EXTREMELY IMPORTANT INTERVIEW FOR INVESTORS

Especially new ones!

I disagree with most of it, but ULTRA-IMPORTANT!

Here's why

1/

@stevenmarkryan

@jpr007 @stekkerauto @garyblack00 @TeslaBest @iamtomnash @TeslaPodcast @EvaFoxU @WR4NYGov

$TSLA #Investing

Especially new ones!

I disagree with most of it, but ULTRA-IMPORTANT!

Here's why

1/

@stevenmarkryan

@jpr007 @stekkerauto @garyblack00 @TeslaBest @iamtomnash @TeslaPodcast @EvaFoxU @WR4NYGov

$TSLA #Investing

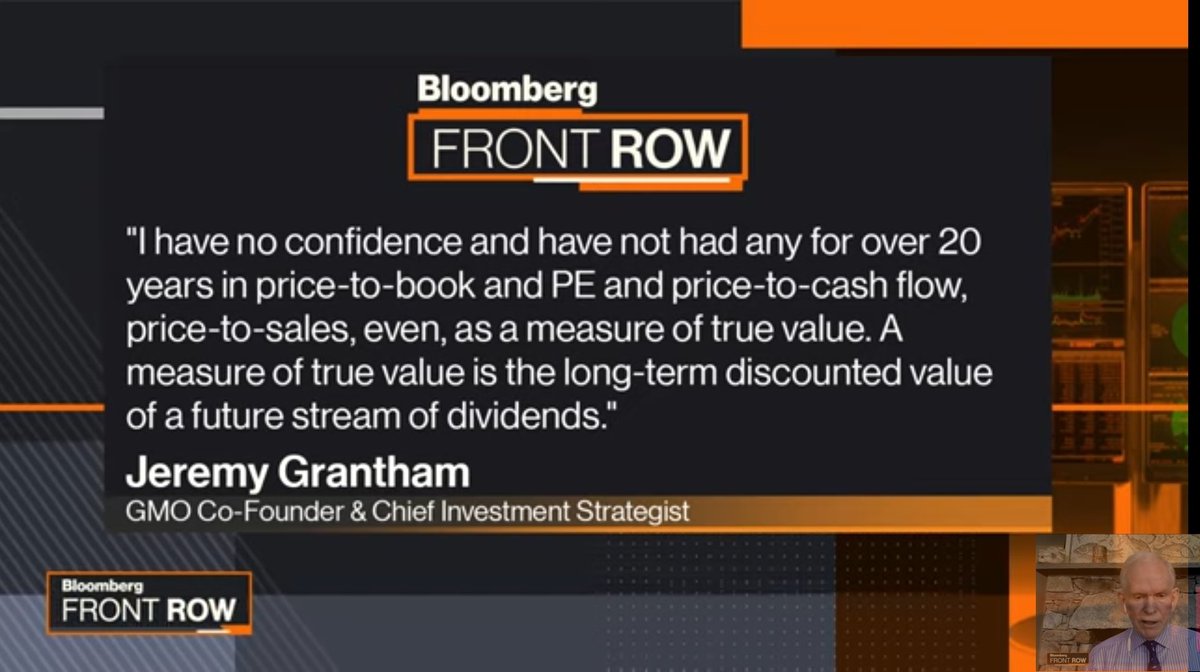

2/ Grantham from GMO is labeled as a value investor, but don't let it fool you. Unlike other "geniuses" he doesn't just check P/E or P/S, but also factors in growth, including possibly huge growth.

Ultimately his preference or bias is for dividend stocks, but he's doing it right

Ultimately his preference or bias is for dividend stocks, but he's doing it right

3/ He sees the current condition as a bubble that should burst in. 2 months - unless further inflated by the fed.

If you disagree don't stop reading. Important!

If you disagree don't stop reading. Important!

4/ Before pointing to where i agree and where i don't, i think it's ULTRA IMPORTANT for investors to hear opposing views, when they have firm grounds

Fine to disagree but bad to just dismiss or ignore - do that and you might lose everything

(that's the only ADVICE i give, BTW)

Fine to disagree but bad to just dismiss or ignore - do that and you might lose everything

(that's the only ADVICE i give, BTW)

5/ Grantham sees the market as a bubble that should burst in. 2 months - unless further inflated by the fed

History shows that on bull mkts once everyone is HUGELY optimistic and put EVERYTHING they have in the mkt, there is nowhere else to go (unless fed gives even more money)

History shows that on bull mkts once everyone is HUGELY optimistic and put EVERYTHING they have in the mkt, there is nowhere else to go (unless fed gives even more money)

6/ He's right on the optimism part.

Bc "The opportunity is too good to miss out" I not only put ALL my savings in stocks, i also borrowed to do so.

I won't sell on bad news, but those leveraged like me who will sell (in panic or margin calls) could lose everything

Bc "The opportunity is too good to miss out" I not only put ALL my savings in stocks, i also borrowed to do so.

I won't sell on bad news, but those leveraged like me who will sell (in panic or margin calls) could lose everything

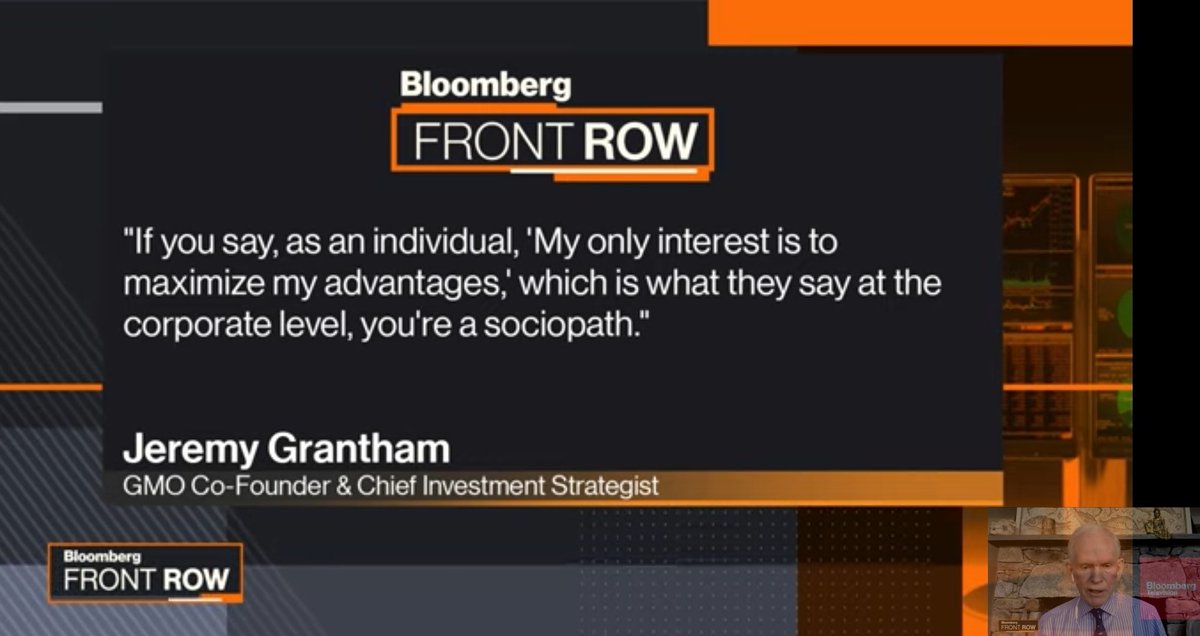

7/ B4 going with what IMO he has right and what very wrong, another pointer that this is no Gordon Johnson.

He invests in clean energy, he believes we should all make the world (not just shareholders) happy,

His analysis is bright, he's just wrong on some assumptions and facts

He invests in clean energy, he believes we should all make the world (not just shareholders) happy,

His analysis is bright, he's just wrong on some assumptions and facts

8/ OK.. He's right in thinking many stocks are a huge bubble inflated by faith. He invested in QuantumScape but admits that a company with no product, no revenues for at least 4years should NOT be larger than GM

He hates SPACs. Much better to make regular IPOs more accessible

He hates SPACs. Much better to make regular IPOs more accessible

9/ We saw how big the $NKLA bubble got before bursting.

We saw Tilman Fertitta roll his Golden Nugget company's debt to the LCA SPAC he also ran that purchased it.

We see vaporware companies getting huge valuations. What happens when they pop?

We saw Tilman Fertitta roll his Golden Nugget company's debt to the LCA SPAC he also ran that purchased it.

We see vaporware companies getting huge valuations. What happens when they pop?

10/ Robin Hooders sometimes see stocks as a money printing machine that never goes down. This is dangerous.

He says that if (artificial) federal bond rates are low, this changes the temptation to invest in companies - but NOT the basic tech and fundamentals of the company

He says that if (artificial) federal bond rates are low, this changes the temptation to invest in companies - but NOT the basic tech and fundamentals of the company

11/ He sees bitcoin as a 0 Dividend stock based on pure faith. You can sell a bitcoin for $1m if someone believes it's worth it; but there's no intrinsic value. No dividend and you can't eat it

Smart interviewer said same true for gold, and Grantham's answer didn't convince 🙂

Smart interviewer said same true for gold, and Grantham's answer didn't convince 🙂

12/ I agree to a lot and will keep watch for warning signs - but more importantly I disagree on the bottom line.

I'm NOT investing in balloon SPACs.

I'm NOT investing in 0-value companies just bc "they're like Tesla"

The only investments I make are in companies ...

I'm NOT investing in balloon SPACs.

I'm NOT investing in 0-value companies just bc "they're like Tesla"

The only investments I make are in companies ...

13/ i only invest in disruptive companies for which i am fairly certain I can calculate a future stream of revenues far higher than what mkt assumes

If cash-Fed 😉 spac/ev bubble explodes, Tesla will still make lotsa cars which will have lotsa demand (Despite lower luxury sales)

If cash-Fed 😉 spac/ev bubble explodes, Tesla will still make lotsa cars which will have lotsa demand (Despite lower luxury sales)

14/ Same for my smaller holdings (FUV, NVX, ARKK, ARKG). They could suffer once the overall party's over, but NOT NEARLY AS MUCH as the bubble stocks

And two years later the dip will be forgotten bc long-term value won't change

That's a risk i'm willing to take 4 current upside

And two years later the dip will be forgotten bc long-term value won't change

That's a risk i'm willing to take 4 current upside

@Vivishkaa @Cosmicstrenght3 @wendishen99 @IamKarsten @WholeMarsBlog @jackfarrington

@LimitingThe @Gfilche

#investing #bullMarket #StockBubble

@threadreaderapp unroll, bro

@LimitingThe @Gfilche

#investing #bullMarket #StockBubble

@threadreaderapp unroll, bro

PS forgot to add he says the way to invest despite the bubble is either emerging markets (ho hum) or RENEWABLE ENERGY companies

Did anyone say Tesla?

Did anyone say Tesla?

• • •

Missing some Tweet in this thread? You can try to

force a refresh