I am today launching a small twitter initiative, the Campaign Against Nonsense about Italy (#CANI). I’ll be tweeting data and arguments for countering myths about Italy’s state and economy. In this thread, I’ll explain why I think this is necessary /1

The way journalists, politicians and economists write and talk about Italy and Southern Europe is often distorted – especially in the “frugal” public sphere. Italy is not the basket case of the popular narrative. The way we speak about stuff matters a lot for policy debates. /2

This was apparent in earlier stages of the COVID crisis, when “frugal” leaders used distorted pictures of Southern Europe to size down the grants in the EU recovery fund. If only Italy were willing to reform along "frugal" lines, things would be splendid! /3

When “frugals” act as “head teacher” of Italy, it contributes to political tensions. Trust between Northern and Southern European politicians already deteriorated during the Euro Crisis. We need to improve relationships and build consensus for macro policies to recover. /4

There are debates around forming a new government (Draghi as prime minister?) and spending the money from Next Generation EU. In this context, I regularly read comments that are just not looking at the macro policy picture in a differentiated way. /5

Italy surely has structural problems of its own, which should be tackled (e.g. banking sector, North/South polarisation, dysfunctional political elements) – what country doesn’t? But if other €Z partners don’t stop treating Italy as a basket case, they’ll also lose big. /6

I am from Austria, a country whose government is proud of belonging to the “frugal” camp. The policy discourse on Italy and European economic policy is very one-sided here, often in contradiction to the facts. I feel responsible for contributing at least a bit to improving it. /7

Italy is a large country (size of economy and population) and systematically important. If Italy were to leave the €zone, it would have ripple effects on financial markets and negative consequences for all. Is that really what we want? /8

Quite often, my experience is that basic facts about Italy and other Southern European countries are simply unknown. Although I am not naïve – I know that a small twitter campaign won’t change the world – I think it’s worthwhile to reach out to open-minded, reasonable people. /9

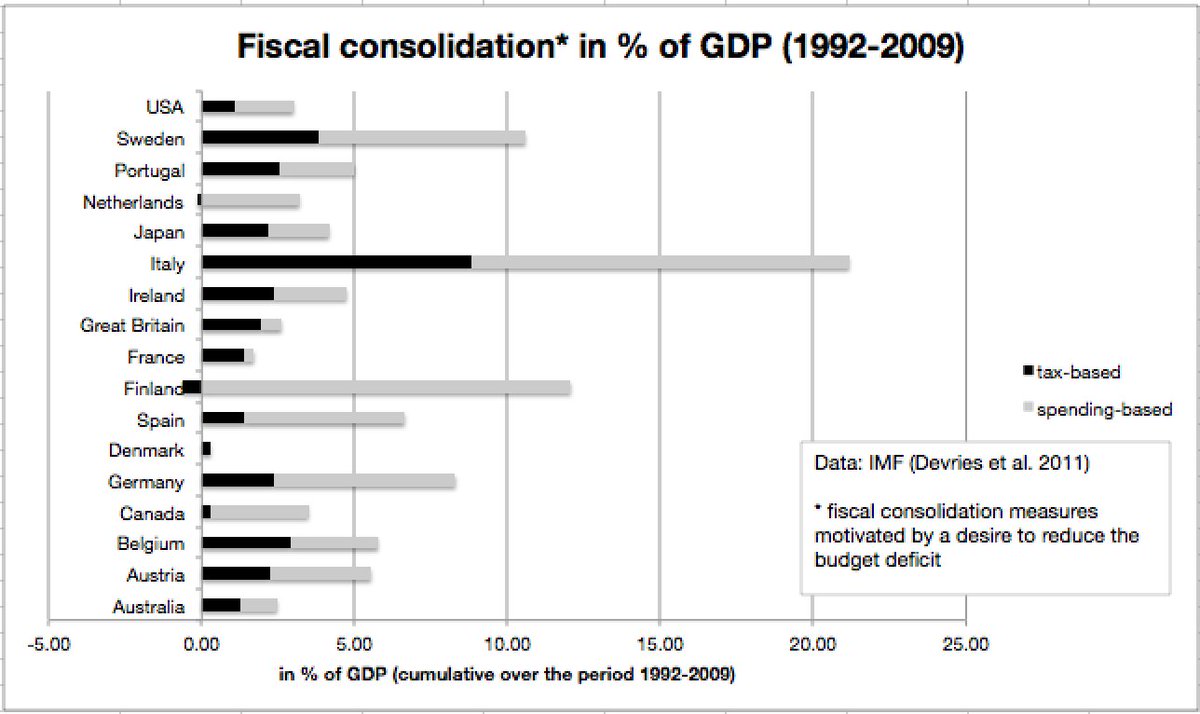

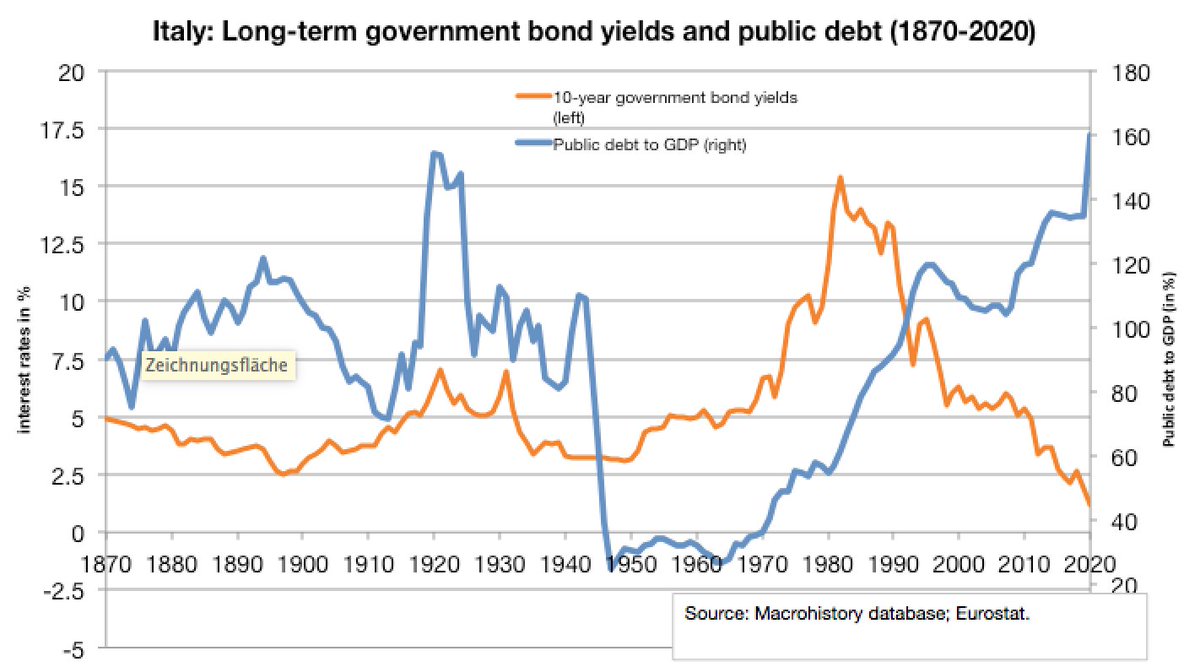

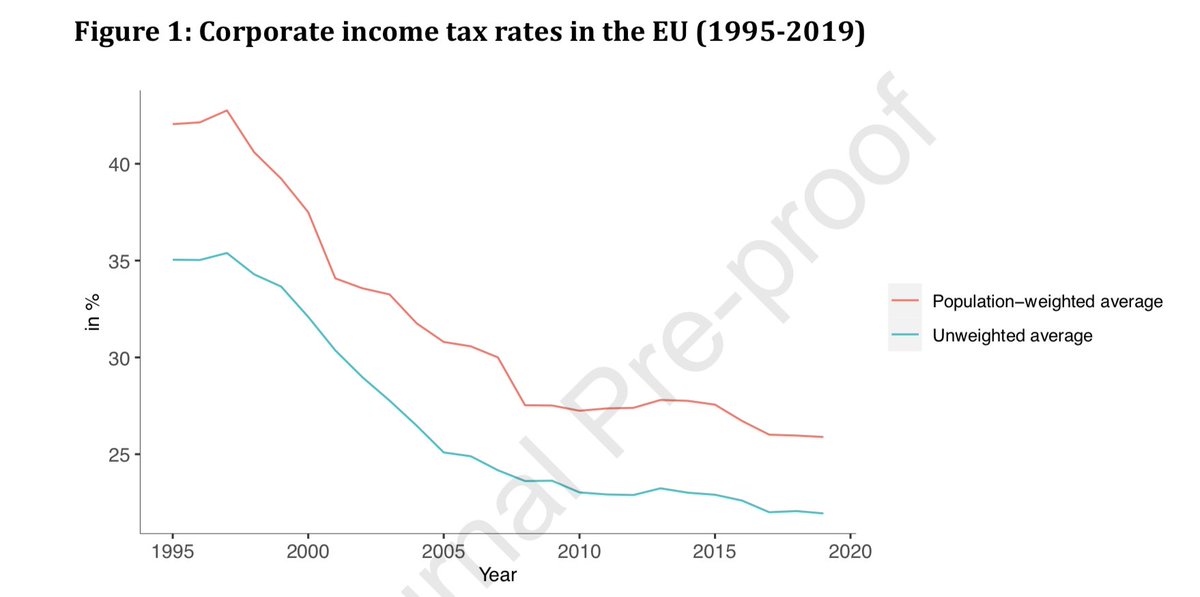

I’ll be tweeting about reforms from the market-liberal playbook in Italy, why Italians have not been living beyond their means, why the Italian state is the world champion of fiscal consolidation before Corona - and why that’s not necessarily a good thing. Hope you read on. #CANI

Thanks for all your amazingly positive responses. It shows that there are many of us out there who think that the dominant narrative on Italy and Southern Europe is distorted, and we should work to reduce these distortions, so that we can achieve better policy outcomes in Europe.

Please note that I am moving the twitter handle to: Campaign Against Italy Nonsense #CAIN

• • •

Missing some Tweet in this thread? You can try to

force a refresh