With $GME hitting all time highs, making people millions & some even billions, let's take a look at one of the gaming companies set to IPO soon.

Time for a thread 👇 👇👇

Time for a thread 👇 👇👇

1/ Roblox is like the world’s largest:

🏨 HOTEL COMPANY #AirBnB 👉 doesn’t own real estate

🚕 TAXI COMPANY #Uber 👉 doesn’t own any cars

AND

🎮 DIGITAL PLAYGROUND COMPANY #Roblox 👉 doesn’t create any games

🏨 HOTEL COMPANY #AirBnB 👉 doesn’t own real estate

🚕 TAXI COMPANY #Uber 👉 doesn’t own any cars

AND

🎮 DIGITAL PLAYGROUND COMPANY #Roblox 👉 doesn’t create any games

2/ Digital Disney World.

Remember building imaginary forts with your friends in your backyard?

It's like that except digital, pros are building the structures and your parents are spending a lot of $$$ buying gear, digital pets and accessories.

Making $RBLX very rich!

Remember building imaginary forts with your friends in your backyard?

It's like that except digital, pros are building the structures and your parents are spending a lot of $$$ buying gear, digital pets and accessories.

Making $RBLX very rich!

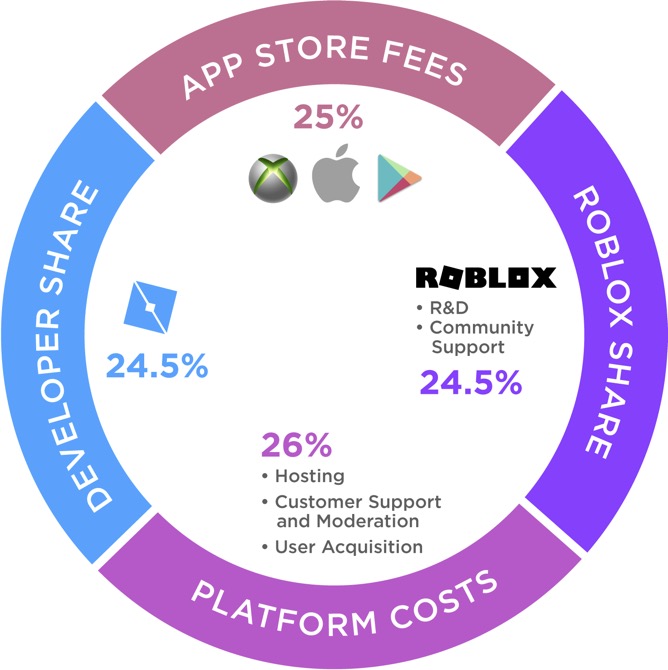

3/ Business Model.

Online gaming platform where millions of kids (and some adults) come to play, learn, communicate, explore, and expand their friendships.

All in 3D digital worlds that are entirely user-built.

Online gaming platform where millions of kids (and some adults) come to play, learn, communicate, explore, and expand their friendships.

All in 3D digital worlds that are entirely user-built.

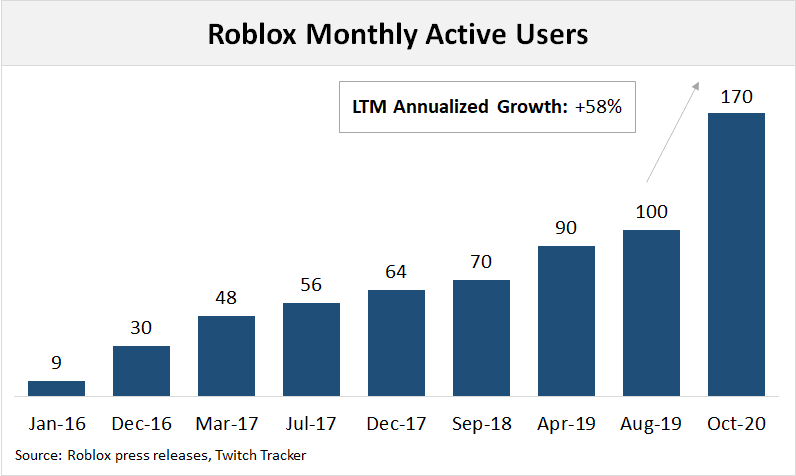

4/ Highlights.

- Founded in 2004

- $589MM revenue

- +170MM monthly active users (Oct 2020)

- Freemium, monthly subscription & one-time payments

- US$29.5B Valuation

- Founded in 2004

- $589MM revenue

- +170MM monthly active users (Oct 2020)

- Freemium, monthly subscription & one-time payments

- US$29.5B Valuation

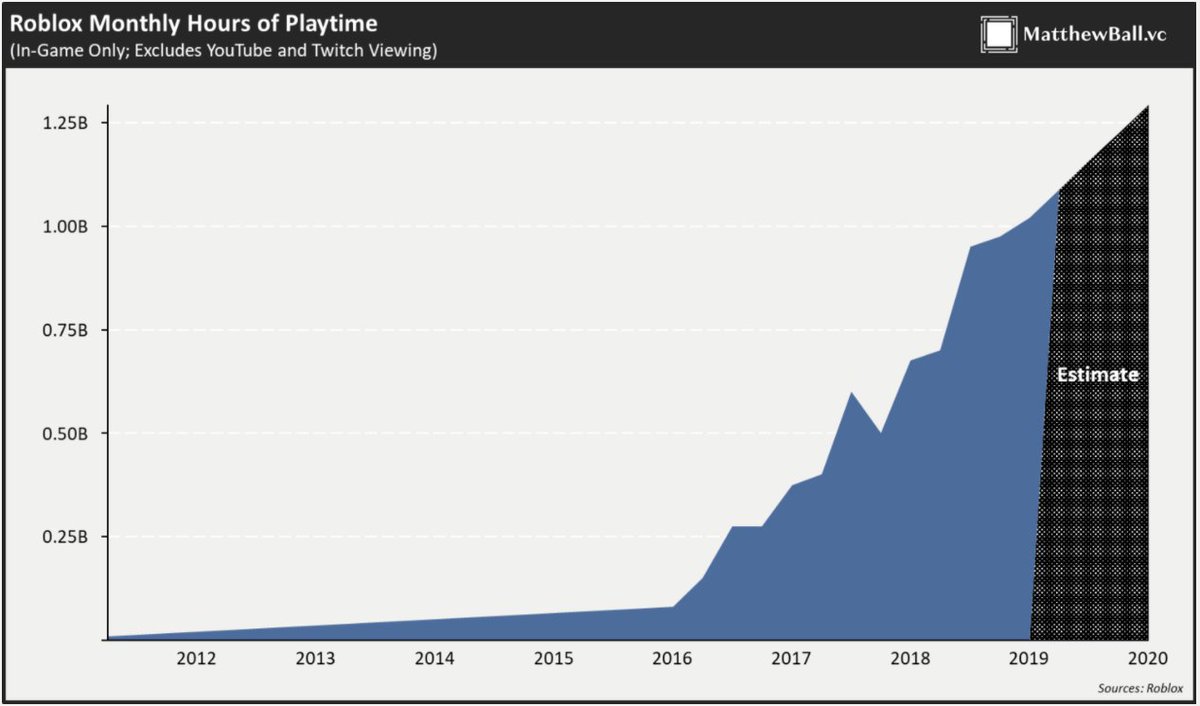

5/ Growth.

No doubt COVID was big for $RBLX; with kids stuck at home they clocked some serious hours.

Revenue was up +68% year-over-year to +$588MM (9 months ended Sept 2020).

But, even pre-covid, the trend was their friend as NEW users flocked to the platform!

No doubt COVID was big for $RBLX; with kids stuck at home they clocked some serious hours.

Revenue was up +68% year-over-year to +$588MM (9 months ended Sept 2020).

But, even pre-covid, the trend was their friend as NEW users flocked to the platform!

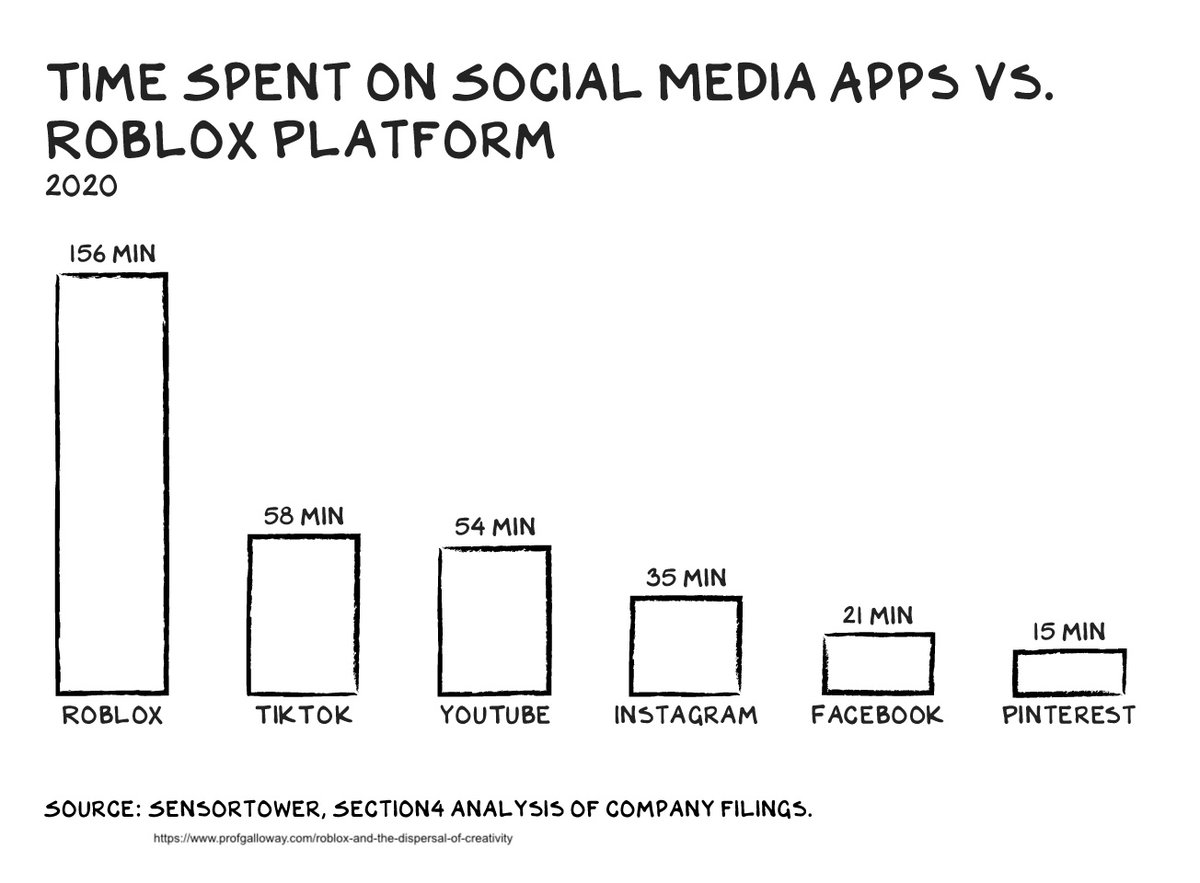

7/ Addiction.

And they are completely addicted. Compare $RBLX to the other MAJOR platforms that compete for our attention and it’s absolutely jaw dropping!

And they are completely addicted. Compare $RBLX to the other MAJOR platforms that compete for our attention and it’s absolutely jaw dropping!

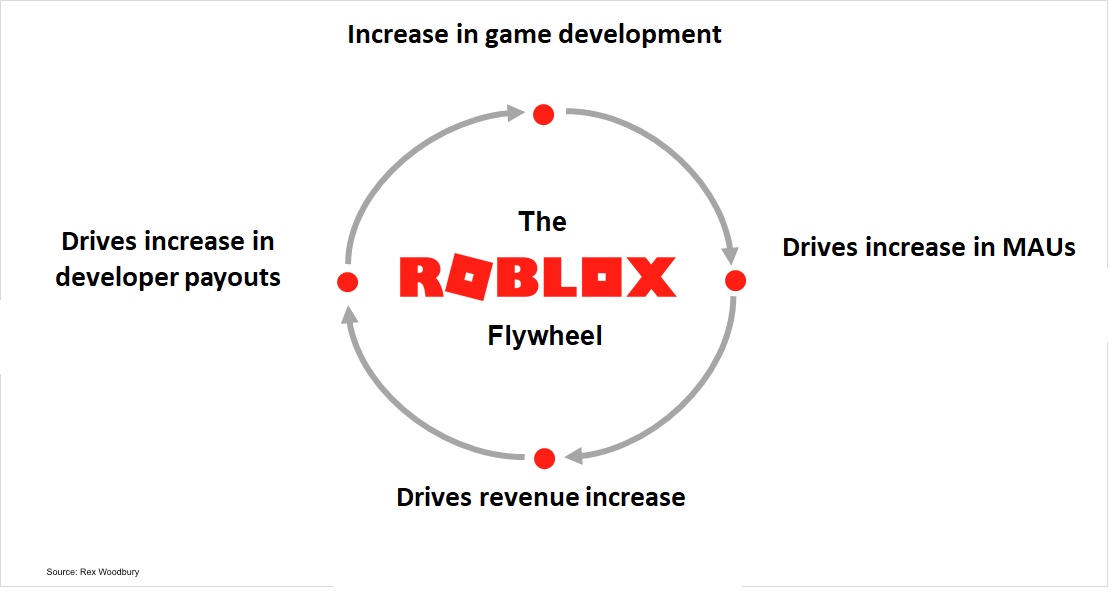

8/ Flywheel.

That’s because they’ve nailed the ‘Holy Grail’ of the platform economy: getting customers addicted!

Attract CUSTOMERS ↔️ which attracts DEVELOPERS who create great content ↔️ Attracting More CUSTOMERS

That’s because they’ve nailed the ‘Holy Grail’ of the platform economy: getting customers addicted!

Attract CUSTOMERS ↔️ which attracts DEVELOPERS who create great content ↔️ Attracting More CUSTOMERS

9/ Developers.

To keep content quality high, their customers coming back and the flywheel spinning, they share a decent amount of their revenue with their developers: +$250MM in 2020.

This has attracted an astonishing +7MM developers!

To keep content quality high, their customers coming back and the flywheel spinning, they share a decent amount of their revenue with their developers: +$250MM in 2020.

This has attracted an astonishing +7MM developers!

10/ Developer cont.

BUT, this is only a 25% payout of revenue to developers. If you compare it to other marketplaces its not a lot:

70%: Apple App Store

75-85%: Amazon (similar to Walmart)

95%: Etsy

Sustaining such a high ‘take-rate’ is insanely impressive for $RBLX

BUT, this is only a 25% payout of revenue to developers. If you compare it to other marketplaces its not a lot:

70%: Apple App Store

75-85%: Amazon (similar to Walmart)

95%: Etsy

Sustaining such a high ‘take-rate’ is insanely impressive for $RBLX

11/ ROBUX.

Is the 'in-game’ currency that powers the ecosystem. It costs real fiat to buy. Customers use it to BUY:

- Games

- Virtual Items

- Animations & Unique Abilities

Fanatic customers are even saying "Robux will replace the USD" ; )

Is the 'in-game’ currency that powers the ecosystem. It costs real fiat to buy. Customers use it to BUY:

- Games

- Virtual Items

- Animations & Unique Abilities

Fanatic customers are even saying "Robux will replace the USD" ; )

12/ Profitability.

Do they actually make money?

Technically, on paper, NO.

Net loss of $203.2MM in the 9 months ended September 30, 2020.

BUT...

Do they actually make money?

Technically, on paper, NO.

Net loss of $203.2MM in the 9 months ended September 30, 2020.

BUT...

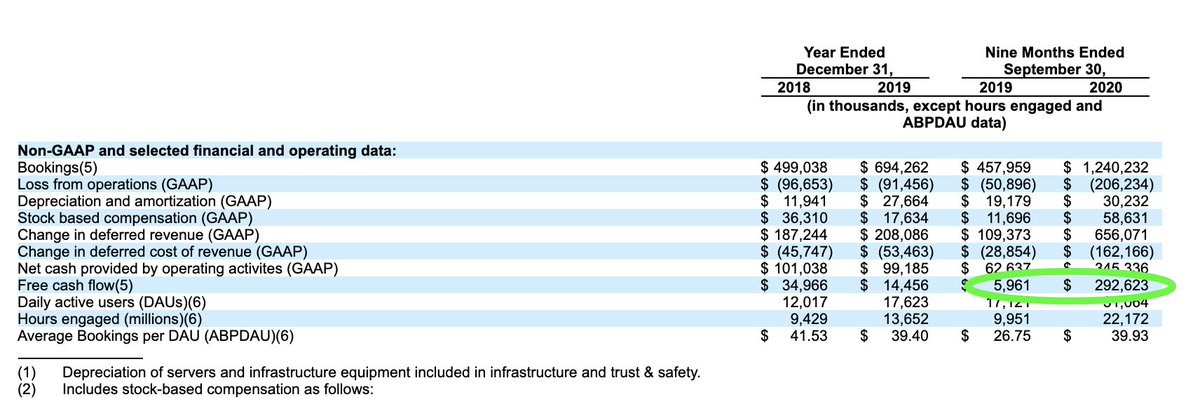

14/ Free Cash Flow.

If you look at their FCF its skyrocketing: $292MM up from a mere $5.9MM the year before.

CA$HING!

If you look at their FCF its skyrocketing: $292MM up from a mere $5.9MM the year before.

CA$HING!

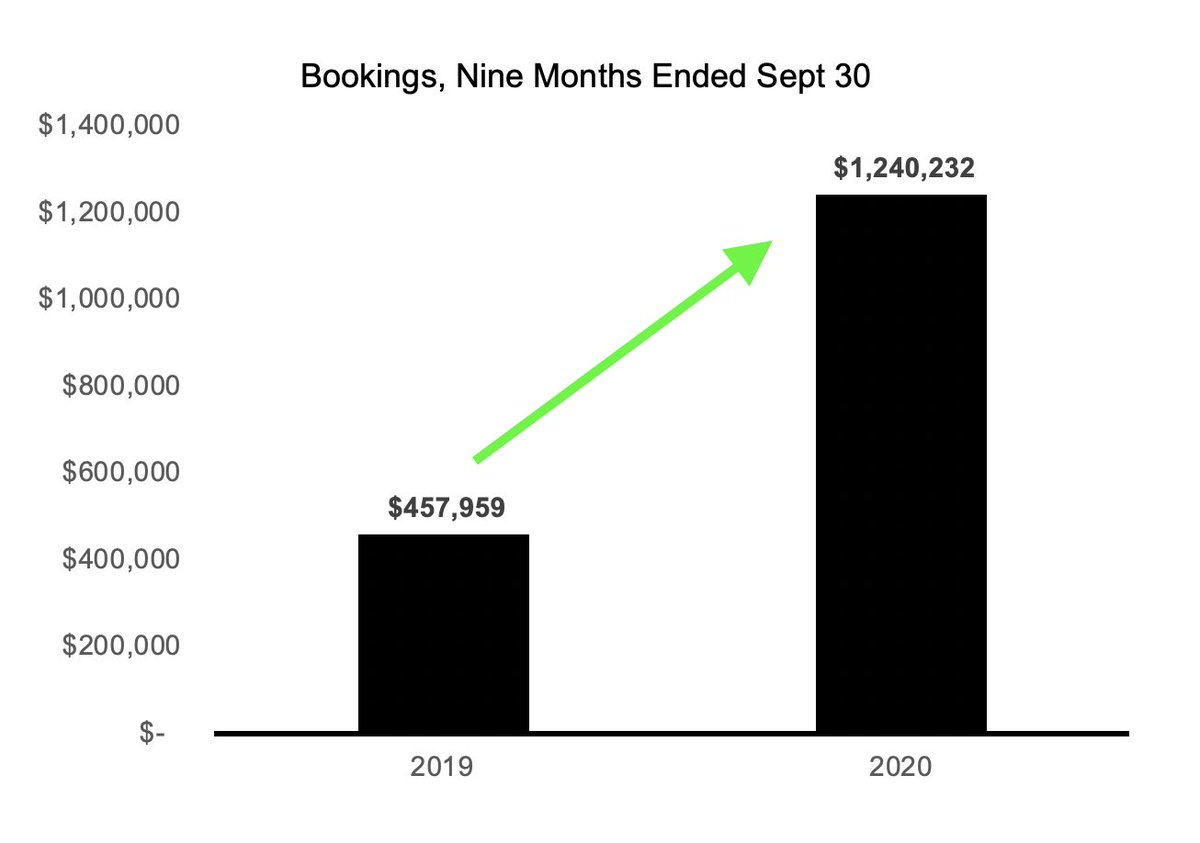

15/ Bookings.

You can see it in their bookings, which grew +170% YoY.

So why a net loss with such high FCF?

Because although the money is “in the door”, they recognize it over 23 months (estimated average lifetime of a paying user)

You can see it in their bookings, which grew +170% YoY.

So why a net loss with such high FCF?

Because although the money is “in the door”, they recognize it over 23 months (estimated average lifetime of a paying user)

16/ Balance Sheet.

You can see the cash piling up over on their balance sheet:

-NO DEBT ($50MM undrawn line)

- +$800MM cash (at Sept 2020)

Plus, on Jan 7th they raised another US$520MM in a pre-IPO financing.

You can see the cash piling up over on their balance sheet:

-NO DEBT ($50MM undrawn line)

- +$800MM cash (at Sept 2020)

Plus, on Jan 7th they raised another US$520MM in a pre-IPO financing.

17/ Competitors

While 99% of the public will say Roblox's biggest public "competitor" is Unity Software (U-US, $39B). I argue that is a false narrative beyond investors bucketing them as "gaming" companies.

But $U has done very well. Up +300% since its #IPO in September.

While 99% of the public will say Roblox's biggest public "competitor" is Unity Software (U-US, $39B). I argue that is a false narrative beyond investors bucketing them as "gaming" companies.

But $U has done very well. Up +300% since its #IPO in September.

18/ Competitors Cont.

The 2 more appropriate competitors are both private and booth owned by major companies:

- Minecraft 130MM active users

- Fortnite 350MM active users

Roblox is giving them a real run for their money with +170MM active users as of October 2020.

The 2 more appropriate competitors are both private and booth owned by major companies:

- Minecraft 130MM active users

- Fortnite 350MM active users

Roblox is giving them a real run for their money with +170MM active users as of October 2020.

19/ Growth.

I see 4 key growth drivers that could yielding hundreds of millions of dollars:

1.Advertising

2.Cross-Over JVs

3.Subscriptions

4.Asia Expansion

I see 4 key growth drivers that could yielding hundreds of millions of dollars:

1.Advertising

2.Cross-Over JVs

3.Subscriptions

4.Asia Expansion

20/ Love the thread?

Want more on $RBLX ?

- Growth

- Risks

- Valuation

- Should you buy on the IPO?

Read the rest here in my (FREE) weekly newsletter 👇 👇👇

gritcapital.substack.com/p/want-to-play…

#Gaming #Stocks #NASDAQ

Want more on $RBLX ?

- Growth

- Risks

- Valuation

- Should you buy on the IPO?

Read the rest here in my (FREE) weekly newsletter 👇 👇👇

gritcapital.substack.com/p/want-to-play…

#Gaming #Stocks #NASDAQ

Huge validation on my analysis by one of the biggest shareholders of $RBLX “I was impressed by your analysis of RBLX. So many reporters and analysts got it wrong, especially on the cash flow vs GAAP. We’ve been investors for 13 years and still view this as just the beginning...”

• • •

Missing some Tweet in this thread? You can try to

force a refresh