Another 1.1 million people applied for UI last week, including 779,000 who applied for regular state UI and 349,000 who applied for Pandemic Unemployment Assistance (PUA). 1/ dol.gov/ui/data.pdf

The 1.1 million who applied for UI last week was a decrease of 88,000 from the prior week, but the four-week moving average of total initial claims ticked up by 51,000. 2/

Last week was the 46th straight week total initial claims were greater than the worst week of the Great Recession (GR). (If you restrict to regular state claims—b/c we didn’t have PUA in the GR—initial claims last week were still greater than the third-worst week of the GR.) 3/

Most states provide 26 weeks of regular benefits, meaning many workers are exhausting their regular state UI benefits. In the most recent data (week ending Jan 23), continuing claims for regular state benefits dropped by 193,000. 4/

After a worker exhausts regular state benefits, they can move onto Pandemic Emergency Unemp Compensation (PEUC), which is an additional 24 weeks of regular state UI (the December COVID relief bill increased the number of weeks of PEUC eligibility by 11, from 13 to 24). 5/

However, in the most recent data available for PEUC, the week ending Jan 16th, PEUC claims dropped by 290,000. I expect that to rise again in coming weeks. 6/

Over 3.5 million workers had exhausted the *original* 13 weeks of PEUC by the end of December. These workers are now eligible for the additional 11 weeks, but they need to recertify. PEUC numbers will continue to swell as this occurs. 7/

Continuing claims for PUA dropped by 126,000 in the latest data, the week ending Jan 16th. I expect that to rise again in coming weeks. 8/

The December bill extended the total weeks of PUA eligibility by 11, from 39 to 50 weeks. As workers who exhausted PUA before the extensions were signed get back on PUA, it is likely the PUA numbers will continue to swell. 9/

The 11-week extensions of PEUC and PUA just kick the can down the road—they are not long enough. Congress must pass further extensions before mid-March, or millions will exhaust benefits at that time, when the virus is still rampant and the labor market is still weak. 10/

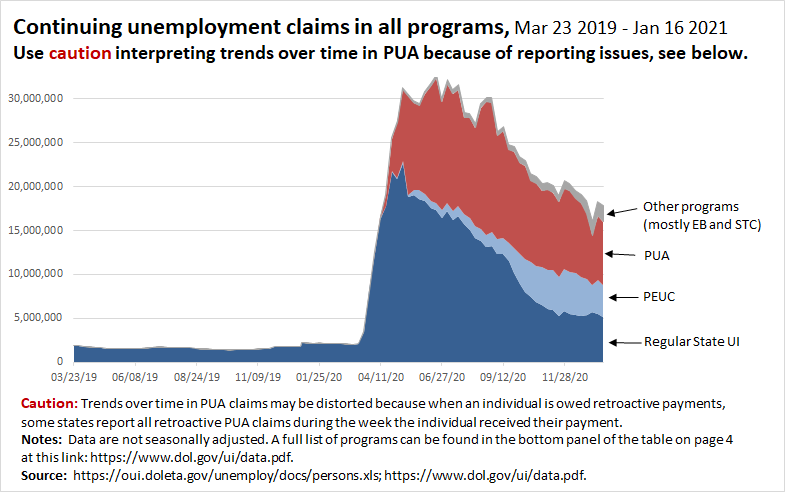

This chart shows continuing claims in all programs over time (the latest data for this are for Jan 16). Continuing claims are still nearly 16 million above where they were a year ago. 11/

Extended Benefits (EB) is another program workers in some states can get on after they’ve exhausted PEUC. EB has risen 376,000 in the last 3 weeks. Some folks who had exhausted the original 13 weeks of PEUC are getting on EB before they get their additional 11 weeks of PEUC. 12/

There are now 26.8 million workers (15.8% of the workforce) who are either unemployed, otherwise out of work because of the virus, or have seen a drop in hours and pay because of the pandemic. More relief is desperately needed. 12/ epi.org/blog/the-econo…

Another reason more relief is so important is that this crisis is greatly exacerbating racial inequality. Due to the impact of historic & current systemic racism, Black and Latinx workers have seen more job loss in this pandemic, and have less wealth to fall back on. 13/

Even with the $900B Dec. COVID bill, we still need more than $2 trillion in relief. A key missing piece from the latest bill is aid to state & local govts—w/o it, state & local govt austerity will cost millions of jobs in the public & private sector. 14/ epi.org/blog/without-f…

Biden announced a relief package that gets the economics right—it is at the scale of the challenge we are facing and is a clear break from the mistakes we made in past recoveries, when we hobbled the economy by not doing enough. 15/ epi.org/press/presiden…

With their slim majority in the Senate, Democrats can now get crucial relief measures through reconciliation, and they must be bold. Top priorities include COVID/vaccine measures, aid to state and local governments, additional weeks of UI, and increased UI benefits. 16/

And, here's this tweet thread in a blog post. fin/ epi.org/blog/unemploym…

• • •

Missing some Tweet in this thread? You can try to

force a refresh