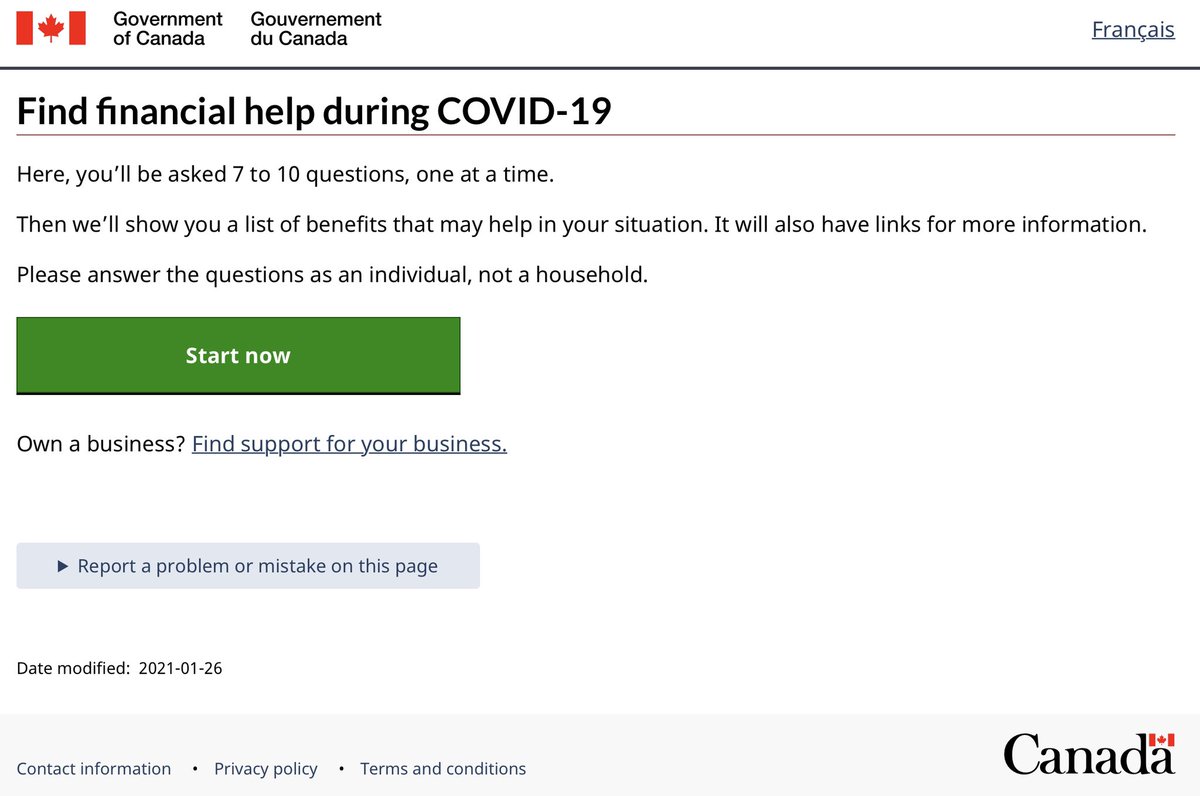

We could have designed something *similar* to this.

The first question is basically, Do you need financial help? Y/N

I pretended I was Canadian for purposes of this exercise. 1/9

The first question is basically, Do you need financial help? Y/N

I pretended I was Canadian for purposes of this exercise. 1/9

• • •

Missing some Tweet in this thread? You can try to

force a refresh