A story about the unpopularity of one-time checks in 2008 and their replacement with reduced withholding in Making Work Pay in 2009 and 2010.

Now checks are popular.

I don't think this has been told before. Will tell it, speculate about the reason, and guess at a moral.

Now checks are popular.

I don't think this has been told before. Will tell it, speculate about the reason, and guess at a moral.

In February 2008 Congress enacted a bipartisan plan that included checks that totaled $1,200 for a family of four (about $1,500 in today's dollars). The checks mostly went out in May, June and July.

When we went to Congress in November & December 2008 the near universal view of Democrats was please, please, please do not do another round of one-time checks.

We shifted to Making Work Pay which operated through reduced withholding and was spread out throughout the year.

We shifted to Making Work Pay which operated through reduced withholding and was spread out throughout the year.

The mythology is that MWP was done for policy reasons because we thought it would appear more permanent and be spent out more and were willing to sacrifice the political gains of one-time checks. That is indeed mythology and as much rationalization as reason.

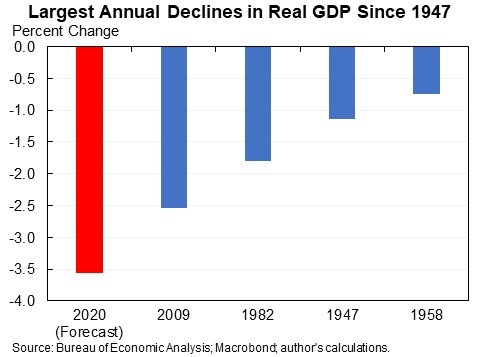

So why were the checks unpopular then & popular now? My hunch is that it is because the economy tanked after the checks were sent out in 2008. Obviously not causal (the collapse would have been even worse without the checks). But it did discredit them in public perception.

This time around the economy got much less bad in the months after the checks went out. Again, not fully causal (but definitely partly) but they contributed and people wanted more of something that appeared to work.

A political problem in 2009 & after was that when the economy was worse-than-expected people mistakenly thought the aspirin caused the fever & the persistence of the fever led them to not want any more aspirin.

Now the more successful trajectory has increased support for more.

Now the more successful trajectory has increased support for more.

Above is my best guess. Some other hypotheses:

--Larger checks reverse the sign, taking it from unpopular to popular.

--Idiosyncracy of how the debate played out with Trump etc. last year.

--Congressional Democrats were wrong in late 2008 and checks were actually popular.

--Larger checks reverse the sign, taking it from unpopular to popular.

--Idiosyncracy of how the debate played out with Trump etc. last year.

--Congressional Democrats were wrong in late 2008 and checks were actually popular.

If there is a moral of the story it is the importance of automatic stabilizers. Automatic stabilizers are insurance against a public that thinks aspirin causes fevers and so wants to cut off the aspirin too soon precisely when it most needed to combat a worsening fever.

• • •

Missing some Tweet in this thread? You can try to

force a refresh