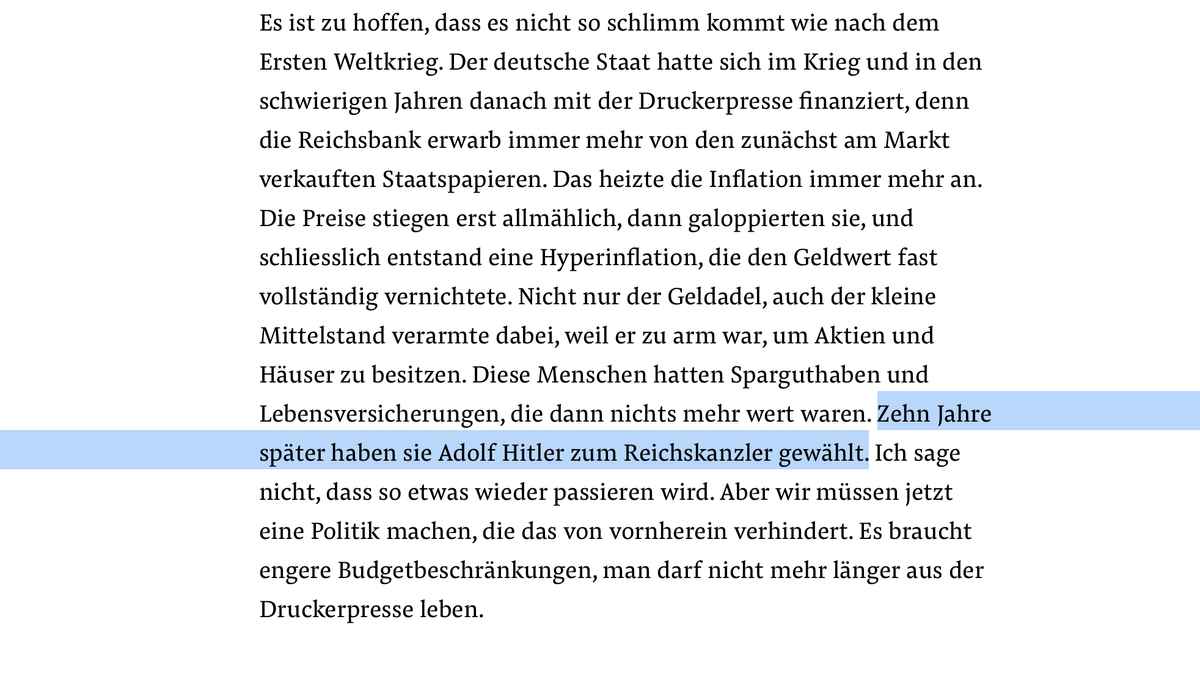

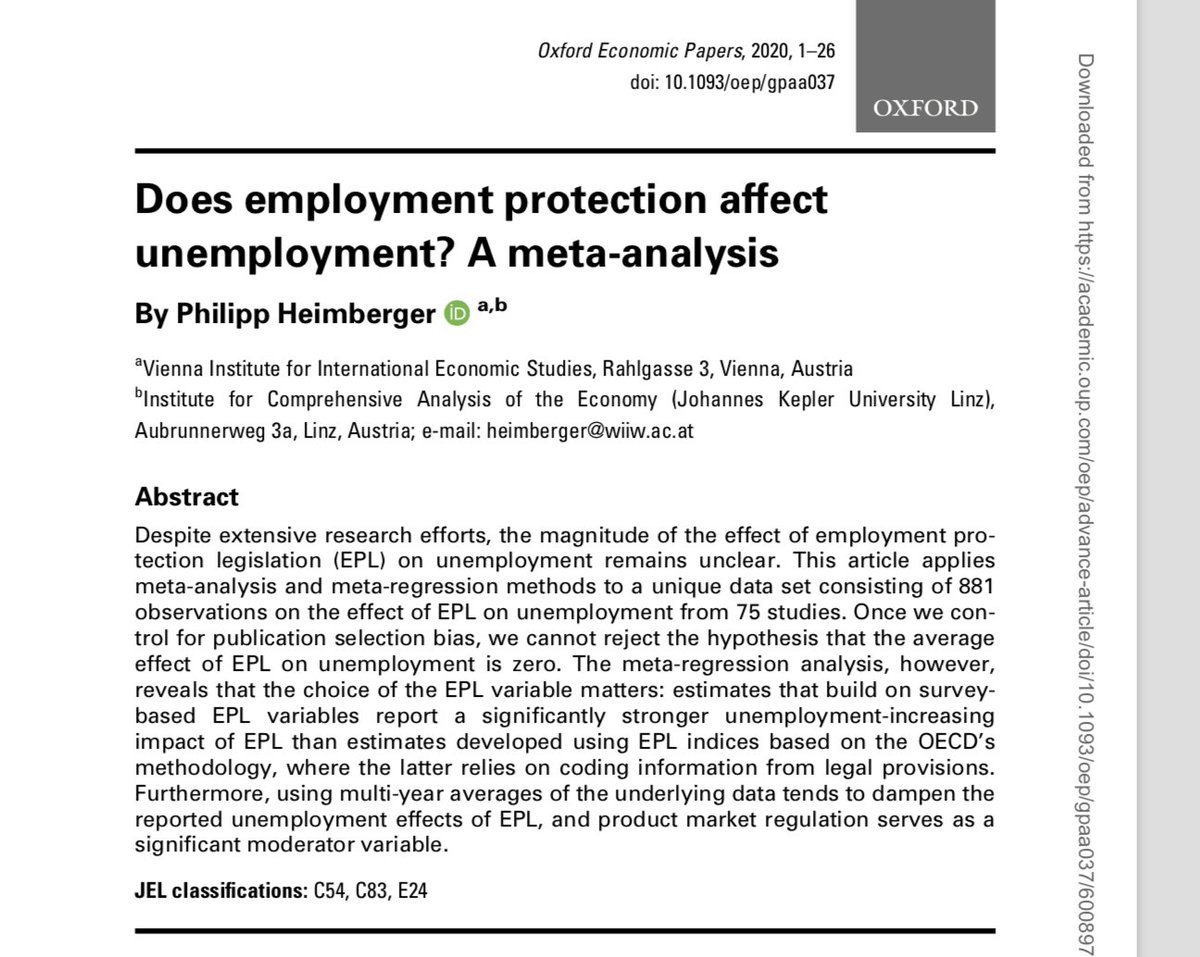

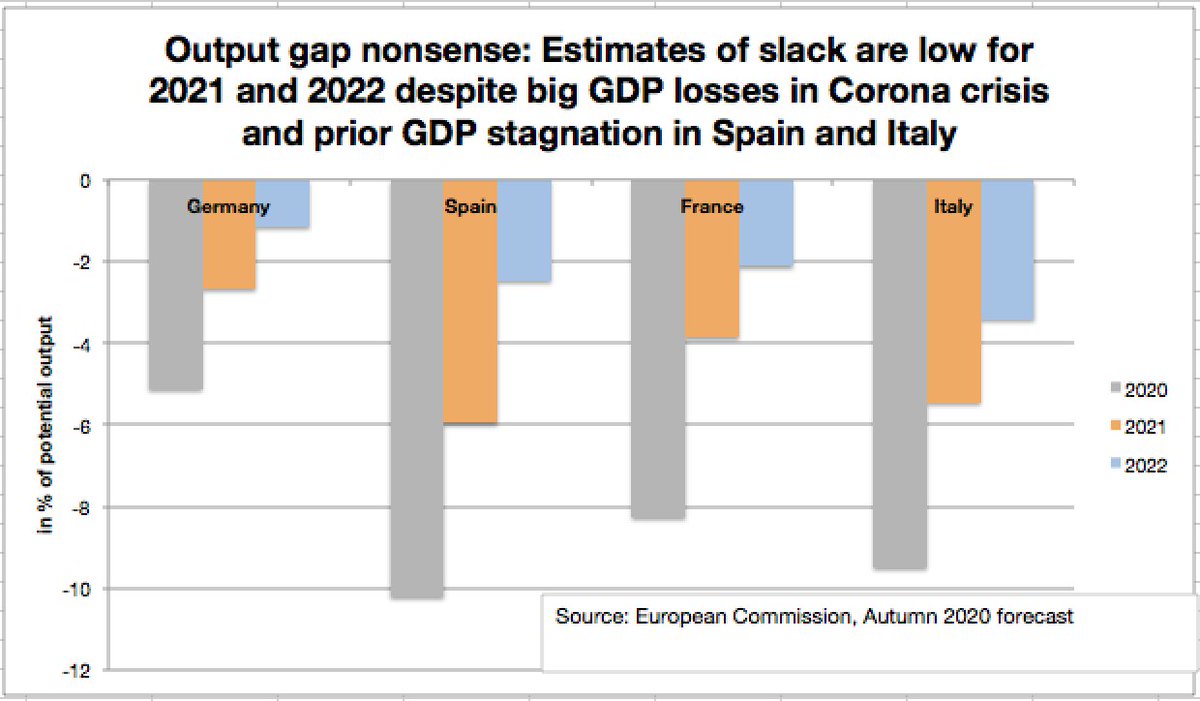

HW Sinn hat es wieder getan: In seiner "Weihnachtsvorlesung" warnt er vor Hyperinflation. Er zieht direkte Linie von Hyperinflation 1923 zu Aufstieg der Nazis, erwähnt nicht, dass Nazi-Aufstieg Deflation vorausging, verstärkt durch Sparpolitik. Thread /1

Sinn hat das gleiche schon in einem langen NZZ-Interview gemacht. Ich habe das in einem Kommentar kritisiert, zumal HWS nicht nur die Geschichte verzerrt darstellt, sondern daraus auch noch verfehlte wirtschaftspolitische Schlussfolgerungen ableitet. /2

https://twitter.com/heimbergecon/status/1339585423354388480

In seiner Replik hatte Sinn behauptet, er sehe die Rolle der Brüning'schen Sparpolitik ähnlich wie ich, aber könne in einem Interview eben nicht alles erwähnen. In 73 Minuten "Weihnachtsvorlesung" hat er Deflation und Sparpolitik wieder nicht erwähnt. /3

handelsblatt.com/meinung/kolumn…

handelsblatt.com/meinung/kolumn…

Von seinen wirtschaftspolitischen Schlussfolgerungen für heute ("engere Budgetbeschränkungen", "nicht mehr aus Druckerpresse leben") war Sinn nicht abgerückt - auch wenn diese sich nicht damit vertragen, wenn er wirklich wesentliche Rolle für Sparpolitik bei Naziaufstieg sähe /4

In seiner "Weihnachtsvorlesung" warnt Sinn wieder mit schrillen Worten vor Hyperinflation: „Geldflut“; „dramatische Aufblähung der Geldmenge“; "EZB als Goldesel".

Ist das eine angemessene Beschäftigung mit dem Thema - auch wenn an Nichtökonomen gerichtet? /5

Ist das eine angemessene Beschäftigung mit dem Thema - auch wenn an Nichtökonomen gerichtet? /5

HW Sinns historische Exkurse sind analytisch ausbaufähig, aber stark auf das Wecken von Emotionen gerichtet. Da spricht Sinn darüber, dass das Geld wie Papier nichts mehr wert war im Jahr 1923. Und zeigt ein Mädchen, das sich aus wertlosen Geldscheinen ein Kleid gemacht hatte. /6

Fachunkundige ZuhörerInnen sind potential verleitet, sich vor Hyperinflation zu fürchten, so wie Sinn die Dinge rhetorisch dreht. Natürlich, die Hyperinflation werde nicht gleich kommen - aber "was, wenn der Kutscher die Zügel nicht mehr findet", wenn sie einmal in Gang kommt? /7

„Die €zone ist auch nichts anderes als die Geldsysteme früherer Zeiten. Die Potentaten erliegen der Verlockung, sich der Druckerpresse zu bedienen.“ - So schließt HWS die Vorlesung.

Oder ist HWS der Verlockung des Warnens mit Verdrehungen und dünner Sachlage erlegen? /end

Oder ist HWS der Verlockung des Warnens mit Verdrehungen und dünner Sachlage erlegen? /end

Am Ende der Diskussion dankt übrigens ifo-Chef Fuest dem Vortragenden HW Sinn für dessen historische Beispiele, die Fuest sehr gut gefallen haben. Scheinbar verfängt Sinns selektive Verwendung der Hyperinflationsgeschichte also auch bei Ökonomen.

• • •

Missing some Tweet in this thread? You can try to

force a refresh