1) Let's talk about the playbook to make a billion-dollar-plus Chinese consumer tech company.

This is foolproof but not easy to execute on.

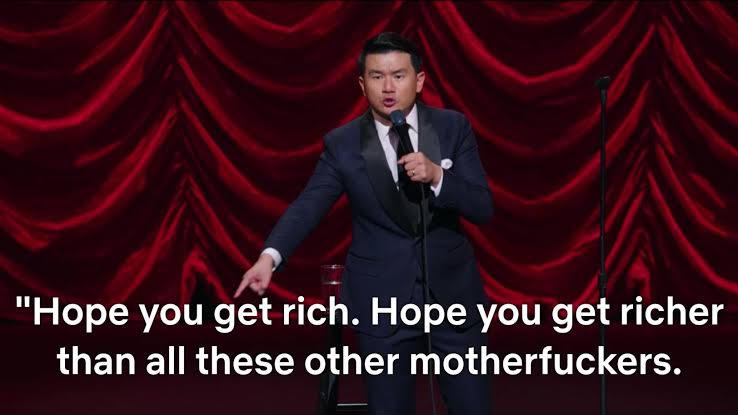

Thank me when you're rich.

This is foolproof but not easy to execute on.

Thank me when you're rich.

2) Had this been pre-2010, I would ask you to find a highly popular US consumer business that doesn't exist yet in China right now.

Now you have to look for a 'fengkou' or a focal point of opportunity that at least three other start-ups are getting into.

Now you have to look for a 'fengkou' or a focal point of opportunity that at least three other start-ups are getting into.

https://twitter.com/lillianmli/status/1345391348837335040

3) Now that you've found your newest trend or opportunity.

(past examples include livestreaming e-commerce)

It's time to start getting a group of people - preferably with degrees in CS from Tsinghua / Peking and other Ivy leagues with a sprinkling of oversea experiences.

(past examples include livestreaming e-commerce)

It's time to start getting a group of people - preferably with degrees in CS from Tsinghua / Peking and other Ivy leagues with a sprinkling of oversea experiences.

4) If you're extra edgy, you can do the native-Chinese route. That's the Bytedance mode, but then make sure you have some cool tech buzzwords (prior examples include AI, AR / VR, blockchain) in the pitch.

B2B is hot rn, but you might need annoying things like domain expertise.

B2B is hot rn, but you might need annoying things like domain expertise.

5) Copy the business model and UX of your competitors as closely as possible as an MVP, because they'll be sure to copy you later down the line.

Then let's find the VCs. Ideally, you're a second-time founder so you have connections but no worries if not.

lillianli.substack.com/p/battle-royal…

Then let's find the VCs. Ideally, you're a second-time founder so you have connections but no worries if not.

lillianli.substack.com/p/battle-royal…

6) You need to paint incredibly audacious goals, preferably involving markets they think are already hot (lower-tier cities, consumption upgrading, fintech services).

Emphasis how the market you're going into is the big one and how they will miss out. FOMO to the max.

Emphasis how the market you're going into is the big one and how they will miss out. FOMO to the max.

7) You can get things like termsheets without exclusivity clauses. Raise a bunch of money and hire a small army. Having 200 people is very normal for a Series A company. Those developers are cheap so don't spend money there. You need that money for other things.

8) You need to be working 996 at the very least to make sure your team is competitive. Great if you can do more than that. The focus should be getting your product to market then quick iterations once you get feedback.

A new release every 2 days is not crazy.

A new release every 2 days is not crazy.

9) You need to be spending all that money subsidising user behaviour. First 5 uses should be on the house. People should be delighted when they sign up and be told what bargains they are missing out. Pay for their behaviour change until it becomes a habit.

10) You might discover at this point that you've got 100 other competitors who are all well funded, copying you and subsidising their own users the same way. There's no honour among thieves.

No worries, you just gotta work harder to stay ahead of that competition.

No worries, you just gotta work harder to stay ahead of that competition.

11) Find out how much they are subsidising their customers and subsidise more. Do more product releases. Hire more programmers and sales agent to keep up.

If the opportunity has a physical component, like a bike or delivery service, investing in creating that infrastructure

If the opportunity has a physical component, like a bike or delivery service, investing in creating that infrastructure

12) Owning the whole supply chain through building it is a moat. Also owning your customers is also a moat. Let's make sure they spend more time in your app so they wouldn't have time for your competitors. How about some mini-apps?

https://twitter.com/lillianmli/status/1333783778284564489

13) You need to be raising money constantly, aim for a new and bigger round every 6 months. The aim of the game is to outlast your opponents who can't raise any more money and die a cashless death.

Table stakes are eye-watering growth metrics to justify those fundraises.

Table stakes are eye-watering growth metrics to justify those fundraises.

14) PDD IPO'ed in 3 years, you can work out the growth rate backwards for your own sector.

Once you get the money you need to keep hiring and subsidising and churning out new releases. The customers should be dining out almost free on your Vc's money.

Once you get the money you need to keep hiring and subsidising and churning out new releases. The customers should be dining out almost free on your Vc's money.

15) At this point if you're doing this right, either Tencent or Alibaba or another tech giant should be trying to invest in you.

Go for Tencent for their traffic or Alibaba if Tencent invested in your competitor. You should call it quits if Baidu wants to invest in you.

Go for Tencent for their traffic or Alibaba if Tencent invested in your competitor. You should call it quits if Baidu wants to invest in you.

16) With a good corporate investor (remember they are the best VC investors because they actually do value-add in China unlike the West), the sky should be the limit. Keep growing, keep hiring, keep the scandals to a minimum though they will happen. lillianli.substack.com/p/the-shadow-w…

17) At this stage you should be like 5 rounds in if you made it this far in the game, your competition should be dying in droves.

This is good but also bad because then the capital and focus will zero in a 2-3 players for the final battle.

This is good but also bad because then the capital and focus will zero in a 2-3 players for the final battle.

18) Might be a good thing to learn unit economics right now and see what a thing called break-even point could be. Try to achieve those in certain regions because your competition might not.

Hopefully, you're not like Ofo where breakeven was not a possibility.

Hopefully, you're not like Ofo where breakeven was not a possibility.

19) This is where it gets very hard since one wrong move can lead to a downfall.

But ideally given your crazy growth rates you should be close to an IPO. Go for that asap.

But ideally given your crazy growth rates you should be close to an IPO. Go for that asap.

20) Now with IPO cash, you should be sitting pretty. Hopefully, you're there when it gets down to two players, then there's a decent equilibrium in the market.

Now's the time to start raising the prices you've kept artificially low all that time.

Now's the time to start raising the prices you've kept artificially low all that time.

21) And since during your battle you've probably put out a bunch of traditional business in the process and retrained consumer behaviour, the users will have no choice but to start paying higher fees.

PROFIT.

PROFIT.

I'll be writing threads like this for the rest of Jan, follow me to get these spams on your TL.

I'm kind of worried how much of this was not a joke.

I'm kind of worried how much of this was not a joke.

• • •

Missing some Tweet in this thread? You can try to

force a refresh