Back in November the market was very worried about inflation. Worried it would be too low.

Now with rising stimulus expectations the market expects considerably more inflation. But still is below the Fed's average inflation target.

Now with rising stimulus expectations the market expects considerably more inflation. But still is below the Fed's average inflation target.

Technical note: market expects 2.25% CPI inflation over 5 yrs. Need to subtract ~35bp to get the PCE inflation measure the Fed targets. So the expectation for PCE inflation is more like 1.9%.

Under the Fed's average inflation targeting goal they should be above 2%.

Under the Fed's average inflation targeting goal they should be above 2%.

Huge uncertainty.

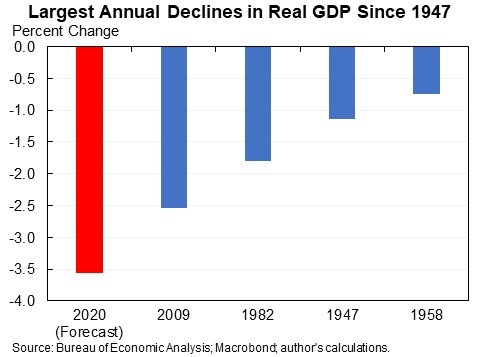

So much is unprecedented: size of stimulus (absent wartime wage/price controls), size of supply-shift due if we get COVID under control, balance sheet improvements.

We don't know what multipliers will be like, how quickly the supply side can rebound, etc.

So much is unprecedented: size of stimulus (absent wartime wage/price controls), size of supply-shift due if we get COVID under control, balance sheet improvements.

We don't know what multipliers will be like, how quickly the supply side can rebound, etc.

Also, the Philips curve has been flat but what happens if you try to change employment very quickly (not counting people returning from temporary layoff)? I have no doubt the unemployment rate can get to 3.5%, but I'm genuinely unsure about how quickly.

So I wouldn't be surprised by 3%+ inflation or 1.5% inflation.

Inflation expectations/risks definitely up but right now that is not one of my top worries, in fact if anything that aspect is reassuring.

Inflation expectations/risks definitely up but right now that is not one of my top worries, in fact if anything that aspect is reassuring.

(And I've never professionally lived through inflation so I may underweight it. 2.9% inflation would not bother me. If we got to 4%+ my guess is the politics would get bad as all households are affected by inflation. And sacrifice ratio could be high so costly to reverse.)

My view is the current plan is a lot of $/month and not enough months, could/should do a lot more than $1.9T but don't need quite as much of it in the first year.

• • •

Missing some Tweet in this thread? You can try to

force a refresh