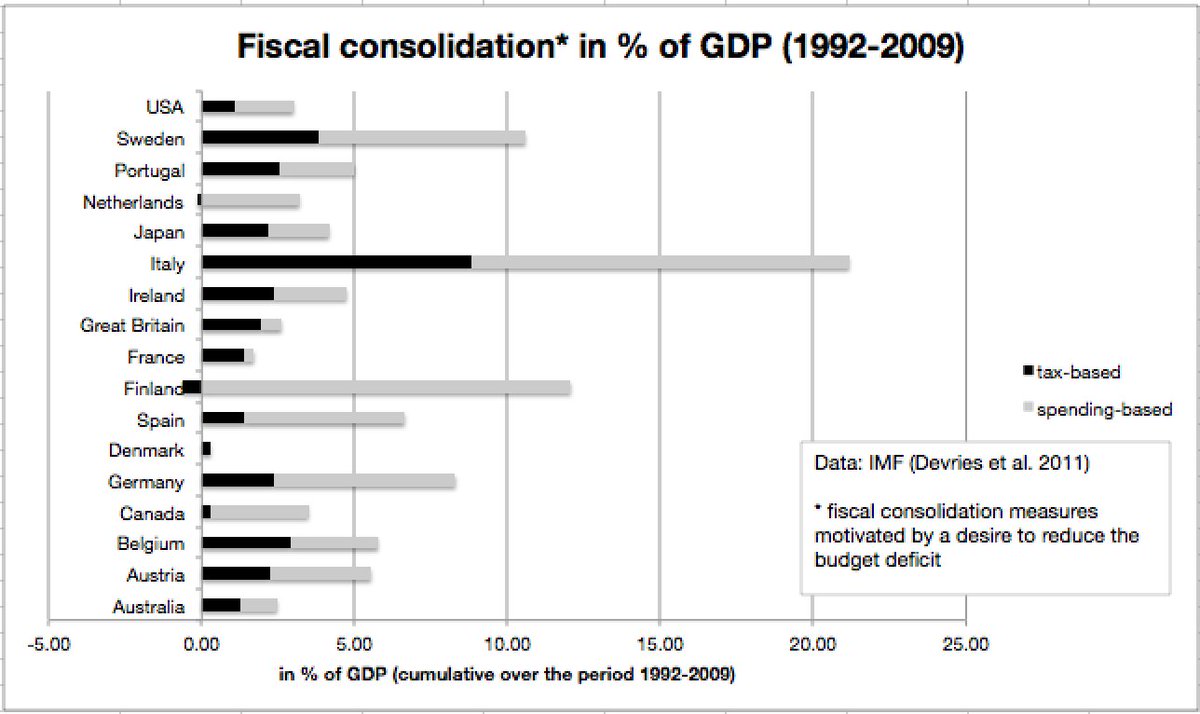

I receive pushback by mainstream voices in Italy: "Don't say that 🇮🇹 pushed for large fiscal consolidation already! Don't say that there were labour market deregulation measures, which have not worked magic. It's too radical!"

I think moderates should wake up. Thread /1

#CAIN

I think moderates should wake up. Thread /1

#CAIN

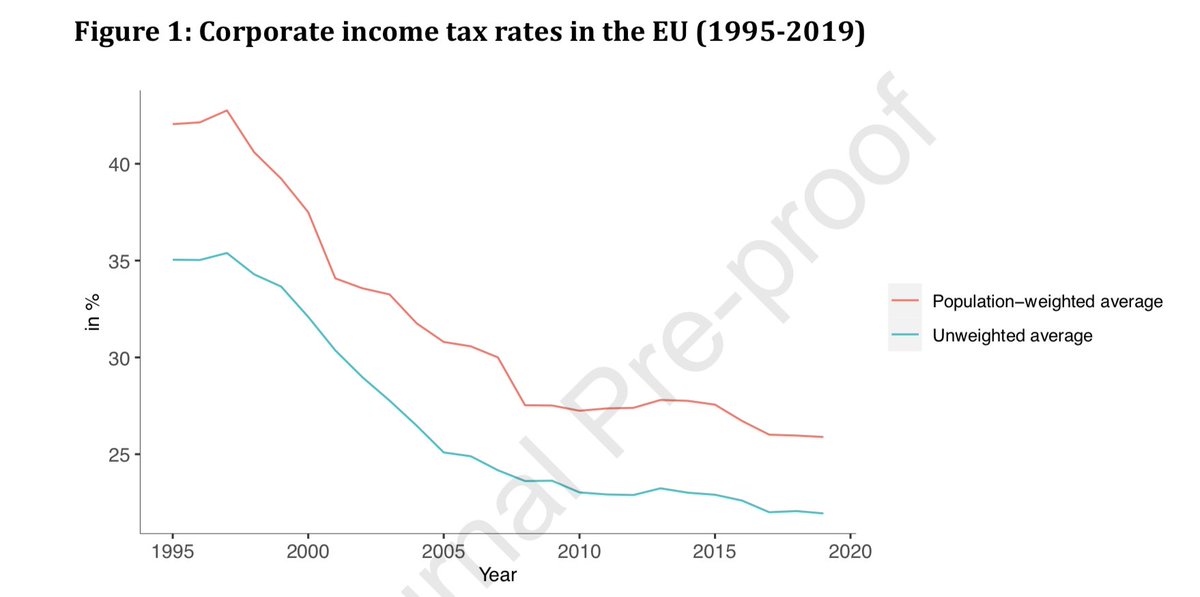

The monopoly for criticising economic policy should not be in the hands of radical voices. I think one of the reasons why we are where we are is that the "mainstream" has for too long remained silent and fallen in line with the fiscal consolidation/structural reforms mantra. /2

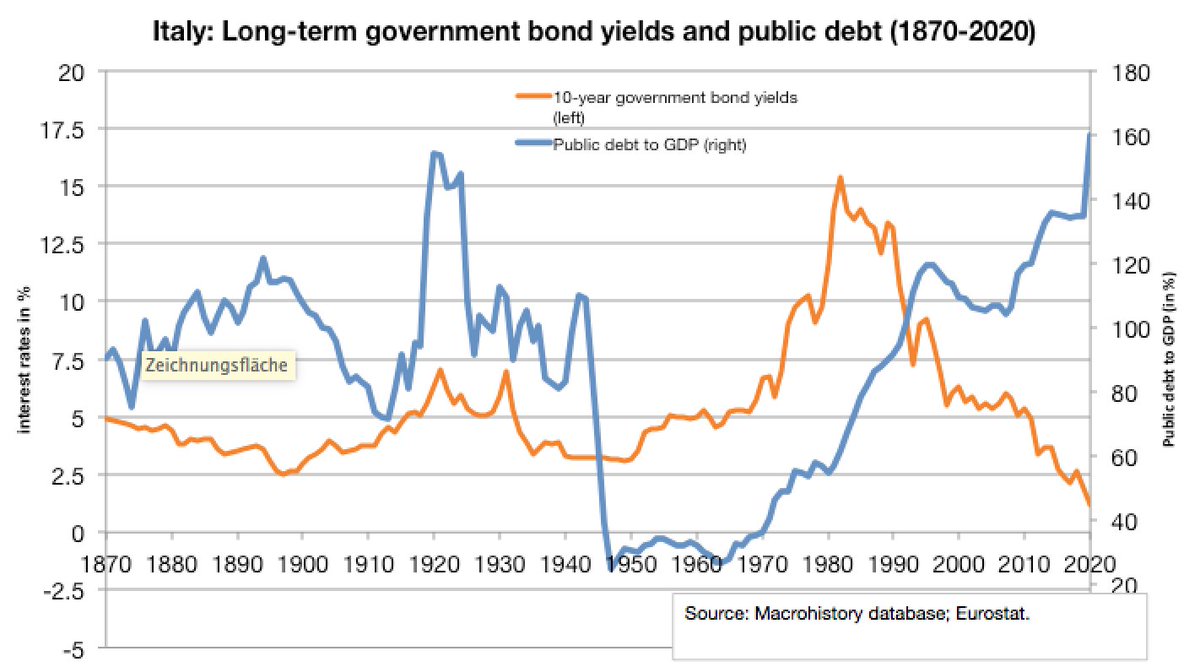

I think we should be honest and say: running large primary surpluses over 30 years has had serious economic and political side effects. We should not just say: let's double down and push even more after the COVID19 crisis. It will not work. /3

I'm running this campaign because I think that European moderates and mainstream voices need to wake up. We won't get many more chances to make the €zone work with its current list of members. I fear that the years after the COVID19 crisis may actually be our last chance. /4

If we repeat the economic policy mix from after the financial crisis, the economics and politics in Italy and beyond will deteriorate further, and we'll see European disintegration. Everyone who does not want that should be willing to rethink old mantras. #CAIN

• • •

Missing some Tweet in this thread? You can try to

force a refresh