A thread summarizing "Sovereignism Part 1: Digital Creative Destruction"

My 12-part essay series explores the digital disruption of the nation-state and the subsequent amplification of individual sovereignty during the digital age.

swanbitcoin.com/sovereignism-p…

Let's dive in ⬇️

My 12-part essay series explores the digital disruption of the nation-state and the subsequent amplification of individual sovereignty during the digital age.

swanbitcoin.com/sovereignism-p…

Let's dive in ⬇️

Statism is a system of socioeconomic organization which originated in the Industrial Age. Statism includes all state implementations of capitalism, communism, fascism, and all other state ‑isms; it does not refer to these ideologies in any pure sense.

Statist implementations arose in the 20th century, when the only known mode of sustainable human organization was a top-down, centrally controlled nation-state.

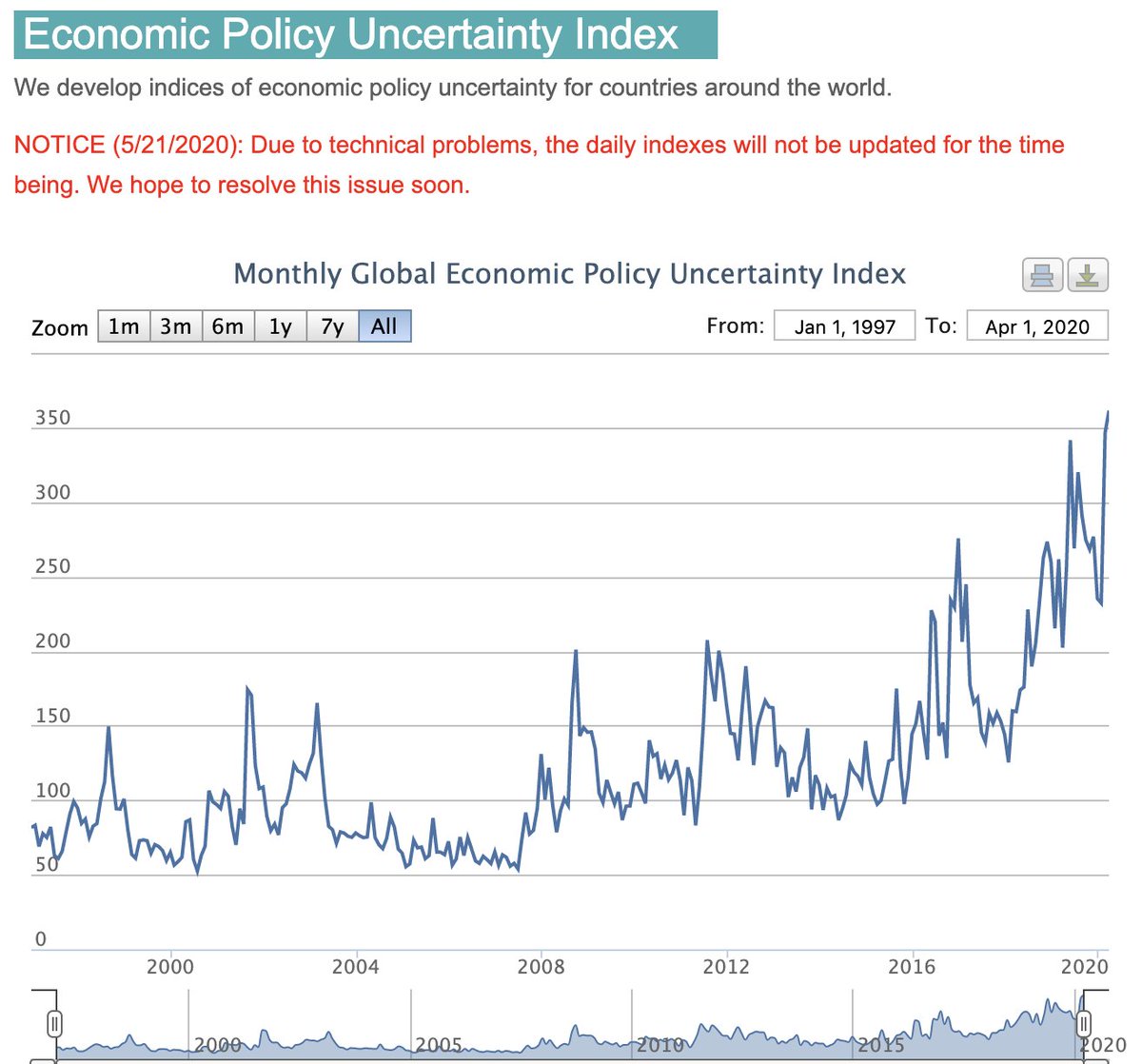

In the 21st century, digitization is devouring every inefficient technological implementation: from media and dating, to advertising and travel. In the sphere of statism, digital tools are antiquating analog nation-states by radically empowering individuals.

20th century capitalism triumphing over communism is the classic Schumpterian process of “creative destruction,” where innovation obsoletes older and less energy efficient tools and systems, liberating energy for allocation to other aims.

Tools are systems are similar. As a socioeconomic system, capitalism allocates energy more intelligently than communism. Organizational wellbeing is maximized when individual sovereignty is prioritized. Capitalism did this well, but was hampered by state intervention.

Stopping the allocation of human energy into “management of” (more accurately, politicking over the power to manage) the money supply, mankind liberates his energies to construct more robust socioeconomic structures on the unshakable foundation of immutable money.

Bitcoin is a momentous monetary innovation enabling a new mode of non-nation-state human organization, a “purified” form of capitalism free of nation-state interference and deserving of its own neologism—sovereignism.

Even more deeply rooted in free market principles than statist capitalism, sovereignism promises to be an unrivaled allocator of energy toward the higher satisfaction of human wants.

As an intrinsically more adaptive, fluid, and volitional system for allocating socioeconomic energy across spacetime, Bitcoin-enabled sovereignism outcompetes the closed-source, analog, and compulsory organization of nation-states.

Societies adhering to organizational principles consistent with sovereignism (broad industrial privatization, debureaucratization, consensual taxation, Bitcoin, etc.) will generate more wealth than the command-and-control economies of more rigid nation-states...

...and attract more citizens. More competitive jurisdictions mean less tolerance for bureaucratic wastefulness, and more wealth generation. As citizens wake up to this new reality, the modern obsession with state politics will fade into a relic of a bygone era.

Sovereignists who rise to the occasion will no doubt be tested, as nation-states will fight back in an attempt to retain their traditional powers over populations. As The Sovereign Individual describes it:

Although this transition may seem alarming and potentially chaotic, the end-game of sovereignism is an explosion of wealth and a commensurate human flourishing in the wake of nation-state dissolution.

Self-organizing digital organizations—like #Bitcoin—stand to become the greatest testaments to Schumpterian creative destruction known to history. In the age of sovereignism, mankind will shed dependence on the nation-state and reclaim individual power.

Read "Sovereignism Part 1: Creative Digital Destruction" at the link below.

Thank you: @SwanBitcoin @Bquittem @CitizenBitcoin @dergigi @BVBTC @skwp @ReedWommack #Bitcoin

swanbitcoin.com/sovereignism-p…

Thank you: @SwanBitcoin @Bquittem @CitizenBitcoin @dergigi @BVBTC @skwp @ReedWommack #Bitcoin

swanbitcoin.com/sovereignism-p…

• • •

Missing some Tweet in this thread? You can try to

force a refresh