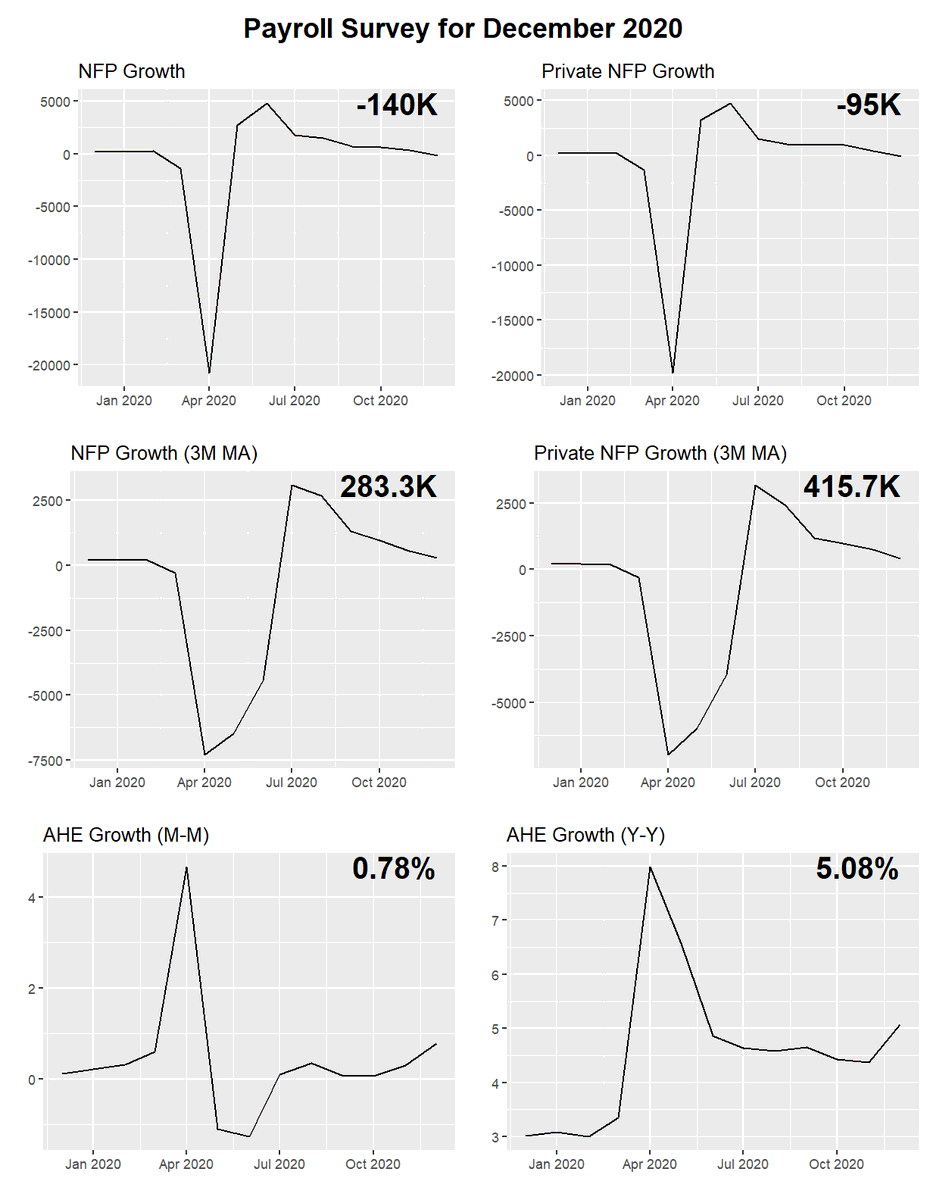

Oof, -159K in normal 2-month revisions (separate from the annual benchmarking adjustments which also got folded in the data).

With January's +49K read, the US is still 9.9 million jobs short of where we were in February, and 12.1 million jobs short of where we probably would have been absent COVID.

That means overall employment is still down -6.5% from February. In leisure/hospitality, it's -23%.

That means overall employment is still down -6.5% from February. In leisure/hospitality, it's -23%.

It also means that, even with the jobs gains since April, the % jobs hole since February is still slightly worse than the *worst* peak-to-trough jobs hole during the Great Recession.

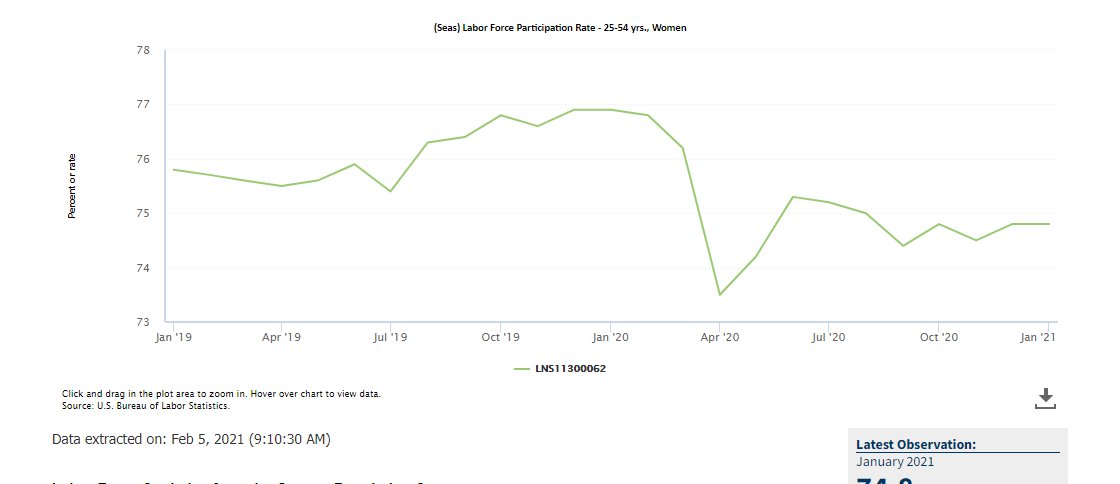

Prime-age (25-54) labor force participation up +0.4pp for men, flat for women (don't read too much into single-month changes in the household survey).

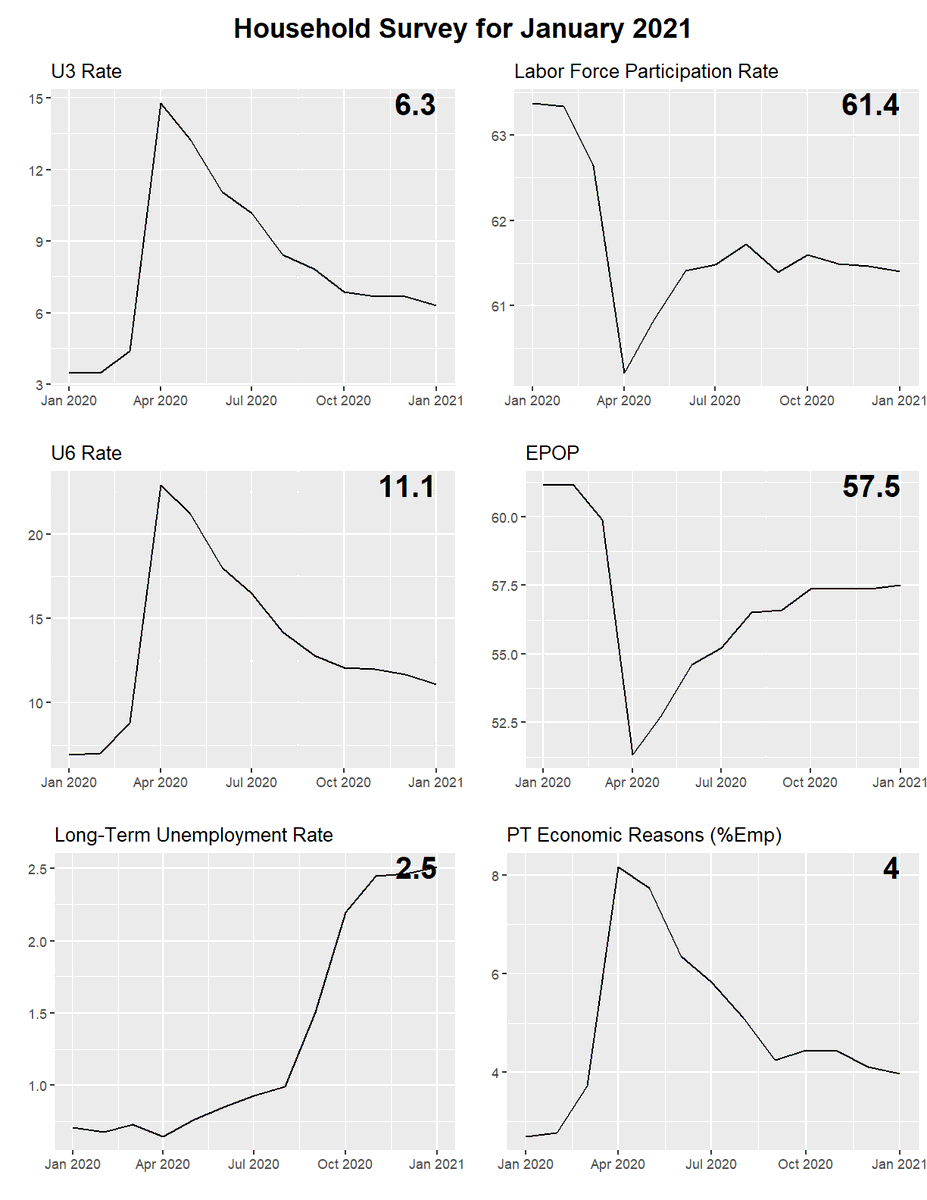

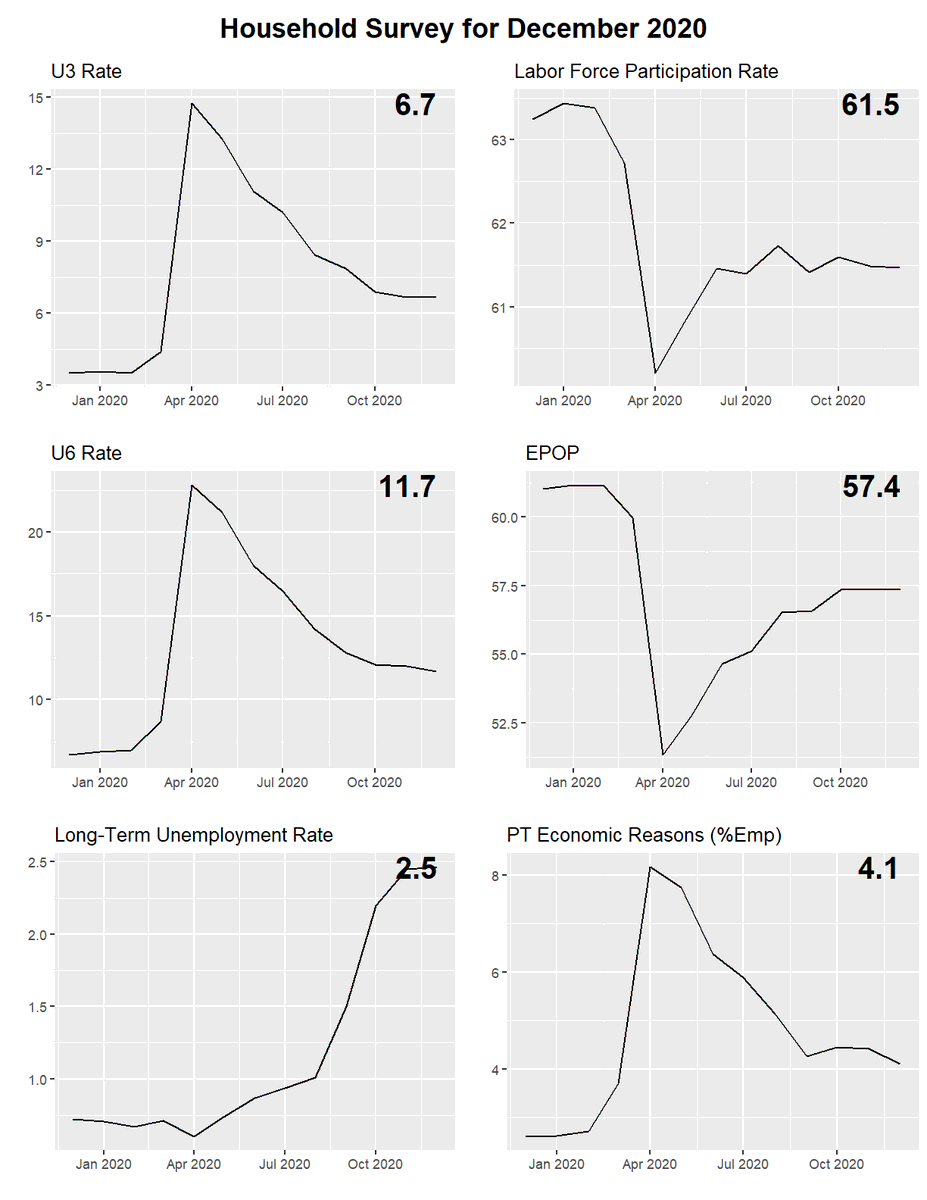

The participation rate has basically been flat since June. The employment rate has been largely flat since October (small changes in both can still translate to declines in the unemployment rate).

If one adjusts the official unemployment rate for potential misclassification of workers and the decline in labor force participation since February, an adjustment Fed Governor Brainard has mentioned, the adjusted unemployment rate in January was 9.8%, down -0.3pp from December.

• • •

Missing some Tweet in this thread? You can try to

force a refresh