-are-ther…

lillianli.substack.com/p/why-are-ther…

5) The cloud has been getting a large amount of interesting (esp in 2020) as seemingly all work moved and companies felt the growing need to digitialise.

But their reluctance is justified. Given the vast amount of users and fraudsters in China, vulnerabilities are numerous

But their reluctance is justified. Given the vast amount of users and fraudsters in China, vulnerabilities are numerous

6) Given the lack of transparency of where the data is stored and good cybersecurity training. Horror stories have proliferated about cloud usage. People who unloaded their customer data to on the cloud only to find the list being sold to telemarketers.

7) Trust is not high for small cloud vendors, so it's no surprise that only the big guys have made headways. As of 2020 Canalys estimate Aliyun to own 40% of the Chinese cloud market, followed by Huawei and Tencent.

8) Aliyun does a good job by 'leading by doing' and has put all of their own functionalities on the cloud. Their also jointly peddling SaaS solutions build on top of Aliyun such as Blockchain and NoSQL databases with Ant. DingTalk is on there as well.

lillianli.substack.com/p/ant-group-pa…

lillianli.substack.com/p/ant-group-pa…

9) They've really gone for the AWS approach, all in for developers, no-code, serverless. Their sites are just documentation after documentation. Though there is still a lot of hand-holding of customers for all players. Digital transformation is a lot like corporate therapy

10) Huawei cloud cut their teeth on government sector work but have been branching out, it's interesting to see a hardware company moving to a software play.

Tencent cloud has been investing heavily, in 2020 it hired more than 3,000 employees.

Tencent cloud has been investing heavily, in 2020 it hired more than 3,000 employees.

11) I guess the pandemic accelerated a lot of attention, in 2020 Q1 - China’s cloud market grew an impressive 67%. Tencent's apparently on a price war to win this race, so I'd keep an eye on them.

12) Unlike the West, most clouds are still hybrid given the privacy concerns and a general desire for companies to own their software.

The top industries undergoing digitalisation are government, finance and healthcare - often the sectors facing the most customers

The top industries undergoing digitalisation are government, finance and healthcare - often the sectors facing the most customers

13) So my bet for this market, it's wide open given how big the market could be. But given Alibaba's full suite of offering and lead, it's a safe bet in the medium term.

I'll be writing tweets like this for the rest of Jan, follow me if you want these to spam your TL

• • •

Missing some Tweet in this thread? You can try to

force a refresh