#PriceAction

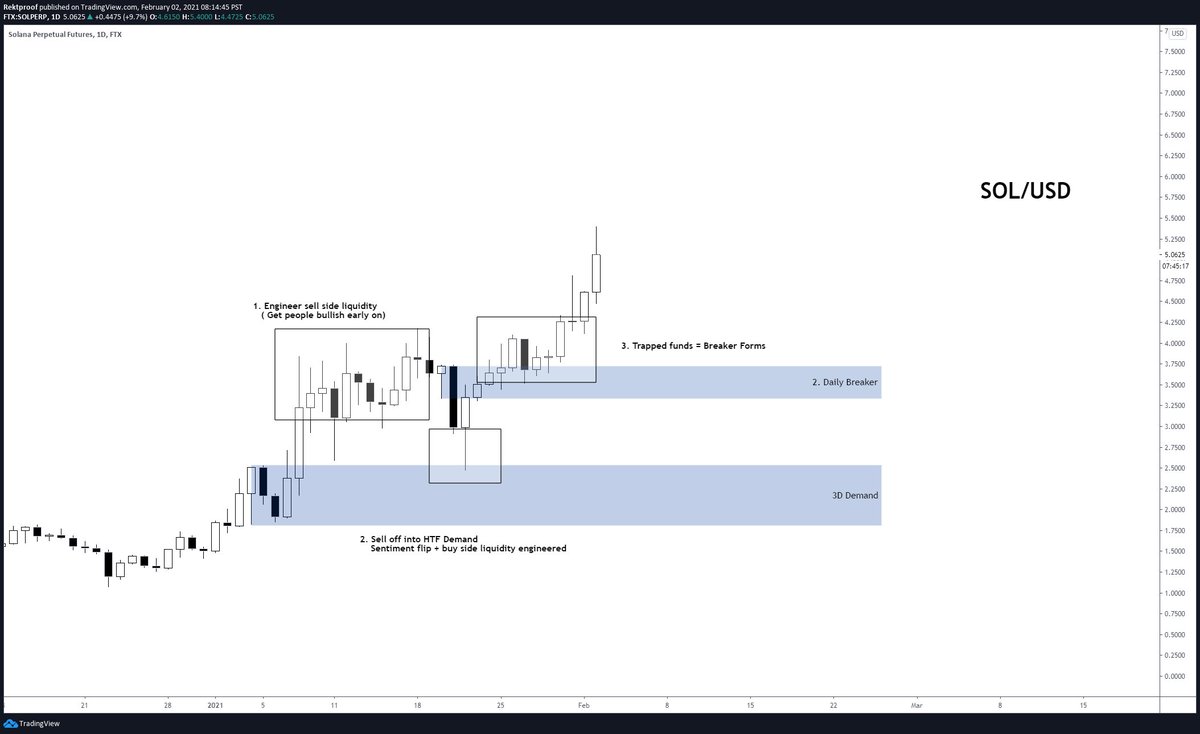

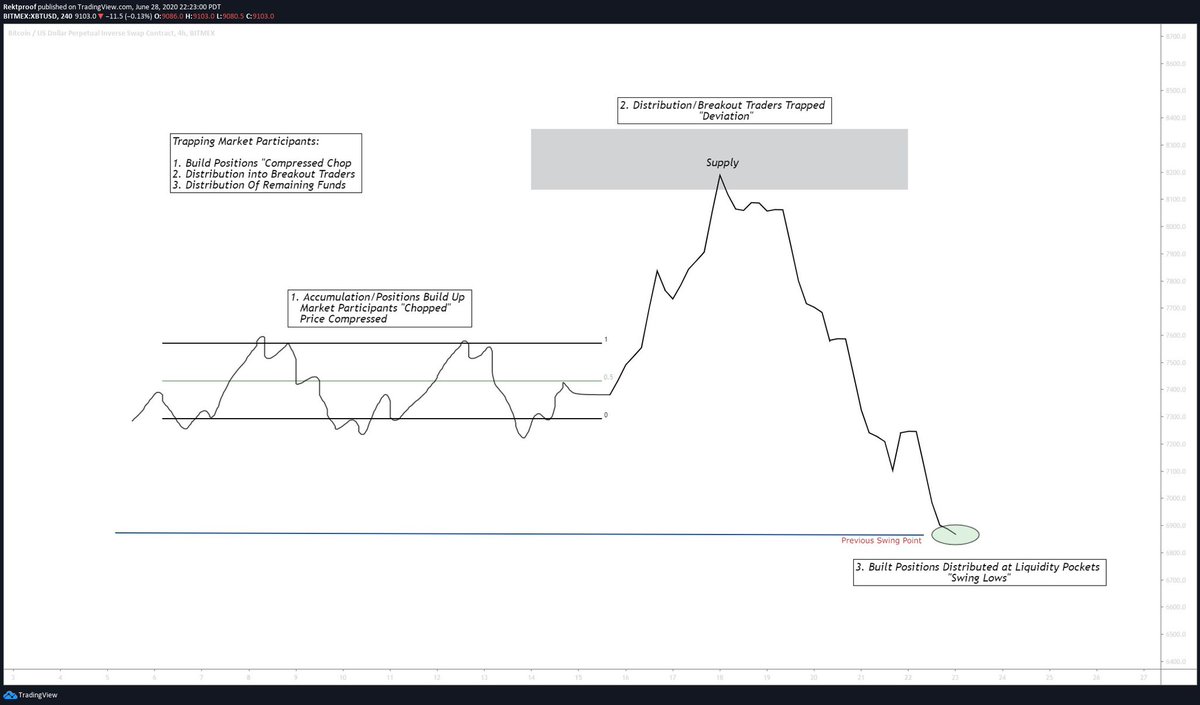

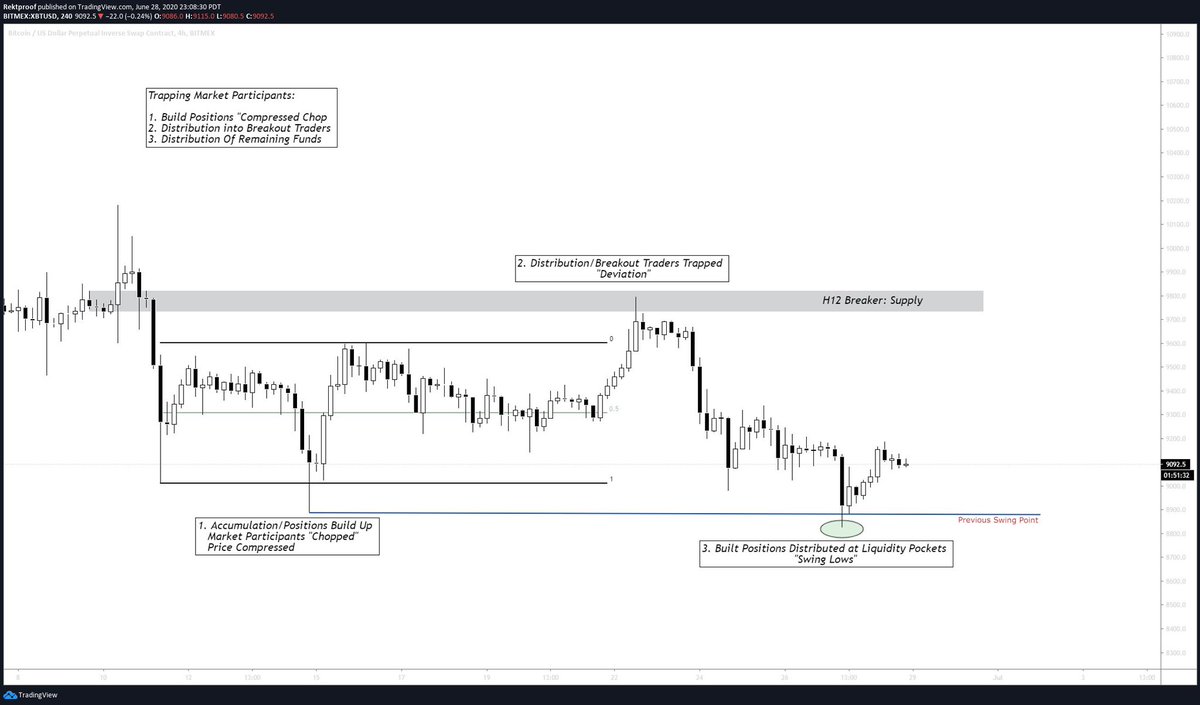

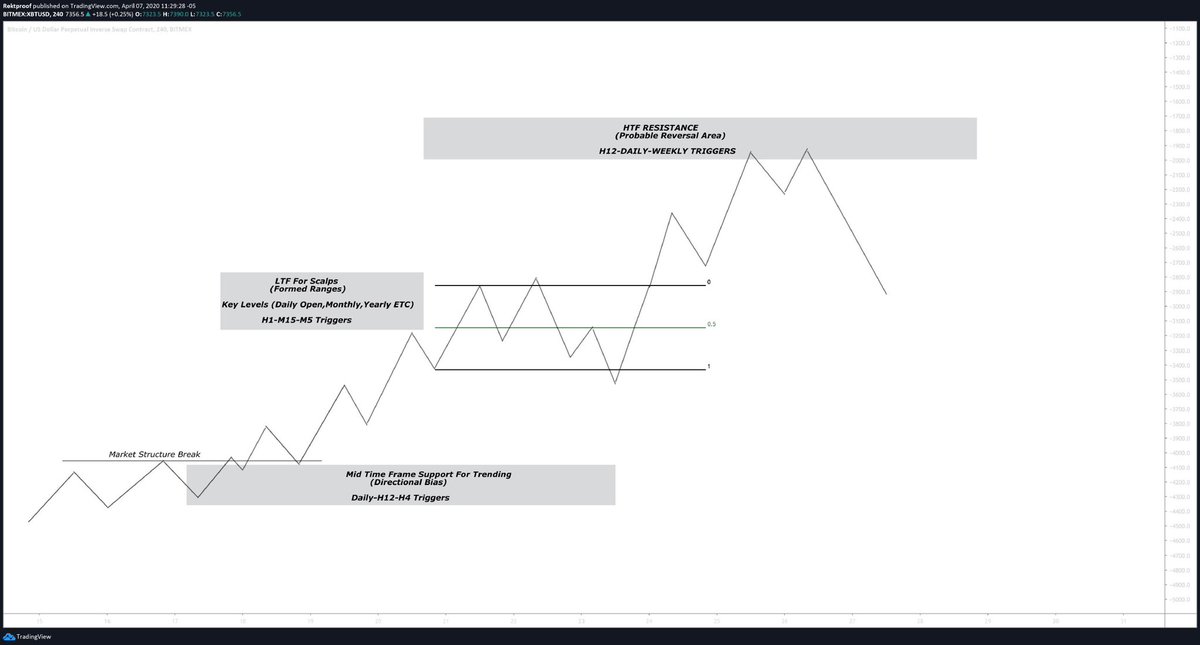

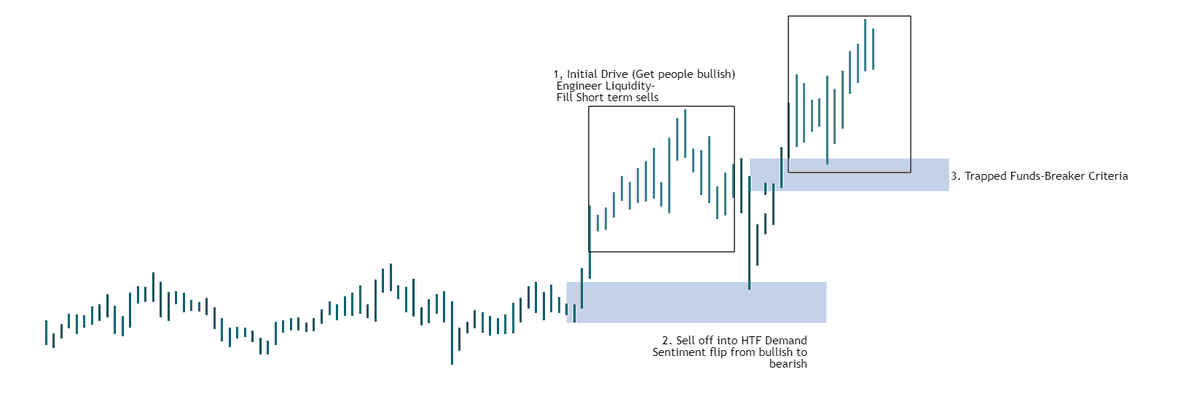

This is how Alts have played out the last few weeks to my perspective and currently.

1. Initial drive up (get people bullish)

2. Sell off into HTF Demand (Sentiment flips bearish)

3. Price gets back above with trapped funds in lock.

Examples attached.

This is how Alts have played out the last few weeks to my perspective and currently.

1. Initial drive up (get people bullish)

2. Sell off into HTF Demand (Sentiment flips bearish)

3. Price gets back above with trapped funds in lock.

Examples attached.

2/4

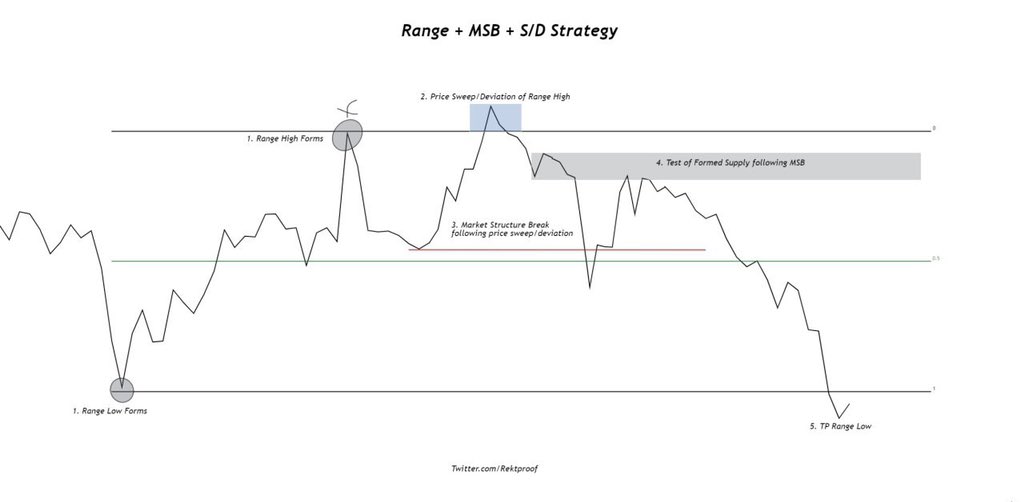

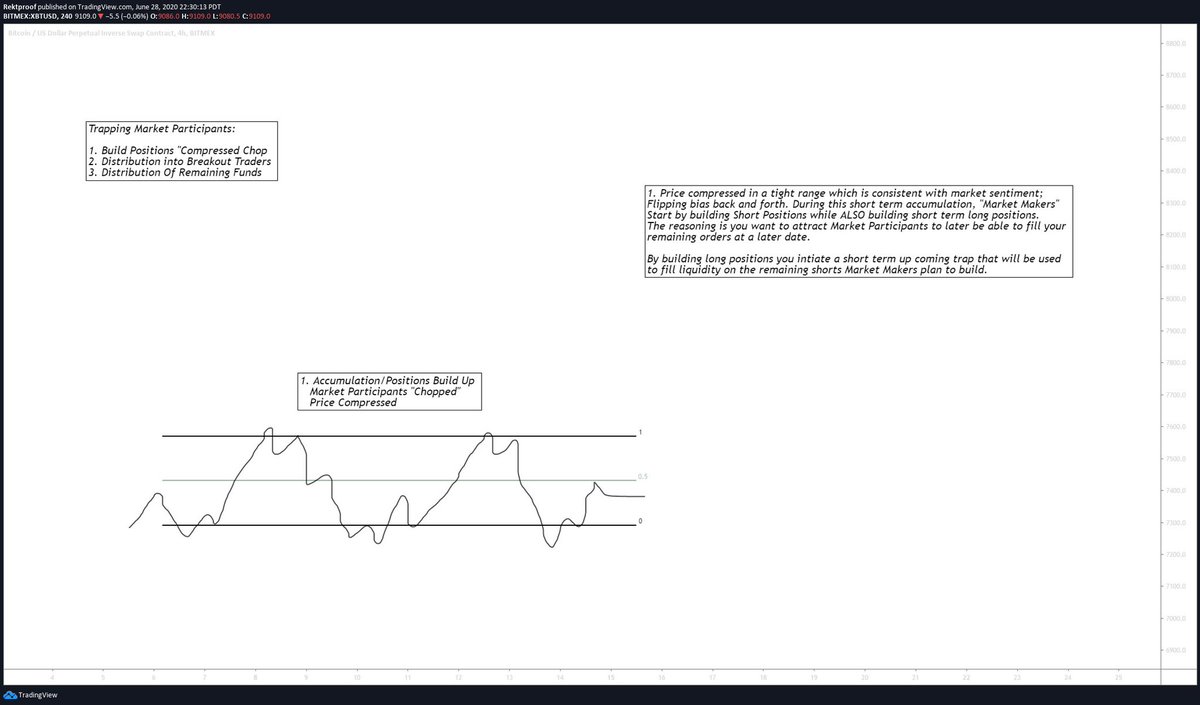

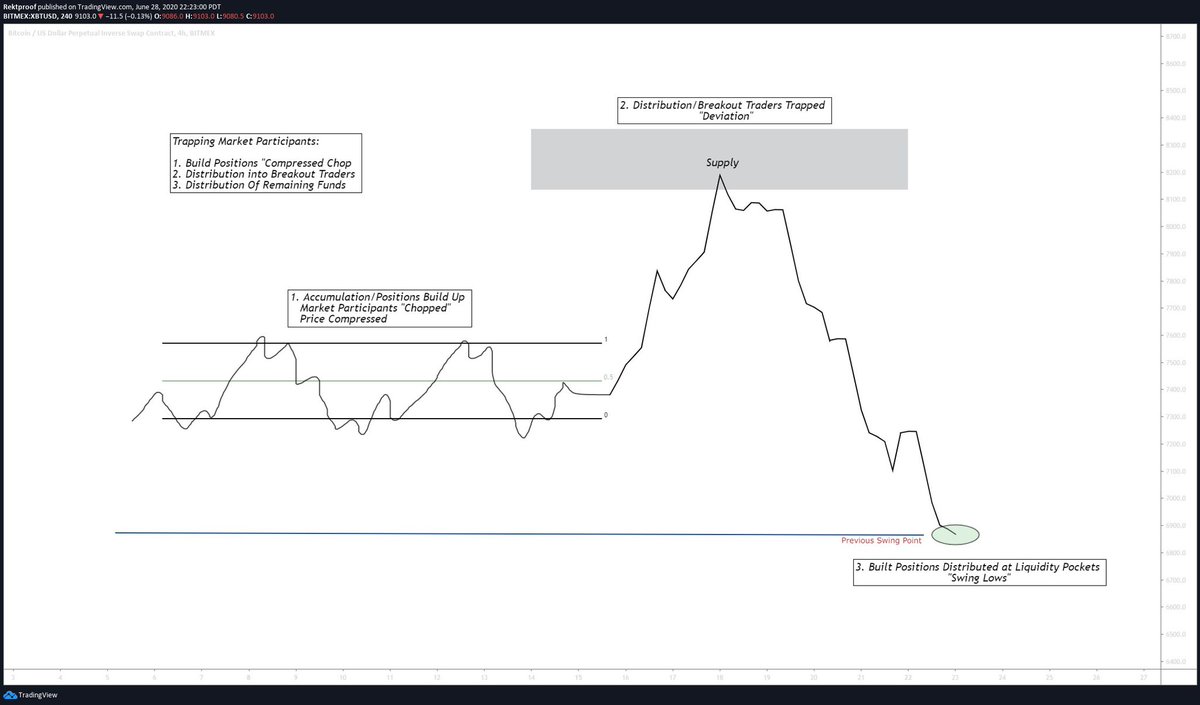

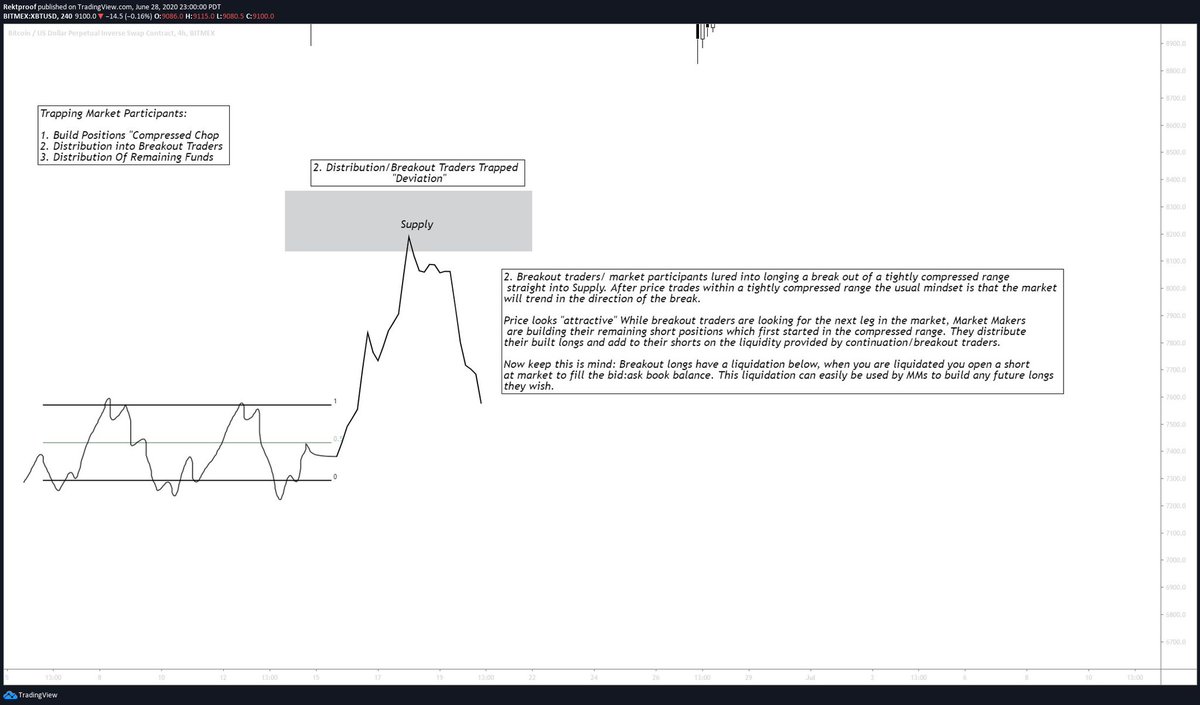

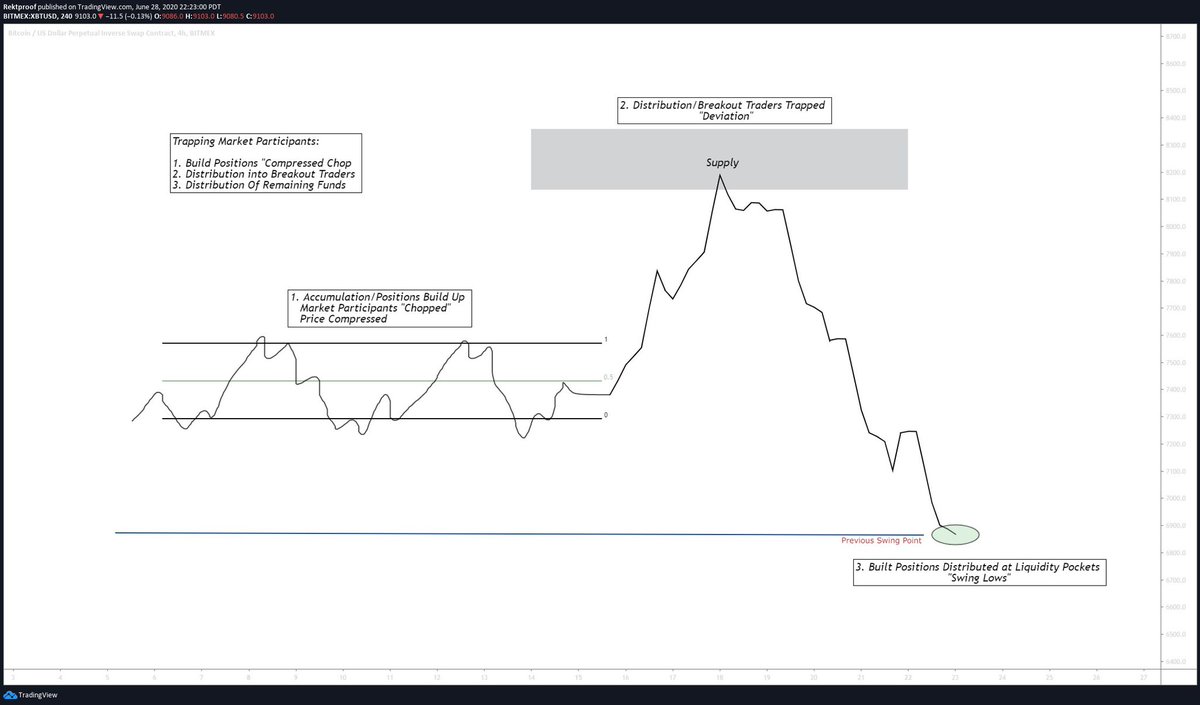

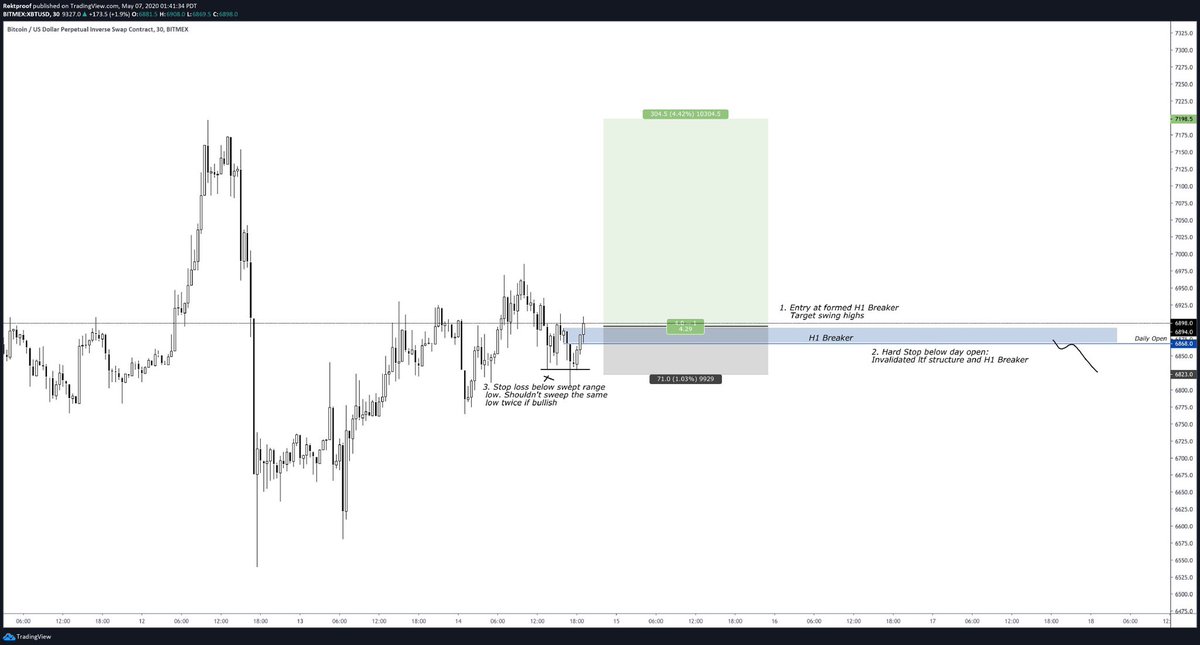

When you see price move up early in the week and sentiment favoring a certain side its good to zoom out and mark out your untested HTF Demands as we might be engineering liquidity.

(Notes on chart)

When you see price move up early in the week and sentiment favoring a certain side its good to zoom out and mark out your untested HTF Demands as we might be engineering liquidity.

(Notes on chart)

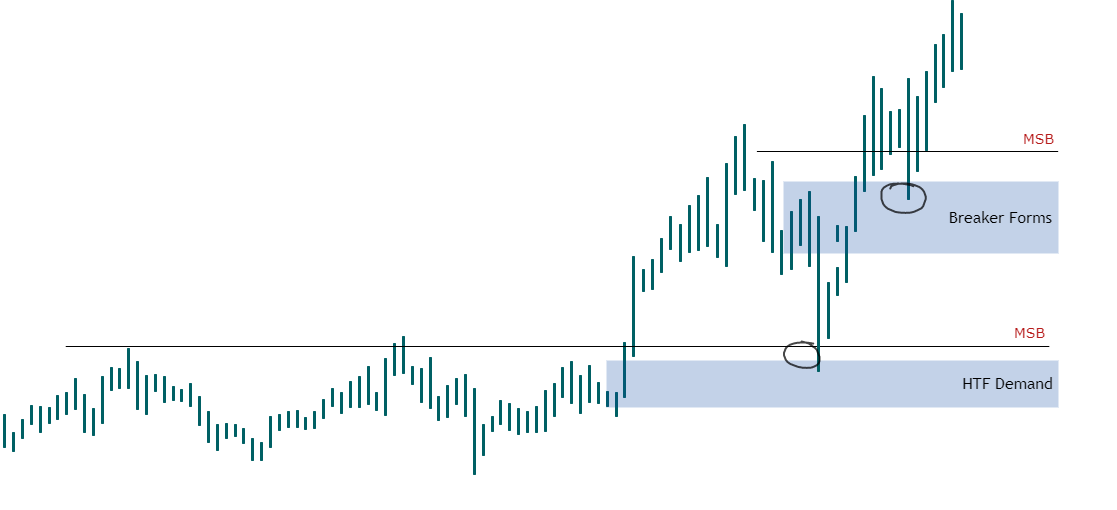

4/4 Conclusion

Mark out your HTF Demands

Don't chase price but rather wait for certain elements to present themselves before entering. Requires patience and discipline but the clarity in the move is much clear.

Block out the noise and trade your system

Trade Safe

End..//

Mark out your HTF Demands

Don't chase price but rather wait for certain elements to present themselves before entering. Requires patience and discipline but the clarity in the move is much clear.

Block out the noise and trade your system

Trade Safe

End..//

• • •

Missing some Tweet in this thread? You can try to

force a refresh