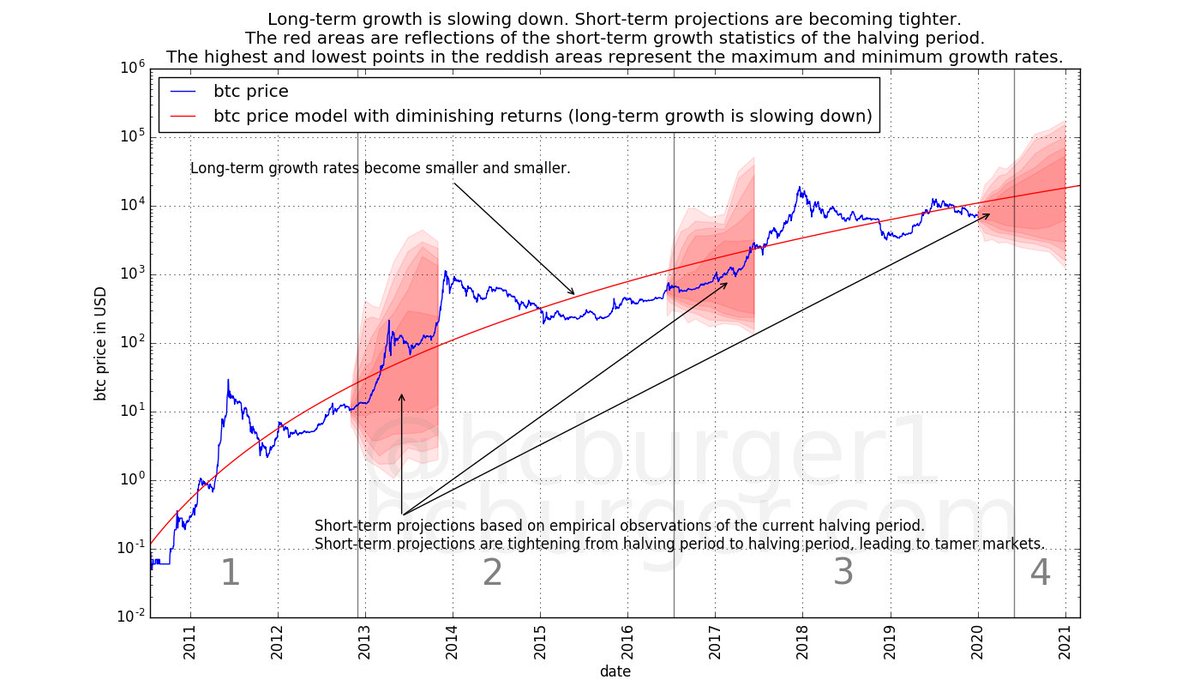

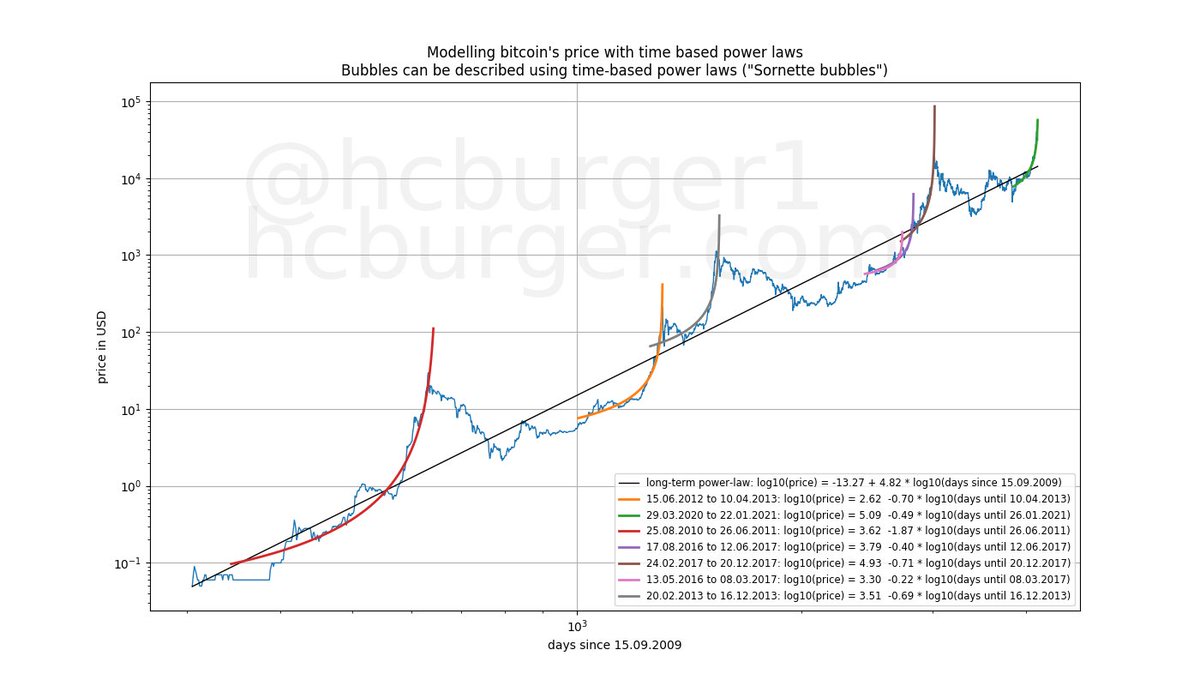

1/ #Bitcoin 's price history is full of time based power laws. Inspired by Sornette et al. I looked for bubbles and anti-bubbles that can be described by power laws.

Plenty of them!

Bubbles and anti-bubbles are short-lived. The long-term power-law governs all of bitcoin's history

Plenty of them!

Bubbles and anti-bubbles are short-lived. The long-term power-law governs all of bitcoin's history

2/ Same plots in log-log scale. #Bitcoin appears to currently be in a bubble. Bubbles ultimately deflate in an anti-bubble.

3/ Sornette models bubbles in financial markets with time based power laws that have a critical time point in the future. Price accelerates rapidly when approaching this critical time point, reaching a singularity at the critical point.

en.wikipedia.org/wiki/Didier_So…

en.wikipedia.org/wiki/Didier_So…

4/ Sornette models bubble deflation ("anti-bubbles") with time based power laws that have a critical time point in the past. The price rapidly drops shortly after this critical time point, and then decreases more slowly.

scholar.google.com/citations?user…

scholar.google.com/citations?user…

5/ Bubbles have a critical time point in the future and a positive slope. Anti-bubbles have a critical time point in the past and a negative slope. Both are unstable and short-lived.

#Bitcoin is the ONLY asset I know of which has a stable and long term time-based power law.

#Bitcoin is the ONLY asset I know of which has a stable and long term time-based power law.

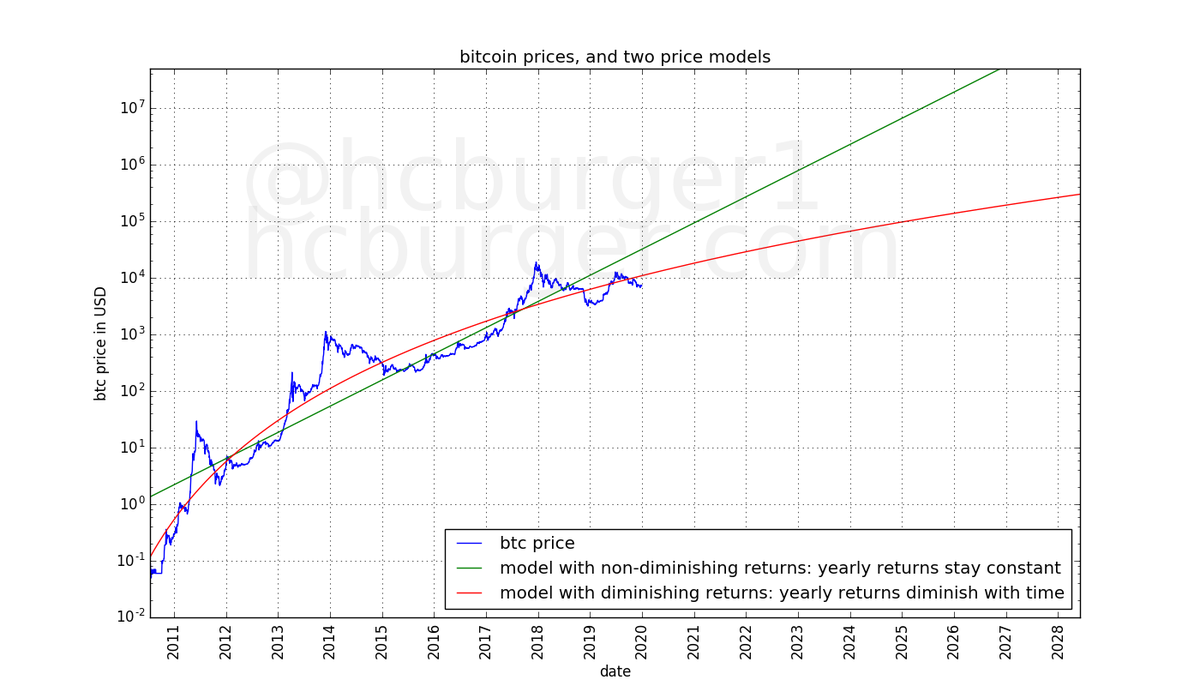

6/ #Bitcoin 's time-based power law: critical time point in the past, slope positive, growth rates decreasing. Stable.

Bubbles: critical time point in the future. Growth rates accelerating. Inherently unstable and short-lived.

Anti-bubbles: critical point in past, negative slope.

Bubbles: critical time point in the future. Growth rates accelerating. Inherently unstable and short-lived.

Anti-bubbles: critical point in past, negative slope.

End/ Sornette uses similar methods to the ones above to make predictions about the future. This is an exercise I left out here.

er.ethz.ch/financial-cris…

Further reading: amazon.com/Why-Stock-Mark…

er.ethz.ch/financial-cris…

Further reading: amazon.com/Why-Stock-Mark…

• • •

Missing some Tweet in this thread? You can try to

force a refresh