1/A LOT of critically important charts in this week's #DirtyDozen.

I cover growing trend fragility, a monthly sell signal, discuss why this *isn't* a major top buy why we should expect a 1-2 month correction to begin w/in the next few weeks, plus more.

macro-ops.com/a-major-monthl…

I cover growing trend fragility, a monthly sell signal, discuss why this *isn't* a major top buy why we should expect a 1-2 month correction to begin w/in the next few weeks, plus more.

macro-ops.com/a-major-monthl…

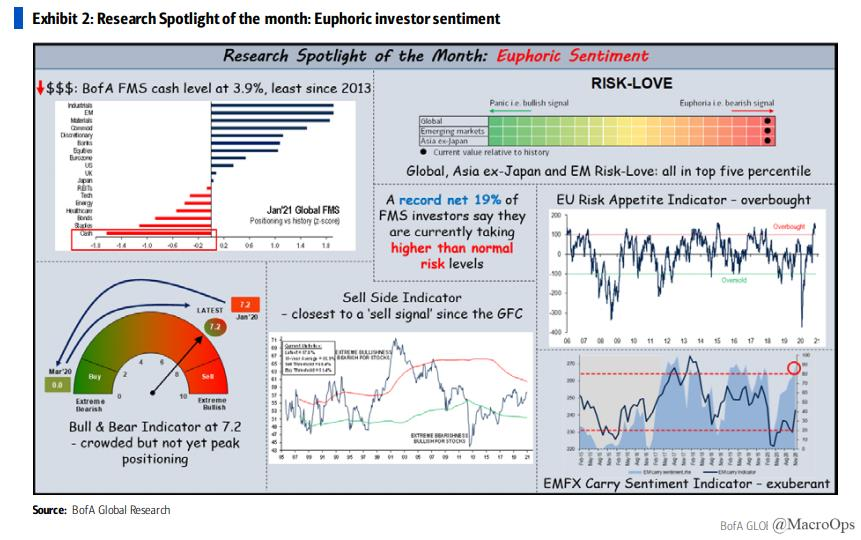

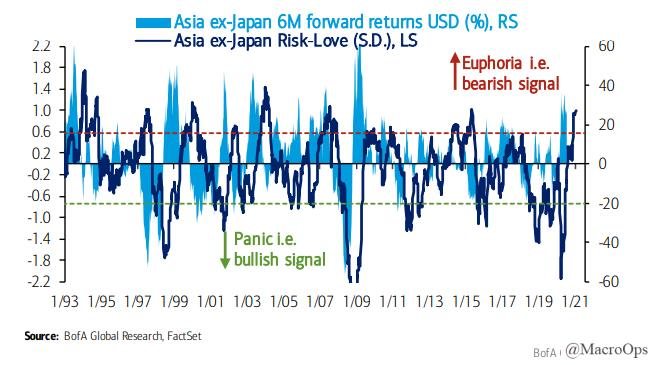

2/ High euphoria = high trend fragility

-Record net 19% FMS investors raking greater risk

-FMS cash level at 3.9% triggering a 'sell signal'

-Global Risk-Love in 97th %-tile going back to 1987

-Asia/EM Risk-Love signaling "euphoria" for 1st time since 2015

-Record net 19% FMS investors raking greater risk

-FMS cash level at 3.9% triggering a 'sell signal'

-Global Risk-Love in 97th %-tile going back to 1987

-Asia/EM Risk-Love signaling "euphoria" for 1st time since 2015

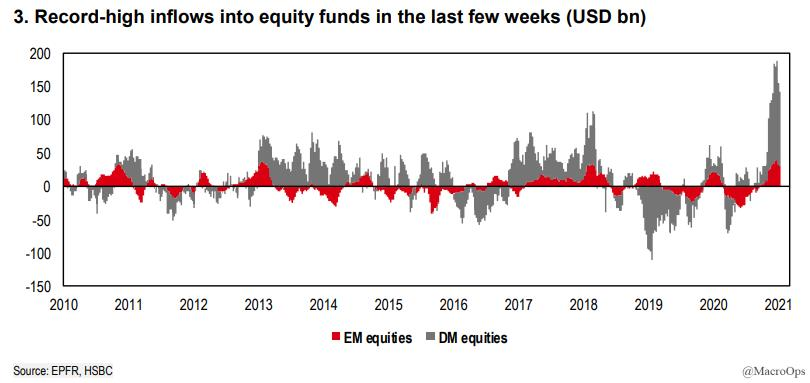

3/ “Two-month flows into DM and EM equity funds the highest since [Oct 2000]. November alone saw the highest monthly inflow into global equity funds on record. Also over a three-month horizon, we’ve now seen the highest inflows into equity funds on record” via BofA $EEM

4/ Asia ex-Japan Risk-Love indicator’s Euphoria / Bearish Signal implies weak 6-month forward returns in Asia/EM.

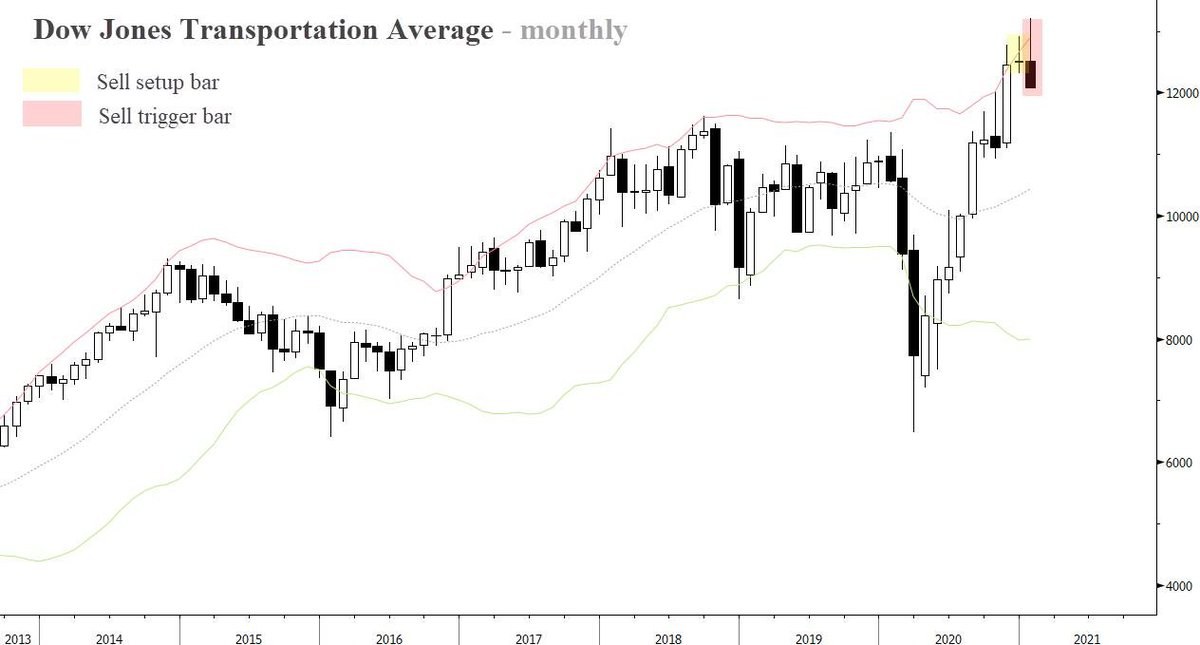

5/ $IYT triggered a sell signal in Jan.

Dec's Doji (yellow) gave us a sell setup. Jan's Outside Bear Bar closed on its lows & gave us a sell signal. But, the strong bullish thrust of the preceding 8 bars means this pullback will likely be bought after a 1-2m pullback.

Dec's Doji (yellow) gave us a sell setup. Jan's Outside Bear Bar closed on its lows & gave us a sell signal. But, the strong bullish thrust of the preceding 8 bars means this pullback will likely be bought after a 1-2m pullback.

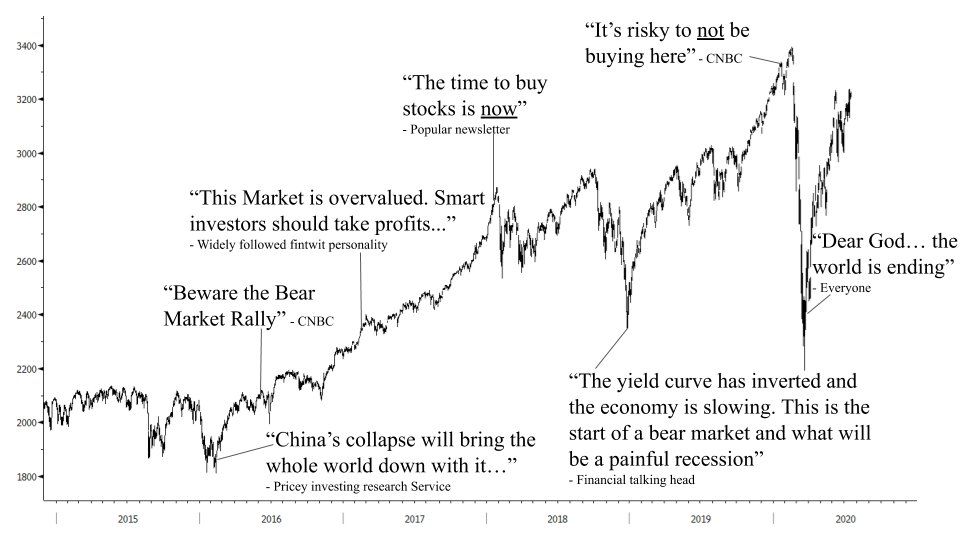

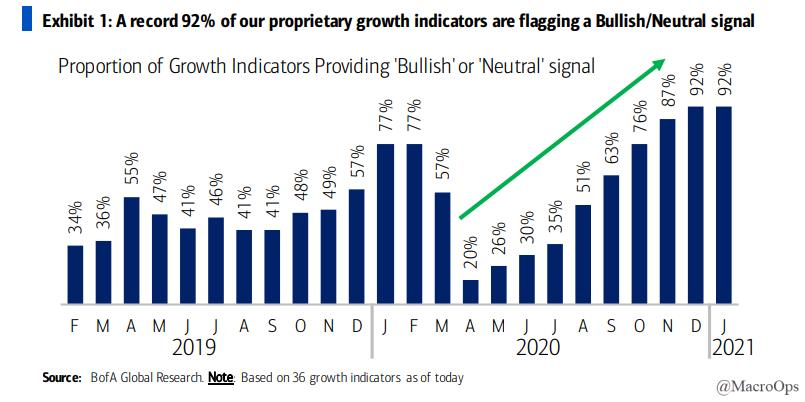

6/ But, investors who continue to try and call a top will once again be disappointed…

The economic backdrop is not one you want to fade. 92% BofA’s proprietary suite of growth indicators “are flagging a Bullish/Neutral signal, the highest level on record.”

The economic backdrop is not one you want to fade. 92% BofA’s proprietary suite of growth indicators “are flagging a Bullish/Neutral signal, the highest level on record.”

7/ BofA writes “The last 3 decades have not witnessed this combination of animal spirits and a system flush with liquidity. All regions across the world are, at present, privy to surplus free liquidity — currently growing at 55% YoY in the US (highest on record since 1980.”

8/ While the long-term economic backdrop looks increasingly bullish, the short-term has been widely discounted and is at increased risk of a washout.

Bloomberg points out that money managers are more long commodities now than they have ever been in at least a decade.

Bloomberg points out that money managers are more long commodities now than they have ever been in at least a decade.

9/ The rebounding economy and wall of liquidity plus declining COVID hospitalizations (largely driven by increasing vaccination numbers) here in the US definitely support the reflation narrative.

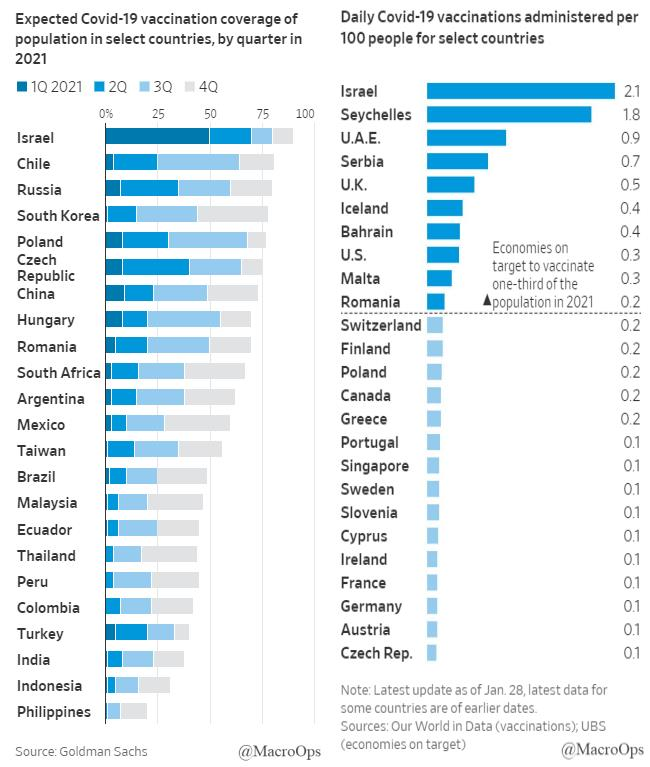

10/ However, the same cannot be said for the rest of the world. The WSJ quotes a recent UBS report, saying “At the current rates of vaccination, only about 10% of the world would be inoculated by the end of the year and 21% by the close of 2022.”

11/ The US’s greater capacity for fiscal combined w/ its inordinate access to vaccines, means it’s likely to outperform the RoW on the growth front. That superior relative growth performance could upset the extremely crowded short USD positioning via USD smile dynamics.

12/ While I remain a cyclical USD bear, I do believe there’s a decent probability we’re about to see a multi-month counter-trend move. USDSEK’s monthly chart looks ripe for a reversal.

macro-ops.com/george-soros-c…

macro-ops.com/george-soros-c…

fin/ $XBI has reversed its multi-year bout of relative underperformance versus $QQQ. Bios have some of the strongest long-term charts at the moment. Illumina (ILMN) is one of these names with a great tape. Last month, the stock broke out of a 2 ½ year consolidation range.

• • •

Missing some Tweet in this thread? You can try to

force a refresh