Navin Fluorine conducted their earnings con-call today at 10:00 am

Here are the key highlights 😀👇

#concall

Here are the key highlights 😀👇

#concall

Business Updates:

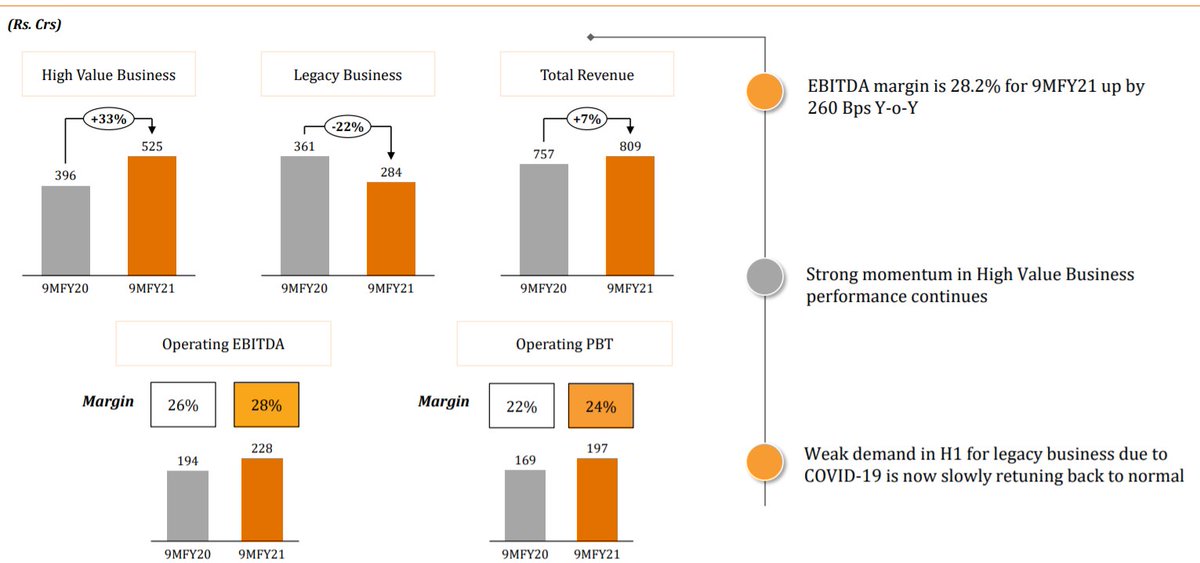

• EBIDTA Margins increased 2.6%

• High value business grew healthy and not contributes 68% of the total revenue.

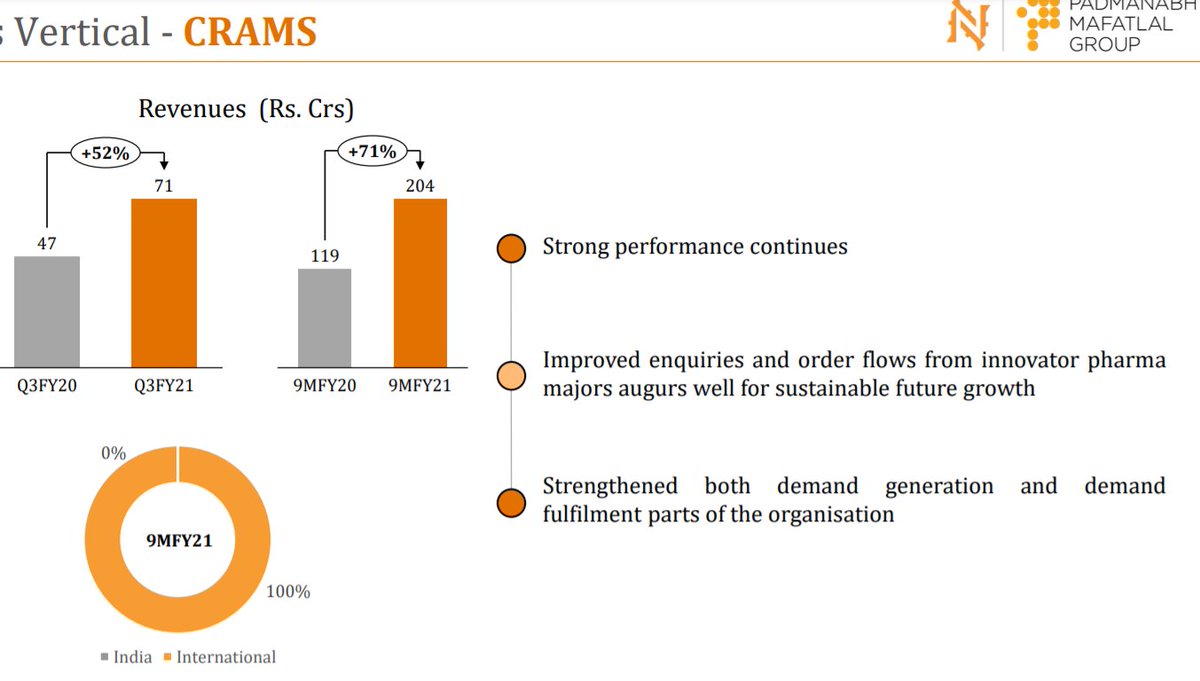

• Crams business grew at 71%YoY while specialty chemicals grew by 16% YoY.

• Refrigerant business degrew by 27%, due to lower volumes.

• EBIDTA Margins increased 2.6%

• High value business grew healthy and not contributes 68% of the total revenue.

• Crams business grew at 71%YoY while specialty chemicals grew by 16% YoY.

• Refrigerant business degrew by 27%, due to lower volumes.

• Company did added new customer.

• JV with Piramal is expected to be completed before April 2021

• Significant business of the company has come from the repeat sales, which was the 1 molecule which delivered good growth.

• JV with Piramal is expected to be completed before April 2021

• Significant business of the company has come from the repeat sales, which was the 1 molecule which delivered good growth.

CRAMS:

• Last CAPEX in Crams was 150cr and total investment of 450 crores.

• Target for cGMP was asset turnover of around 2-2.5, which is the target of the product.

• There is potential utilization left for the plant and company expects to reach the target in the next 2 year.

• Last CAPEX in Crams was 150cr and total investment of 450 crores.

• Target for cGMP was asset turnover of around 2-2.5, which is the target of the product.

• There is potential utilization left for the plant and company expects to reach the target in the next 2 year.

CRAMS:

• Company is seeing good growth from new customer.

• There are other molecules in the pipeline as well but company ensure that product has good market demand in order to start the production.

• Company is not at optimum utlization

• Company is seeing good growth from new customer.

• There are other molecules in the pipeline as well but company ensure that product has good market demand in order to start the production.

• Company is not at optimum utlization

Inorganic Chemical:

• Company expects the same growth in the next quarter and next year is expected to grow is 10+%

• Company has acquired 2 big customers which are expected to deliver good growth. 1 customer is of India and one outside

• This will help the inorganic business

• Company expects the same growth in the next quarter and next year is expected to grow is 10+%

• Company has acquired 2 big customers which are expected to deliver good growth. 1 customer is of India and one outside

• This will help the inorganic business

Pipeline:

• 1 molecule is expected to grow well contributing the sales in Europe and America market.

• While there are other 2 molecule which are expected to grow well.

• 1 molecule is expected to grow well contributing the sales in Europe and America market.

• While there are other 2 molecule which are expected to grow well.

Manchester Organics:

• Currently there is lockdown, hence staff is very minimal.

• Focus of the team of there has shifted bit, but company is thinking to expand the R&D facility and also expand Kilo Labs facility.

• Currently there is lockdown, hence staff is very minimal.

• Focus of the team of there has shifted bit, but company is thinking to expand the R&D facility and also expand Kilo Labs facility.

CAPEX:

• For CRAMS, company will wait for the market demand and then think of expanding.

• For Specialty Chemical, it takes 9-10 months to come up for new facility.

• New plant comes after inquiry with the customers, clarity of demand from the customers and then add new plant

• For CRAMS, company will wait for the market demand and then think of expanding.

• For Specialty Chemical, it takes 9-10 months to come up for new facility.

• New plant comes after inquiry with the customers, clarity of demand from the customers and then add new plant

Focus:

• Current focus of CRAMS is to stabilize the business and stabilize the sales.

Pipeline:

• There are 20-25 molecules in pipeline.

• Company has about 15 qualified molecules in the pipeline.

• Currently company has 25 molecule in the manufacturing.

• Current focus of CRAMS is to stabilize the business and stabilize the sales.

Pipeline:

• There are 20-25 molecules in pipeline.

• Company has about 15 qualified molecules in the pipeline.

• Currently company has 25 molecule in the manufacturing.

Refrigerant:

• Current 9 months volumes has been significantly dip due to slowdown in the market.

• Dip has happen in non-emissive side.

• Decrease in demand, resulted in decline in volume.

• 20% of the sales comes from non-emissive side and company

• Current 9 months volumes has been significantly dip due to slowdown in the market.

• Dip has happen in non-emissive side.

• Decrease in demand, resulted in decline in volume.

• 20% of the sales comes from non-emissive side and company

• New customer are majorly fluorine business.

• Specialty Chemical business is expected to grow at around 20% for next year.

• Specialty Chemical business is expected to grow at around 20% for next year.

Margins of new molecule:

As new molecules margins tend to decline and then subsequently moves up.

Hence focus remains to maintain the opex margins and then increase gradually. But this may not function on quarter wise.

As new molecules margins tend to decline and then subsequently moves up.

Hence focus remains to maintain the opex margins and then increase gradually. But this may not function on quarter wise.

PEL deal with convergence chemical:

• This is a separate business with Navin has 49% stake.

• Both will focus on their business technology.

• PEL can use the technology design by the Navin for their manufacturing while Navin can also work on other molecule from the technology

• This is a separate business with Navin has 49% stake.

• Both will focus on their business technology.

• PEL can use the technology design by the Navin for their manufacturing while Navin can also work on other molecule from the technology

Fear of selecting molecue:

• Selecting the wrong opportunity. Should see that company is not stuck with the false enquiry.

• Ensure that the organization is able to deliver the opportunity in a discipline manner.

• Company maintain their capital prudent.

• Selecting the wrong opportunity. Should see that company is not stuck with the false enquiry.

• Ensure that the organization is able to deliver the opportunity in a discipline manner.

• Company maintain their capital prudent.

• • •

Missing some Tweet in this thread? You can try to

force a refresh