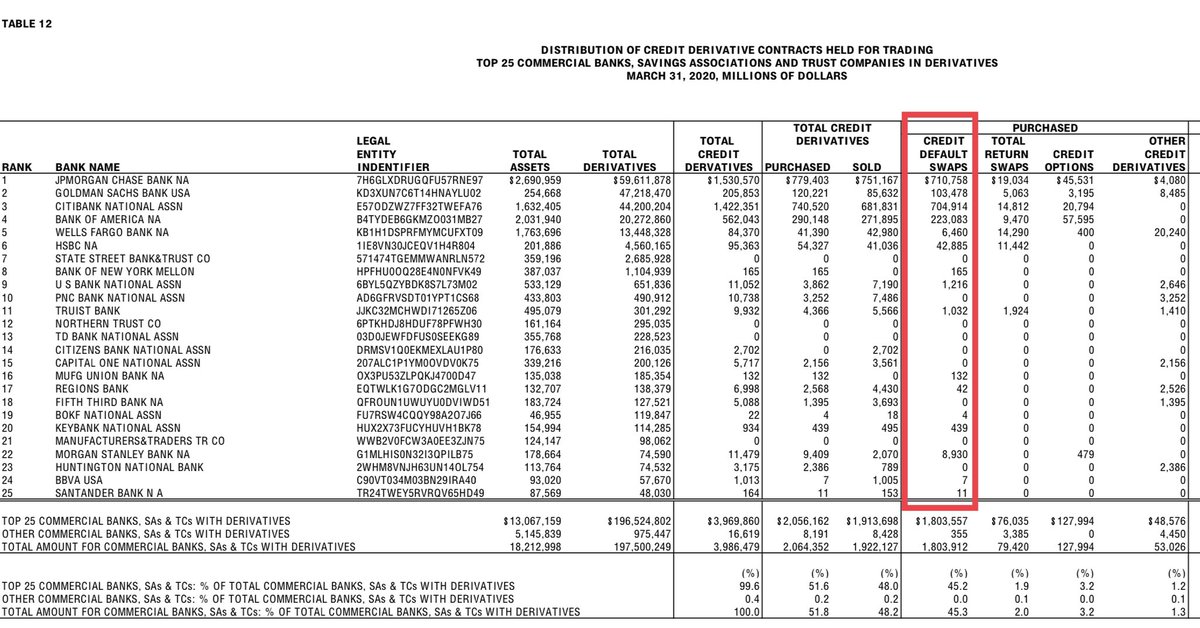

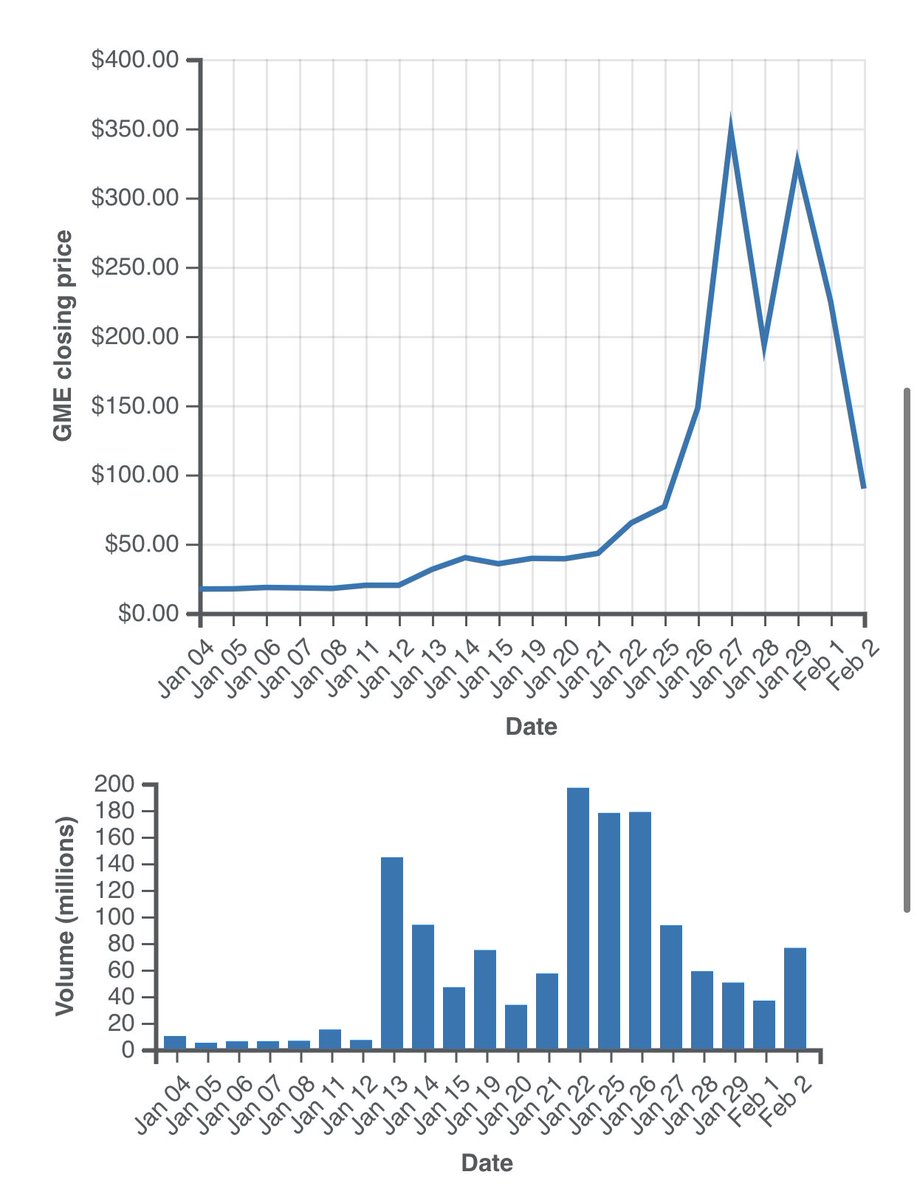

This is a MASSIVE STORY!! After researching the Overnight Bank Funding which comes STRAIGHT From the Feds App, the Squeeze on Jan 12 caused overnight bank funding volume to spike. As the shorts continued to get squeezed they needed more money. You can see this in the next slide.

https://twitter.com/cnbcnow/status/1356785327931871233

You can see as the overnight bank funding volume increased volume on GameStop and all the other squeezes contributed to this. This all peeked last week as soon as RobinHood and firms limited buying and raised margin requirements. This event probably caused more liquidity problems

That is why the #RobinHood CEO came out last week all over the media saying there was no #liquidity problems but the data says other wise. ReTweet spread the word @realJosephRich @MedievalNomad @LibertyTre3 @JeromePowellet1 @EndTheFed001 @EndTheFed_org @litcapital

• • •

Missing some Tweet in this thread? You can try to

force a refresh