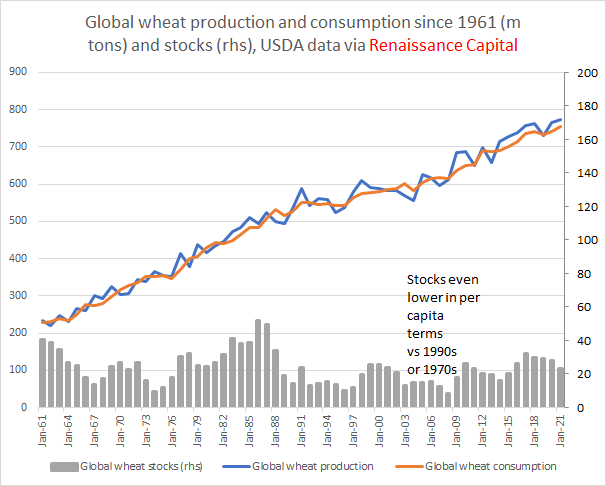

Why are food prices soaring? #Wheat prices are up 37% from their low and #corn prices are up 61%. Both are at the highest levels in years ..

Thread

Thread

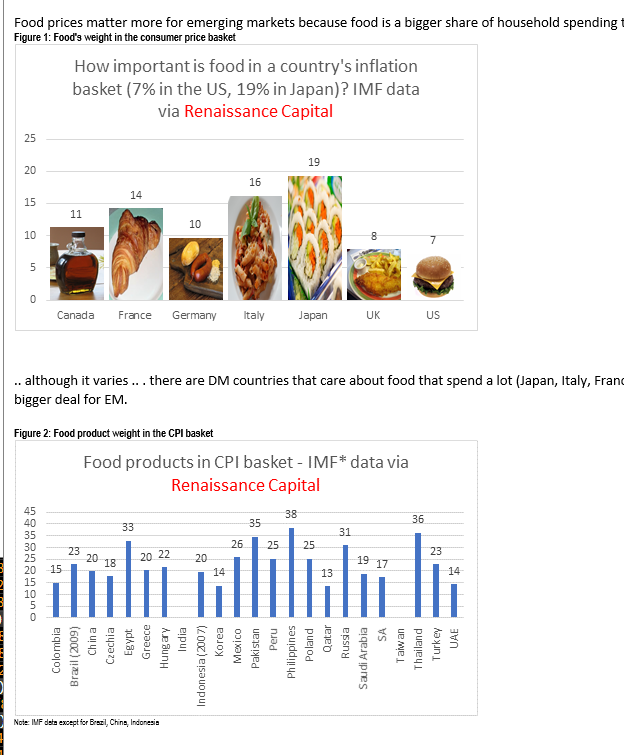

This matters for emerging markets (EM) more than developed markets, because lower incomes in EM means a higher proportion of spending goes on food. There's enough famous Marie Antoinette "let them eat cake" examples to justify concern about unrest when food prices go up in EM

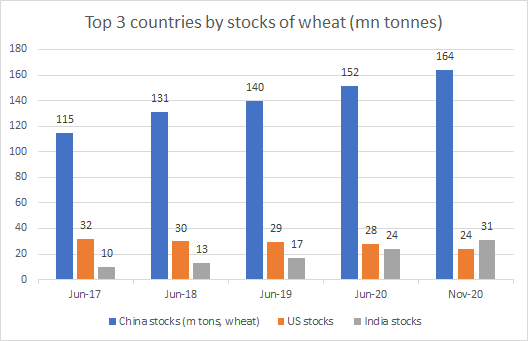

The last time we sustained big rises in food prices was the 2000s when global stock levels fell due to poor harvests, the Chinese middle class were eating more meat and high oil prices encouraged bio-fuel usage - but stock levels are much higher now than in the 2000s

It looks like the global agricultural surplus has been bought up by China. Together with India (but India has bought much less and has far lower stocks per capita), China appears to have bought up the entire global wheat surplus

My guess is that China is taking advantage of CNY appreciation to buy up stocks of wheat, corn .. and probably copper and iron too .. at prices that look relatively OK to them. The implication is China's surge in demand for these products will end when CNY appreciation stops

This means that agriculture exporters like Canada, US, Australia, Argentina, Russia (*), Ukraine and Kazakhstan should have an export boost while food importers like Egypt (the world's biggest wheat importer) and countries like Turkey face more challenges

* Russia domestic grain prices are closely linked to the world price (Russian traders are smart and arbitrage between them) so we'll see export restrictions to crash the local price in Feb.

In the medium-term, good global stocks suggests upward price pressures won't last

In the medium-term, good global stocks suggests upward price pressures won't last

• • •

Missing some Tweet in this thread? You can try to

force a refresh