We all use Cloudflare -- it's one of the simplest, easiest, most robust way to protect and enhance your website

But many of us know less about Cloudflare the company

Well, it's at ~$500m in ARR, has 3m+ free/paid accounts, and is worth $25 Billion!

5 Interesting Learnings:

But many of us know less about Cloudflare the company

Well, it's at ~$500m in ARR, has 3m+ free/paid accounts, and is worth $25 Billion!

5 Interesting Learnings:

#1. Their funnel is impressive:

3.2m Total Free+Paid ↘️

100,000 Paid ↘️

736 at $100k+ in ACV ↘️

16% of the Fortune 1000

3.2m Total Free+Paid ↘️

100,000 Paid ↘️

736 at $100k+ in ACV ↘️

16% of the Fortune 1000

Like many similar developer-centric products, vast majority come in via self-serve, but as the deals grow, sales is brought in

#2. 48% of revenue outside the U.S.

We've seen this vary wildly at public SaaS & Cloud companies

48% outside the U.S. may be the highest outside of Xero, which is HQ'd in New Zealand. A reminder to go where your customers are. Otherwise, you just leave revenue on table.

We've seen this vary wildly at public SaaS & Cloud companies

48% outside the U.S. may be the highest outside of Xero, which is HQ'd in New Zealand. A reminder to go where your customers are. Otherwise, you just leave revenue on table.

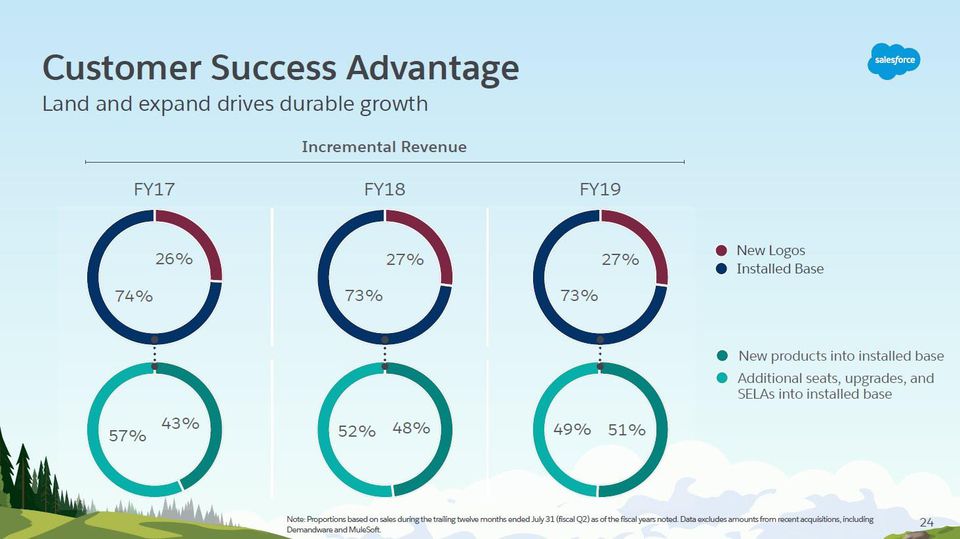

#3. Largest customers growing the fastest -- 68% YoY vs. 54% overall

We see this often in Cloud and SaaS -- but not all the time.

With Twilio & Zendesk, the average customer size has stayed constant, as SMB growth has kept up with enterprise

We see this often in Cloud and SaaS -- but not all the time.

With Twilio & Zendesk, the average customer size has stayed constant, as SMB growth has kept up with enterprise

Overall revenue has grown at 50% CAGR, while large customers have grown 68%, and customer count "just" 22%.

That means the $100k+ deals are really driving growth at Cloudflare now, even as it continues to serve a massive number of websites.

That means the $100k+ deals are really driving growth at Cloudflare now, even as it continues to serve a massive number of websites.

4. Even with a partially freemium model, sales & marketing expenses are still "normal" at 45% of revenues

An interesting contrast to Atlassian & a few others, Cloudflare still spends a "normal" amount on Sales + Marketing, even with the efficiencies of a freemium base

An interesting contrast to Atlassian & a few others, Cloudflare still spends a "normal" amount on Sales + Marketing, even with the efficiencies of a freemium base

Freemium is a huge boost, and we've recently seen Atlassian and New Relic revitalize their Free programs, as well as Hubspot

But in the end, sales usually needs to come in to close the bigger deals

But in the end, sales usually needs to come in to close the bigger deals

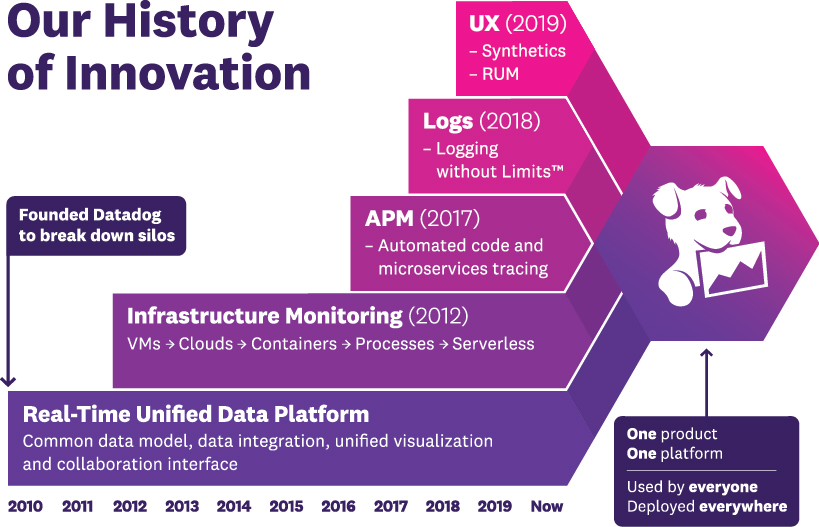

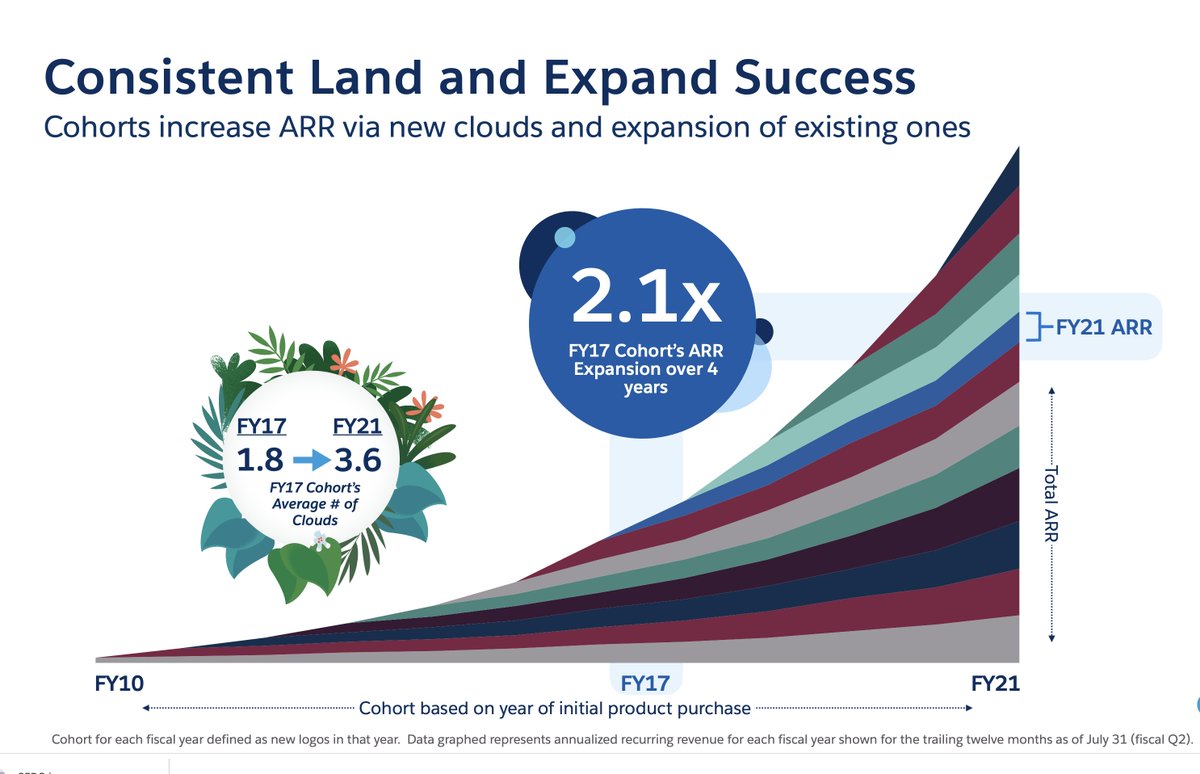

#5. New Products are the next key driven of growth to $500m - $1B ARR.

Needing to have at least one core second product at $1B ARR is a key learning from this series, and Cloudflare has outlined that as part of its key strategy.

Needing to have at least one core second product at $1B ARR is a key learning from this series, and Cloudflare has outlined that as part of its key strategy.

Path to $1B ARR:

1⃣First, acquire a massive base of users & customers

2⃣Second, drive up deal sizes

3⃣Third, sell them more products

1⃣First, acquire a massive base of users & customers

2⃣Second, drive up deal sizes

3⃣Third, sell them more products

• • •

Missing some Tweet in this thread? You can try to

force a refresh