medium.com/coinmonks/bitc…

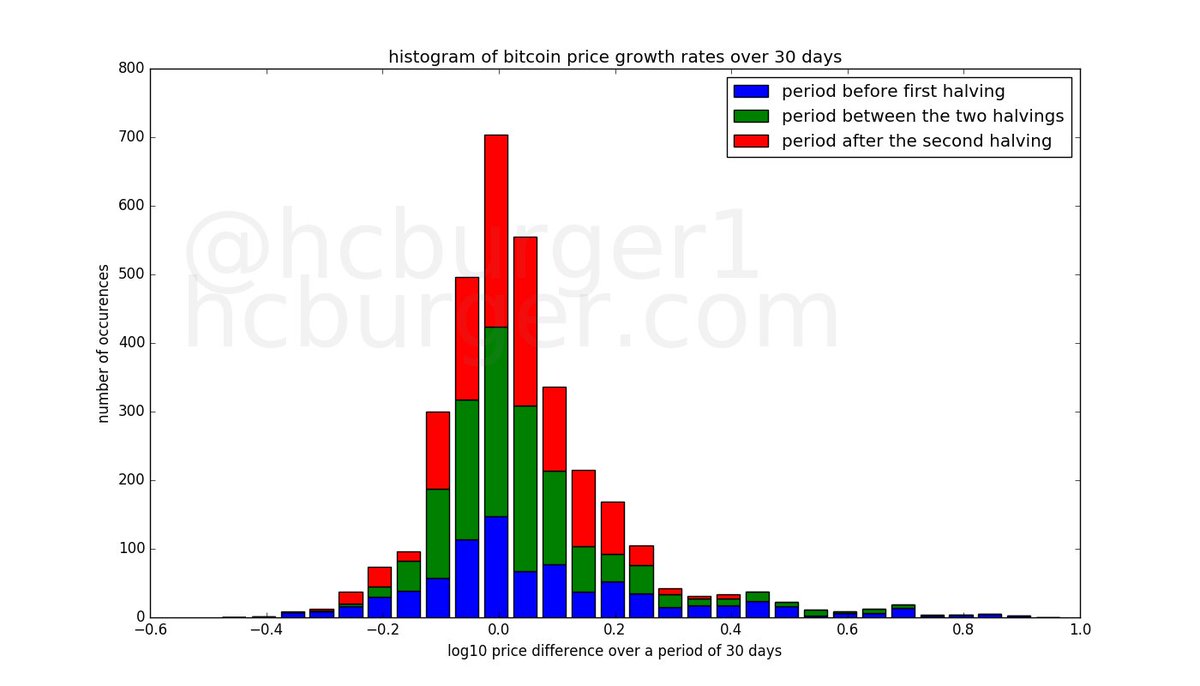

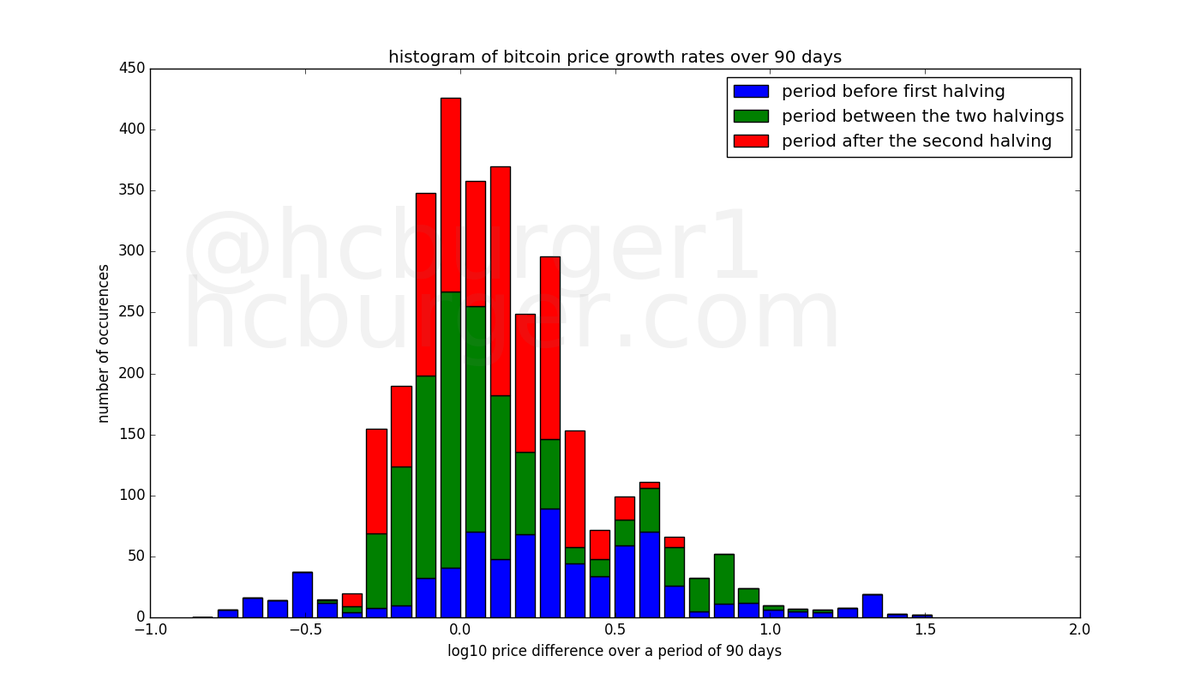

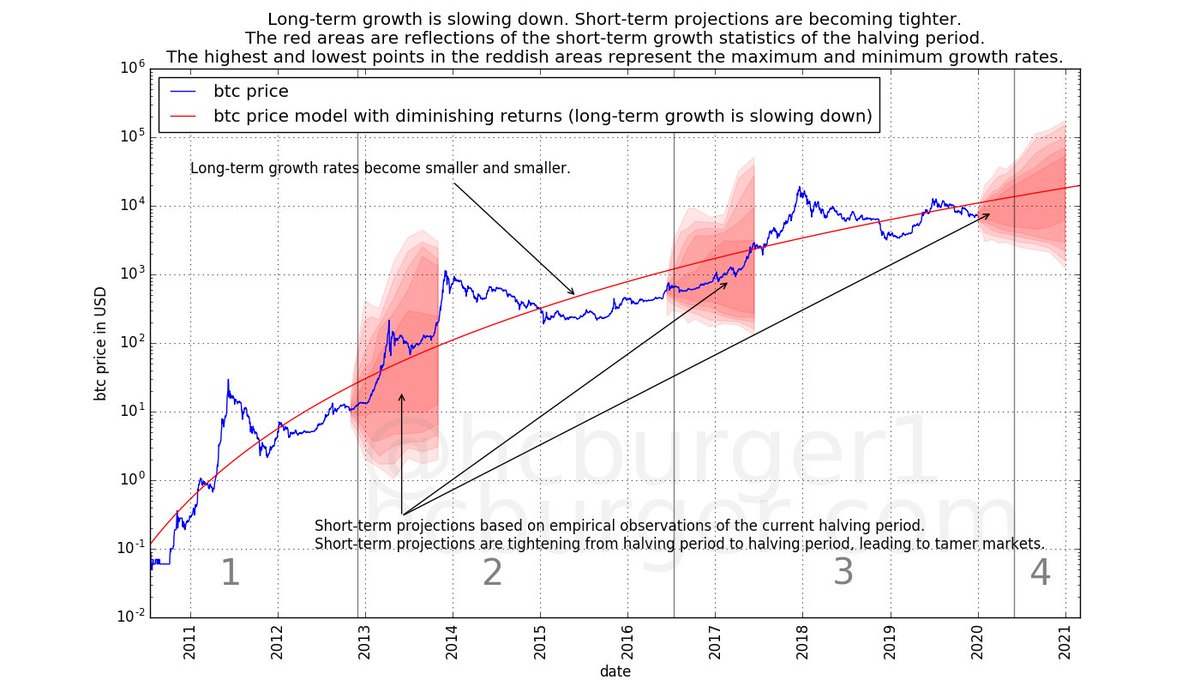

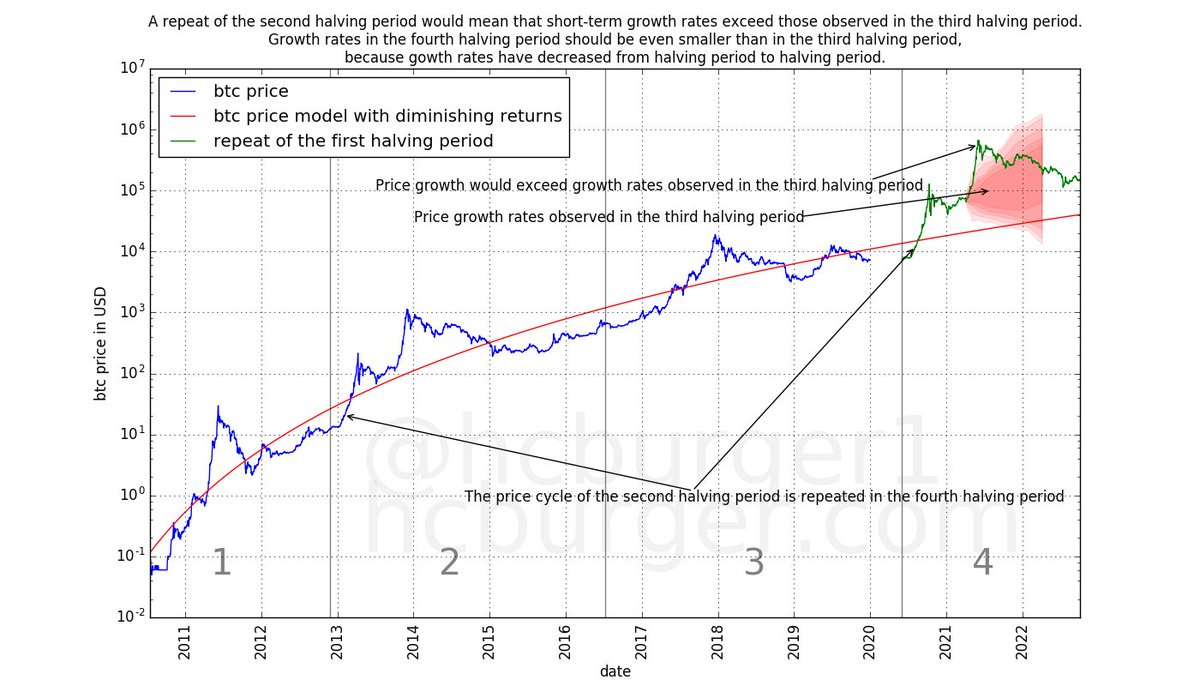

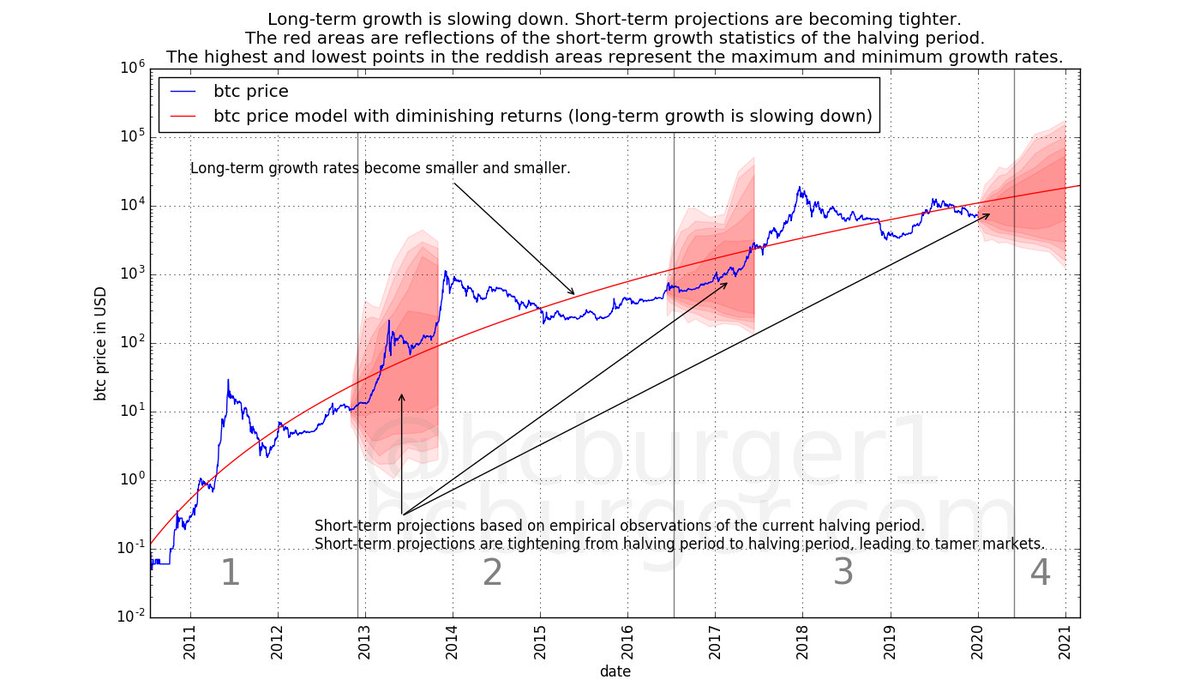

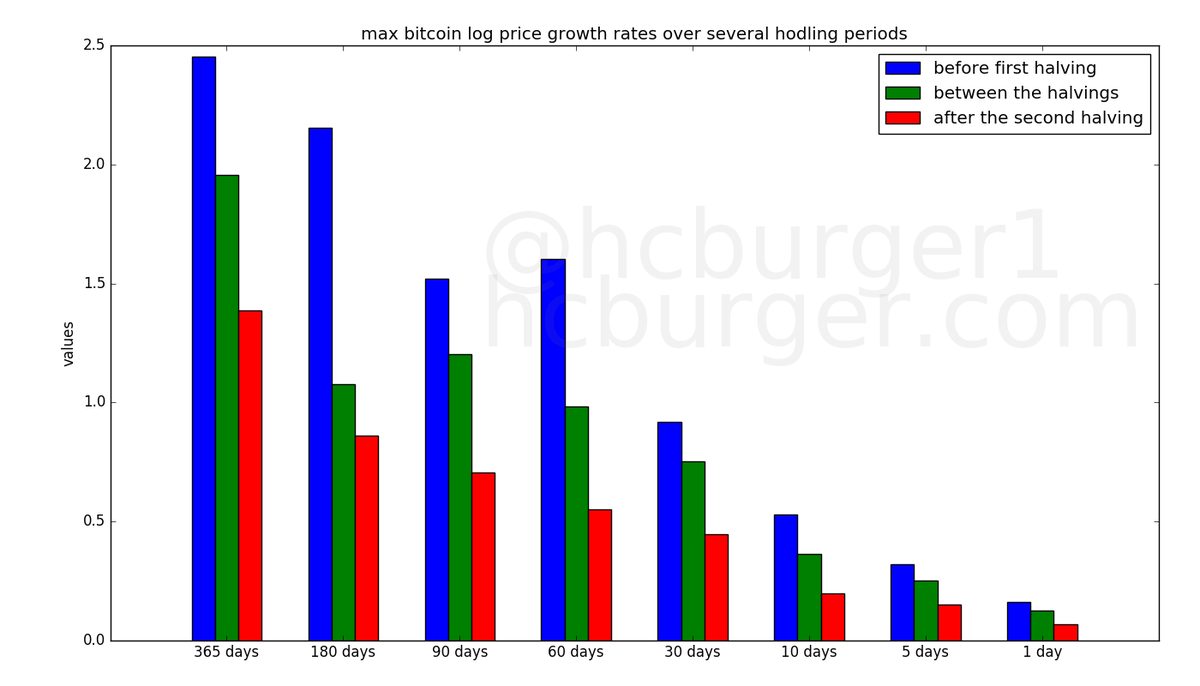

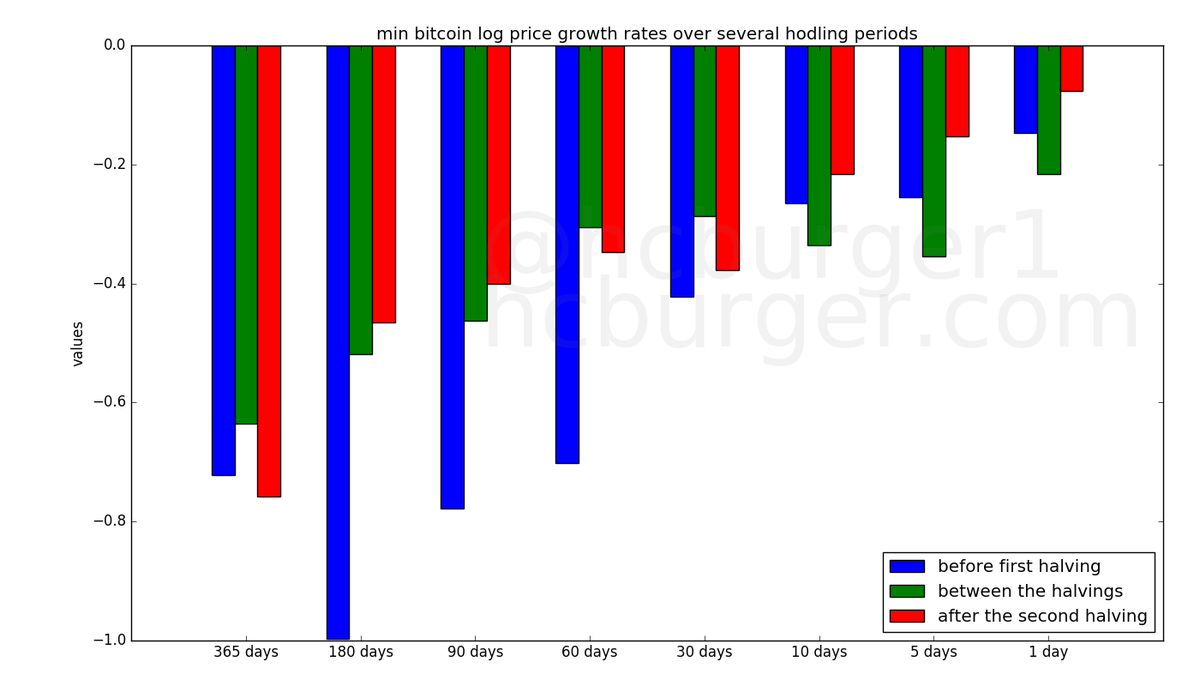

- #btc grows slower and slower, long-term

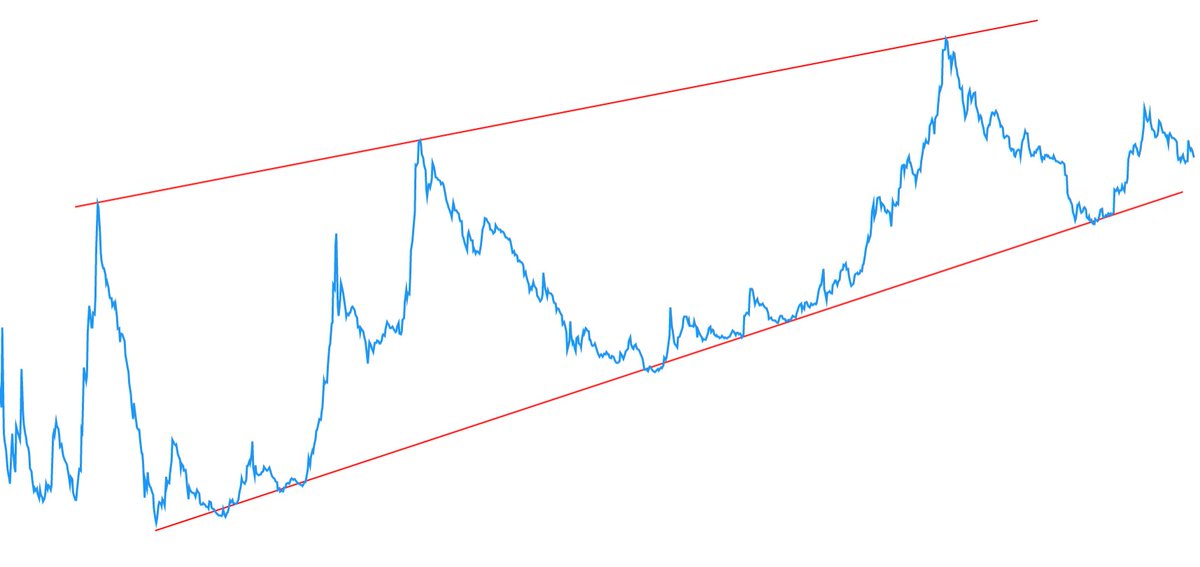

- short-term volatility decreases over time

- these trends should continue in the future due to ever higher capital requirements

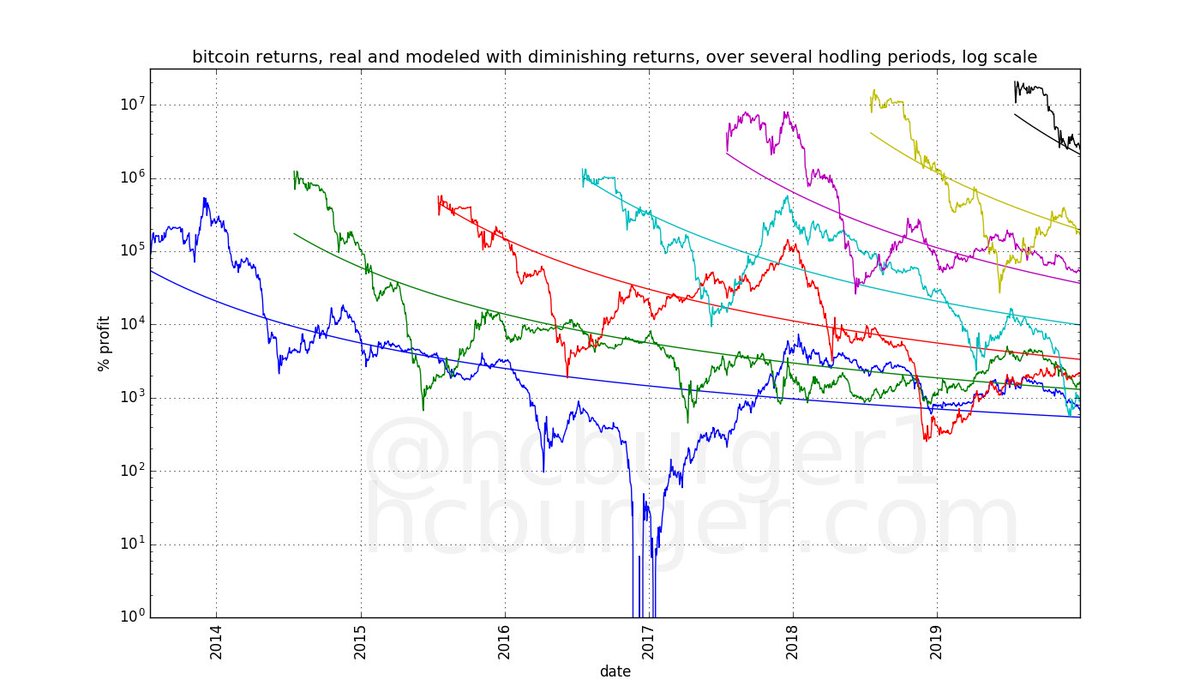

Bitcoin's power-law corridor of growth used diminishing returns. We'll see more evidence for diminishing returns here.

medium.com/coinmonks/bitc…

1. his hodling time (how long he held his btc before selling them)

2. how early on he bought his bitcoin

?

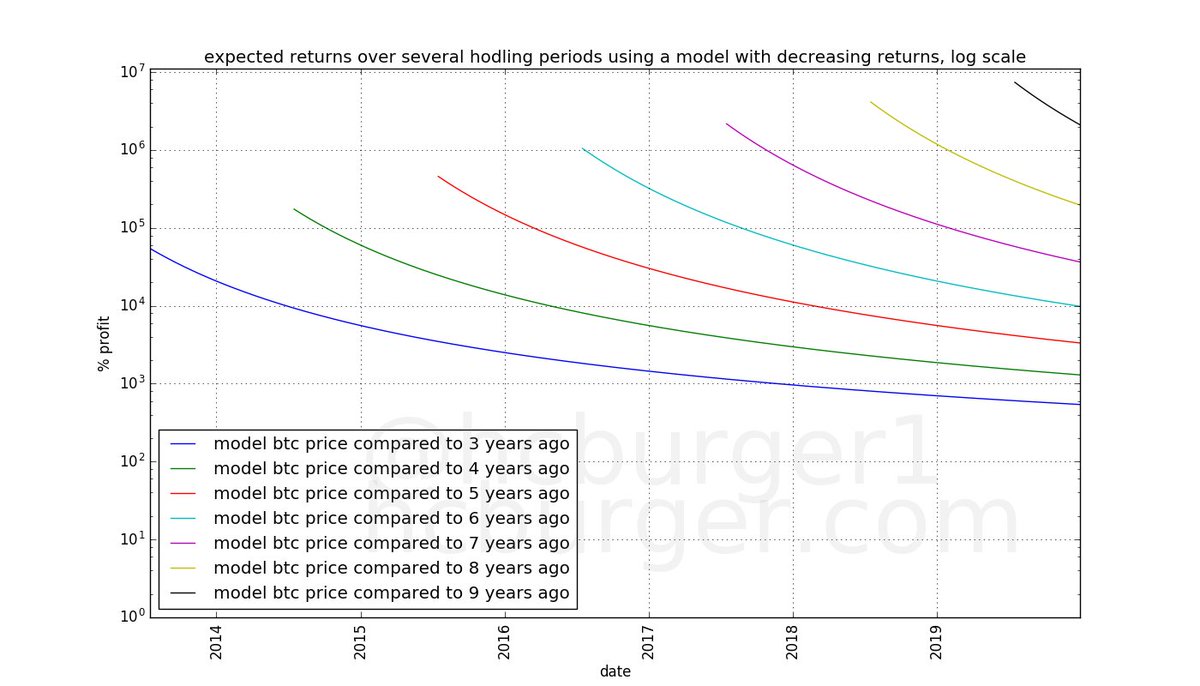

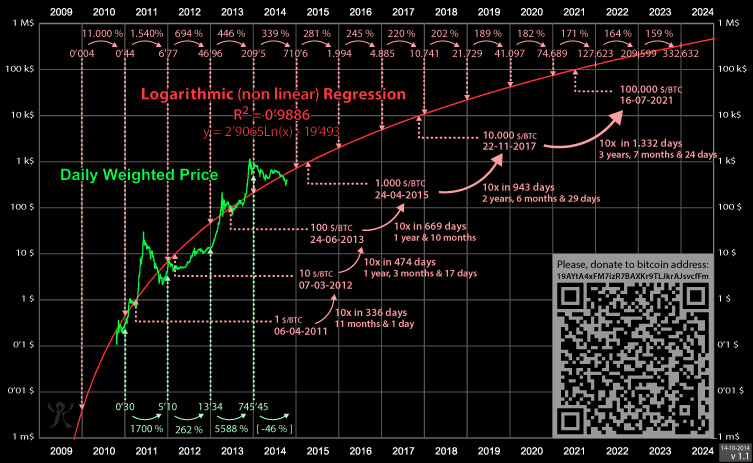

- returns are diminishing over time

- returns are noisy

@gsantostasi has observed this early on:

reddit.com/r/Bitcoin/comm…

#bitcointalk user Trolololo observed this already in 2014:

bitcointalk.org/index.php?topi…

Same conclusion: Short-term price swings are becoming less crazy. Volatility decreases.

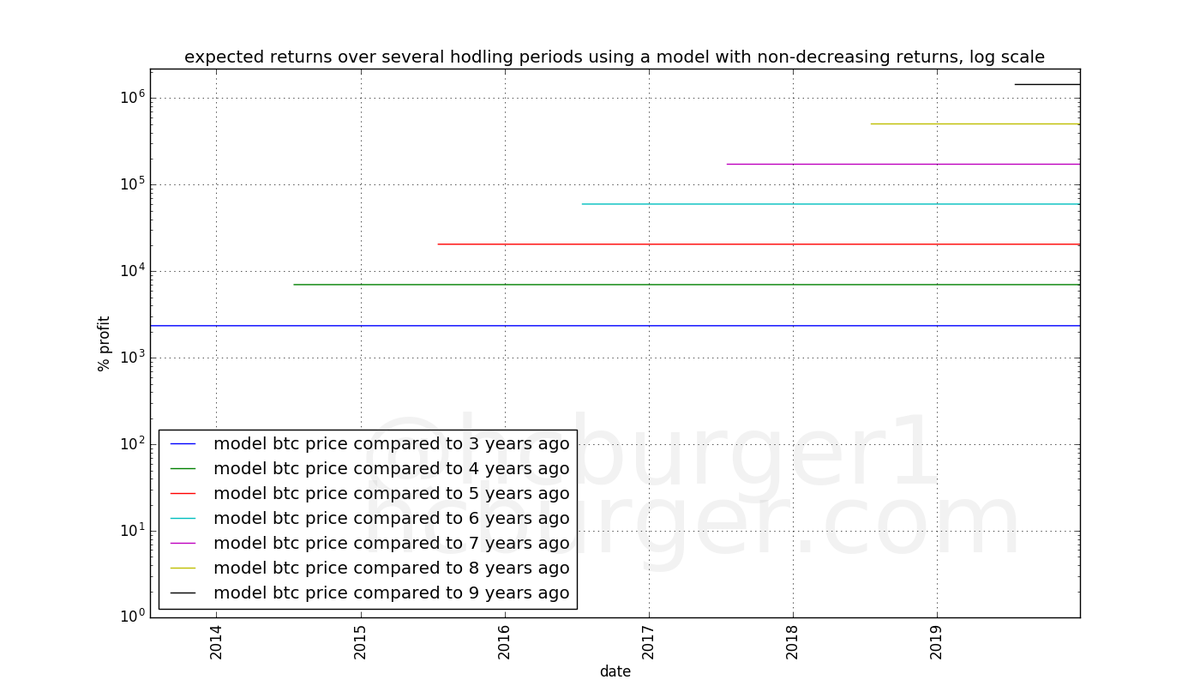

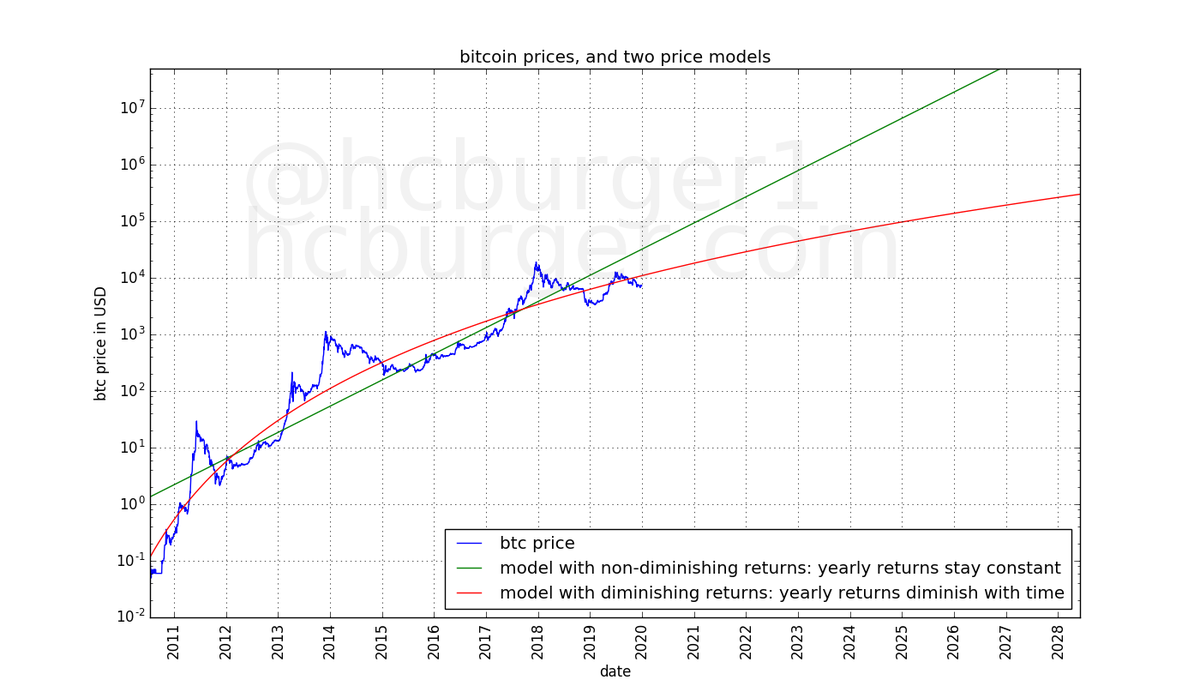

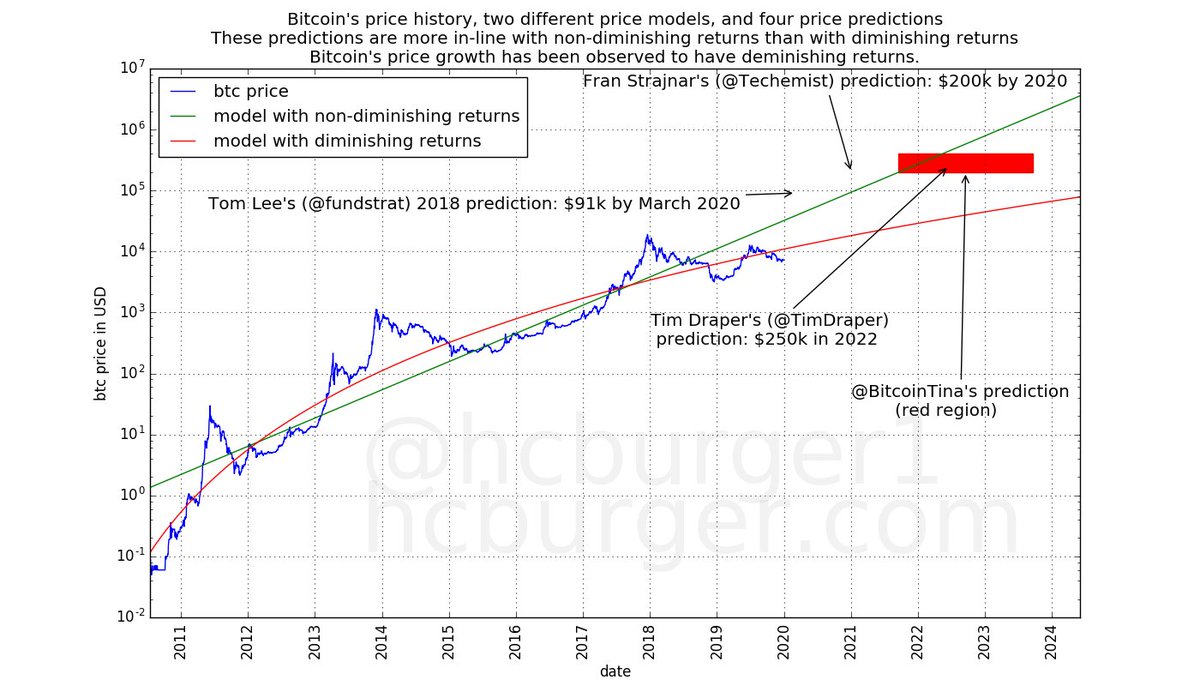

Long-term: Predictions made by some individuals (@bitcointina, @fundstrat) seem to assume NON-diminishing returns, whereas we have observed DIMINISHING returns.

For these predictions to hold, #bitcoin needs to start to have NON-diminishing returns.

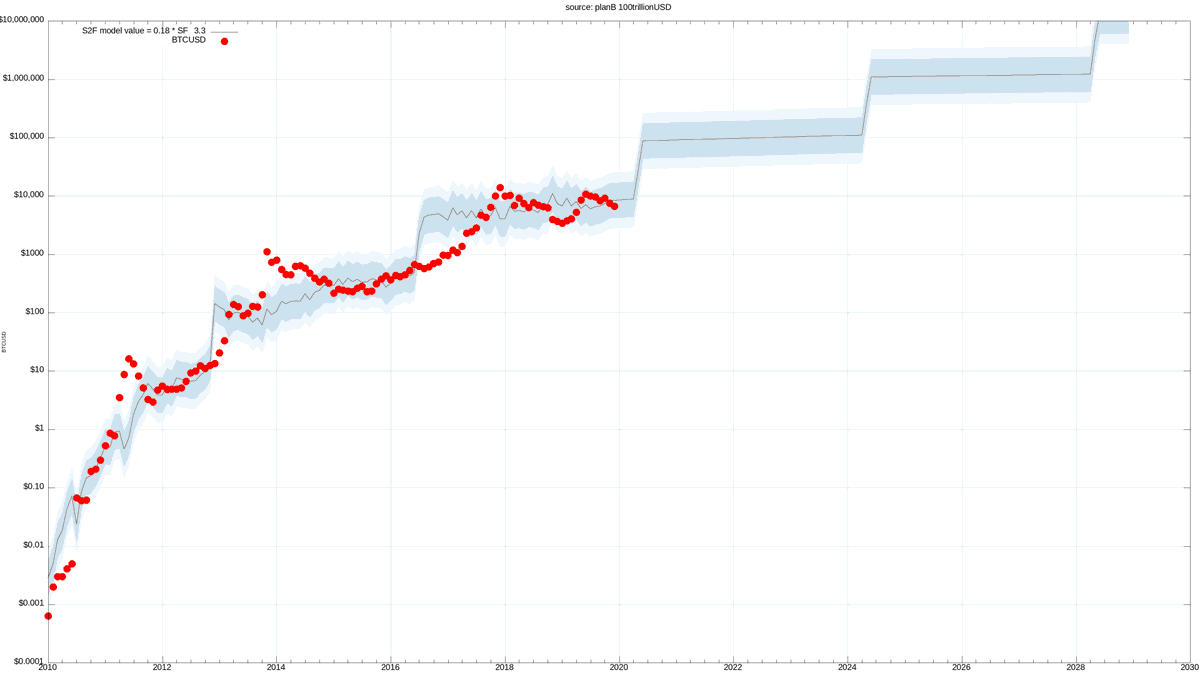

So: for the #S2F model to hold, currently observed return curves need to change (transition to non-diminishing).

We have (so far?) seen no evidence for long-term:

- constant,

- accelerating, or

- S-curve type

growth.

#bitcoin price growth has been diminishing from the beginning of its history.

"As Bitcoin becomes more liquid, it becomes less volatile[...] These subsequent cycles also see the law of diminishing returns coming into effect [...]"

medium.com/max-exchange/b…

"[...] the general principle being that with more liquidity, comes less volatility. Also predictable, [...] is volatility reducing on the over-all long-term macro chart of Bitcoin."

medium.com/max-exchange/m…

- looking at short-term price changes

- seeing how far we can go without (almost) any model.

Thanks guys!

"Bitcoin’s increasing price resistance uphill, short- and long-term"

is also hosted on my personal website:

hcburger.com/blog/diminishi…

- end of thread -